Stock Market Bucketology for Clues of Market Tops

Give my HGSI supporters an inch and they take a mile! Joe came up with a great new term for all this %B good stuff I have thrown at you and “Bucketology” sure fits the bill. The hour is late so here in two slides is my New Year’s gift to you.

In my last blog I covered all the bases for you and showed you how the Market was deteriorating. We must recognize that this week is a very quiet week with little volume since most people are still enjoying their holidays despite the turmoil on both the East and West Coast with snowstorms and heavy rains, respectively. We all are saddened for those who have suffered so much these last few days.

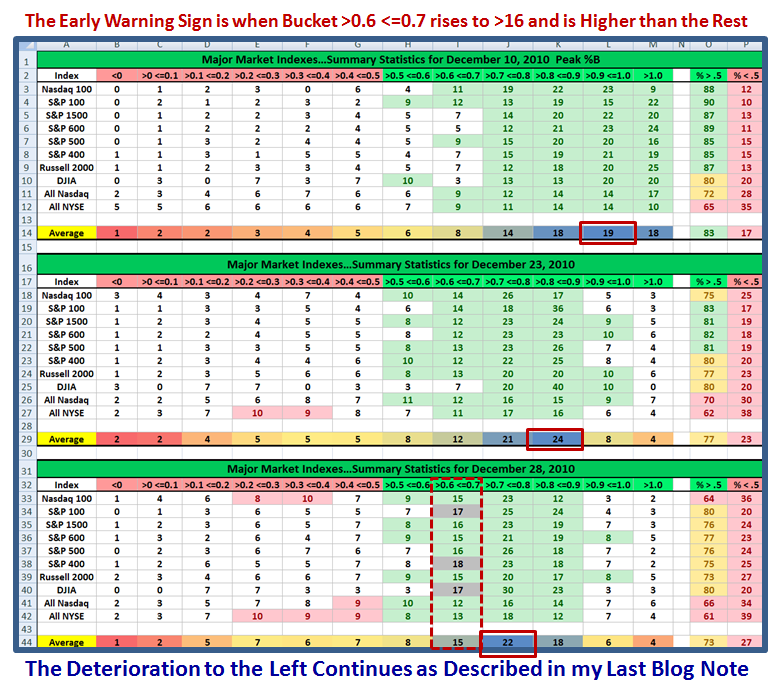

I have followed up with what I had suggested should be an early warning sign and to watch carefully for the #17 or greater in Bucket #8, >0.6 <=0.7, and here is the first signs of chinks in the armor. Not full blown yet, but if this downward deterioration continues one more day, it will be interesting to see what happens next:

Don’t forget to click on the chart to see a bigger view if the numbers are too small for your beady eyes, but I have highlighted the three 17’s/18’s that “fired” today as shown. As you all know this is a new concept evolving as it is happening, so take it for what it is worth with a pinch of salt, and we shall soon see if the Market bounces from here as it must do to maintain the rally, or it fizzles in the next few days or early next year.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog