We have come around to that time again where we all celebrate Thanksgiving with our Families, and The HGSI Team send you our wishes for a Happy Thanksgiving and thank you for all your support.

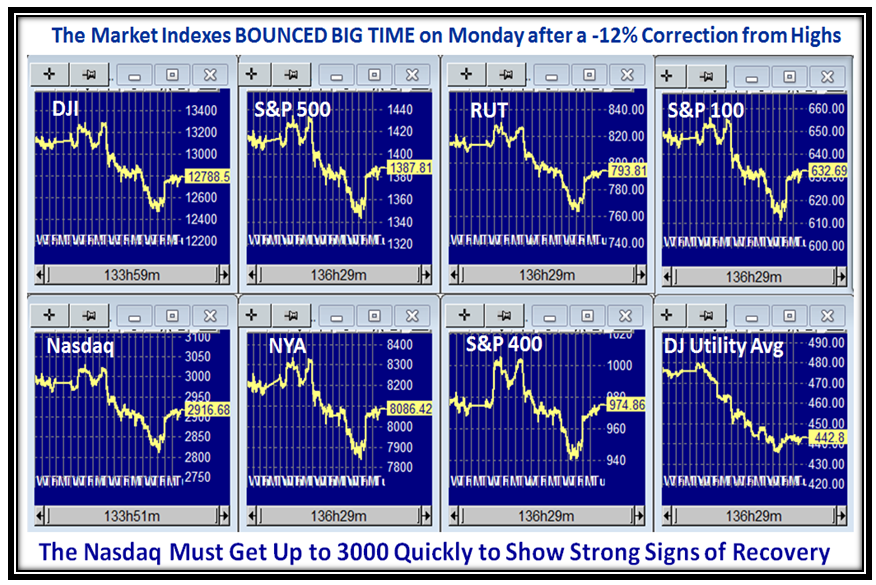

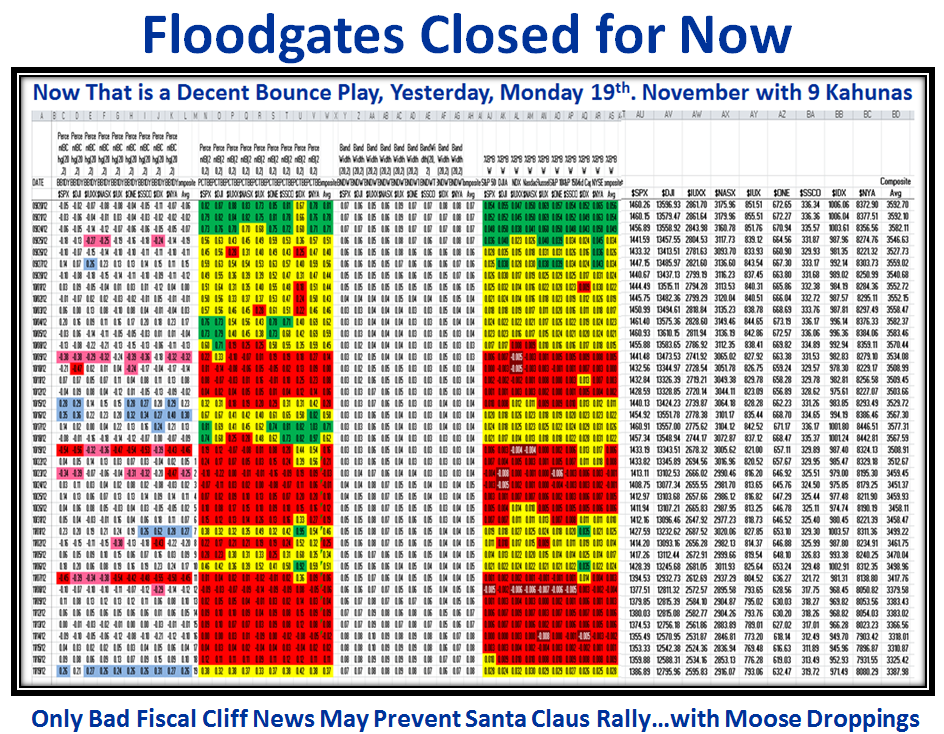

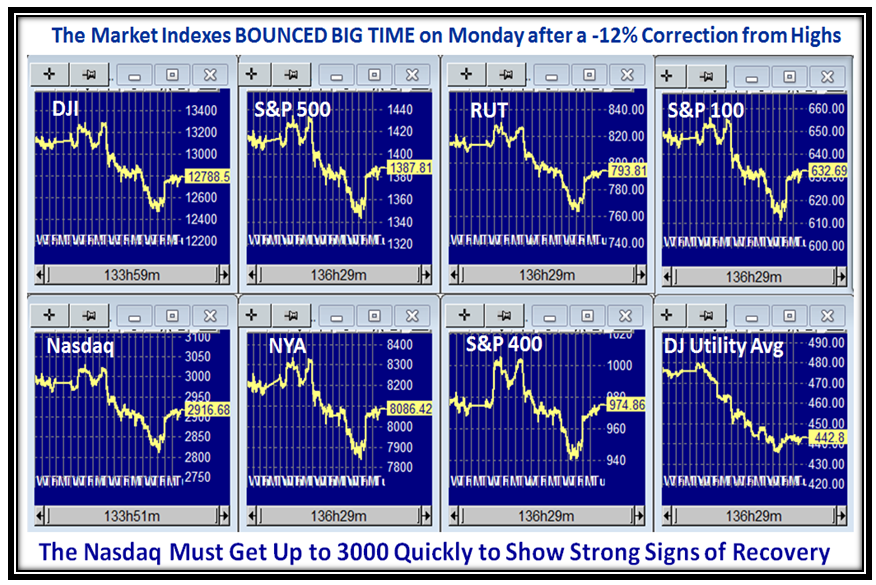

The Bulls were lucky to get a Strong Bounce Play on Monday with a 2% gain for many of the Market Indexes accompanied by nine Kahunas as you will see below that salvaged what was a miserable downward trek in the Market for these past two weeks, to round out a rotten two month drop from the Market Highs with a total loss of ~ -12%:

I hope by now that you followers have got into the swing of it to stay on the right side of the Market and to take heed of the Warning Signs I give you when things are about to trundle down. For those of you who want a recap, I suggest you try my August 1 Blog for what has become a benchmark of what to look for when the Floodgates are about to open. I have summarized key slides to give you continuity in the Story Line as I bring you up to date.

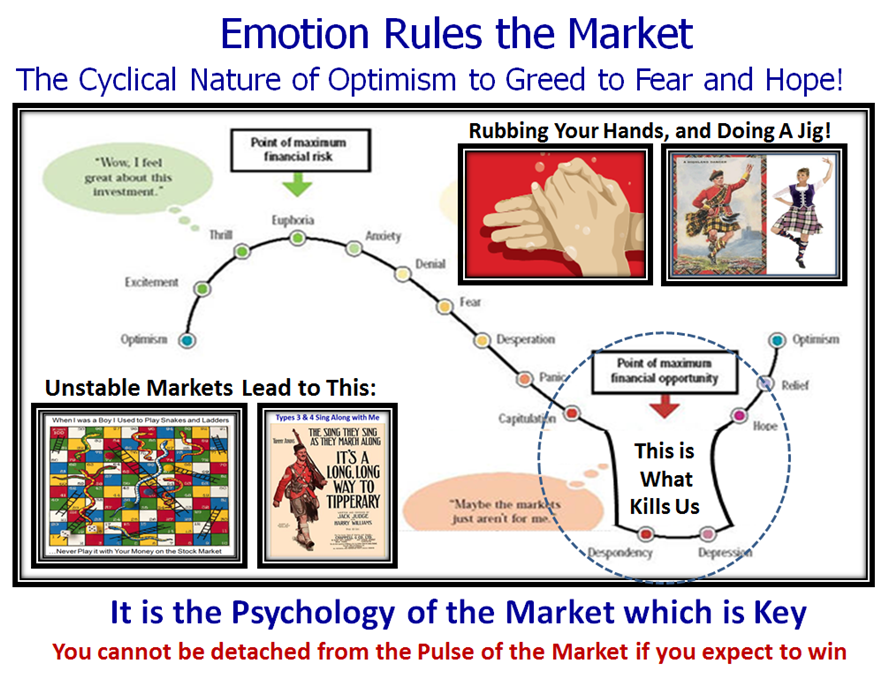

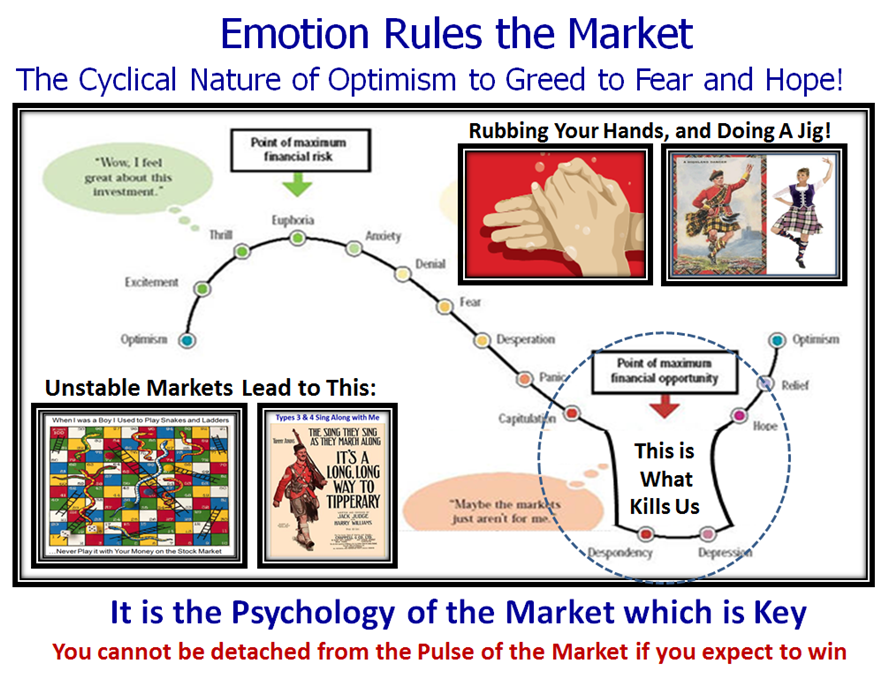

The biggest damage is done when we move from Capitulation to Despondency and Depression in the Psychology of the Market, and this is a reminder of the mood swings I often use:

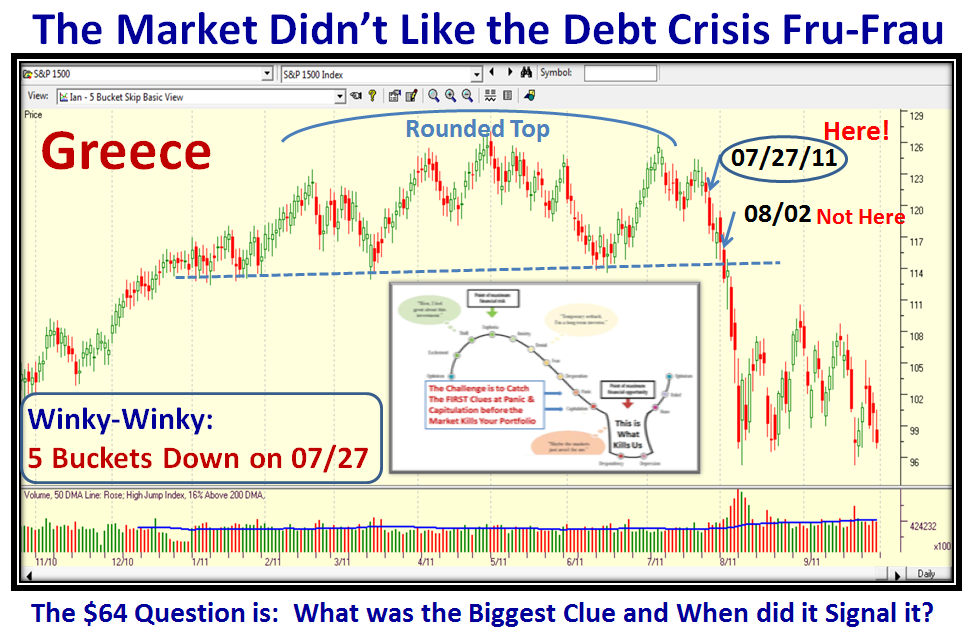

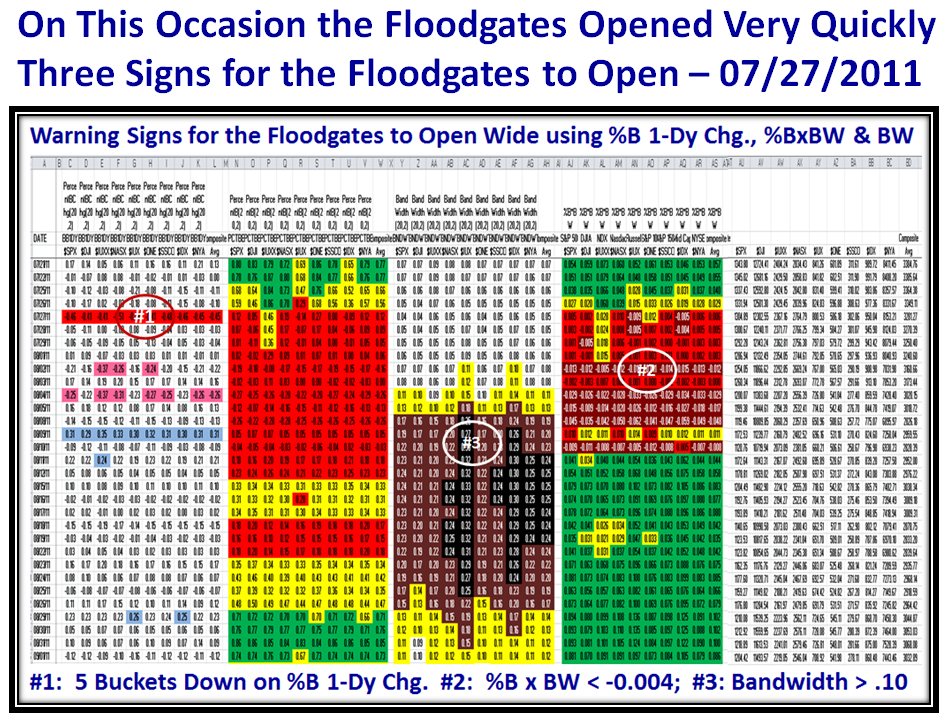

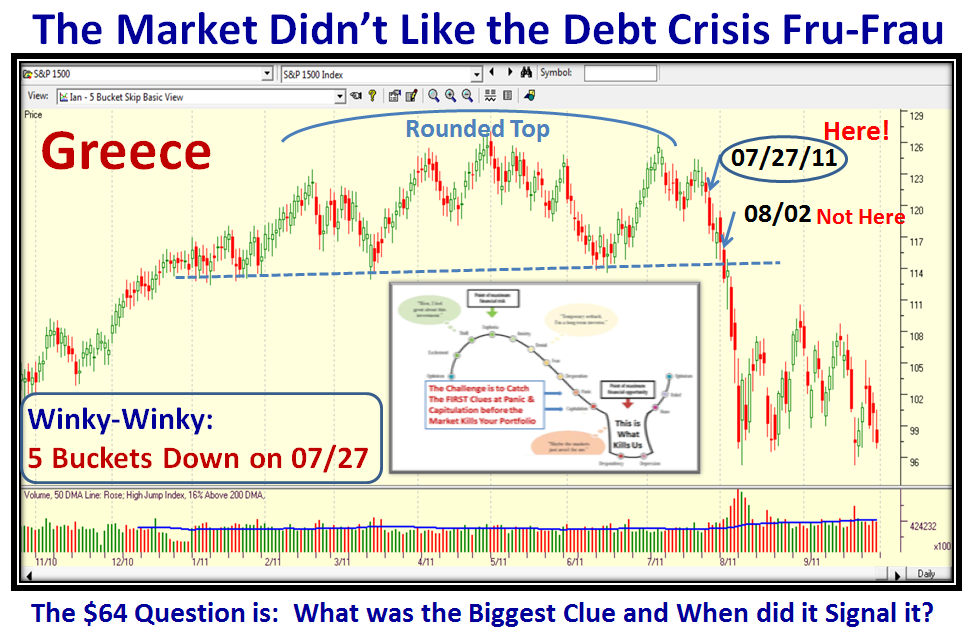

The perfect Benchmark for understanding how to recognize that the Floodgates are about to open was over a year ago when the Global Concern was the Economic problems in Greece. The following chart captures the essence of what to look for which as you will see from the chart is “5 Buckets Down on %B in one day”:

The net result in a matter of little more than a week was an approximate 17% drop which as the chart shows got the early warning signal on 07/27/2011, one week before other techniques called the usual Market in Correction.

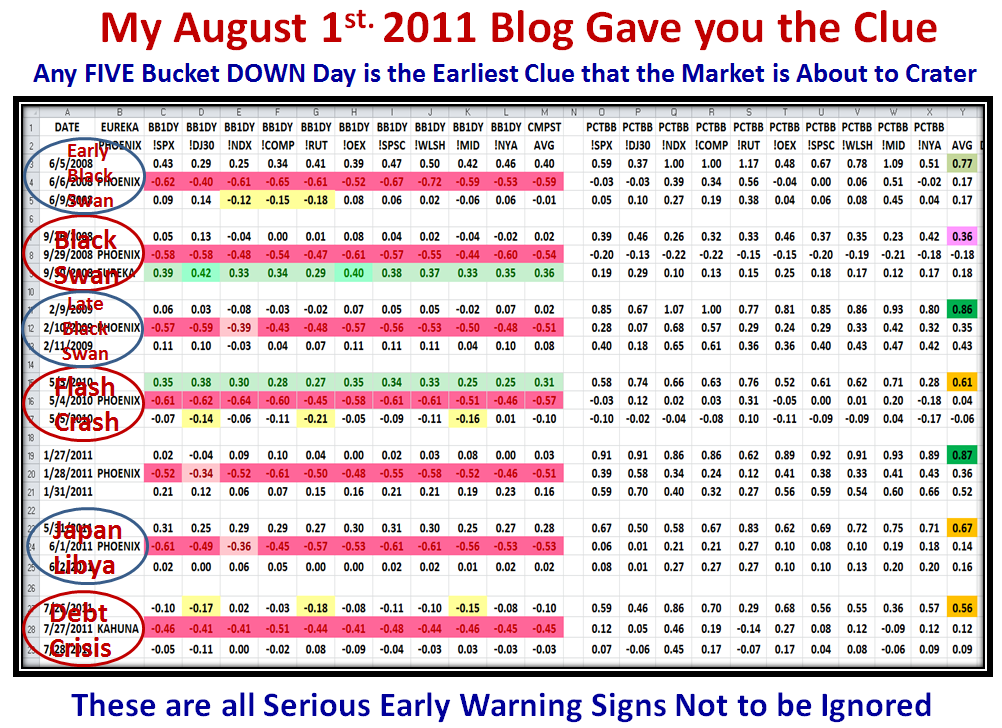

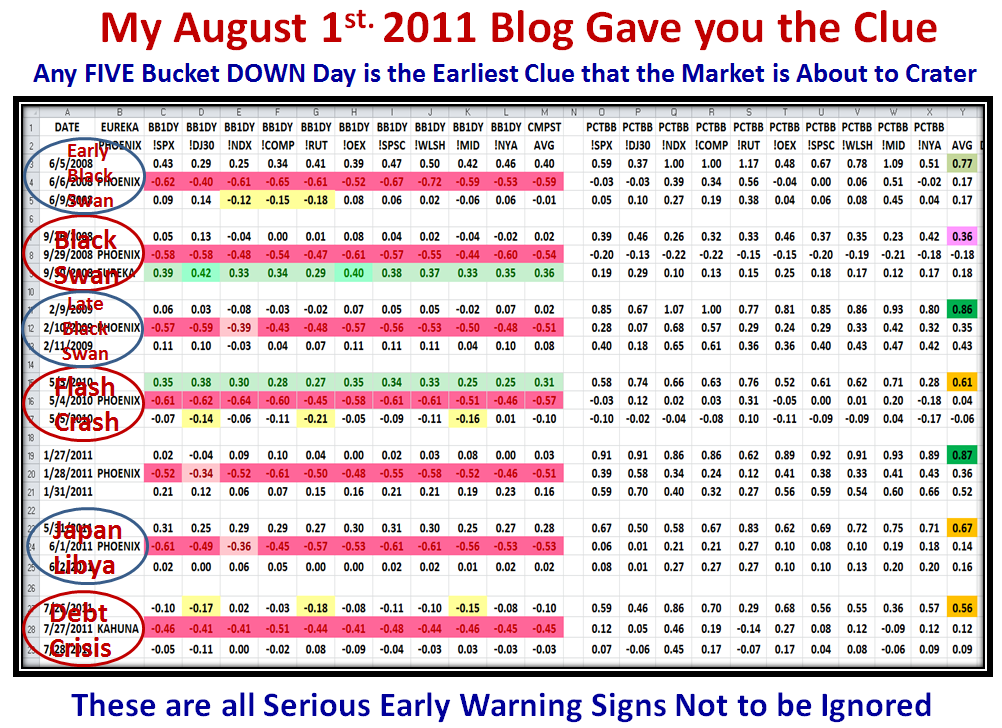

That led me to look back in time to find other occasions when we had a “5 Buckets Down Day” as shown in the next Chart:

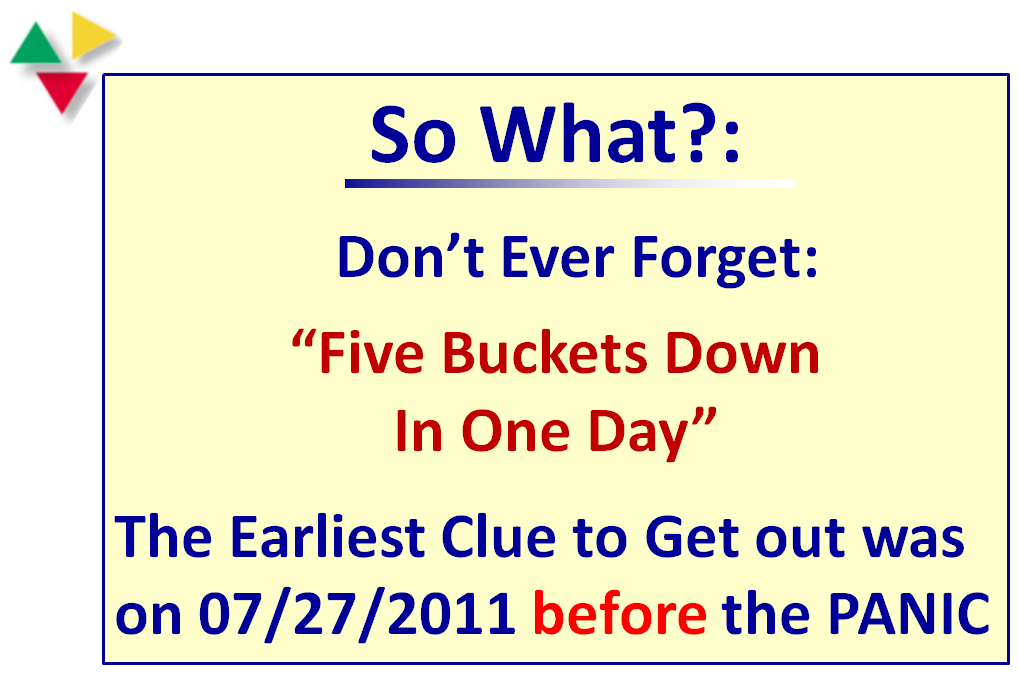

At that time, the Bottom line was never to forget “Five Buckets Down in One Day”:

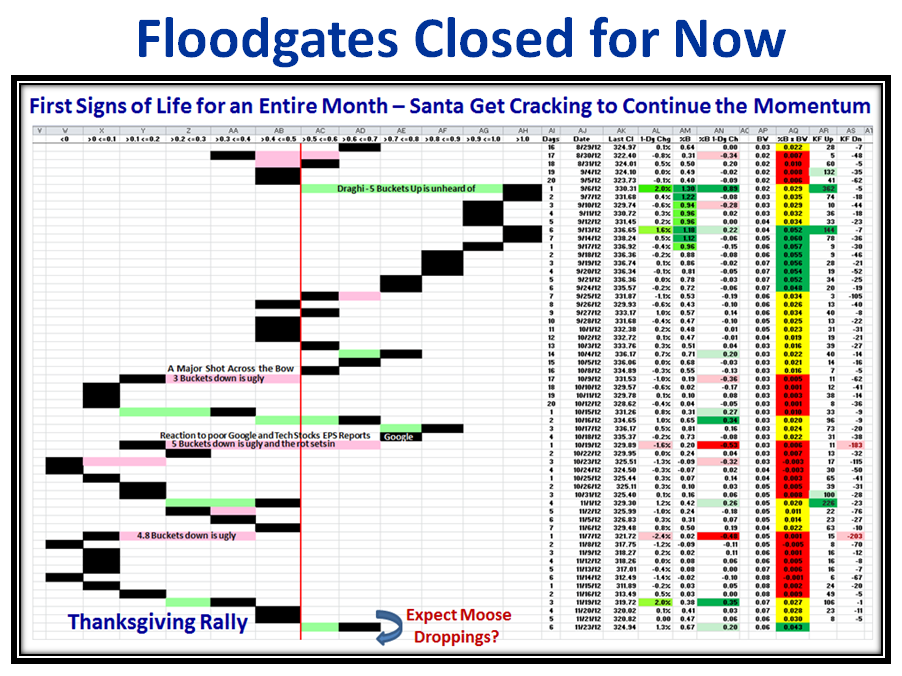

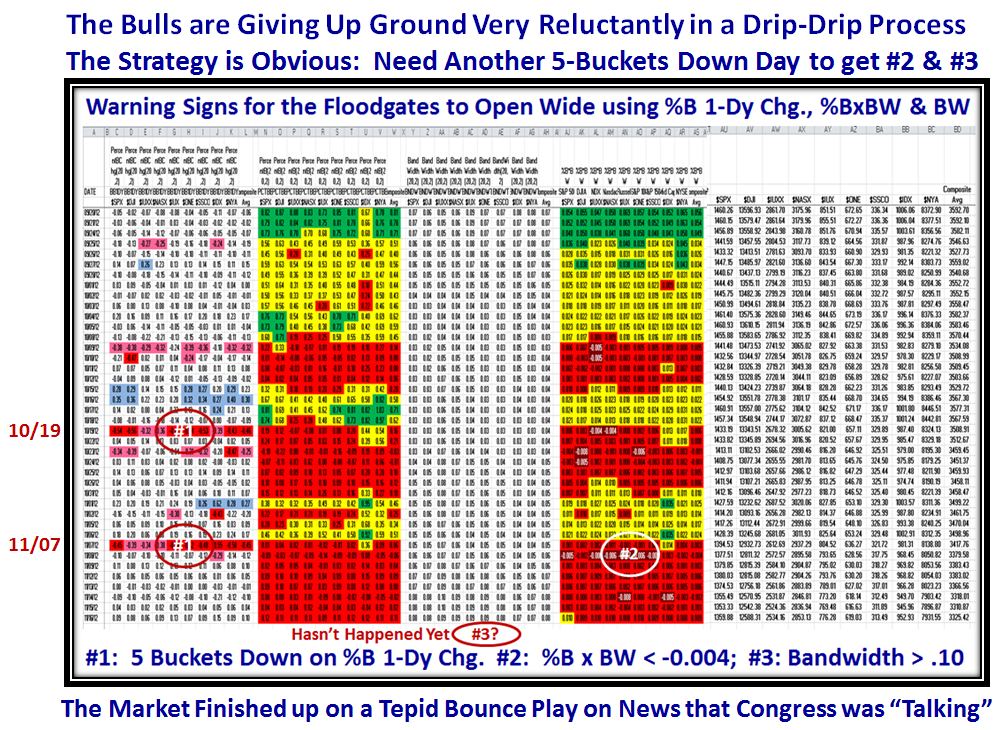

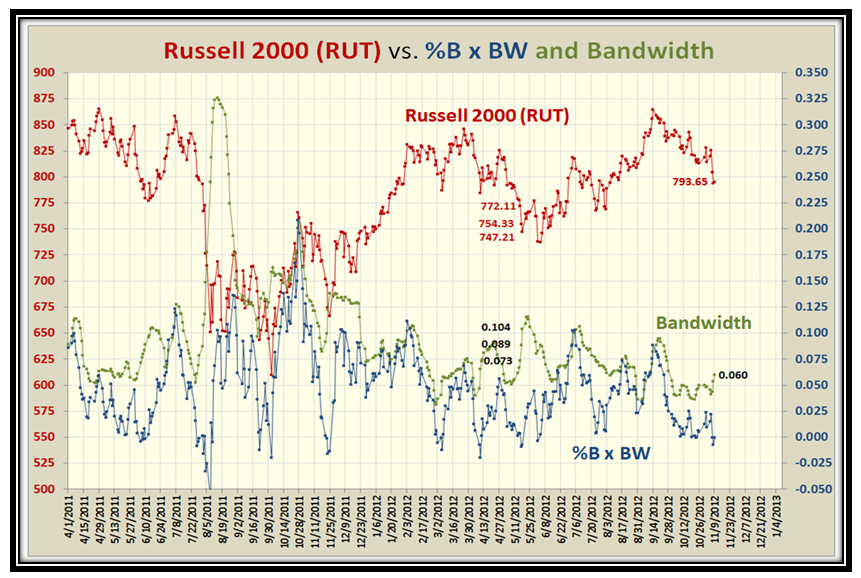

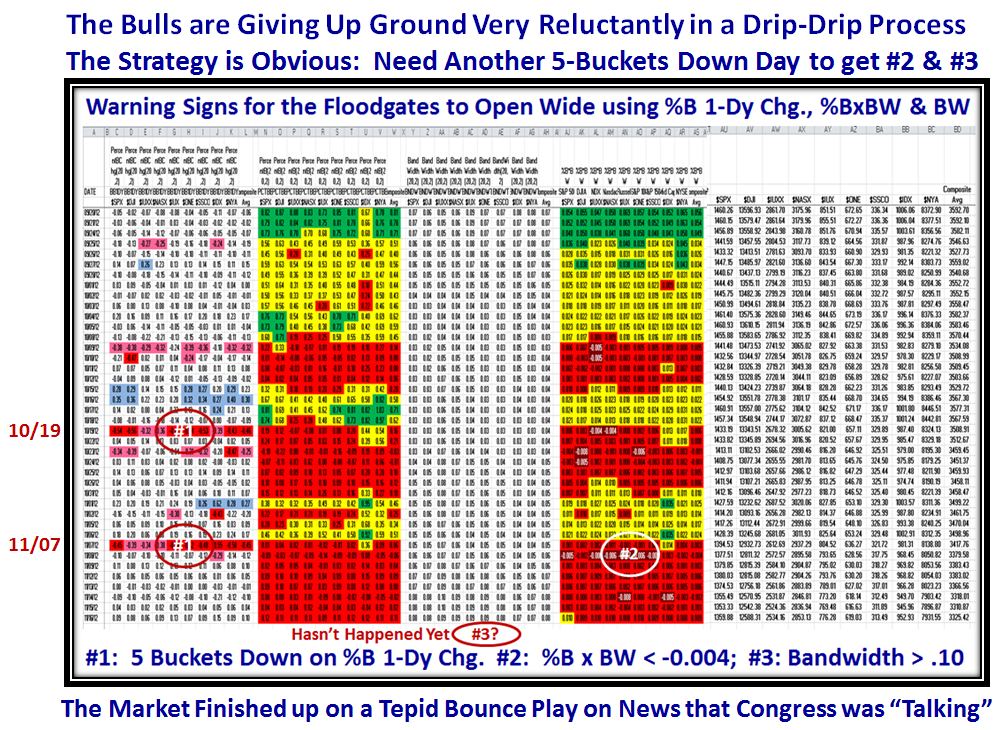

Now let me show you how we can expand on this to truly know when the Floodgates will open. Let’s fast forward to over a year later when in my blog note of a month ago I showed you this chart with the Big Warning on October 19th. It is important you review my last three Blog notes as they provide a substantial amount of background of the process and results:

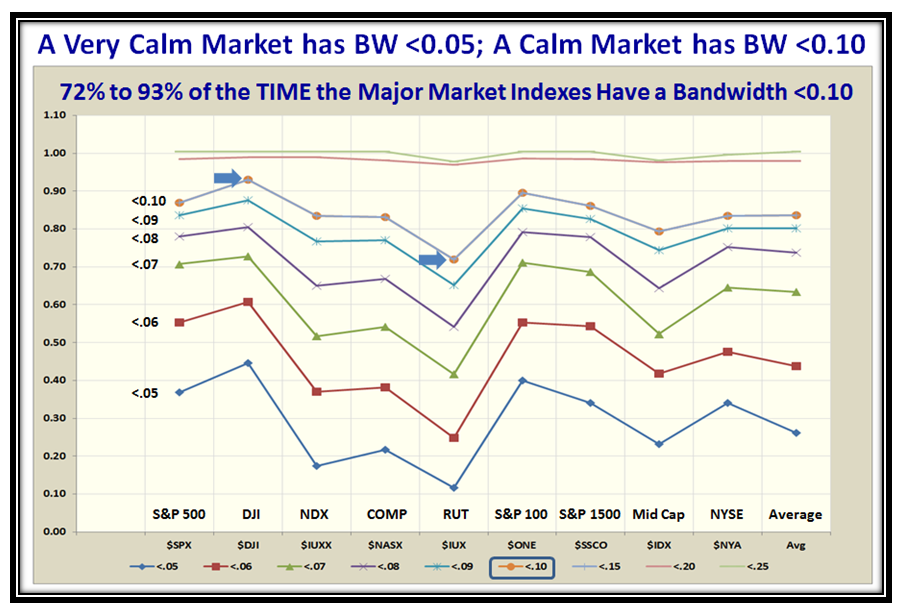

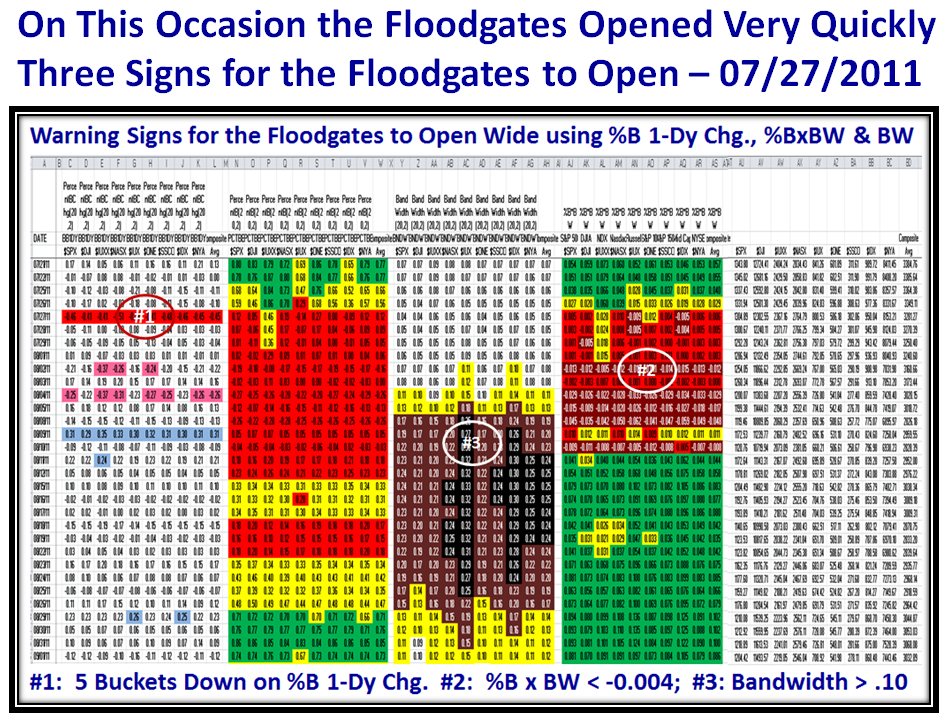

The Bottom Line is that it takes three signals using Bollinger Bands to know when we are on a cliff edge and when the Floodgates start to break wide open. So, let’s first look at our Benchmark for 07/27/2011 and then compare it to Now!

Don’t bother with trying to read the numbers, its the Color Formatting that is far more important. On the left hand set of numbers is the %B 1-Day Change for ten Major Market Indexes. As you well know by now Kahunas up are in Blue and Kahunas Down in Red. Note that we essentially had approximately 5-Buckets down on all indexes on 7/27/2011 as I previously mentioned. This and succeeding charts are produced on EdgeRater:

Now look across to the 4th set of numbers, i.e., the %B x BW which is dubbed the Woody Indicator and notice #2 in white in that set of columns where all the Indexes are Less than -0.004…that is the second sign.

The third sign comes when the third column from the left, i.e., the Bandwidth opens up to >0.10 on most Indexes and then turns ugly as shown by the Brown and Black cells.

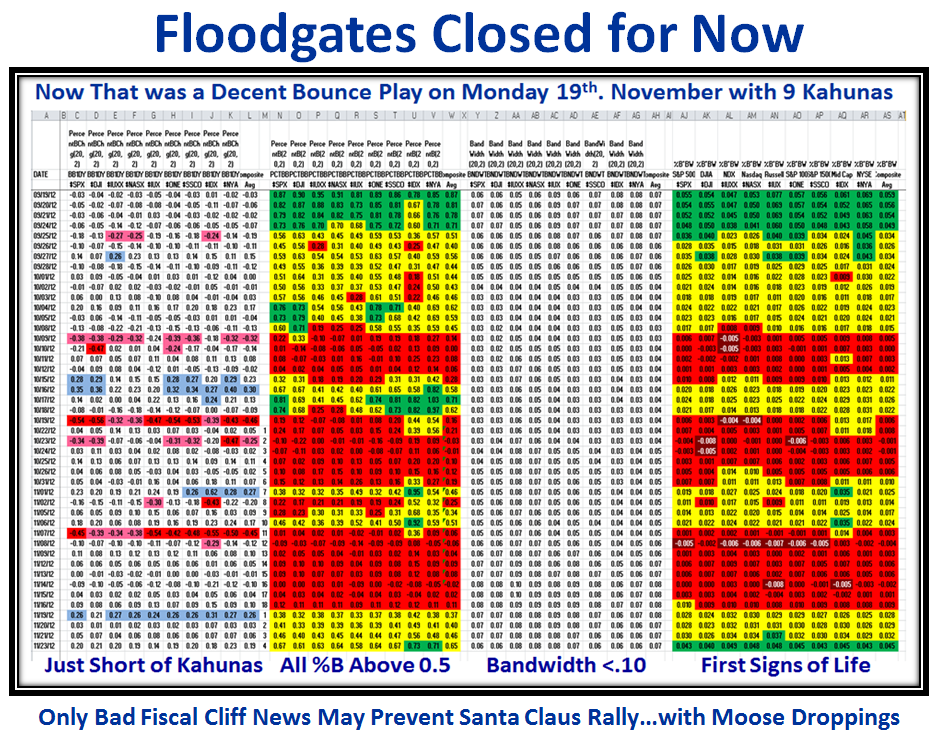

Note how all three signals fired within the course of seven or eight days max! I’m sure you are wondering where we stand to date, so let me show you the picture as of Friday of last week:

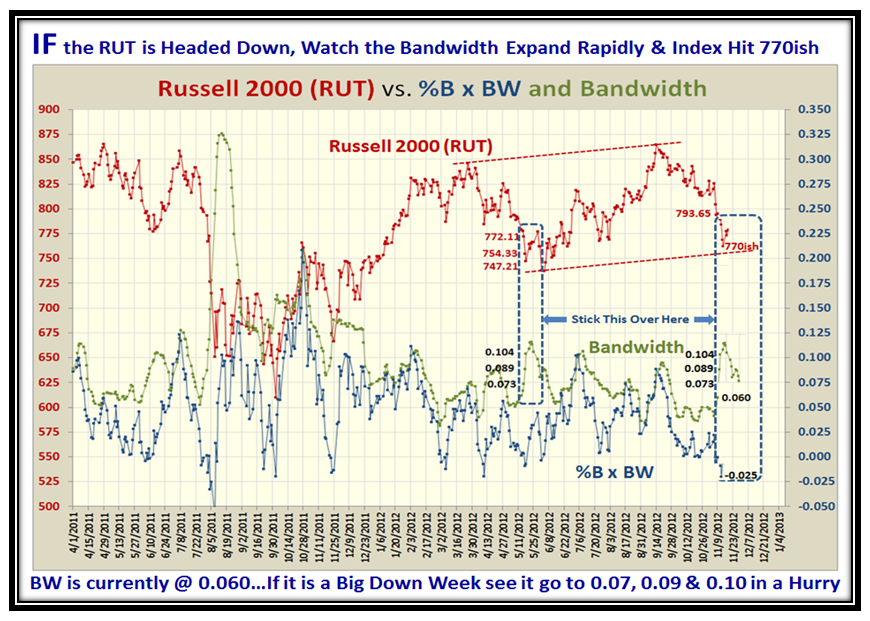

I’m sure you can immediately see the difference between the two charts, where the Bandwidth changing above 0.10 has not yet happened, and although we have experienced a 12% drop, it has been more of a drip-drip process rather than a burst of the floodgates opening.

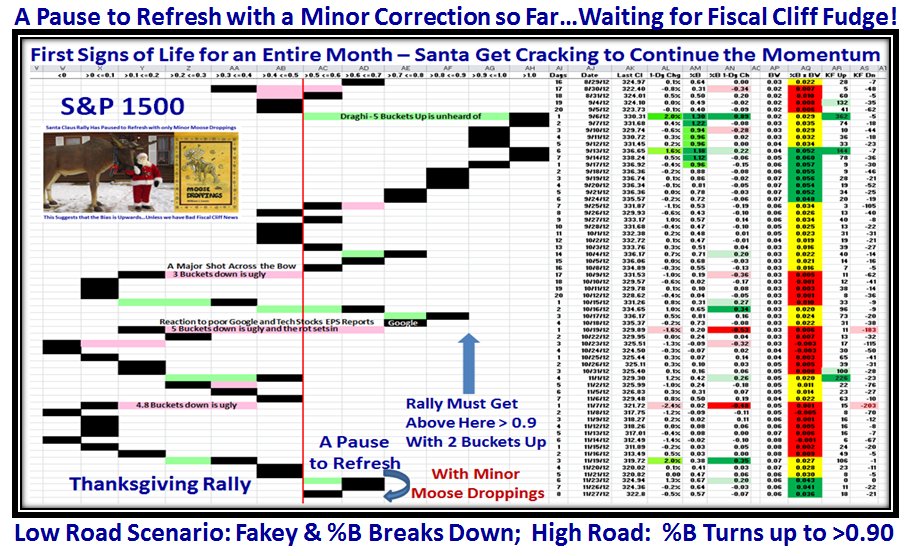

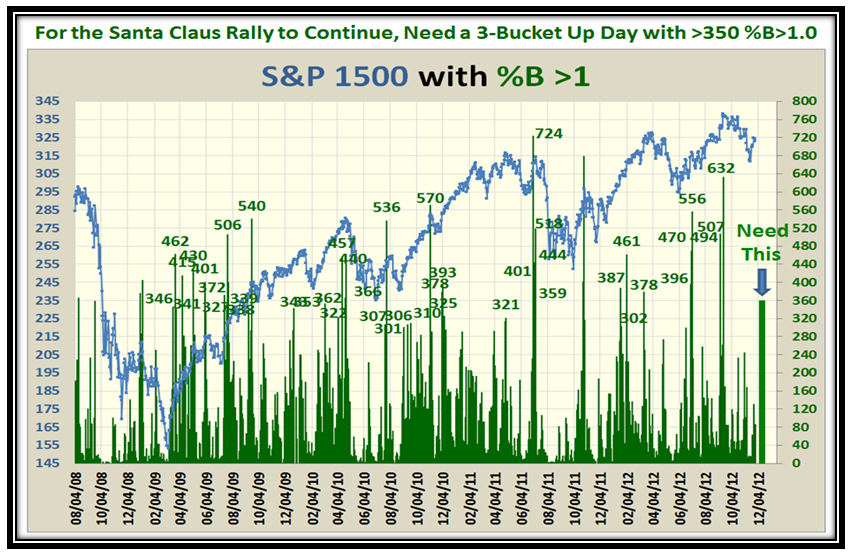

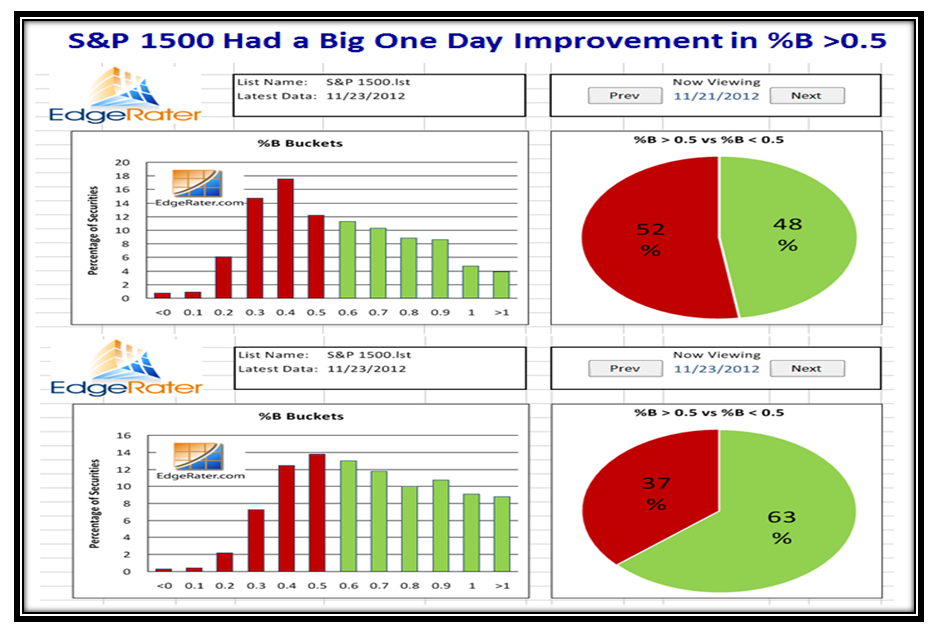

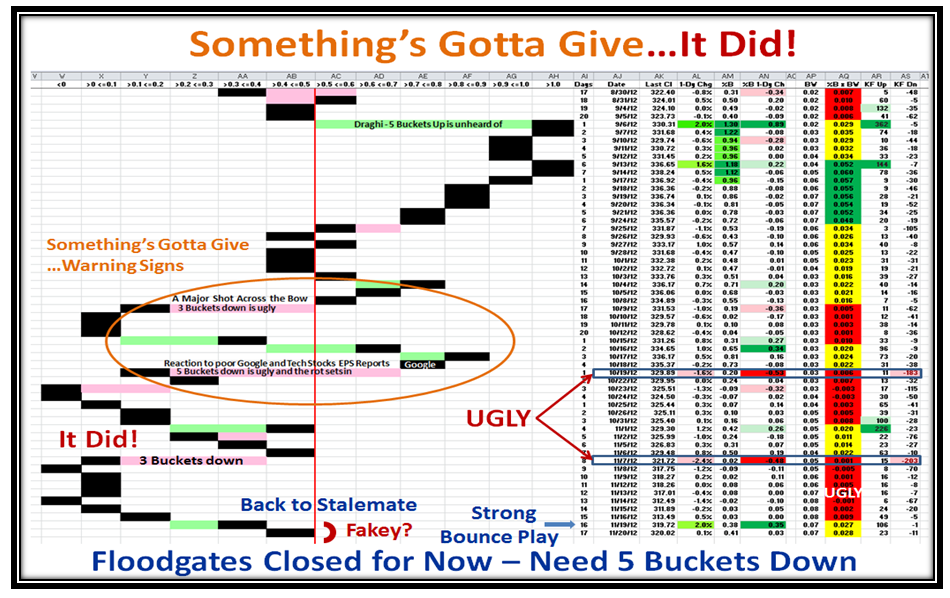

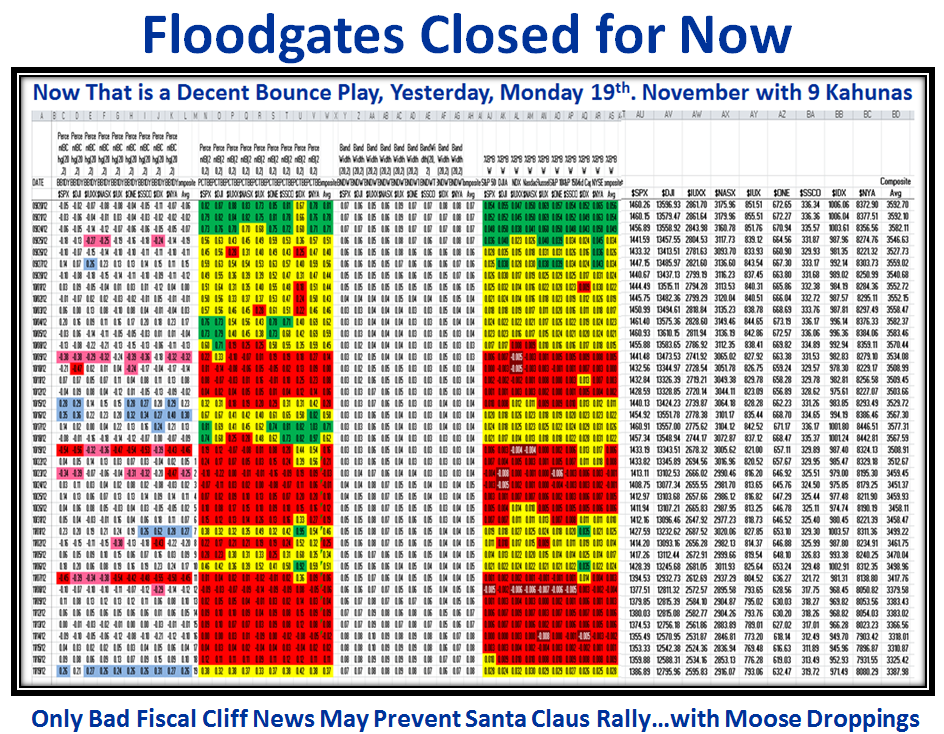

Therefore, the final clue is the Bandwidth must expand rapidly to cause a Major drop of >16%. Now let’s look at where we stand two days later, where you will recall we had nine Kahunas (blue) that related to an approximate 2% Index Gain as shown at the bottom left of the next chart:

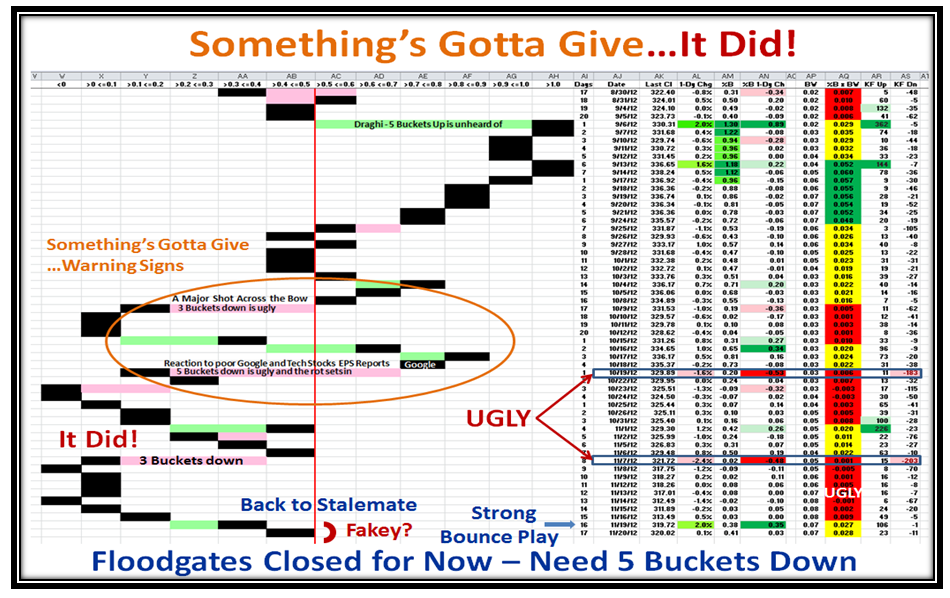

Finally, let’s look at our favorite chart which shows how the Bounce Play has now brought the S&P 1500 back to the “Red Line” of Stalemate. Now we wait to see if the Bounce Rally can continue to take the Nasdaq back up to 3000 or we have a Fakey and fall back one more time into the doldrums:

All the very best to you and yours as you enjoy each other at this special time.

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog