Stock Market: Remember Draghi & QE-3 Euphoria?

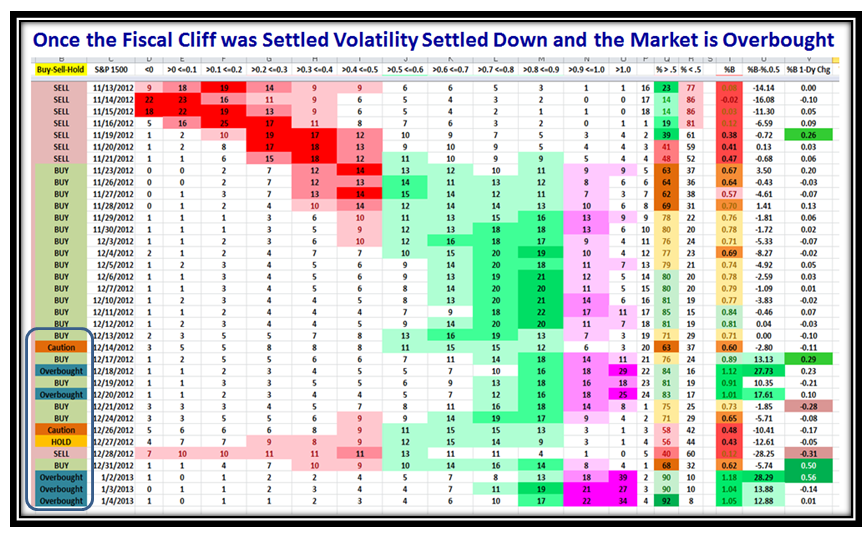

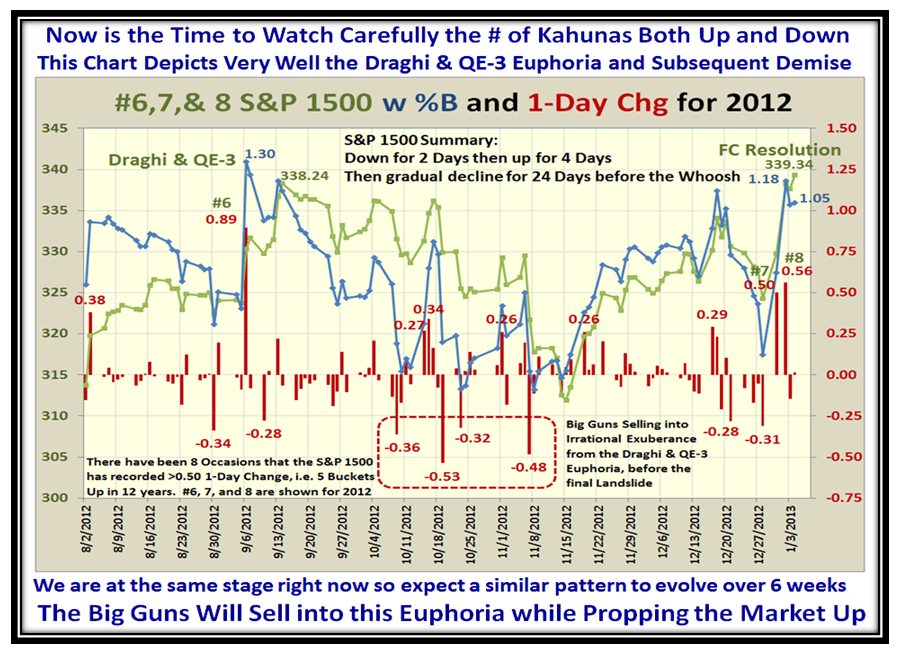

I am sure you recall the Irrational Exuberance of a couple of months ago when the Draghi Plan and QE-3 came out a week apart and the Market shot up only to then start the steady decline while the Big Guns propped the Market up long enough to pull you in while selling into it. We are at that same stage now that the Fiscal Cliff fiasco has been temporarily fixed as they kicked the can down the road a couple of months before we have the next fru-frau.

So in the short term enjoy the remainder of the January Effect, but then look for similarities to the last chart in this blog note which I have developed to keep you on your toes. I see Italy and India have recently gone “gaga” on this good stuff so my thanks to them for their support along with all the other faithfuls:

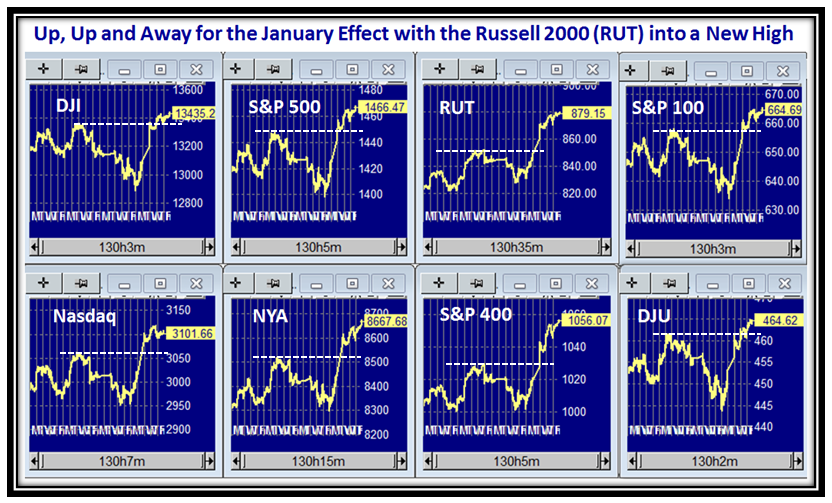

As you can see from the Market Indexes Charts they are all up, up and away above the resistance lines with some of them into new High Territory…notably the Small Cap Russell 2000 as I predicted previously:

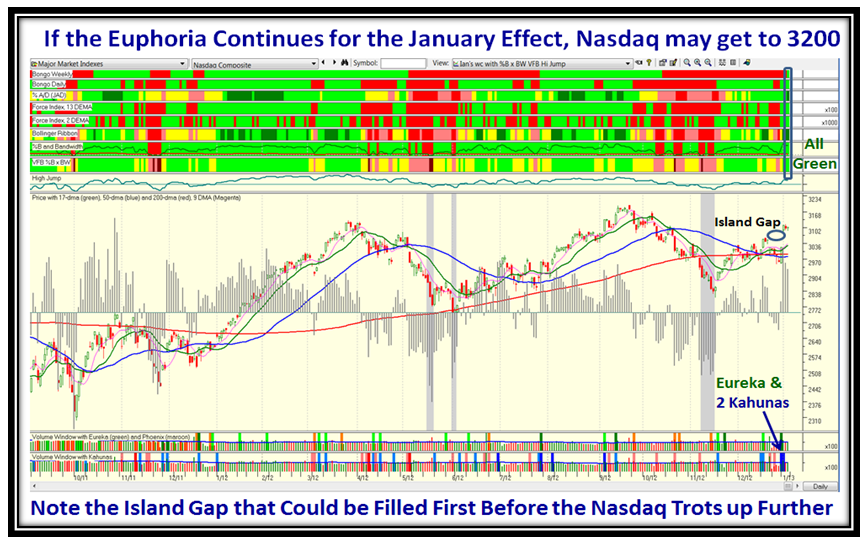

As you would now come to expect, we got the usual Eureka and Kahuna signals to suggest the Rally was on, but we have an Island Gap in the Nasdaq Composite. The bias is up, but watch for a slight pull back to close that gap before we see a continuation of this powerful rally. Alternatively, should the rally continue straight up from here then watch for that spot to be filled on the first retrenchment when there is a correction:

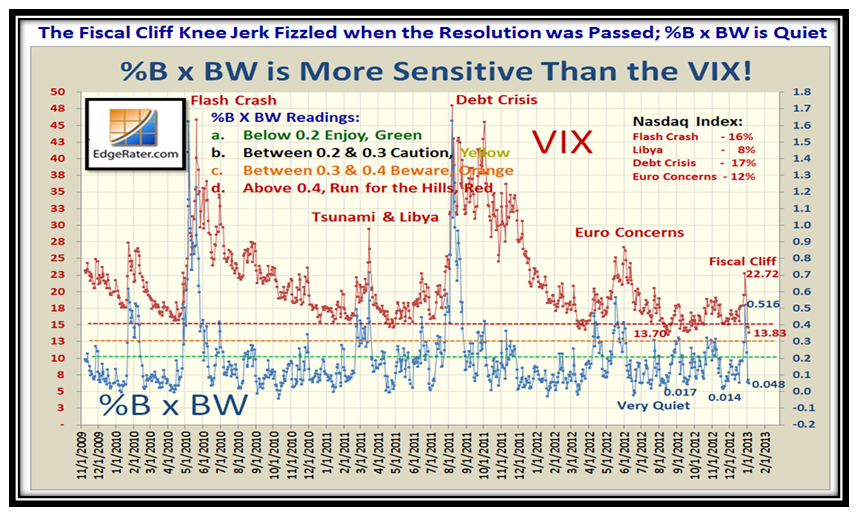

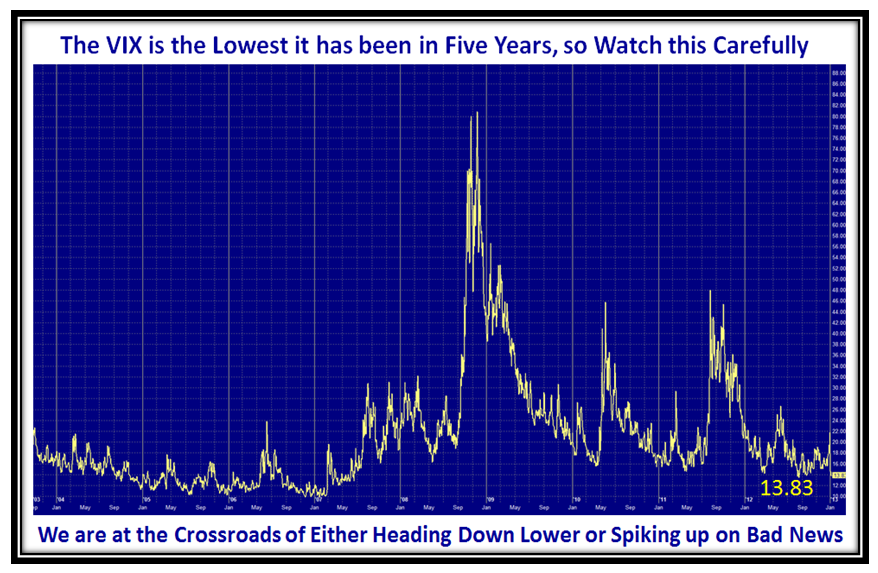

We had the expected knee jerk in the VIX while there was the possibilty that there would not be a settlement in the Fiscal Cliff mumbo jumbo, but now the VIX has dropped to below the 14 mark and quietness abounds implying no fear for the moment…only greed!

Just to give you perspective on the VIX, here is the picture going back several years and we now watch for whether this is the start of something big in that the VIX should stay below 14 for some time to come (wishful thinking) or once this recent euphoria is over we trot back up to stay on our toes to be on the right side of the Market between Fear and Greed:

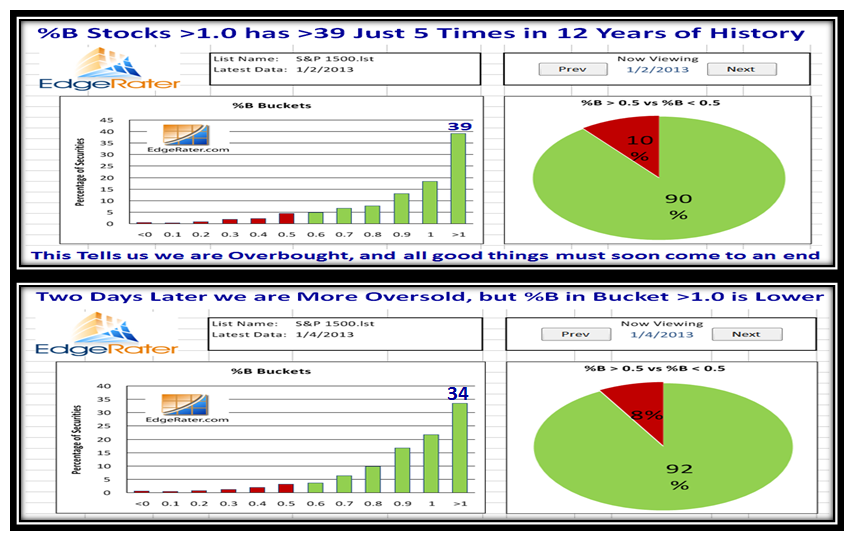

Needless to say that Grandma’s Pies shot up to overbought and invariably within 6 to 8 days of euphoria we should see the decline start to set in.

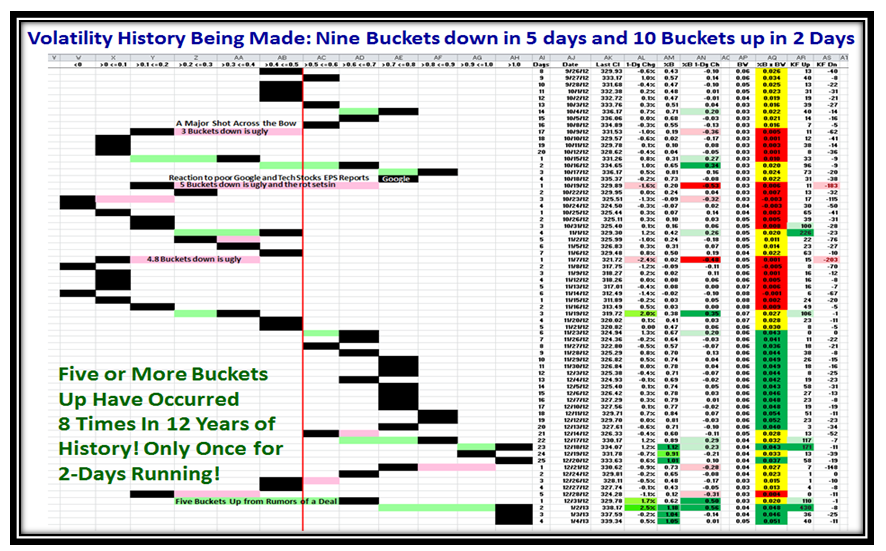

Shorts were covering feverishly these last few days which took us from nine buckets down in 5 days to 10+ Buckets up in 2 Days, where we have remained in Overbought territory for the last three days:

…And here is it’s twin picture, thanks to Pat Turner who developed these basic concepts many moons ago:

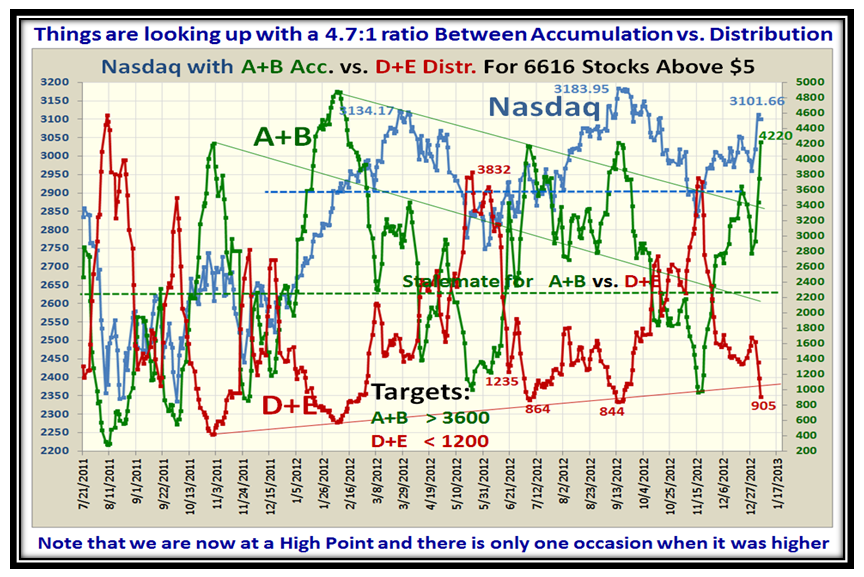

Accumulation A+B took off like a rocket and all it needs is one more push to reach the peak of a year ago:

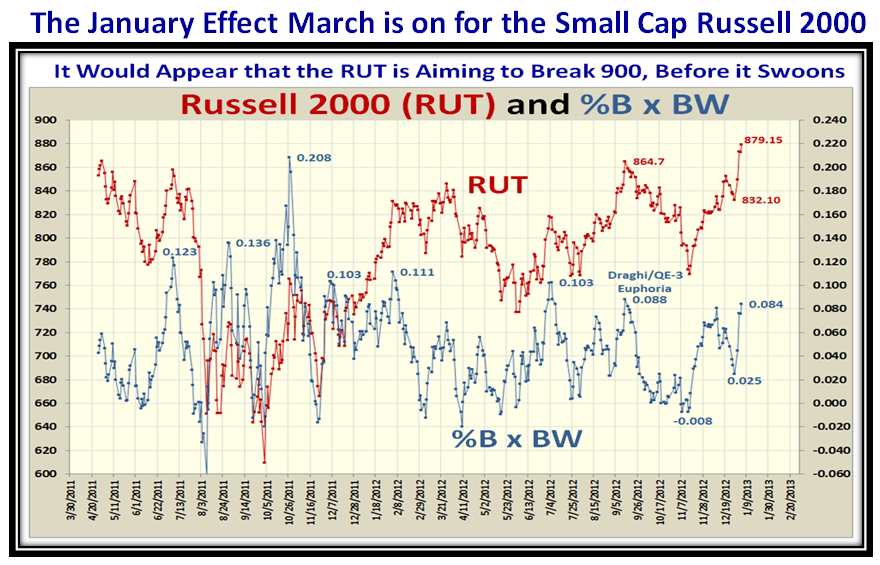

Always remember to watch the Small Cap Russell 2000 (RUT) Index for the January Effect and it is in New High Territory. The Target is for it to reach the round number of 900, and that is possible given that %B x BW though up is not yet to the moon:

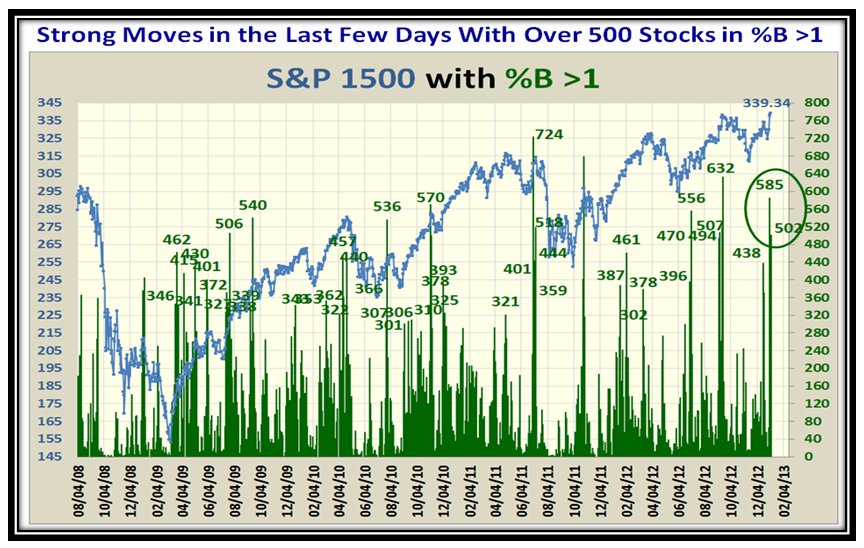

…And to cap all of this euphoria off, here is the proof this was no ordinary rally:

Now you know precisely where you stand on the ladder between Fear and Greed, but let me give you the New Year’s Present I have for you to show you precisely what to watch for in the coming weeks based on what transpired at a similar stage of Greed with the Draghi + QE-3 announcements a couple of months ago. They say History never repeats itself, but it usually does “Close Enough for Government Work”.

I know there is a lot to digest in this chart, but click on it which will enlarge it. Then make a copy of it and watch it like a hawk. The SINGLE Key Item to watch for is the Number of Kahunas to the downside interspersed with those to the upside (shown in the dotted red area) which will give you a clue as to when the Big Guns are pulling you in while they sell into the rally and then when they have got you committed, they will drop the market like a lead balloon!

Best Wishes for a Happy New Year comes with this present to you and may all your bets be winners.

Give us some feedback in the Comments at the bottom of the note! It only takes a minute.

Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog