Helicopter Ben: Risk Going Over a Massive Financial Cliff

The six-month meeting between the Fed Chairman and Congress ended in Finger Pointing both ways while Helicopter Ben indicated concern that we risk going over a massive financial cliff. If it is that massive then there is no prettier cliff than the White Cliffs of Dover, so I couldn’t resist thinking back to my youth and singing the song which I am sure you all know:

So What you ask? Given what we have put up with these past few months and especially this last few weeks, I offer you a suggestion which it seems that most of you have already done and that is stay away from this “Cut you to Ribbons” Market.

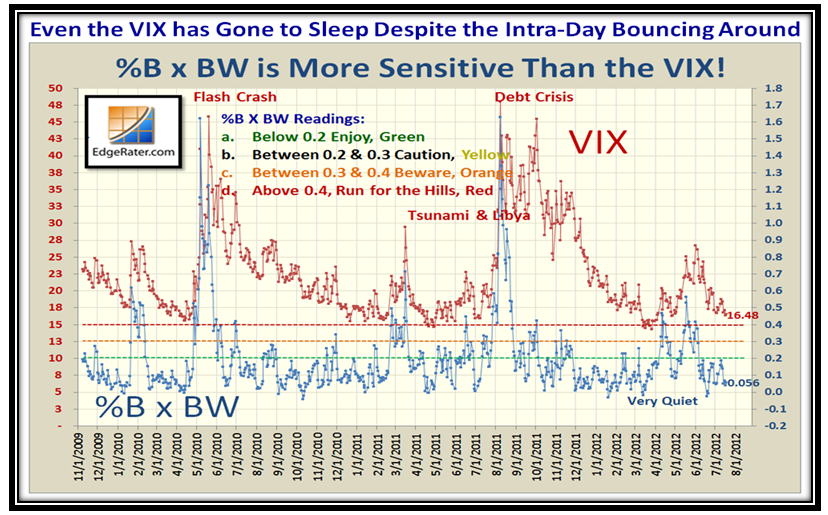

…And yet, in all this turmoil, the only signs of volatility is intra-day as the VIX is very quiet…so that confirms that the High Frequency Traders (HFTs) are making hay while the sun shines:

You are well familiar with this picture and the only good thing is that the Market is going up through all the see-saw we have put up with:

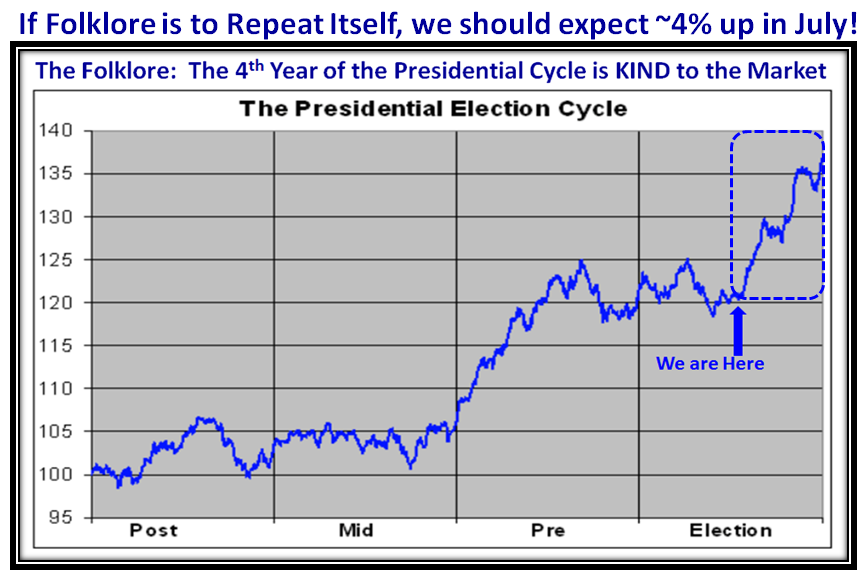

The only ray of Hope that this market will climb a wall of fear is the folklore of the 4th year of the Presidential Cycle:

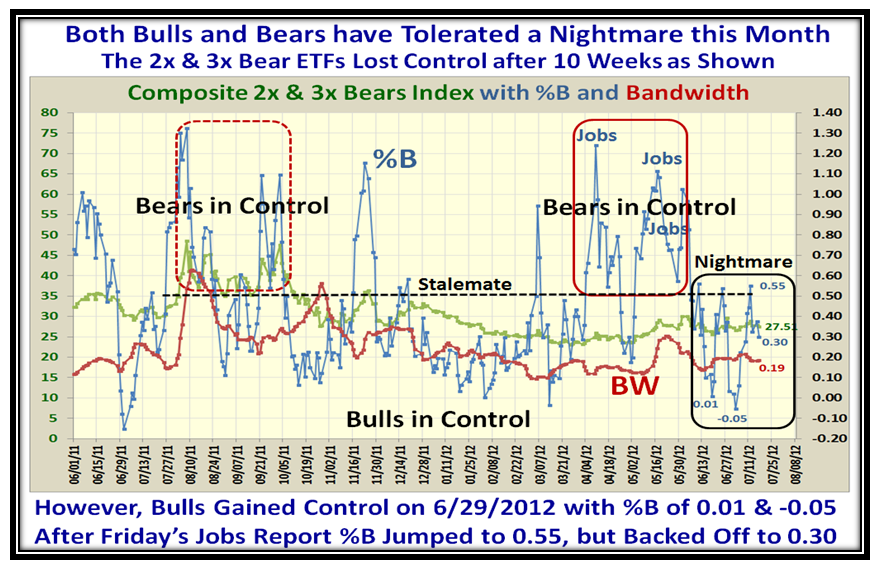

Keep an eye out for August 3rd…the Next Jobs Report must be golden or we hit the skids one more time:

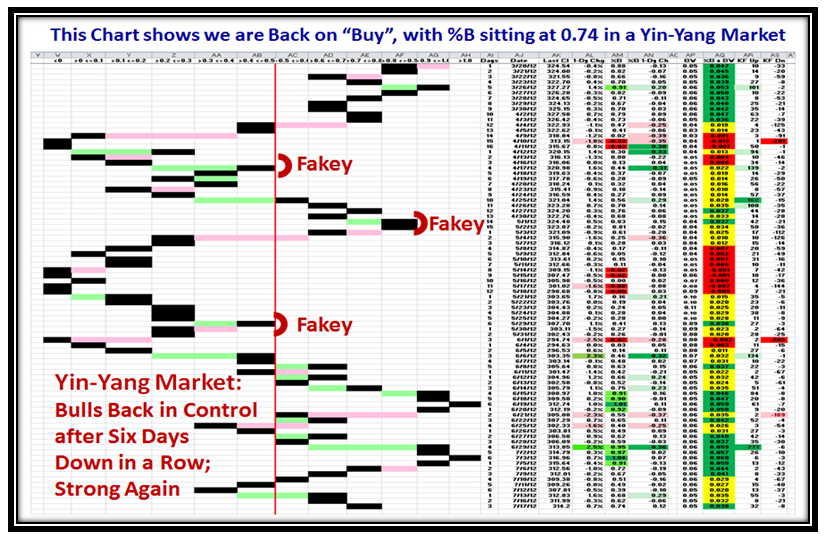

I mentioned on the recent Blog Notes that the best early clue for knowing for sure which way the wind is blowing is to track the %B for 2x & 3x Bear ETFs, and this has proved to be a valuable tool. We can see that the Bears have been losing ground for the last month. The other value is to understand very near term volatility and whether we have a calm and stable market or one in oscillation. The over exaggerated moves in %B give us that clue! We want to see %B below the Bandwidth (red line) and relatively quiet as seen in the middle of the chart and not a yin-yang up and down as on the right hand side, which is a nightmare.

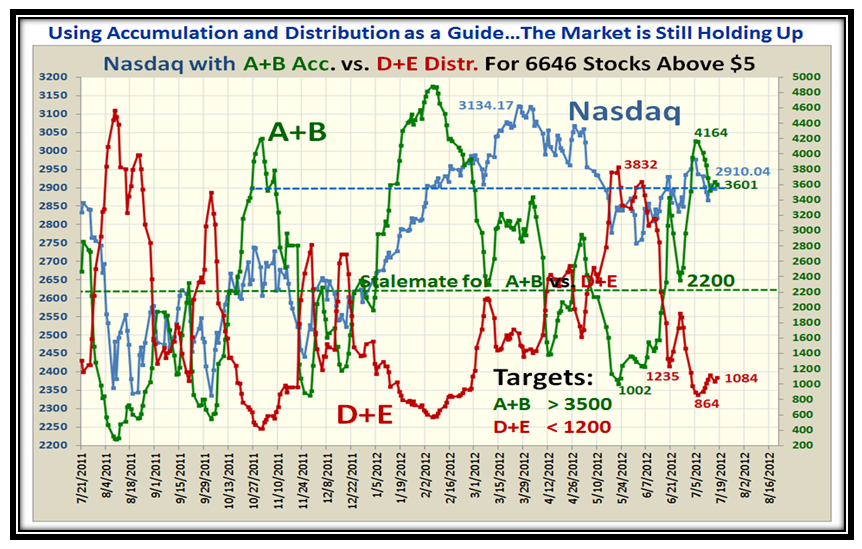

So What is the Near Term Bias based on %B with the S&P 1500 and then with Accumulation/Distribution? Both are very positive, but play it close to your vest:

Well there you have it…Keep your powder dry and pick your spots, but be nimble.

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog