Stock Market…Don’t Fight the Fed!

Are we headed one more time for a Climax Run. My good friend Mike Scott reminded me that this is the same “kerfuffle” that occurred at the Peak in October 2007. Imagine IBD caught in the same dilemma with Market under Pressure, then Market in Uptrend and back to Market under Pressure within a week, and what do you think they will say right now? The word is out, you guessed it…Market in Uptrend! I warned of both Bull and Bear Traps, but there is only one golden rule which is to let the Market tell you what it is doing, but I strongly advise us to play with one foot in the exit.

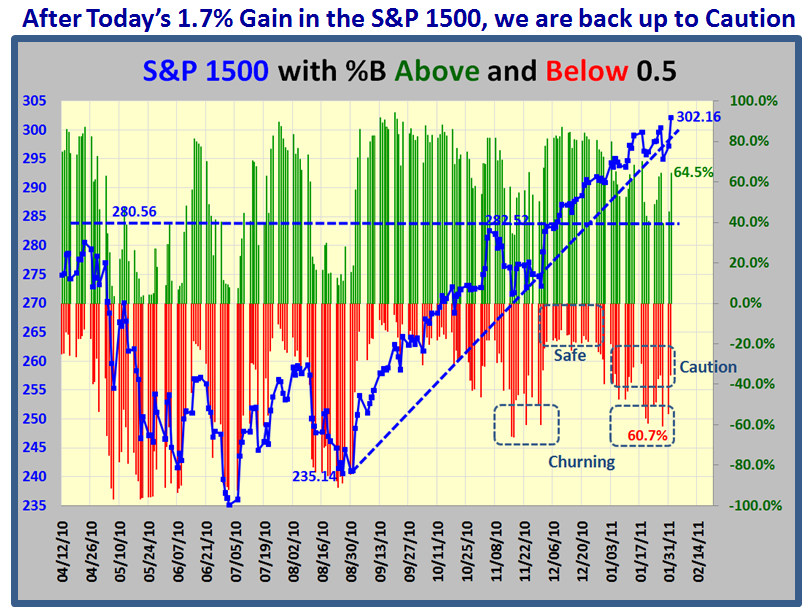

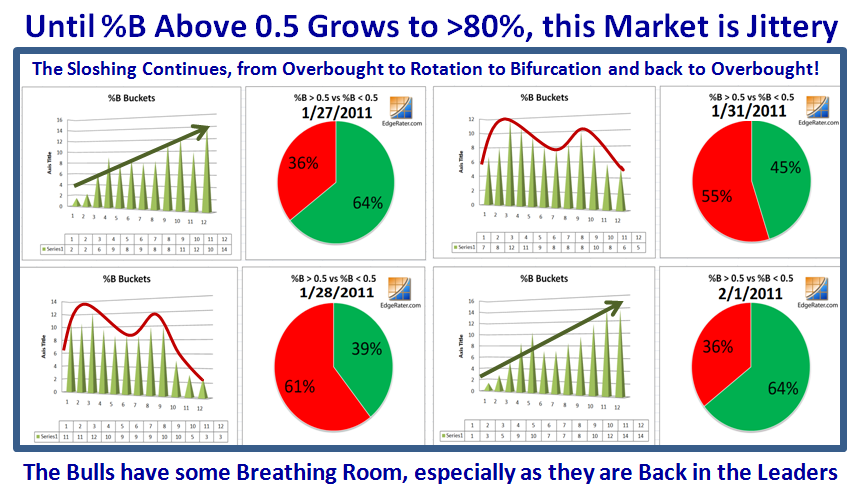

The Bucket Sloshing naturally continued today with a strong move to the right, but with a 64:36 Ratio, though the S&P 1500 %B has jumped back to Overbought Territory with a reading of 1.06! Net-net we are back to Disparity and the stocks above 0.5 have to be pulled up by the bootstraps as I show in the following slides.

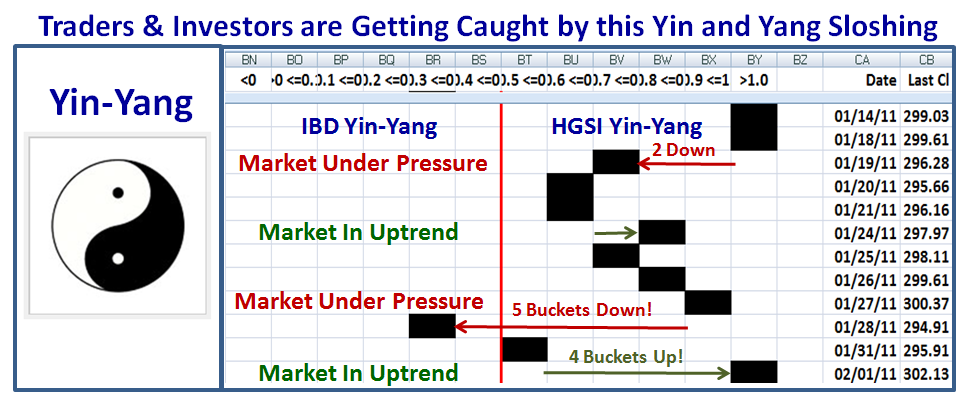

I guess we are all confused by the extent of this Volatility and here is the reason why…the Yin and Yang:

However, I am satisfied that our process is working and we now have a method not only that a Market is Under Pressure or that it is in an Uptrend, but the extent of the damage and the recovery with the sloshing buckets.

…And now let’s look at Grandma’s Pies and the Buckets which show how Jittery it has been these last four days:

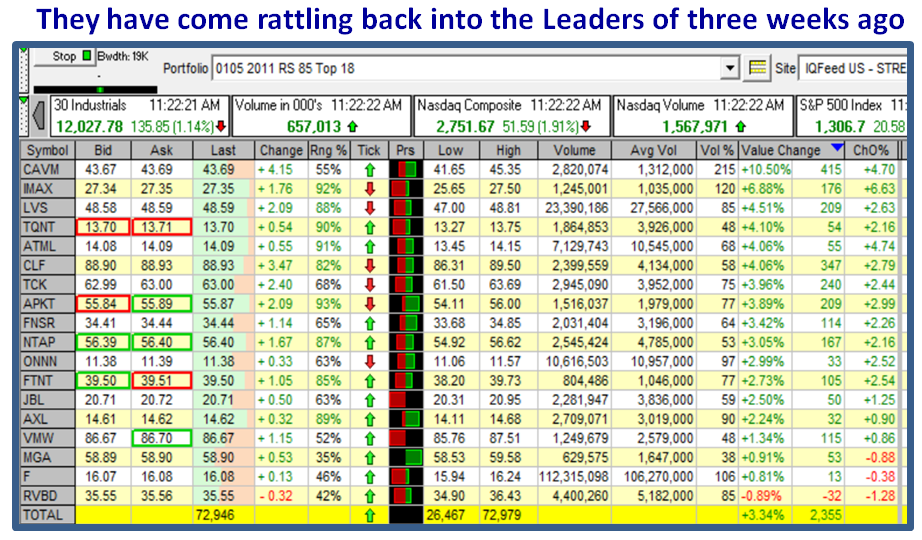

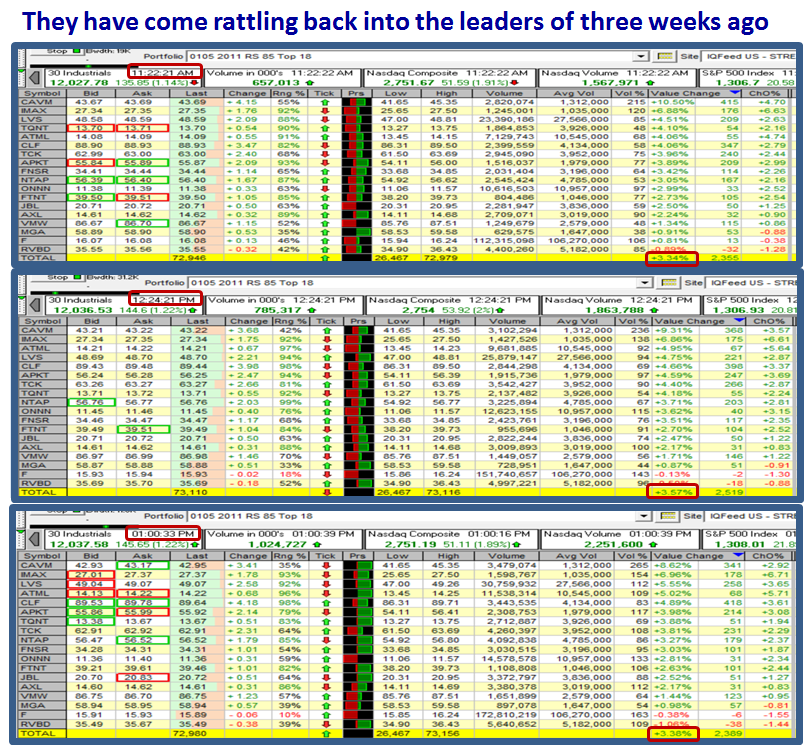

Today was a very good day for the Leaders that were trashed as they came right back into them. Here is a list of 18 stocks which I captured three weeks ago with an RS 85 rating which I keep tabs on at times like this. For those of you who have HGSI and QuoteTracker, this is a worthwhile tip to see which way the wind is blowing on key days:

To see which way the wind is blowing on a strong day up, keep an eye on snapshots at 11.30, 12.30, and 1.00pm Pacific Time to see how these Leaders behave, and you will immediately see that they held up well, so this was not a one day wonder for the moment. I know the numbers are hard to read, but just click on the chart to see a bigger view and you will see that they held up respectably with some stocks having strong volume…of course, the big boys could be selling into the rally! One more clue, they were buying the top two in after hours and drove the Average up to 3.58% once again:

Last but not least, my good friend Paul got permission from Barr of his website to post this picture which says it all:

Keep your powder dry and good luck in these tricky times. Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog