Stock Market: The Pullback Before the January Effect

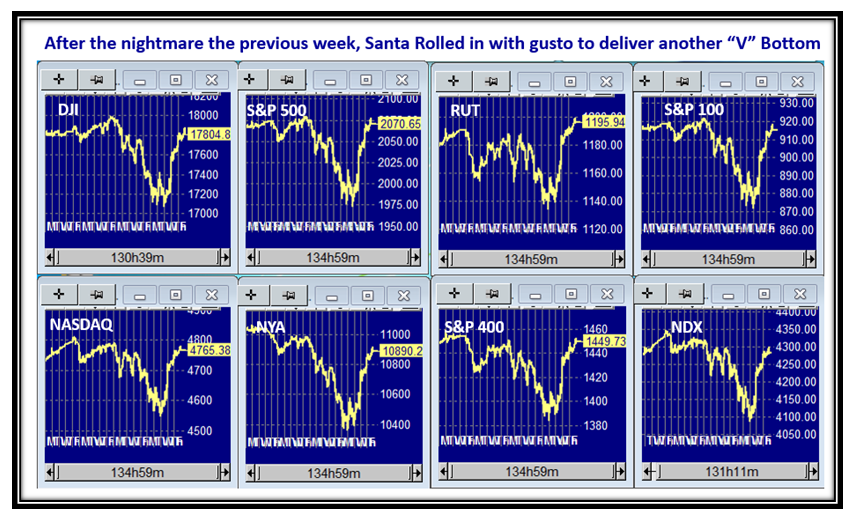

Tuesday, December 30th, 2014The Grinch dampened the Santa Claus Rally, but the January Effect is still on the cards.

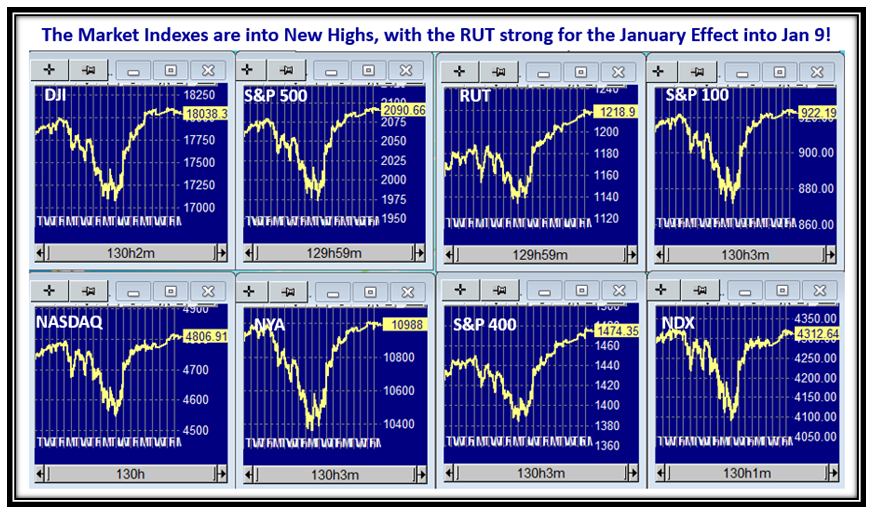

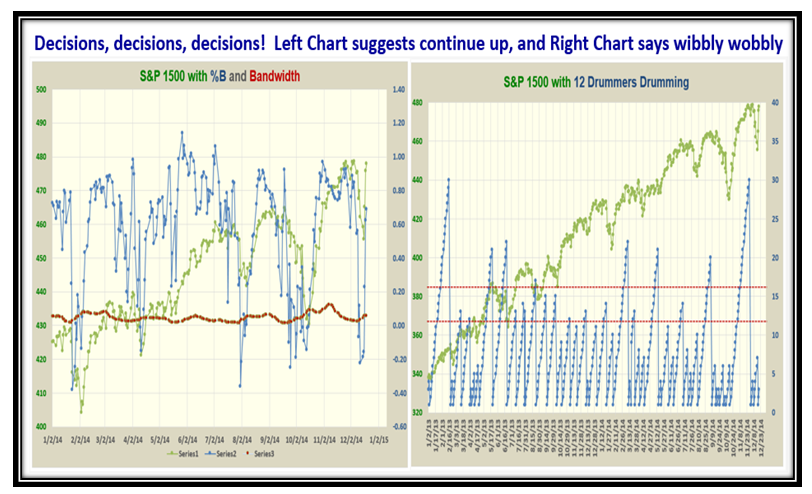

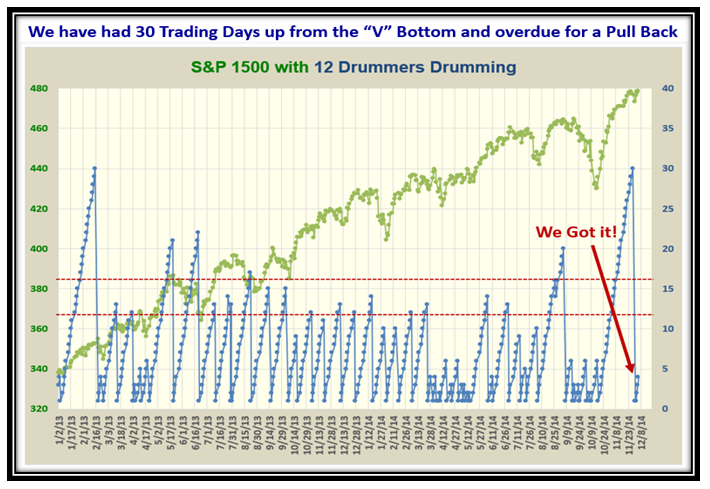

The Market Indexes are now Pausing to Refresh and with luck we should see the January Effect kick in soon:

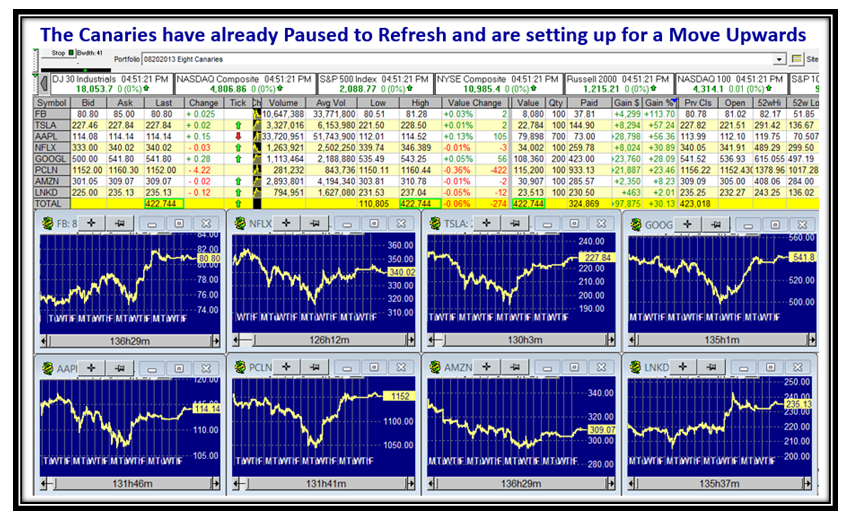

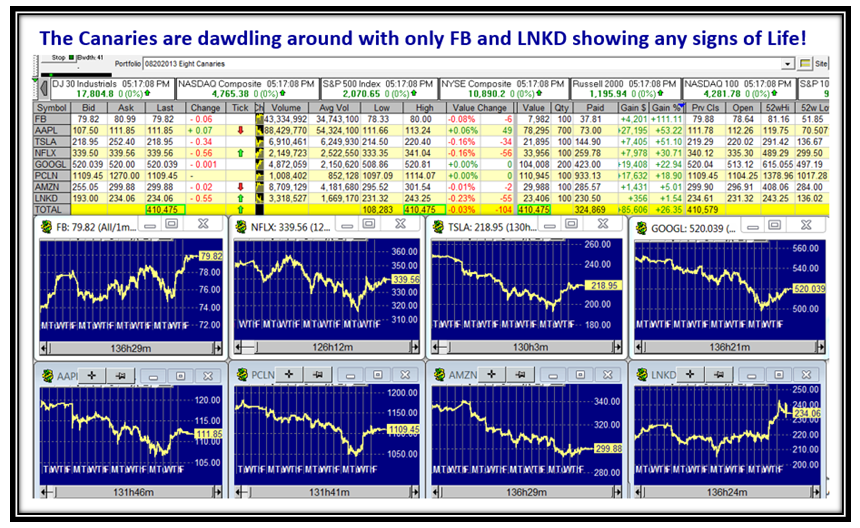

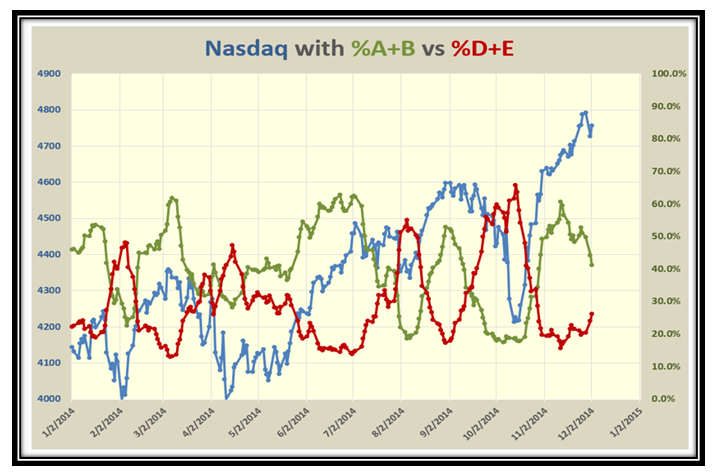

The Canaries have already Paused to Refresh, and are ready to move again:

The VIX has moved up today with the pullback in the Indexes, but if it stays below 17.0 we have room to move up:

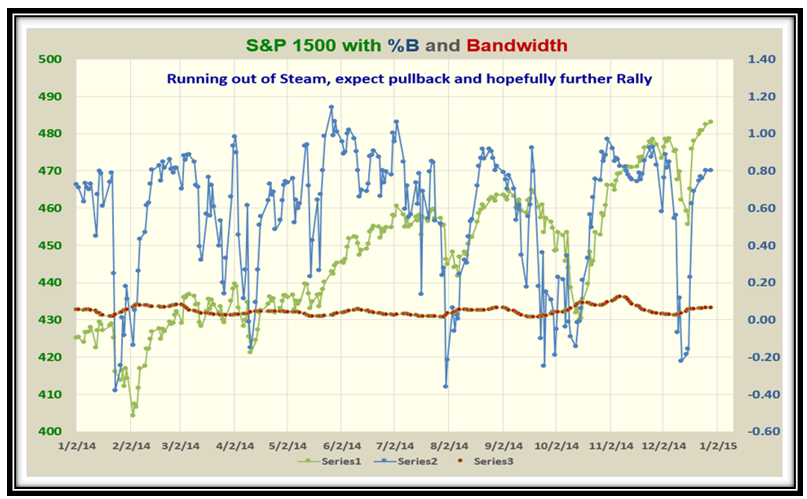

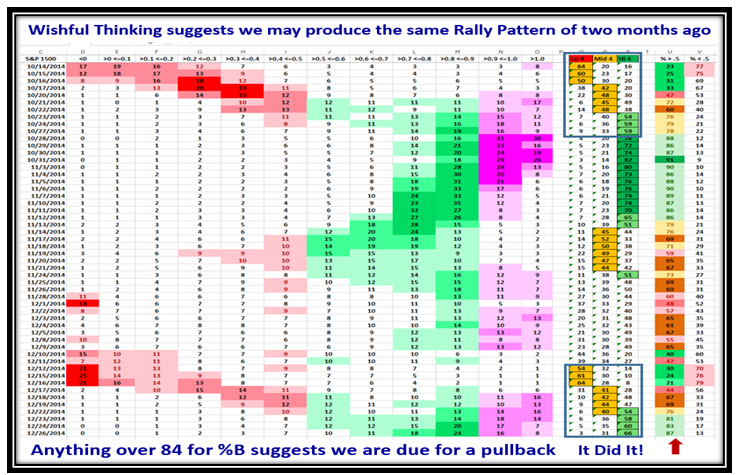

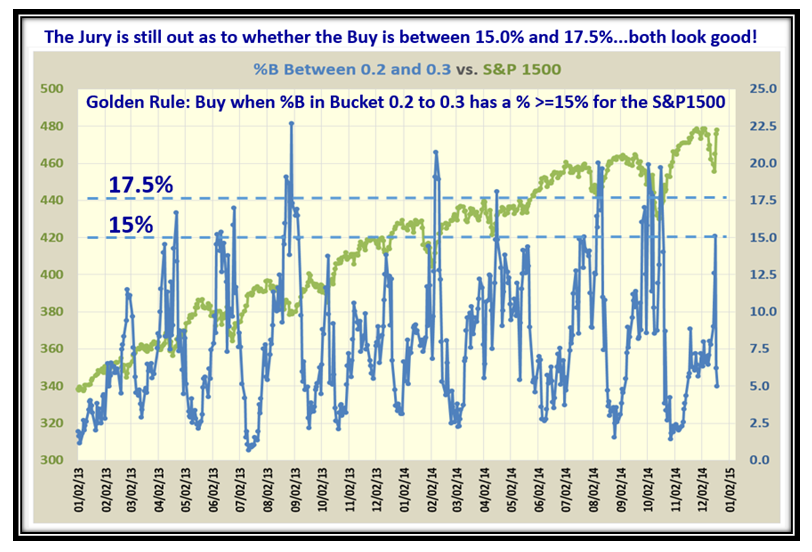

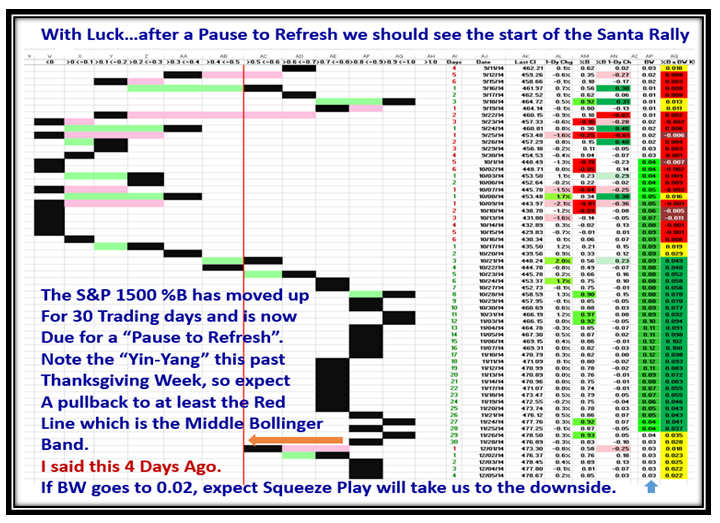

%B for the S&P 1500 is at 0.80 and running out of steam, so we are now into a pullback today as expected:

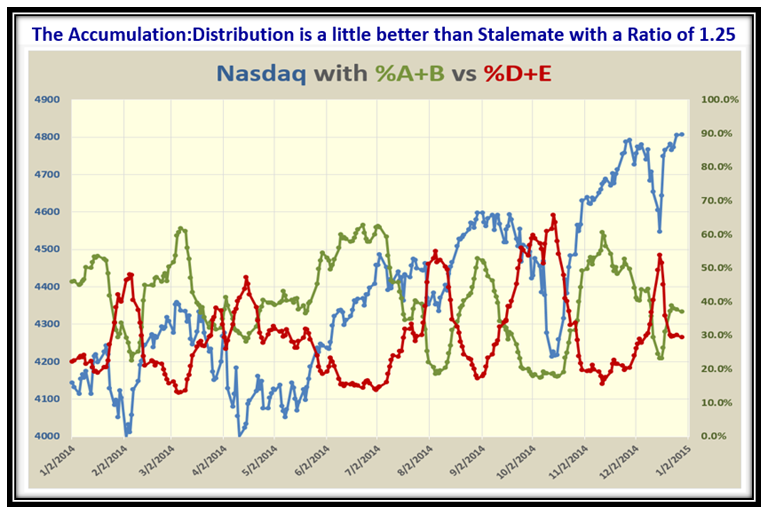

The Acc/Dist Ratio is only 1.25 so there is plenty of room for the Markets to go up:

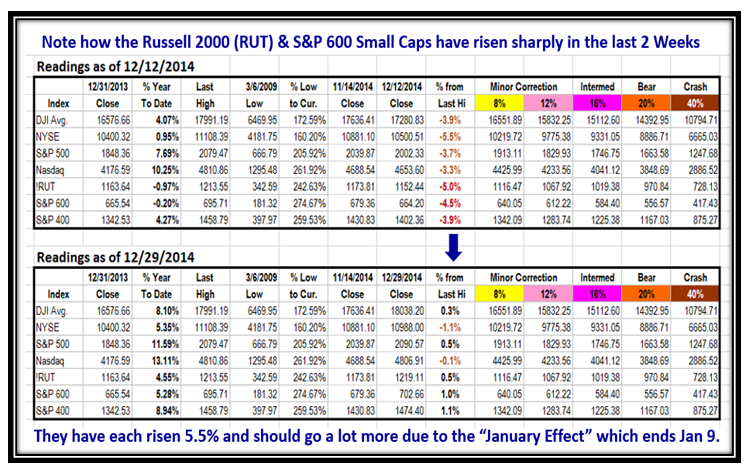

True to form the Small Caps have already started their run for the January Effect, but expect more moves higher:

Looking at the low, mid and upper four buckets may have some value as to direction so we will watch this item:

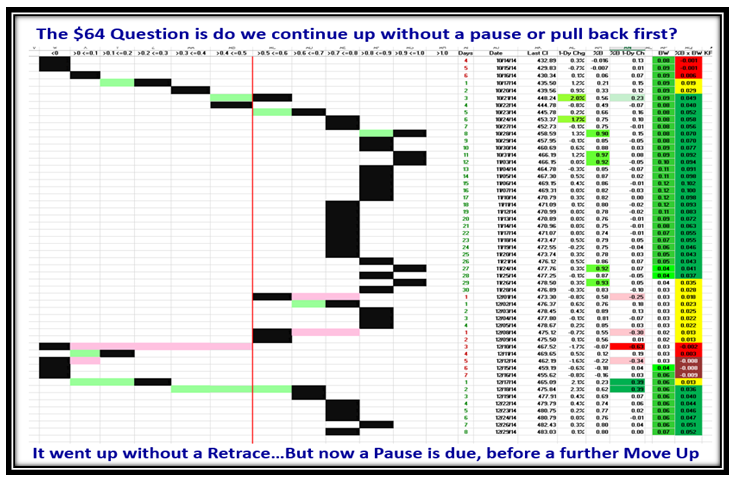

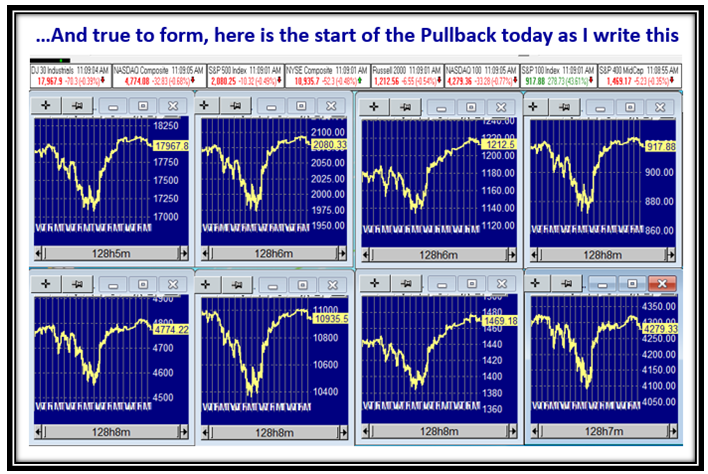

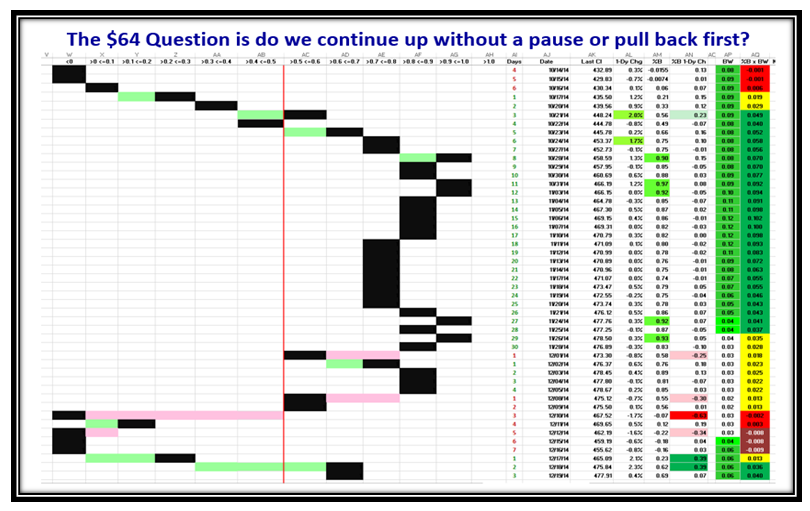

We have risen 7 days in a row so we are due for a pullback which is underway as I write this note:

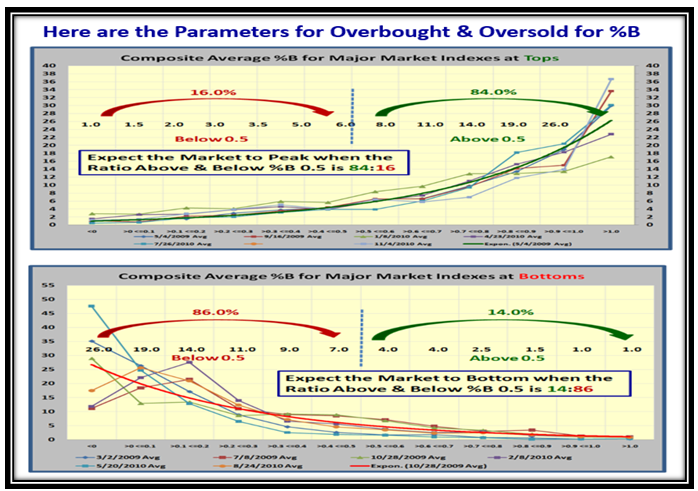

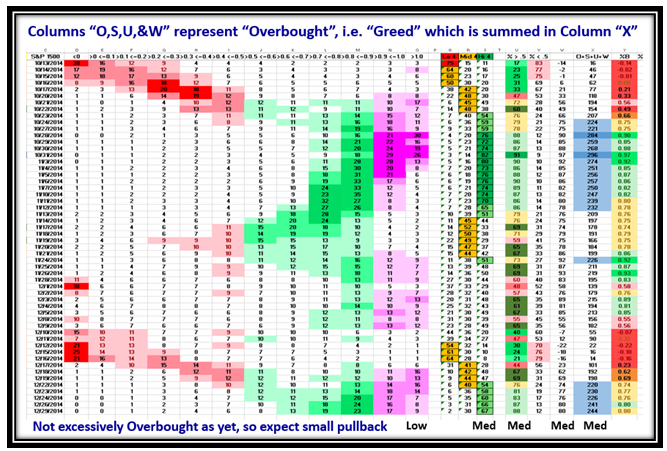

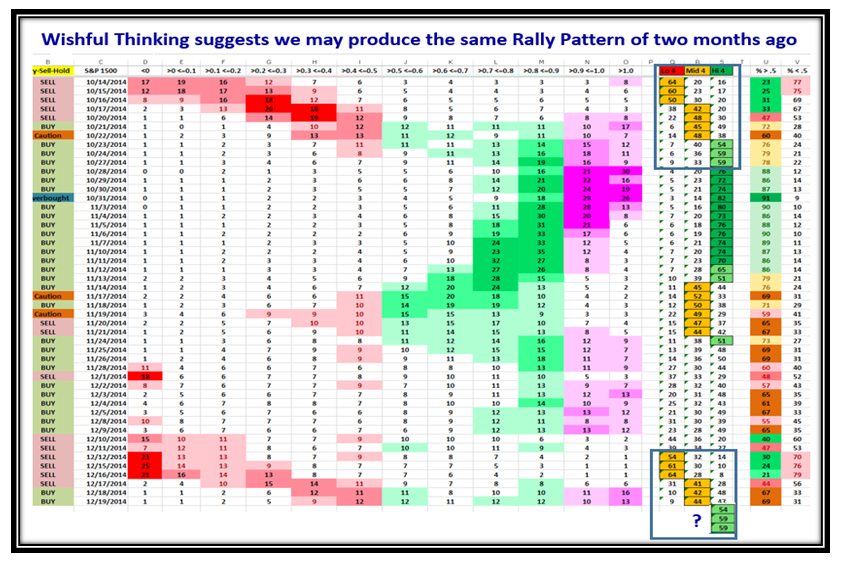

Here is some research I showed you four years ago, and worth noting at this time for the Market being Overbought:

Here is new research hot off the press relating to finding additional value for Overbought Markets…enjoy!

…And would you believe it the pullback is here as I write this with half an hour to go to Market Close:

Happy New Year to you all…give us some feedback on all of this good stuff!

Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog