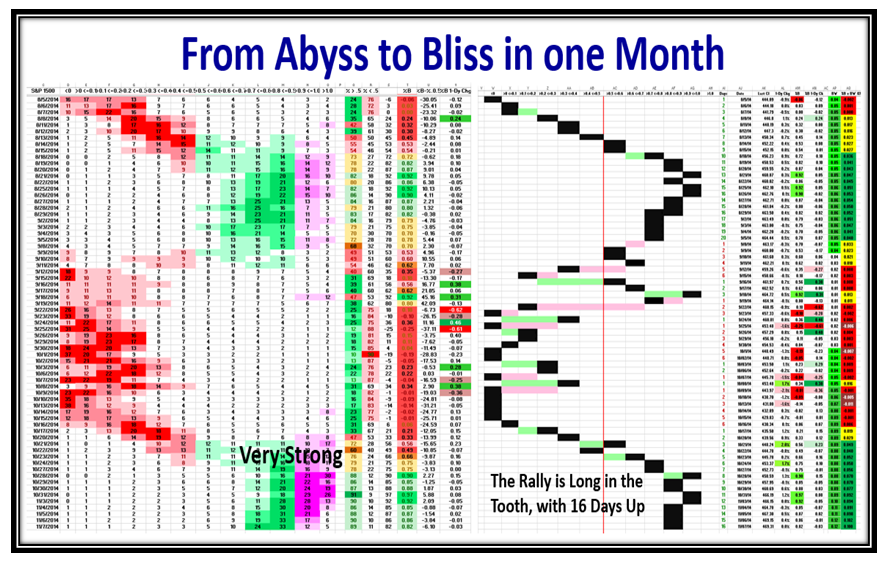

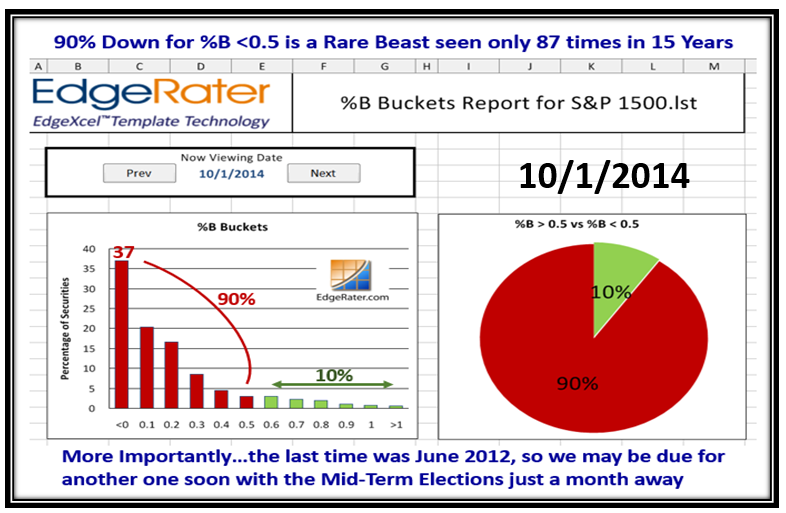

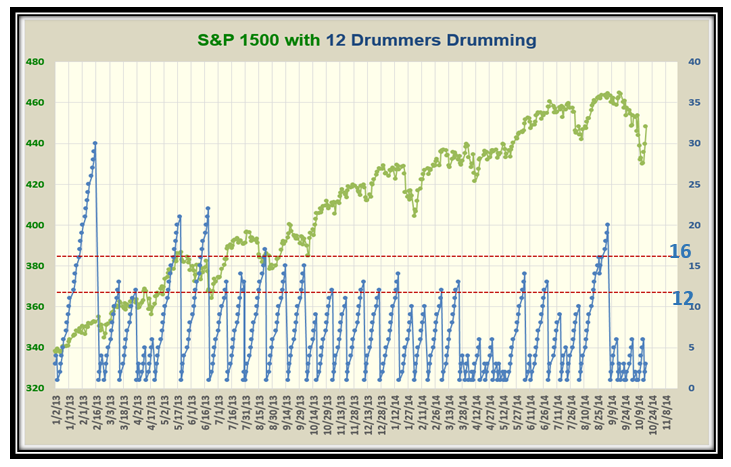

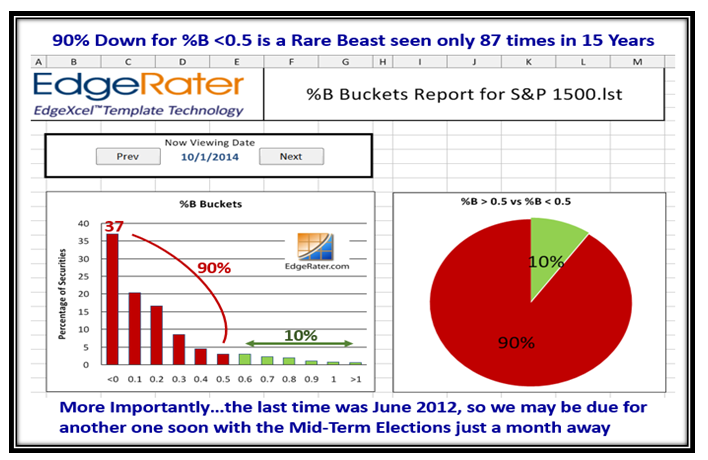

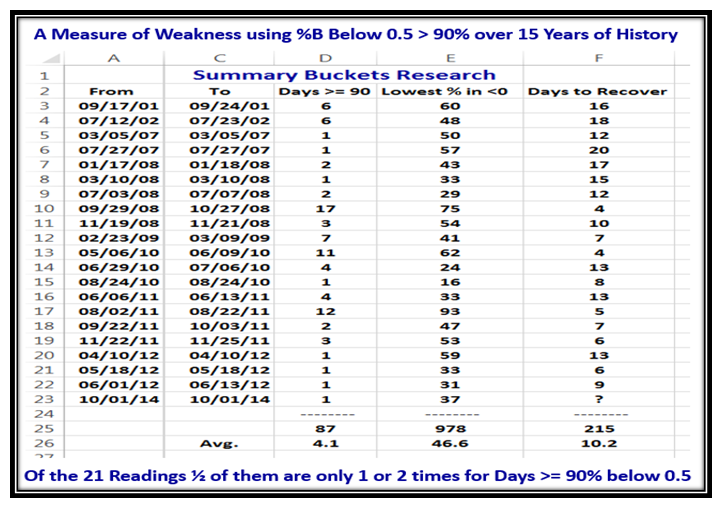

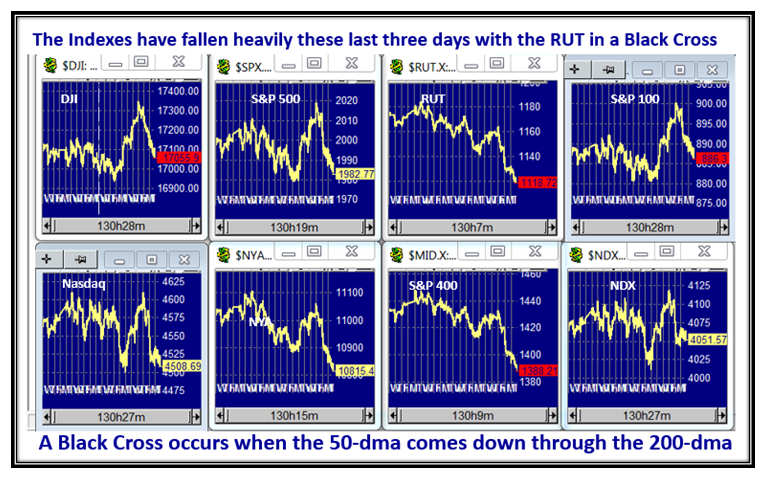

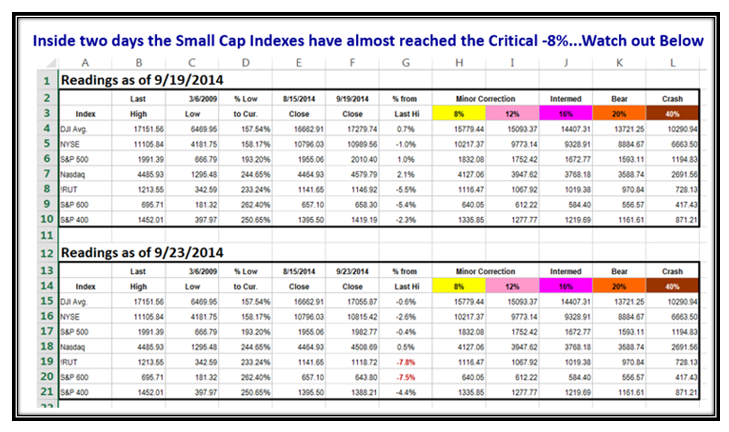

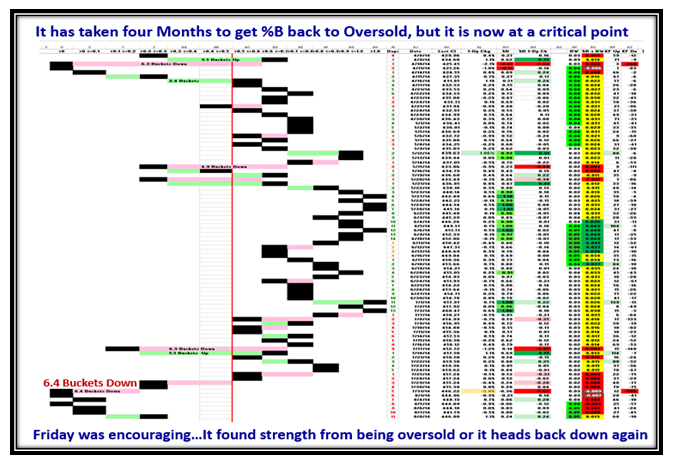

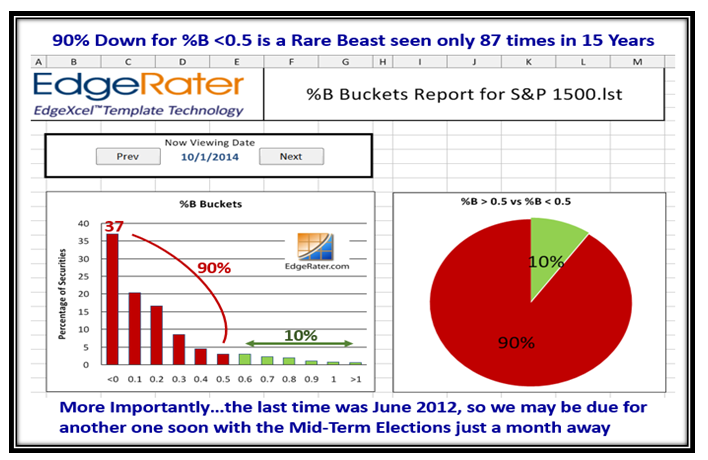

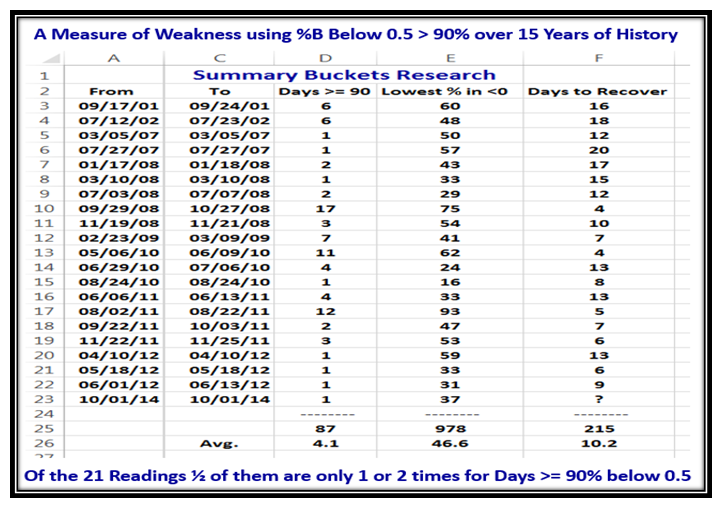

Finally the Market Indexes took a drubbing, first on 9/25 and again four trading days later on 10/01, which then produced a reading of “90” for the % of Stocks in the S&P 1500 with %B <0.5. We have not experienced such an oversold reading since June of 2012, 28 months ago. The last straw of an excuse to slam the Stock Market was the Ebola Breakout potential only to be saved by the decent Jobs Report on Friday which once again produced ~ 250,000 Jobs in September.

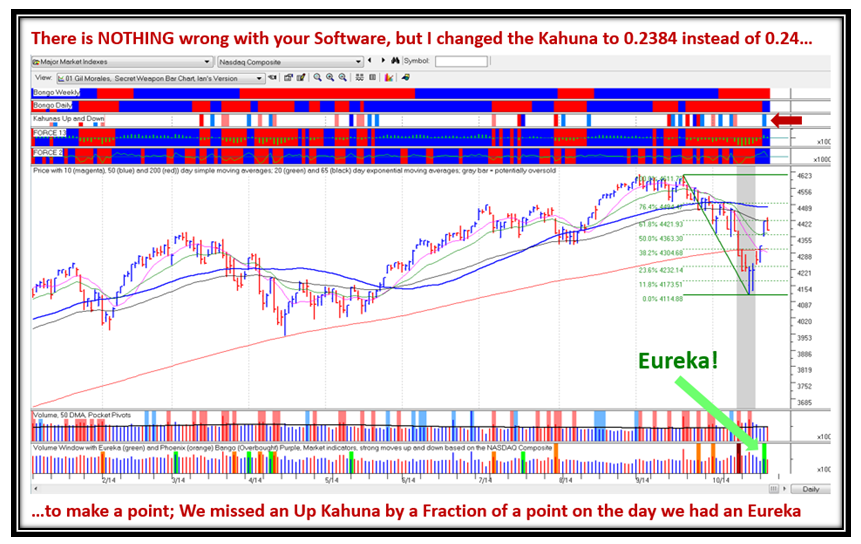

I hope this Blog Note is timely for you as I have broken new ground on the 15 Year History of when the S&P 1500 gets slammed hard, where Grandma’s Pies and “Bucketology” are the key tickets for staying on the right side of the Market. Of course we will cover all of this at the HGSI Seminar in Sunny Palos Verdes in two weeks time, where Ron and I look forward to seeing old and new attendees for three days of intense learning.

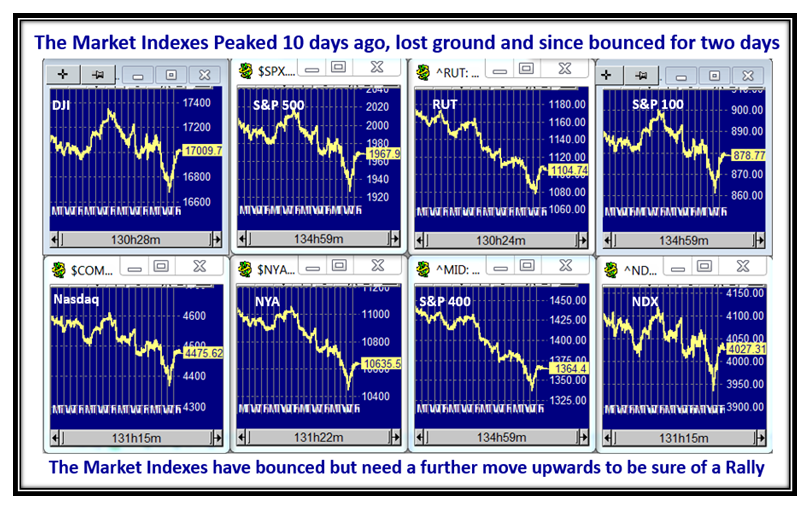

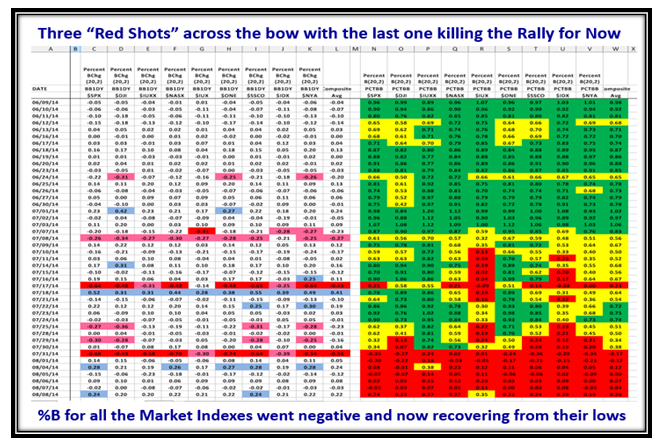

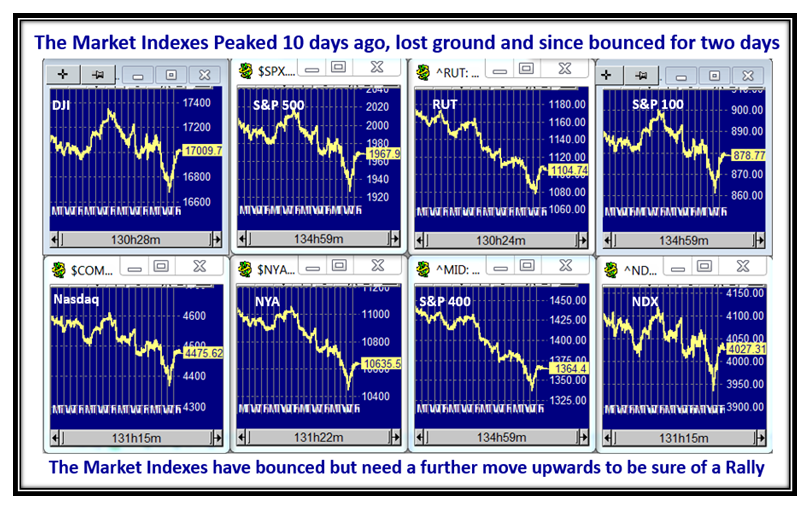

The Market Indexes peaked ten days ago, sold off with the Ebola scare and bounced back up from an oversold situation with the decent jobs report on Friday, which frankly saved the day for now for the Bulls.

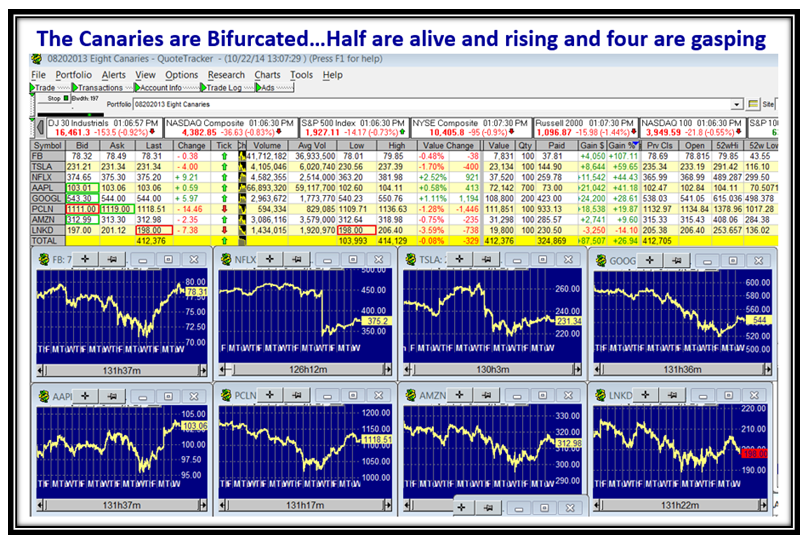

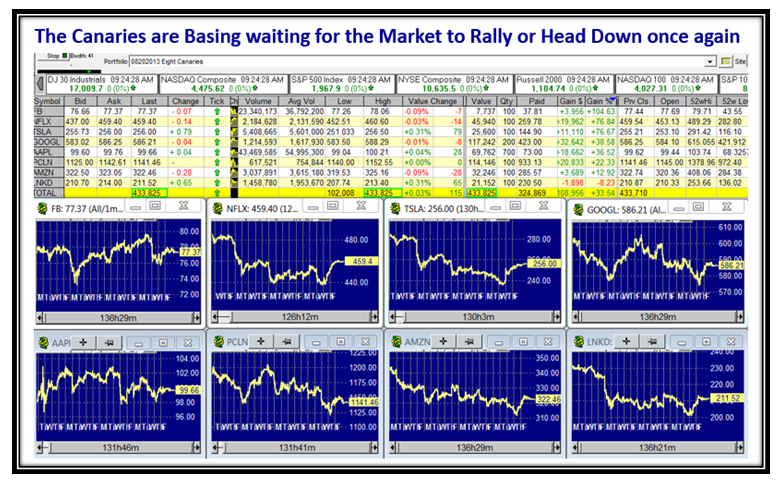

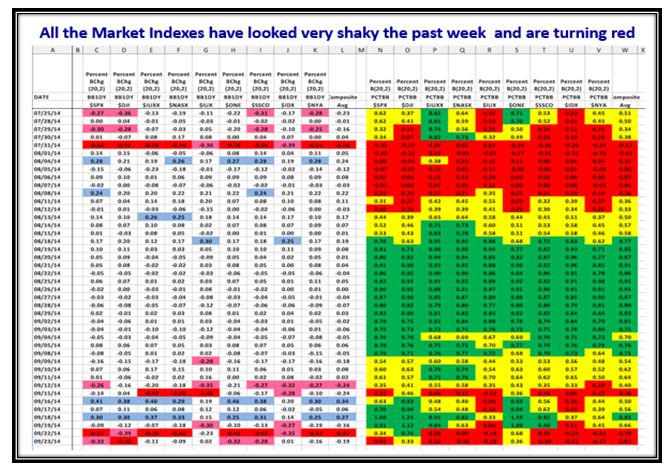

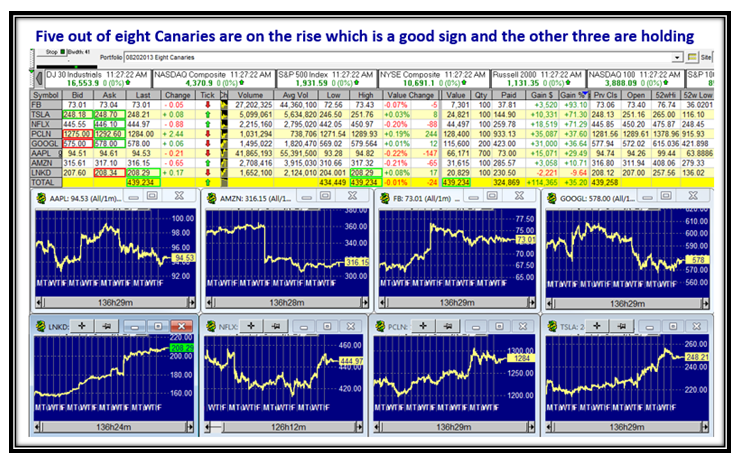

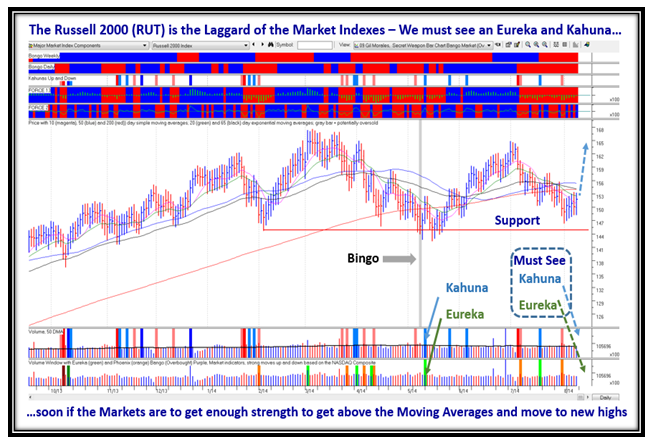

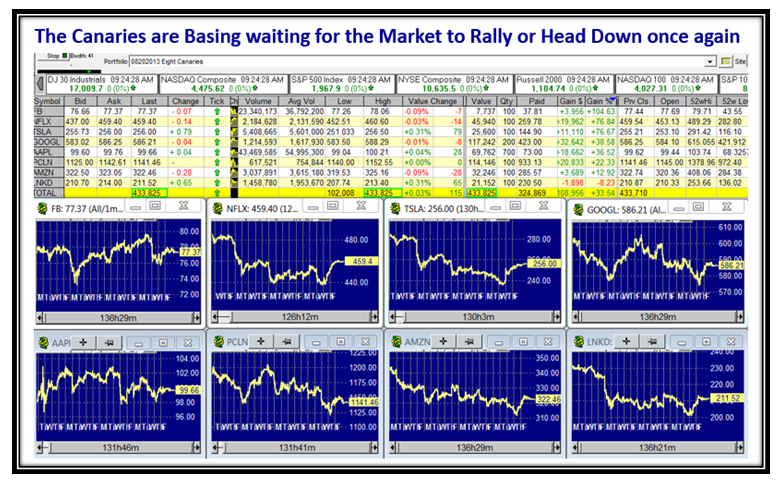

The Canaries are marking time and waiting for the Markets to show the direction rather than leading them upwards:

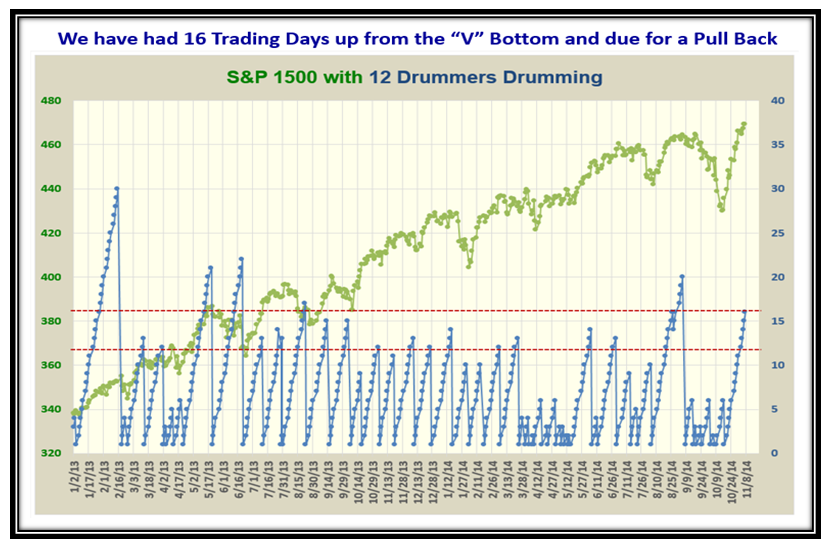

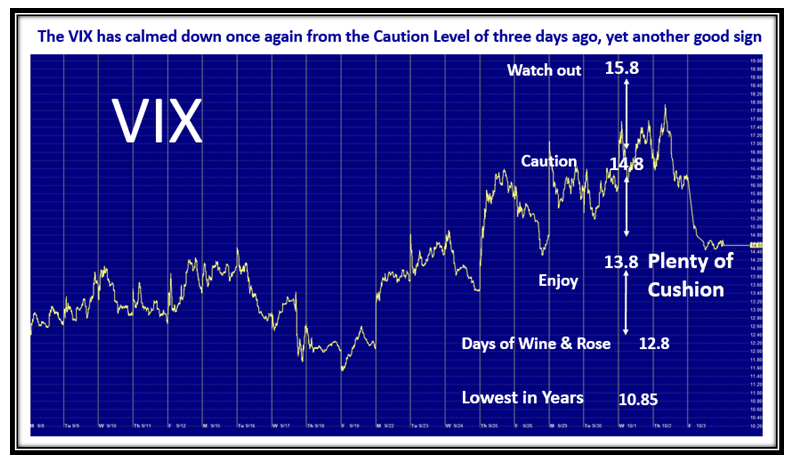

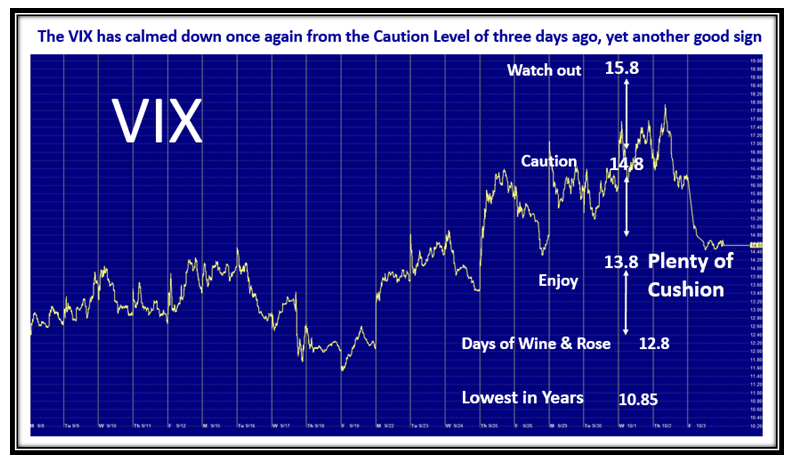

As expected, the VIX behaved counter to the Market Indexes, rose for ~10 days and then fell back to the comfort zone of around 14:

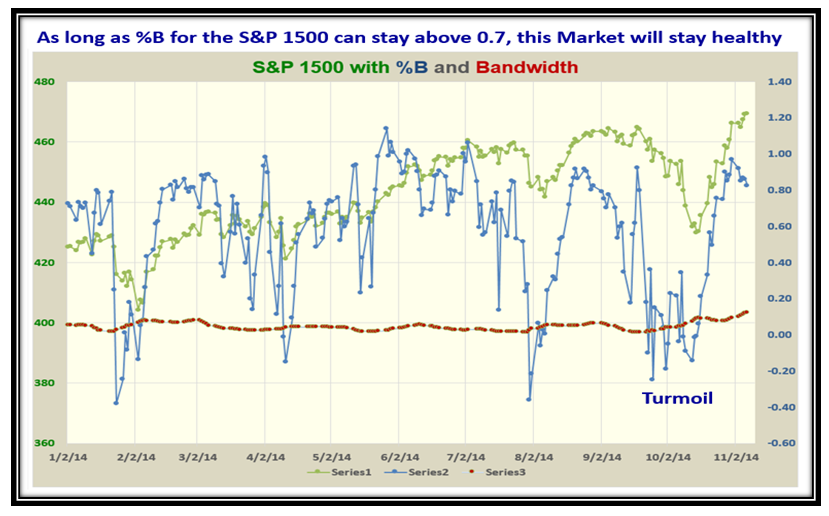

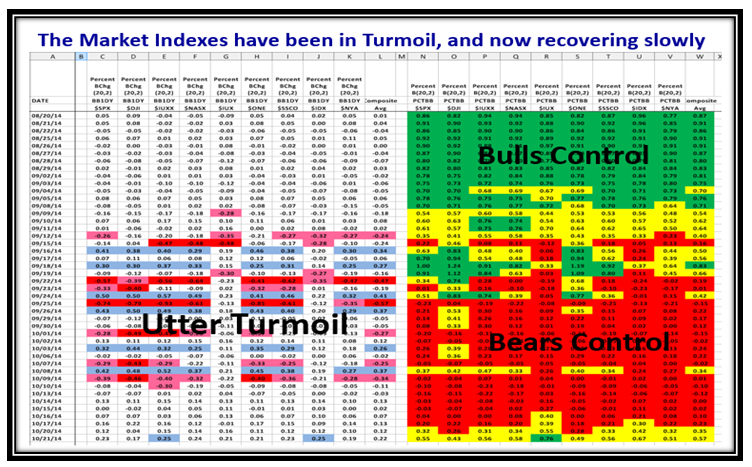

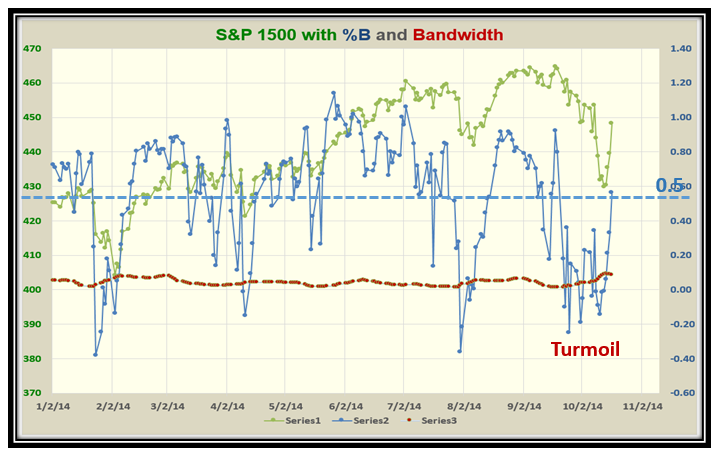

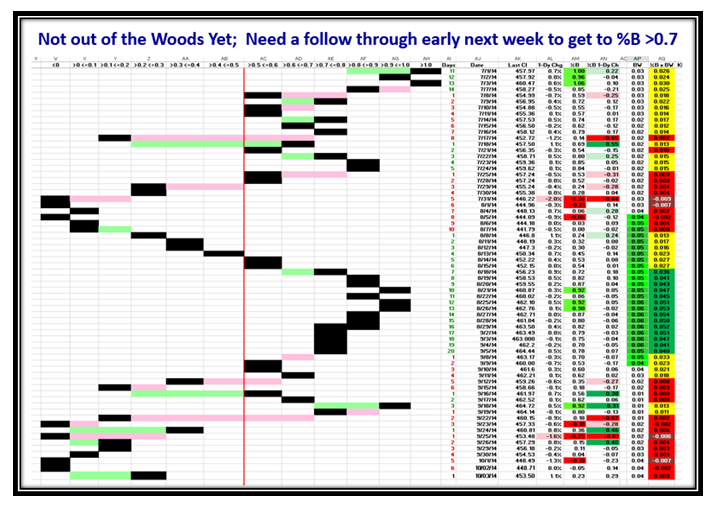

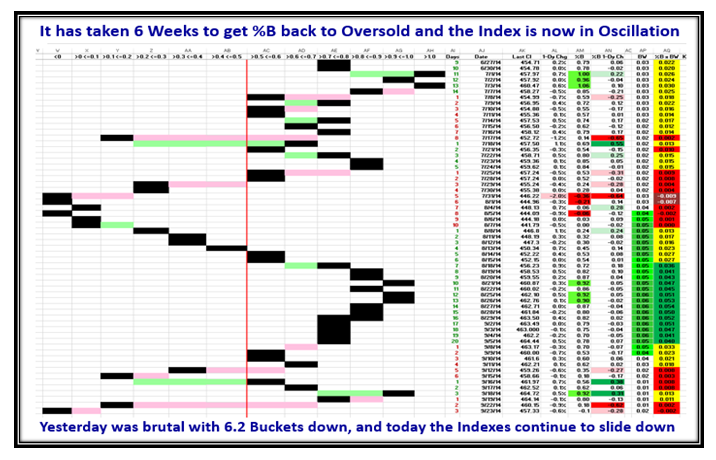

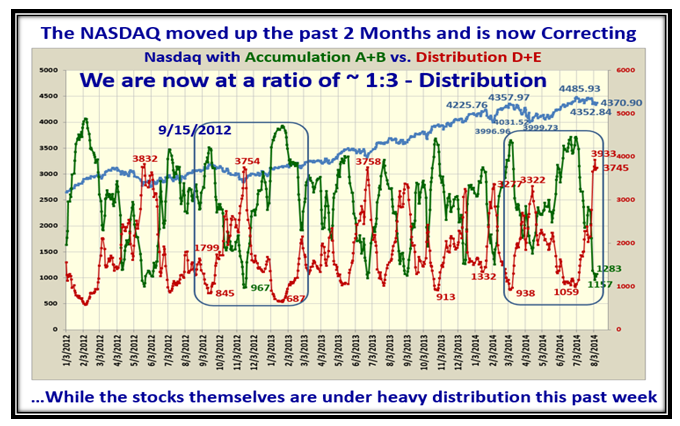

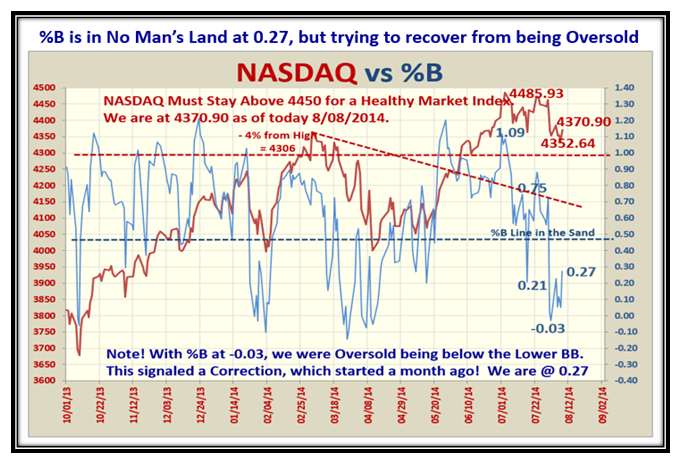

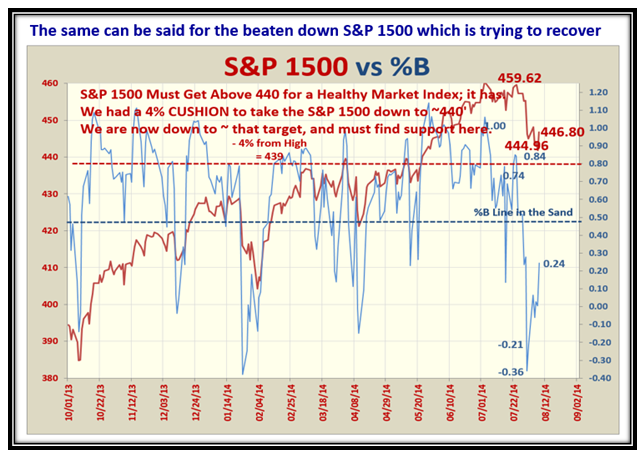

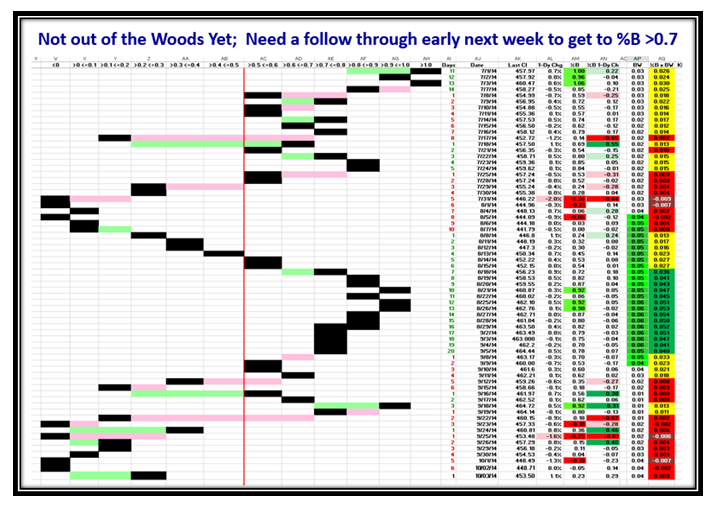

Note how %B for the S&P 1500 has meandered down these past ten days with a decent bounce on Friday. We are by no means out of the woods:

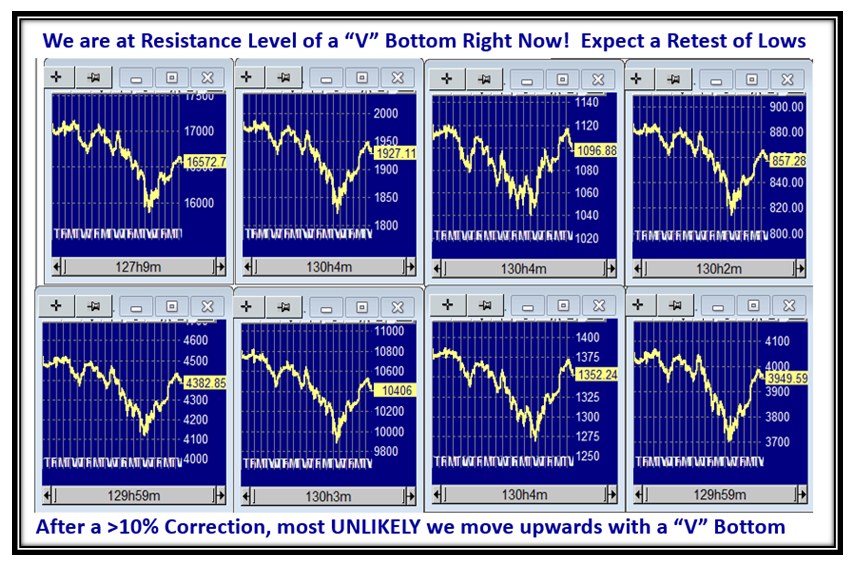

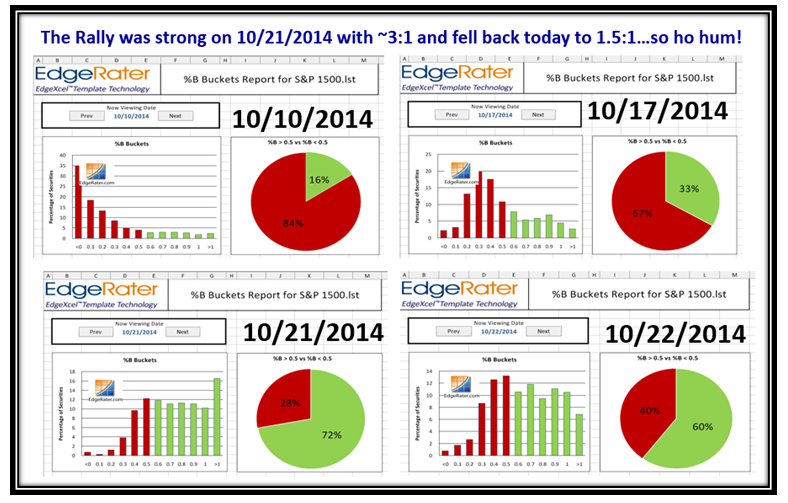

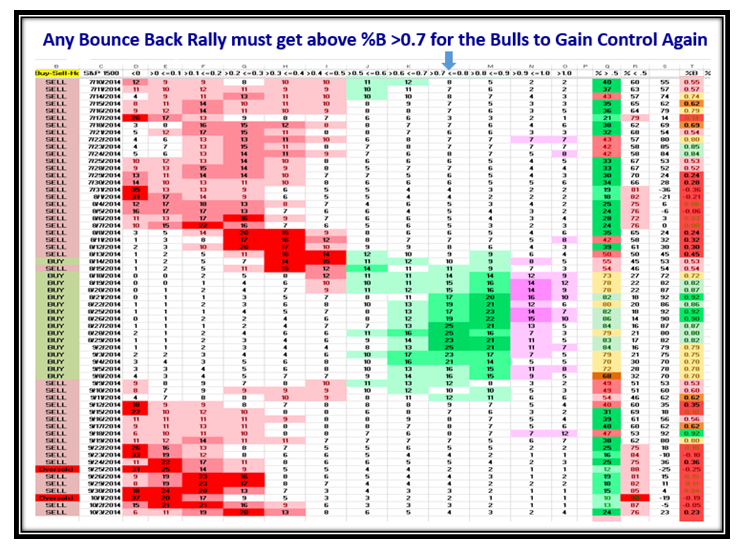

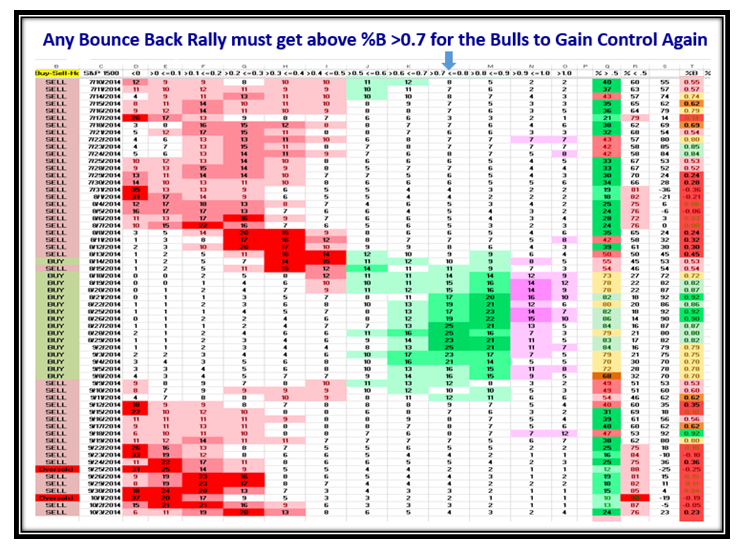

Bulls and Bears have had a good fight trying to get control…the Bears have it for now, but a further couple of up days are needed before the Bulls can have confidence that they are back in the saddle. However, Oversold can also become more oversold should panic set in, so be very careful:

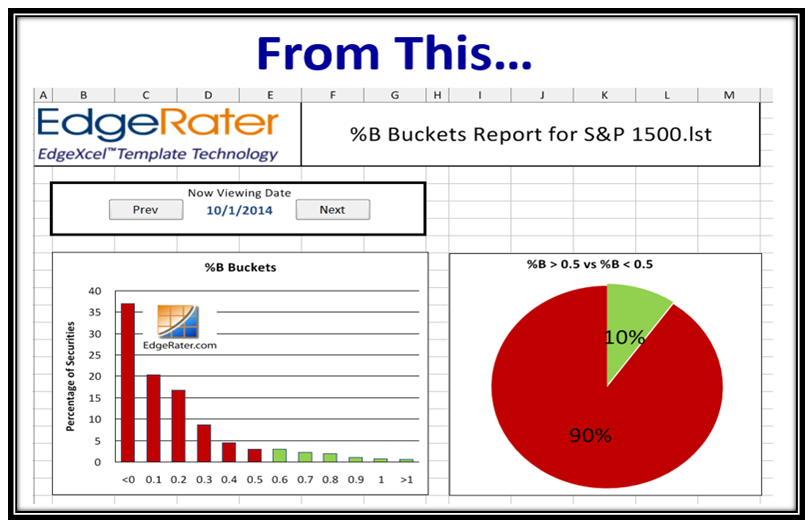

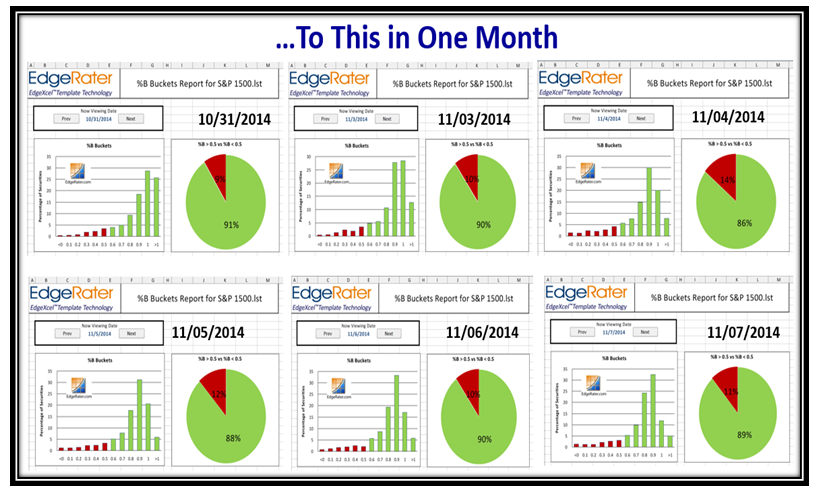

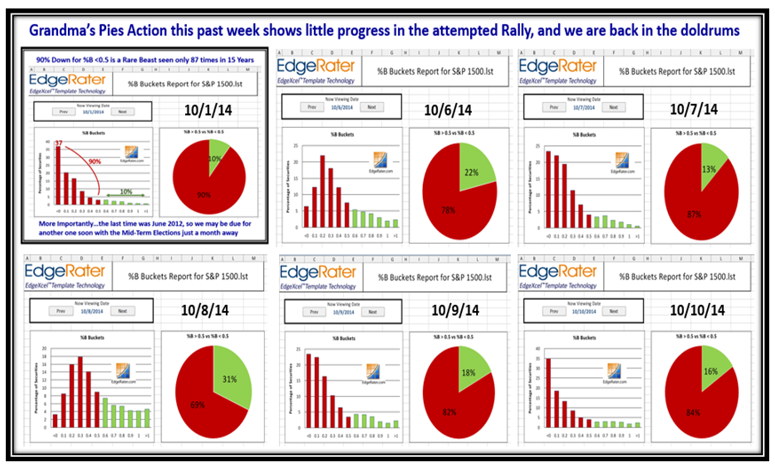

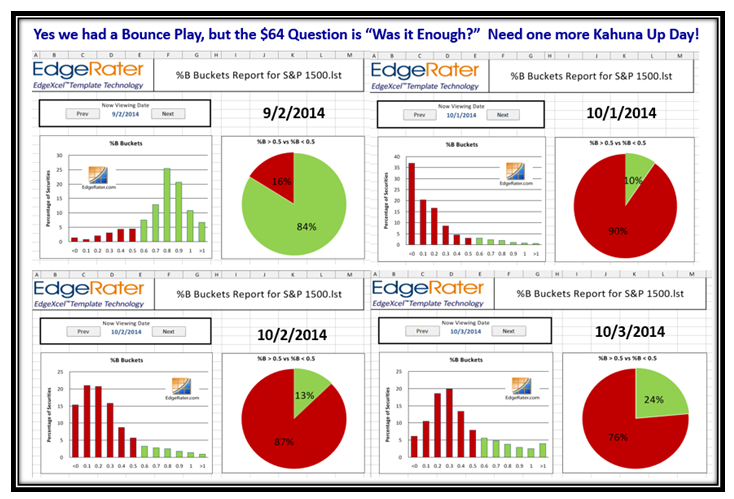

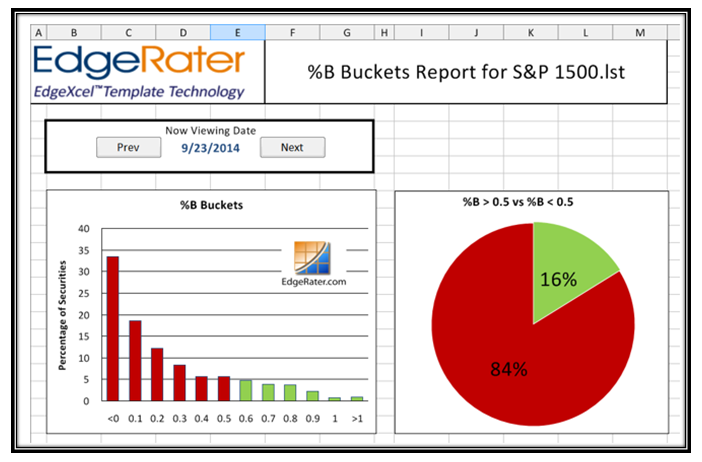

Here is Grandma’s Pies in all its glory showing you the split for the S&P 1500 stocks where 90% of them are below the middle Bollinger Band of 0.50, and only 10% are above. My good friend Chris White has done a great job for me to show us at a glance the behavior from day to day:

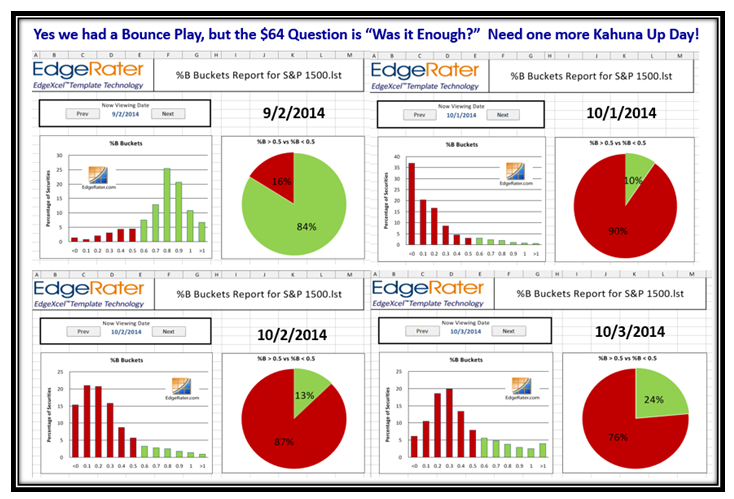

So you might ask, “What has happened since then?”, and here is that picture. A reasonable Bounce Play, but hardly enough to feel comfortable:

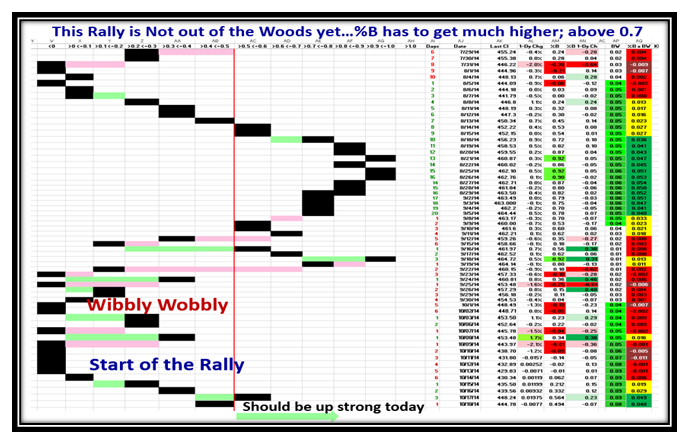

The Ball is currently in the Bear’s court. To feel comfortable that the Bulls are back in control requires %B to have risen to where the arrow is, and then head higher:

Those who have followed me for all these years will see that I have given you Manna from Heaven. Newbies will have to fathom this out for themselves, but I will cover this for those who attend the Seminar in two weeks time. Net-net, don’t expect recovery in less than a week!

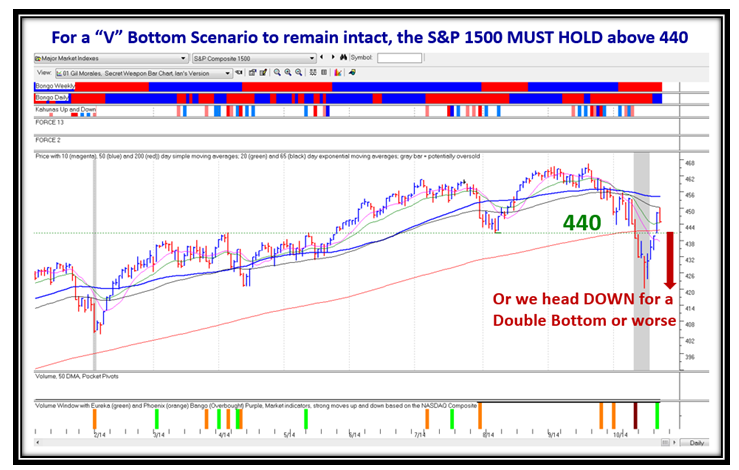

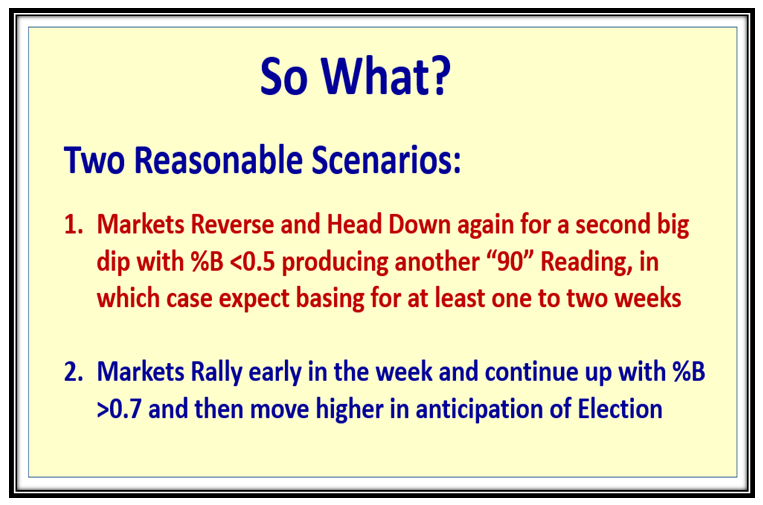

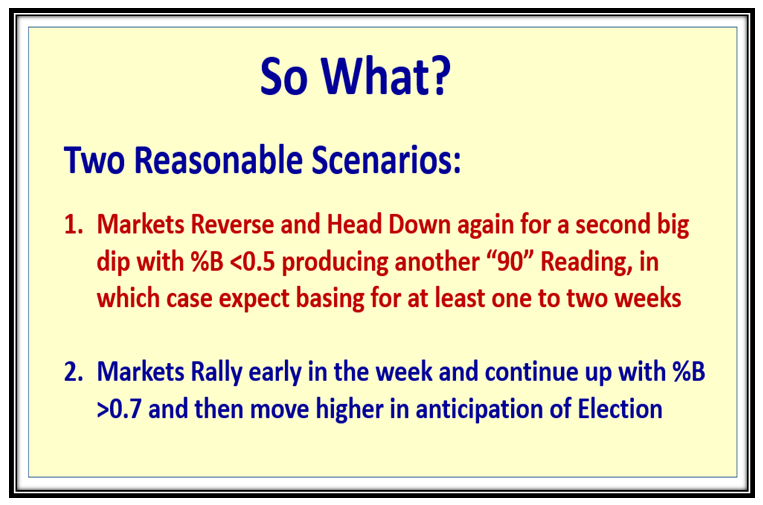

I’m no Soothsayer, but here are two possible scenarios for the immediate future based on the Fear of the potential Ebola Breakout on the one hand and the decent Jobs Report on the other:

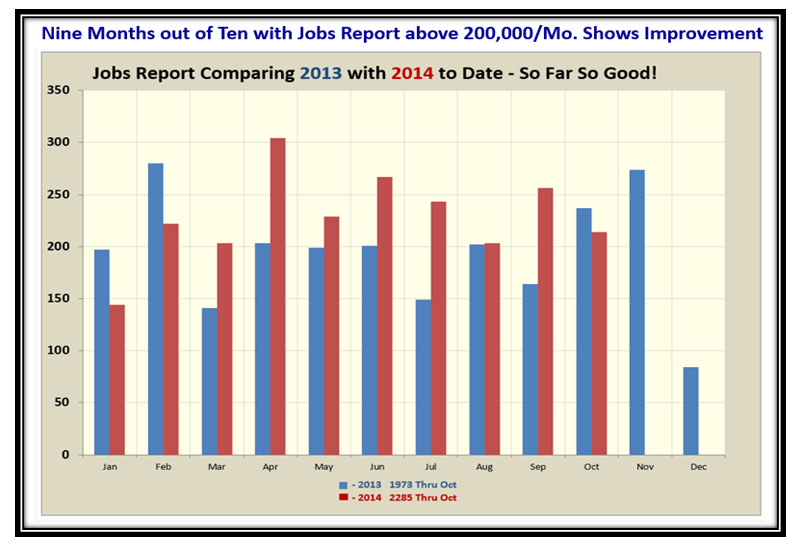

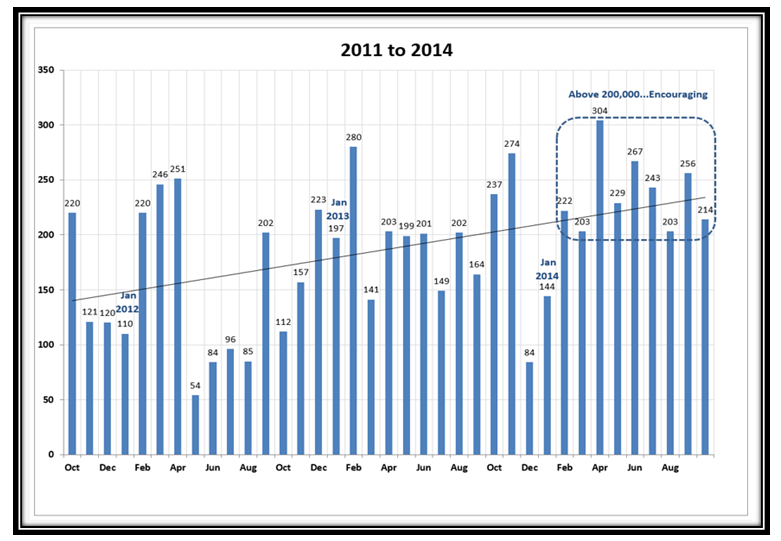

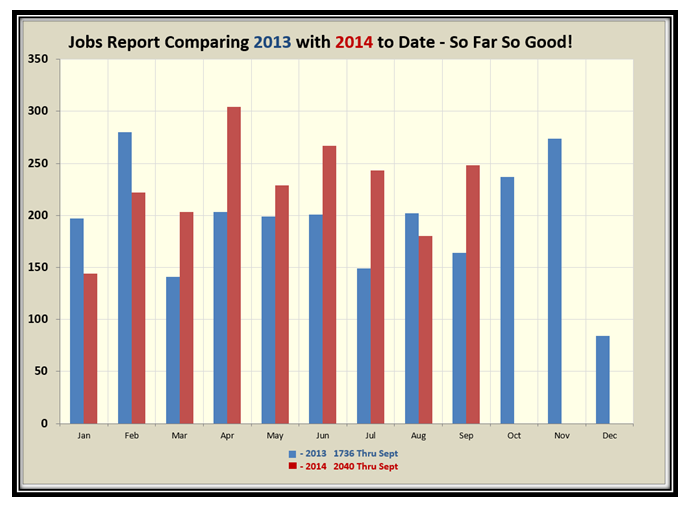

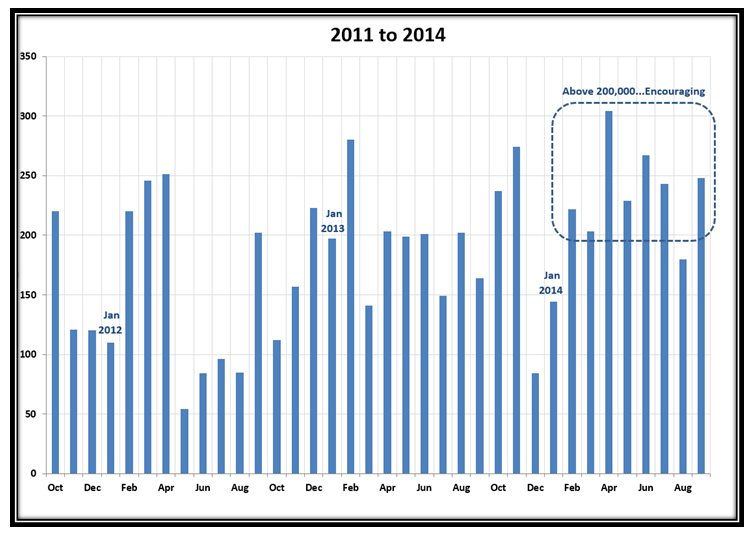

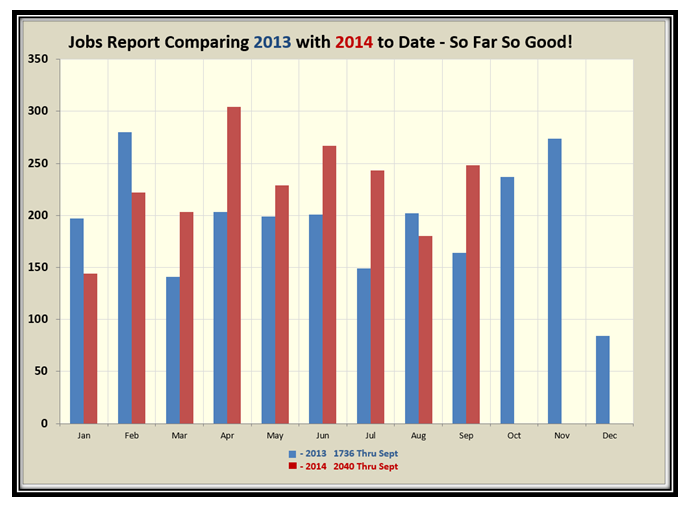

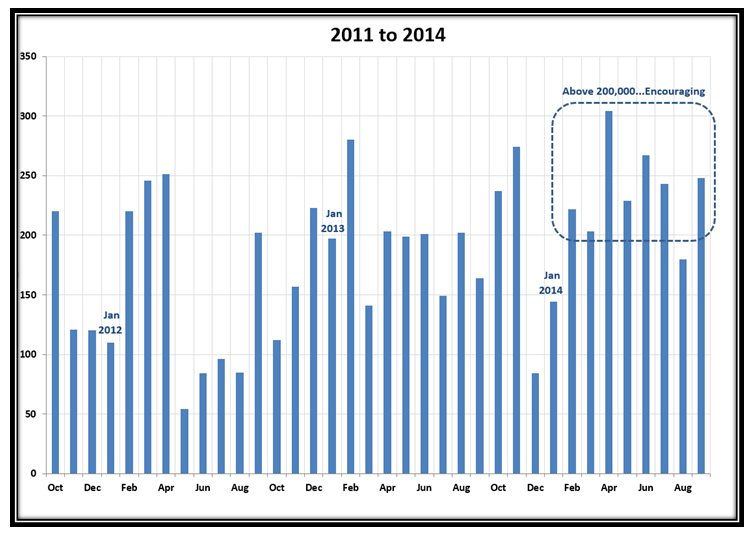

The next two slides show the latest results in the Jobs Report that came out this past Friday, with close to 250,000 for September:

Well, there you have it, the whole nine yards. Enjoy and keep your powder dry.

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog