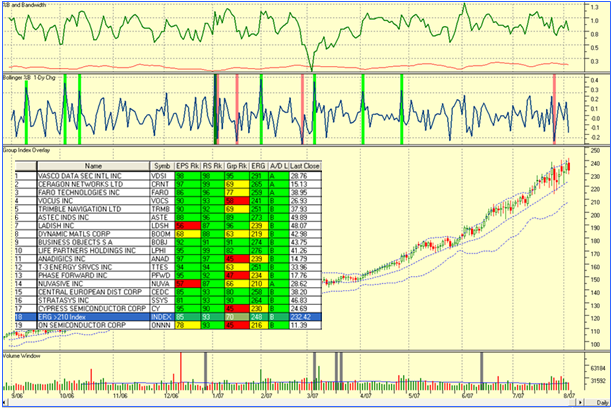

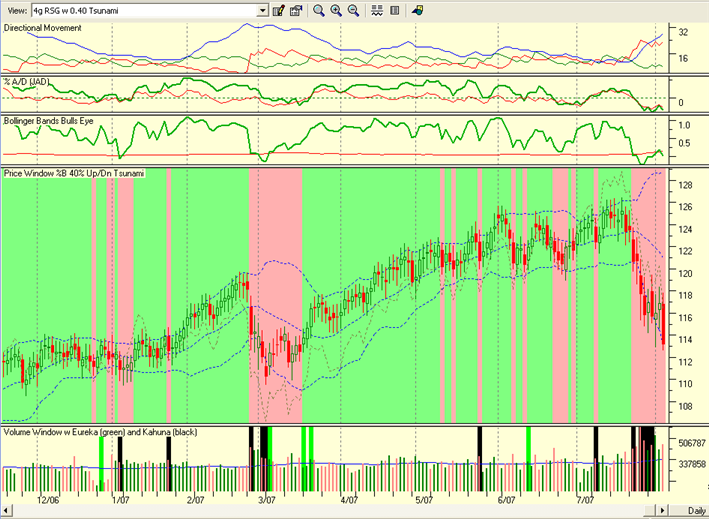

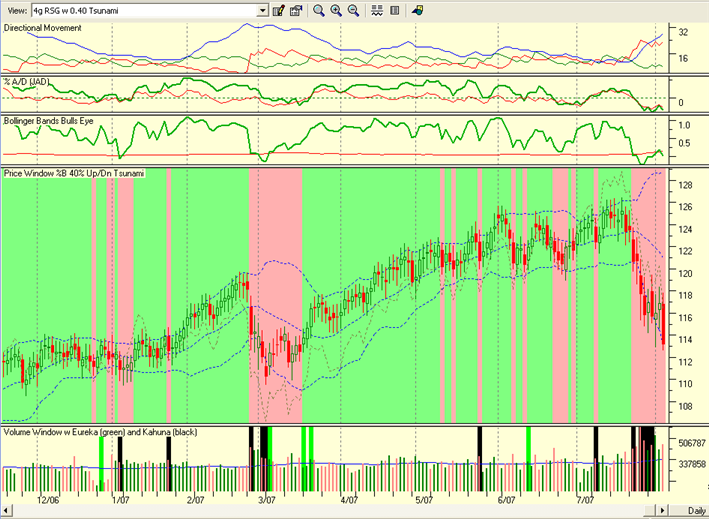

In my last few notes we have had plenty of warning signs this past week that the Market Indexes were going to head down. I won’t repeat all of that, but at least you now know the steps to take if you find yourself in this situation again. Before I go into an analysis I showed you how valuable the Tsunami Indicator is in times like this. Here is the current picture. Just look at the damage:

It is worth a few sentences on what possibly caused the psychology to change in the Bears’ favor:

Three things immediately come to mind:

I. The clientele were primed for a correction with weeks and even months of anticipation for a 10% correction on the S&P 500. The talking heads talked that one up daily on CNBC.

II. The sub-prime lending bubble which affected the Hedge Fund debacle for Bear Stearns and others.

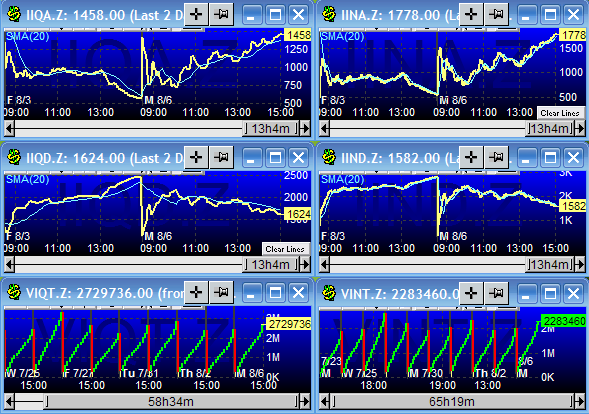

III. The unbelievable Volatility in the Markets for the past year building up from the correction last May 11, 2006 and increasing right up to the present day. This discouraged most investors and even swing traders to throw in the towel. Day Traders had a ball, but even they were put to the test at being very nimble.

It is far more important to assess where next and what the possible alternatives maybe for the immediate future:

1. The Volatility is here to stay. It may decrease but not anytime soon, so realize you must contend with that.

2. The housing market and the sub-prime fiasco have still a ways to go to work itself off.

Net-net on these two items is that it will take a while and there is little investors can do than to realize that for the moment long term Buy and Hold is very risky no matter how tempting we might feel in trying to bottom fish for value. The knife is still falling and our motto is never catch a falling knife. We have no idea of where the bottom might be. That leads me to item I above, where at least we can resort to the up, down and sideways scenarios you have seen me use for setting the Benchmark Targets:

3. The psychological mood is “let’s get a decent clean out and start a fresh bull rally”. The $64 question is how low is low, but we have the tools to identify reasonable targets:

a. Go back to the psychology – 10% correction for a decent clean out. The odds suggest an 8% correction on top of the several we have had since the bottom of 2002 is unlikely. We are essentially there right now and already broken the 200-dma. If the market does stop here then this problem is only postponed. So we must be on guard for at least a 10% correction which takes us down to a nice easy number to remember, which is 1400 points on the S&P 500. That is just 33 points away. The odds suggest there is a 77% chance the correction will be <8% and an 11% chance of it being between 8% and 12%. Since the 200-dma is broken, it usually takes weeks rather than a few days to recover, unless we have a major snap back next week.

b. Beyond that we head for an Intermediate Correction of 12 to 16%. You can do the math, but that takes us down to 1369 and then 1307, which would essentially mean wiping out the entire rally from this past March. The continued sub-prime mess can do that. Anything above 10% hurts and deeper corrections will kill you. Appreciate that 12% down would be 6% down on the Limbo Bar (Reverse High Jump) and gives us an estimated P-E of about 15 for the S&P 500. It goes without saying that the market would be very oversold and undervalued at that stage.

I will give you a Game Plan for the immediate future in the next blog note, but I would appreciate any comments which you can leave at the bottom of this note as to whether this is of help to you. For more on the health of the Market, I strongly recommend you listen to my colleague Ron Brown’s movie at http://www.highgrowthstock.com/WeeklyReports/

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog