Stock Market: No Blarney on the Hindenburg Omen!

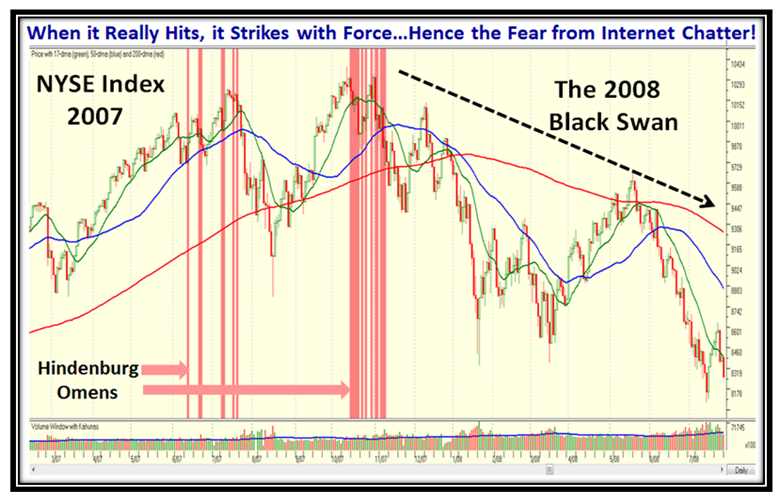

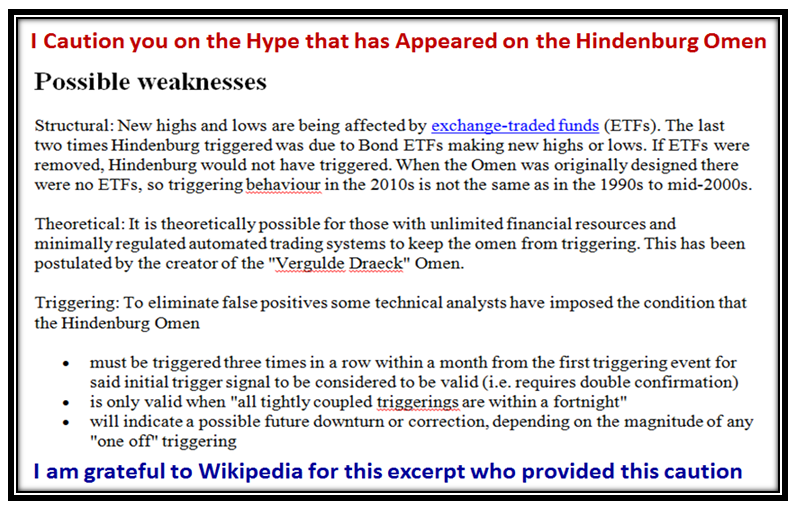

Sunday, June 16th, 2013Many Moons ago, particularly back in the time-frame of 2005 and 2007, we had plenty of Hindenburg Omen Signals and of course because of its name, everyone sits up and takes notice when these signals fire. It’s a strong warning signal for a Market Top, and in essence what is happening is that the Herd, which is the likes of you and me, is buying while the pros are selling.

During that timeframe I was fortunate to have Wikipedia pluck one of my blog notes relating to the Hindenburg Omen’s that fired then, and so whenever there is a hint of a sighting my blog gets hits from all over the world to see what more they can glean from my notes on the subject. I appreciate that and here is my updated discussion on the subject to bring you forward one more time on the genesis and history of the whole subject from then to now:

When the Internet goes gaga 24/7 on this good stuff, you would naturally ask “What is all the fuss about?” Its claim to fame is that there has never been a significant Stock Market decline in History that was NOT preceded by a confirmed Hindenburg Omen signal. However, on the other hand, not all signals are going to turn out to be major corrections. In fact, 75% of them are small corrections, and I will show you that in a moment.

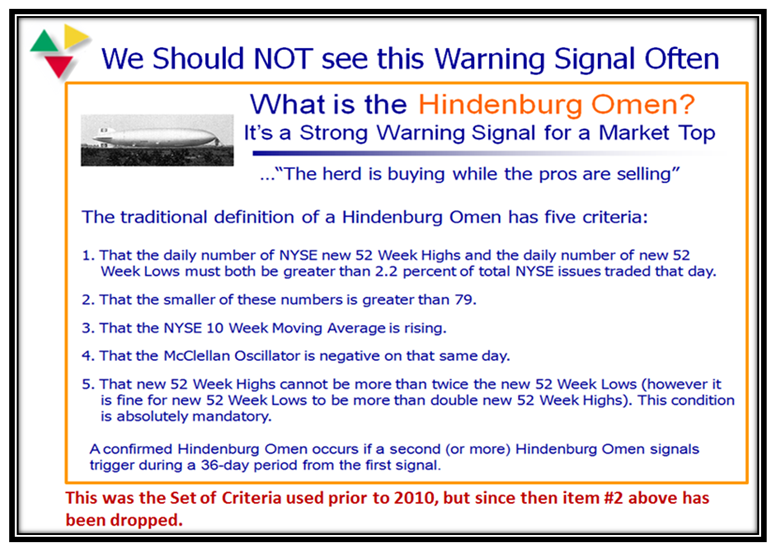

But let me first describe what the Criteria are to trigger a Hindenburg Omen Signal of which there are five in all. You will soon see they are cleverly selected to ensure that these signals do not fire except on rare occasions when all must be TRUE on the same day. This is the brilliant work of Jim Miekka who was the originator of this signal and together with Kennedy Gammage came up with the name. You can’t have a spurious single Signal for us to have a confirmed Hindenburg Omen in play. You must have two or more, and invariably you will see there is a cluster at Market Tops. Here they are:

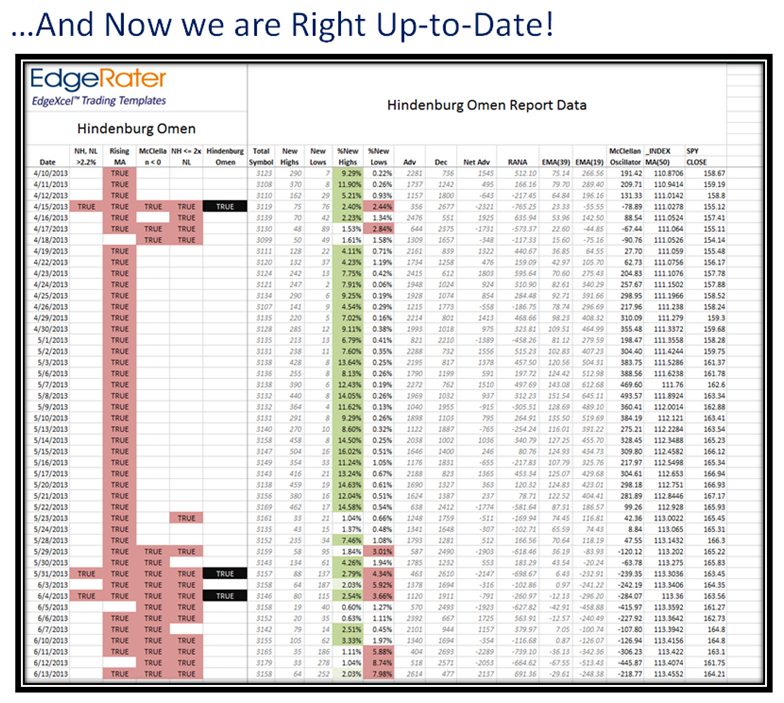

Although the HGSI Hindenburg Omen Indicator has served us well over all of 10 years, times have changed and others have turned to using the ALL NYSE instead of the NYSE Composite, so Chris White, CEO of EdgeRater has worked with me to help keep you up to date. In essence this is the major change in addition to dropping item #2, from what we see in the current literature.

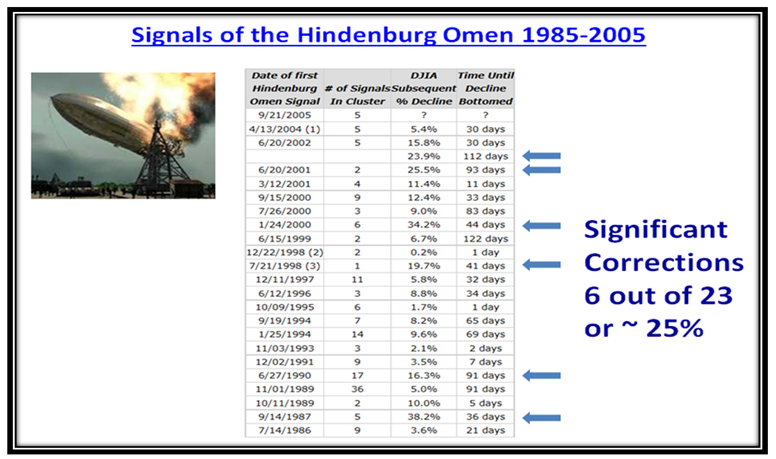

This next slide is the past History from 1985 to 2005, and I have plucked out those that are above 16% which is close enough to a Bear Market Correction of 20% to be considered significant. You will see from the list that these significant corrections amount to 25% of the time. The remaining 75% of the occasions turned out to be essentially small with most of them single digit corrections.

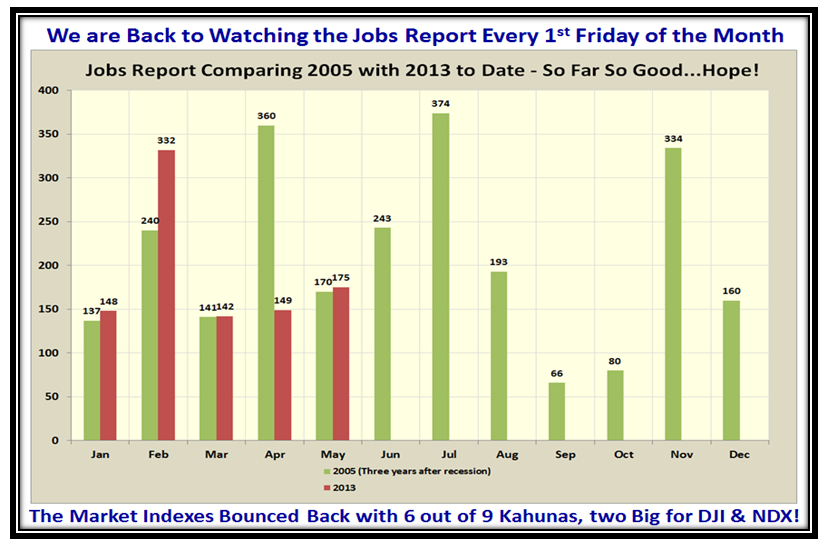

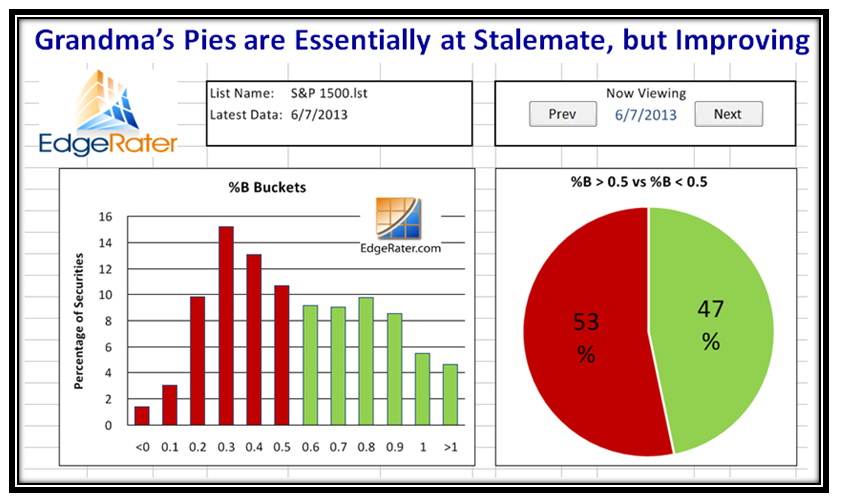

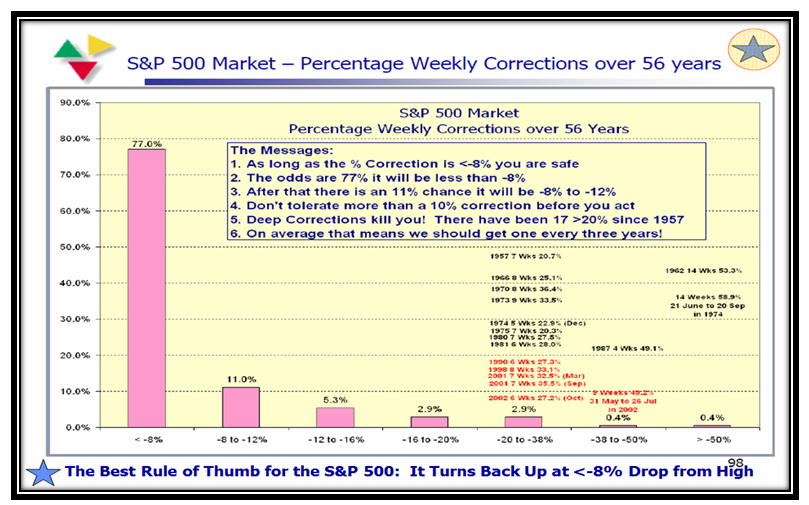

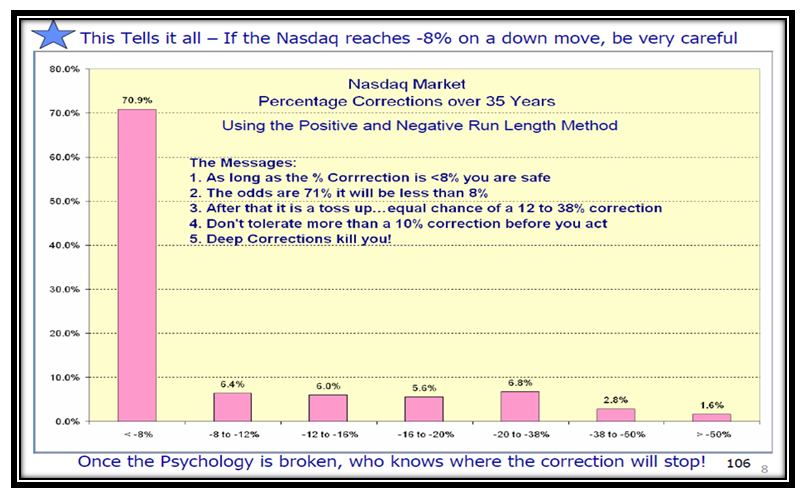

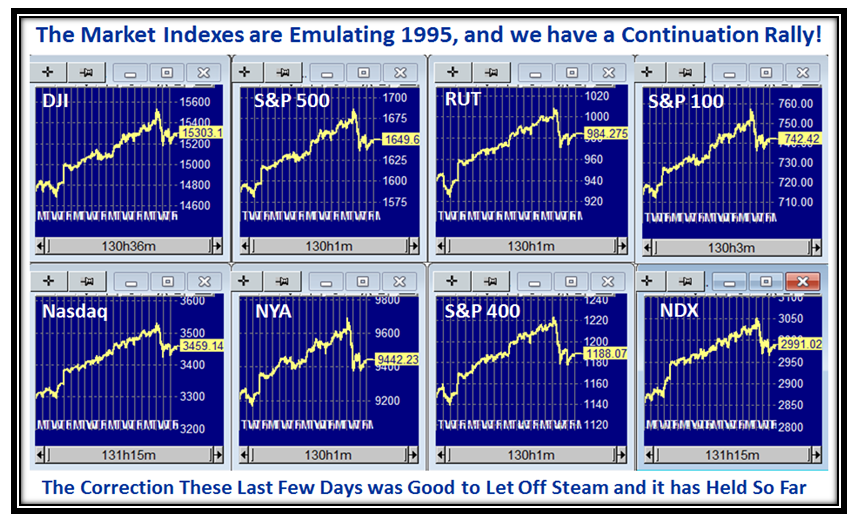

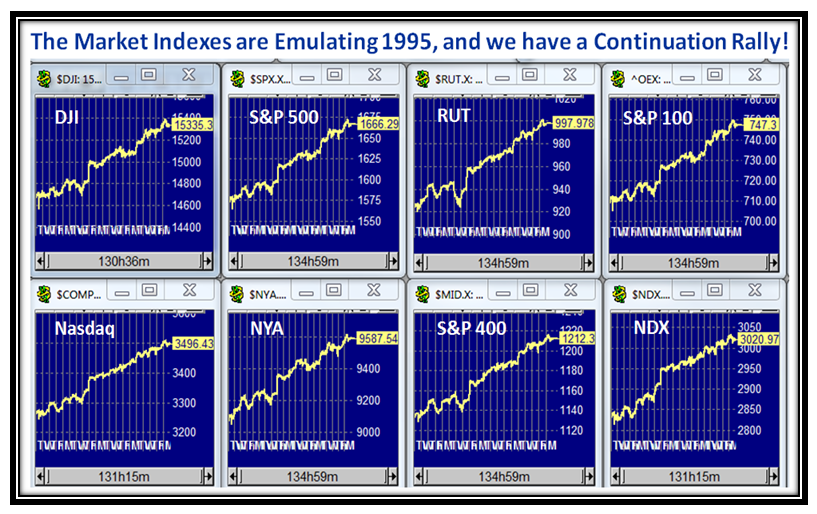

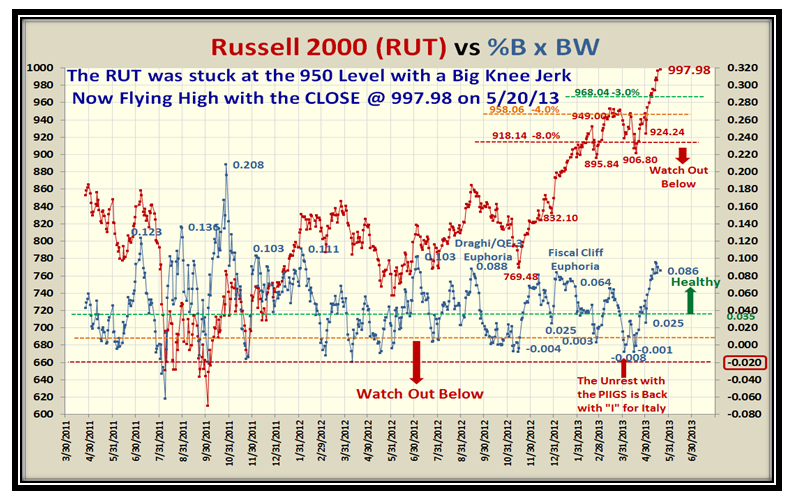

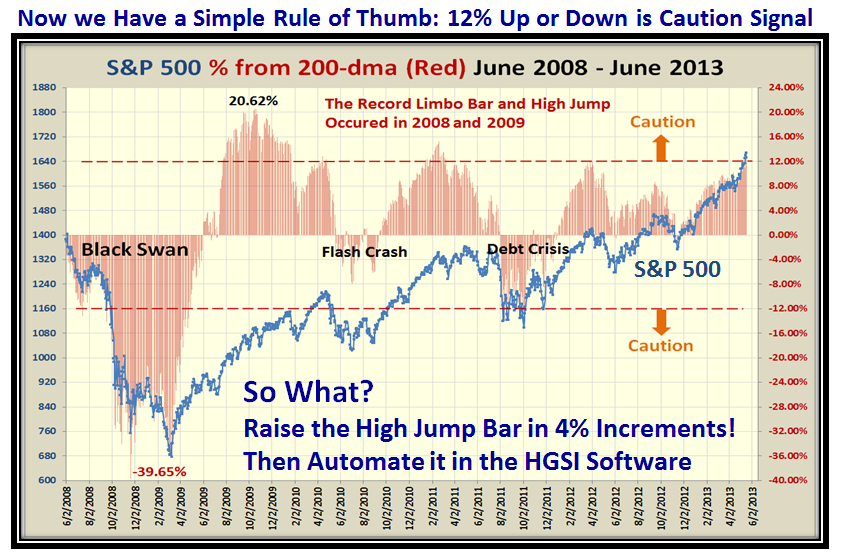

So the bottom line out of all of this is to sit up and take notice when these fire and be on guard until they fizzle out which is 75% of the time…Where have you heard that swan song before? It ties in directly with what I showed you in last month’s Newsletter and on the Blog where Market Corrections are seldom more than -8% from the high, before they find support and rally up again!

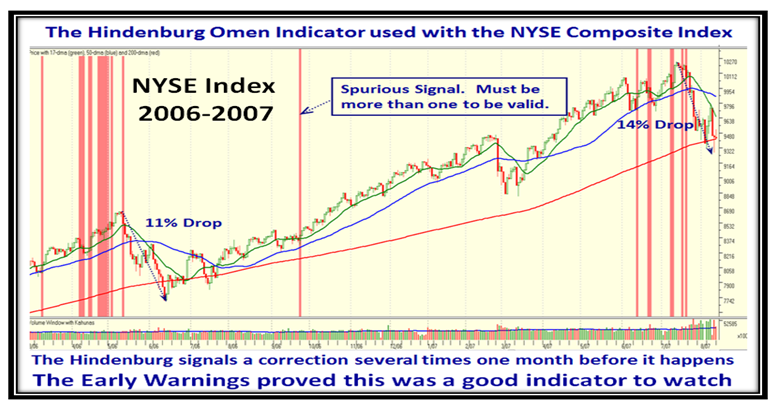

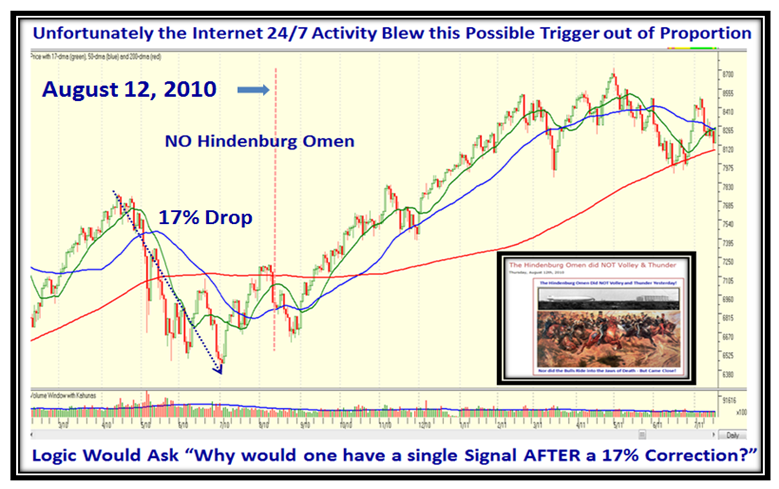

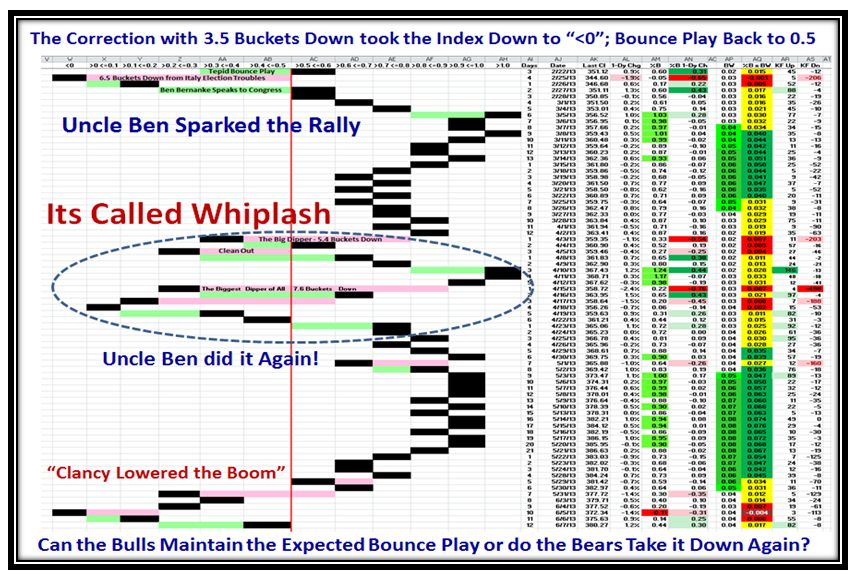

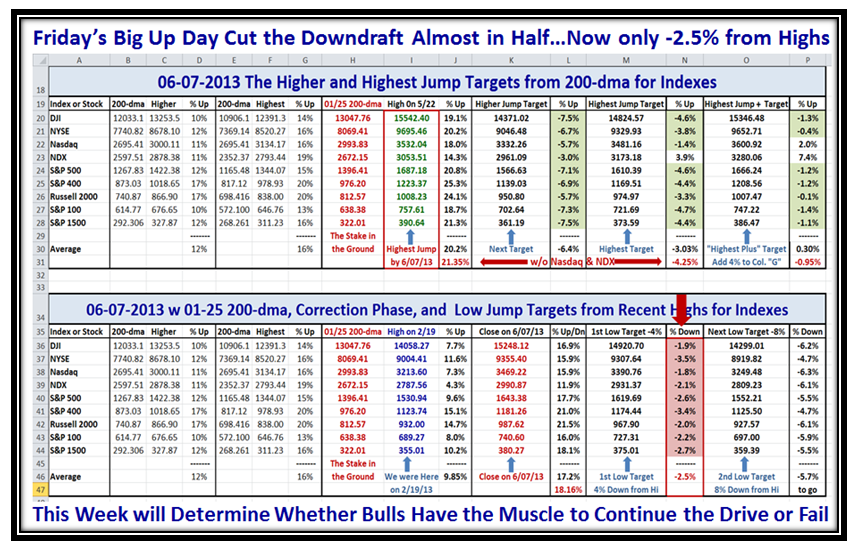

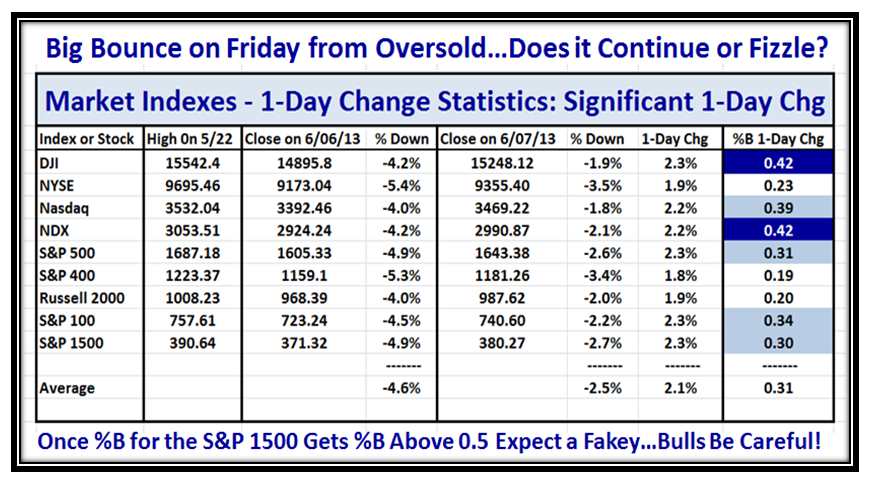

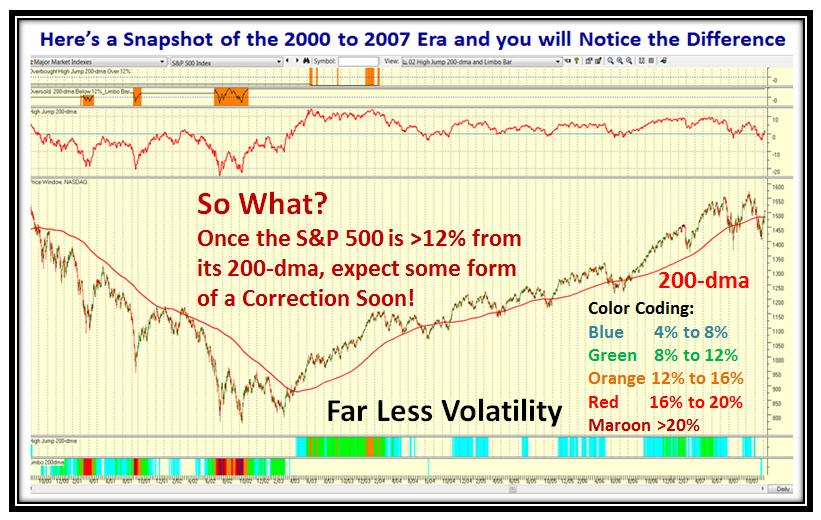

So let’s first see a couple of slides which have been plucked from past Blog Notes for the 2005 to 2008 timeframe, and then one in August 2010 which turned out to be “bogus” even though the Internet went gaga when it occurred. The slides are self-explanatory:

Here is a Screen Shot of the Blog Note Picture I used for the “bogus” sighting back in August 12, 2010:

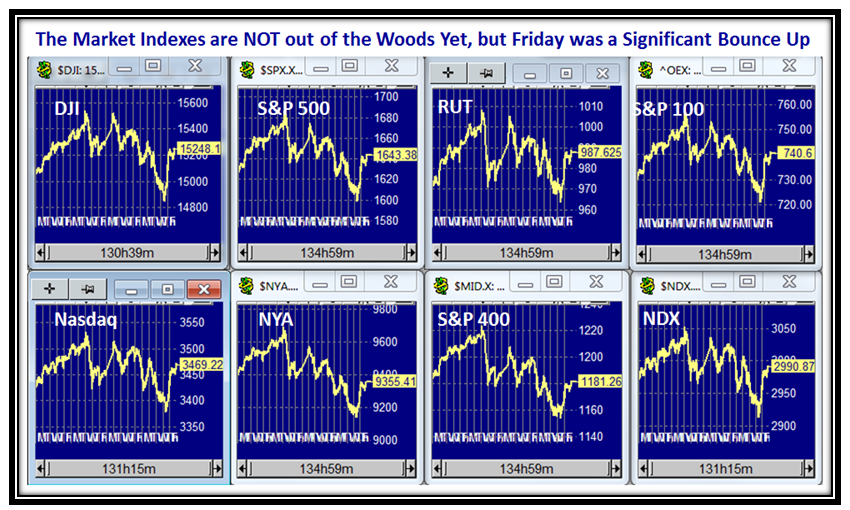

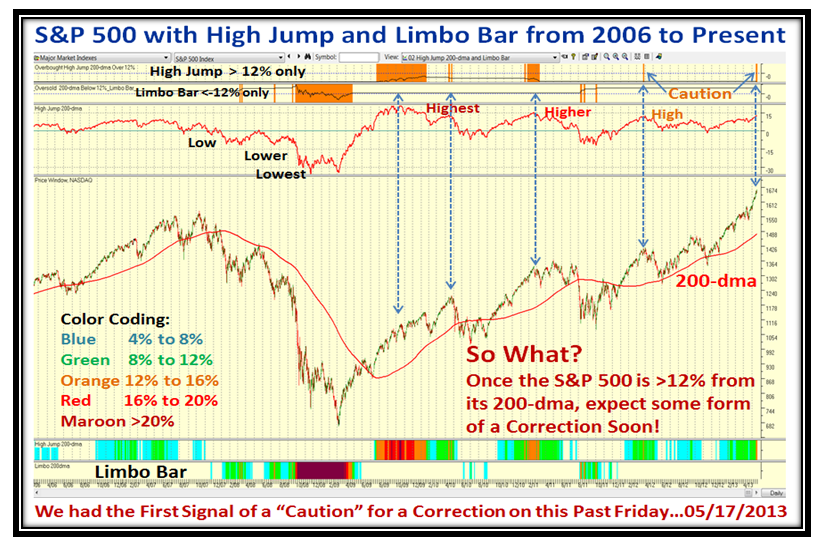

…And here is why; so never ever take action on a single signal, and even then reason with yourself if it even makes sense, by reviewing such other favorite indicators such as the High Jump, the Eurekas, the Phoenix’ and the Kahunas! This next chart shows that I was correct, since it just made no sense when looking at the chart, period. The stuff to the right was not there at the time, so it was a judgment call:

So now we fast forward to this past month, and as I say, it seems that the masses out there are now using the ALL NYSE instead of the NYSE Composite, and with all the work that we have underway in several directions to improve the presentation of the work which we have done over these past 15 years, I was fortunate enough to have Chris give me a lending hand to show how we are hearing 24/7 on the Internet about all this fru-frau of sightings. It seems that it takes Class Stocks, Preferred Stocks, and Warrants in addition to Common Stocks to get these triggers as Chris has ably shown in the video we put together. (See below for the link to U-Tube and how to view it without leaving this Blog)

It goes without saying that my Blog has been lit up with hits from all over the world with 50 from Australia in one day, and I certainly do not want to disappoint them when it is the hot topic of the moment. Needless-to-say, not even a thank you except for a faithful few, but that goes with the territory.

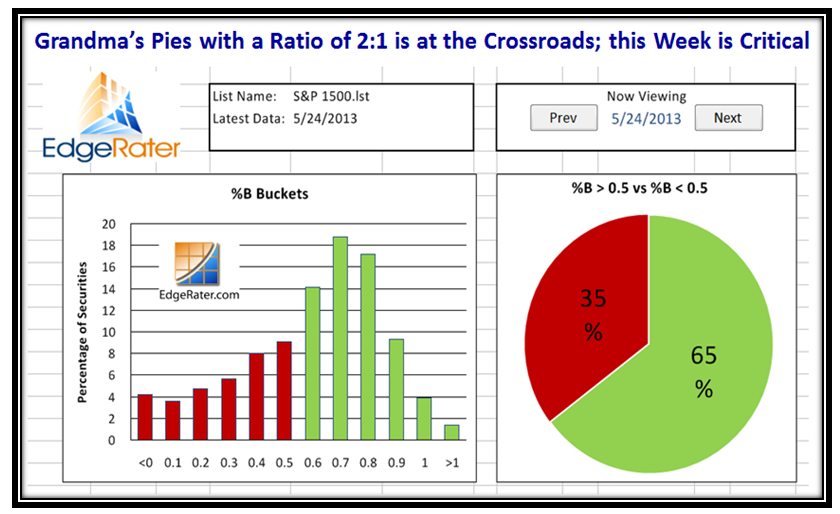

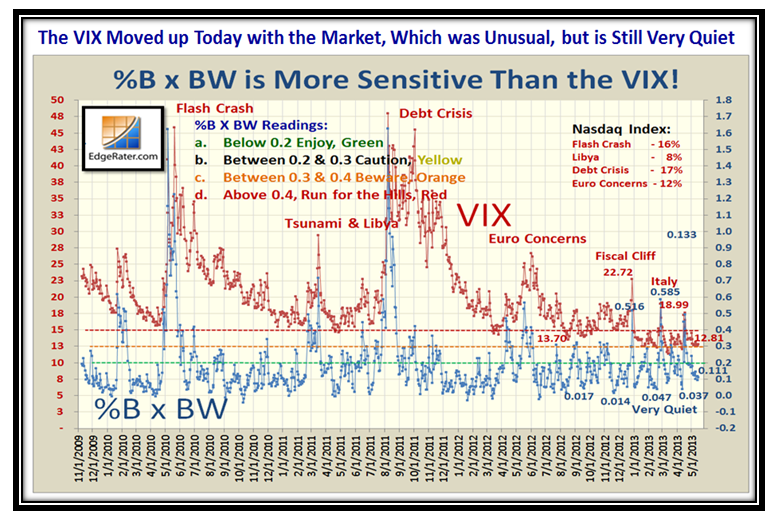

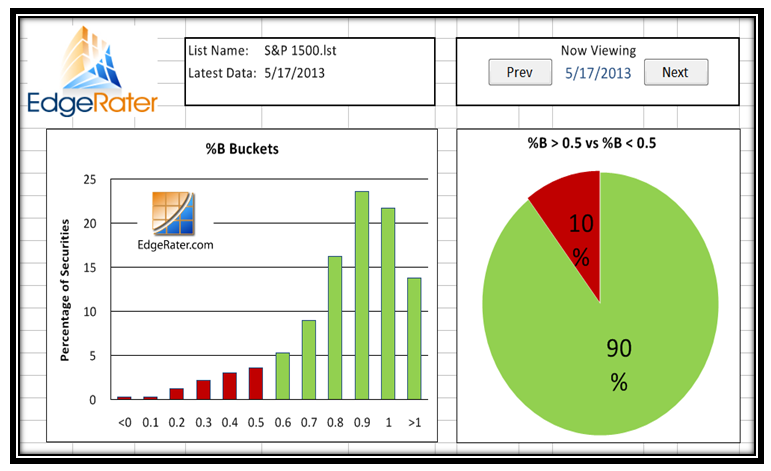

You should immediately see the powerhouse of a job that Chris has done with just this one slide:

There you have it, all you need to know about the Hindenburg Omen but afraid to ask!

Here is the video:

With Best Wishes on Father’s Day to all my Supporters around the world.

Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog