Stock Market: Uncertainity Weighed Heavily on the Market

With all the recent writing I have done getting the Newsletter out, Carpel Tunnel is back in my right hand so I will keep the typing to a minimum:

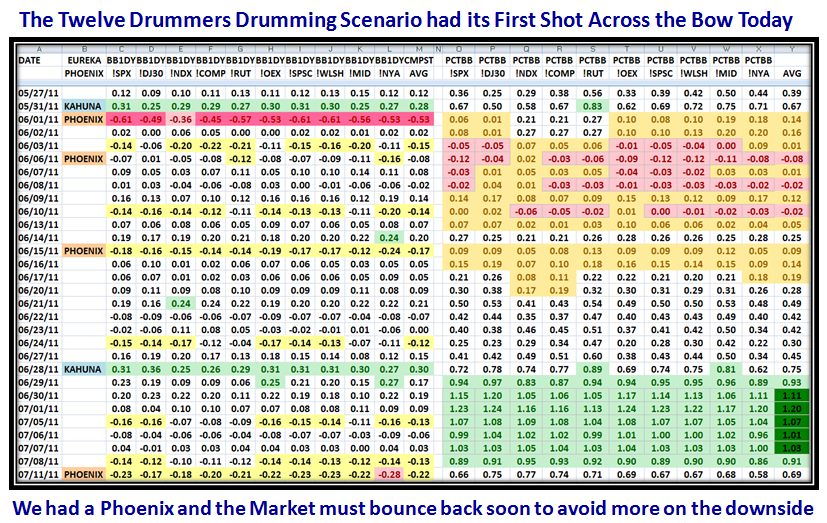

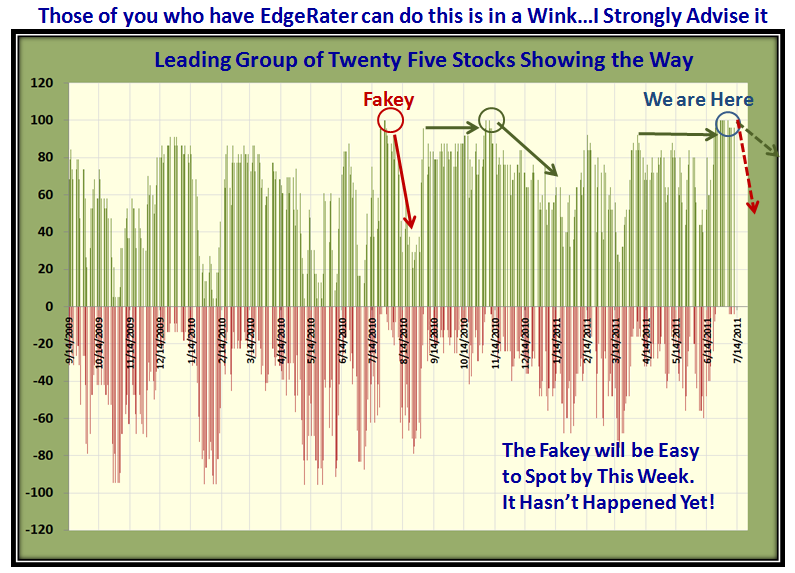

You know the symptoms…once we hit a peak WITHIN twelve days one should see a correction. How big nobody knows:

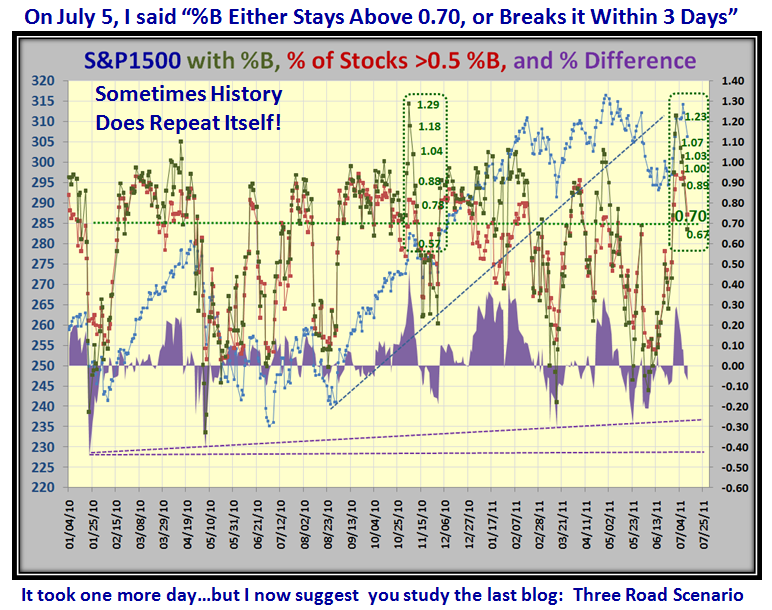

Who says “History Doesn’t Repeat itself?” Well close enough for Gov’t work:

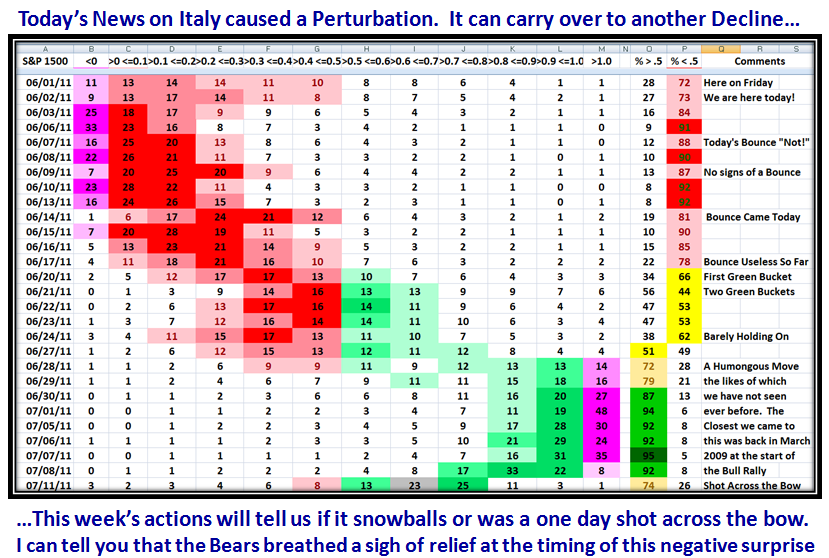

A shot across the bow, but we still have a decent cushion…a bit of luck for the Bears for such a turn of events, who were biting their finger nails:

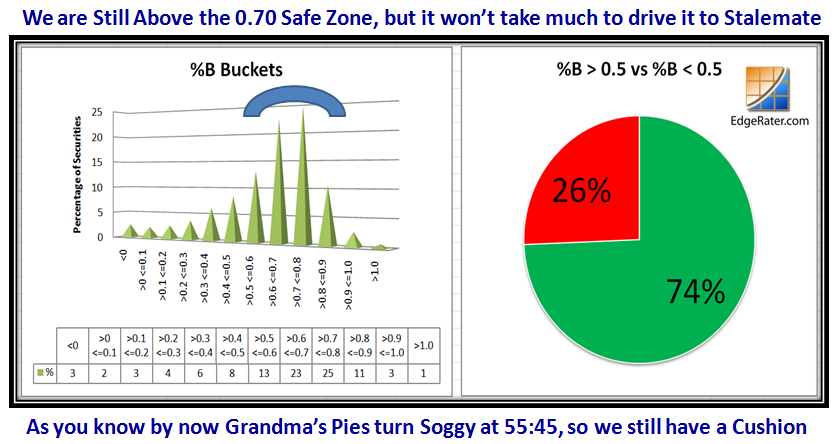

Grandma’s Pies are still in the Safe Zone, but one more day like today can turn them pretty soggy:

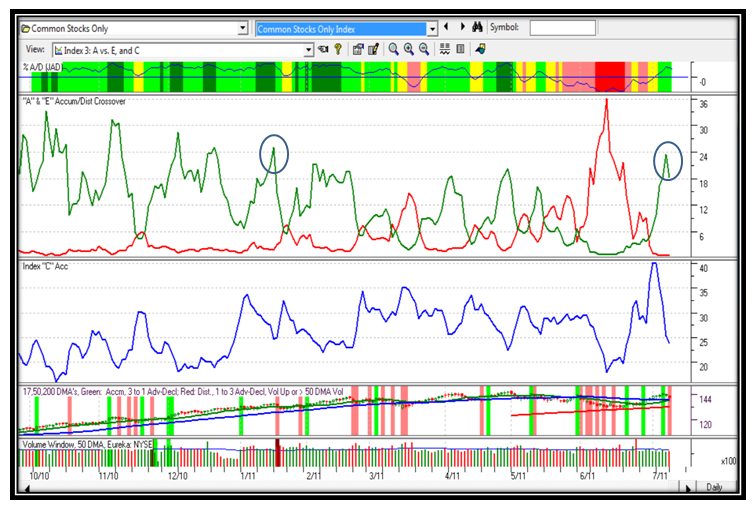

“A” Accumulation has turned back as expected, but not enough to be alarming at this stage:

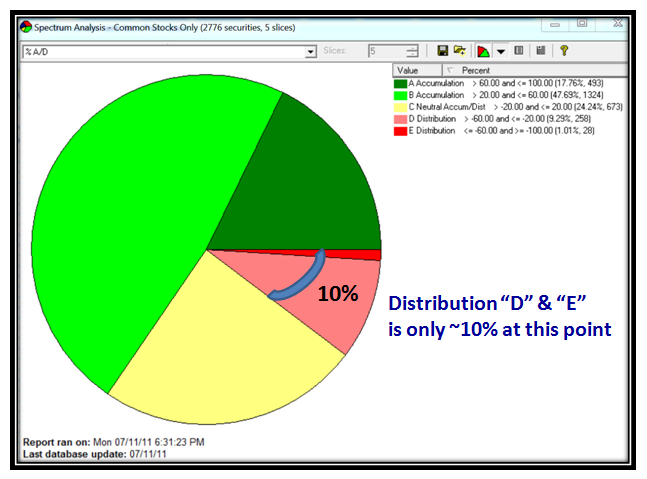

This Pie Chart shows more clearly that Accumulation is still strong with only 10% in “D” and “E”:

The strong group of 25 stocks I featured a couple of blog notes ago are still holding up, but has slid down a bucket or two though still above 0.5:

The Ball Game for the overall market hasn’t changed in several months and stays between 2600 and 2900 as I have shown before:

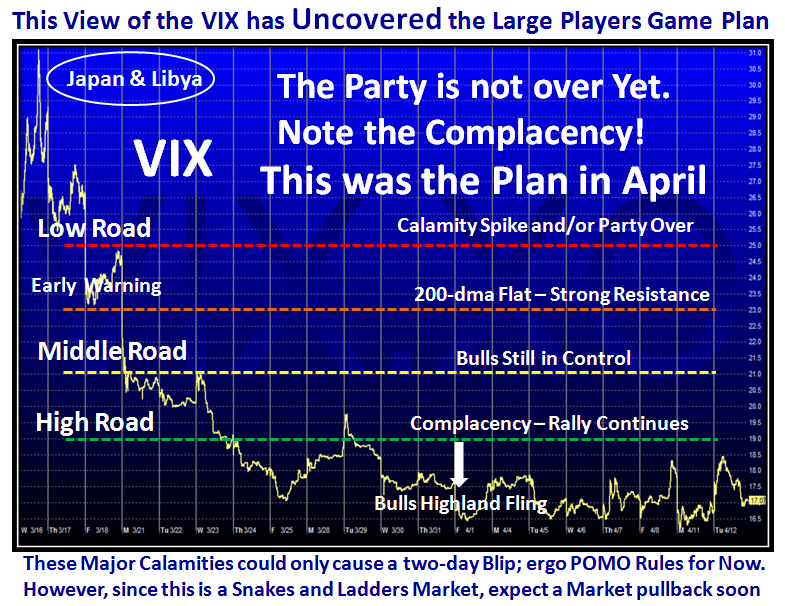

The Bears are now focusing on the VIX and similar instruments…this is good for Type 1 and 2 traders. I gave you the Game Plan Moons ago:

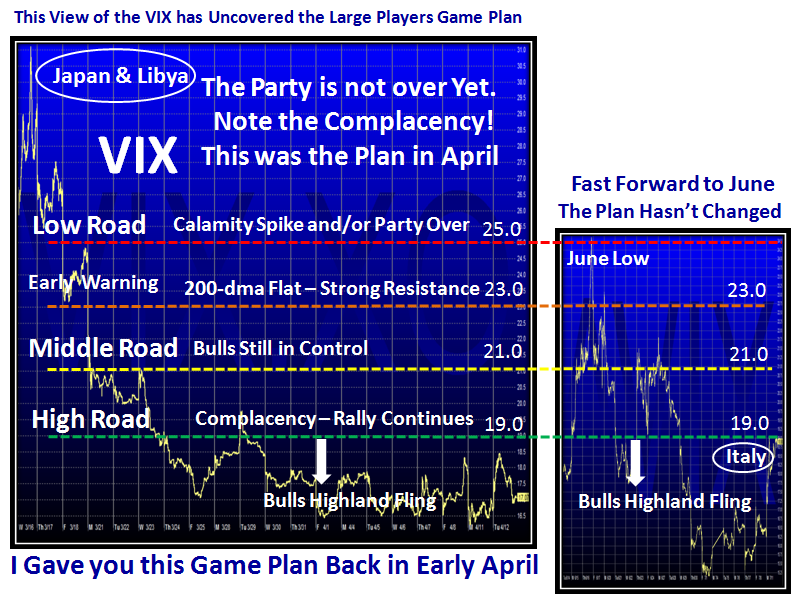

…And here is where we sit today with a fast forward to June:

…And there you have the picture to help you plan for the week ahead.

Best Regards, Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog