Stock Market Snakes & Ladders are Back

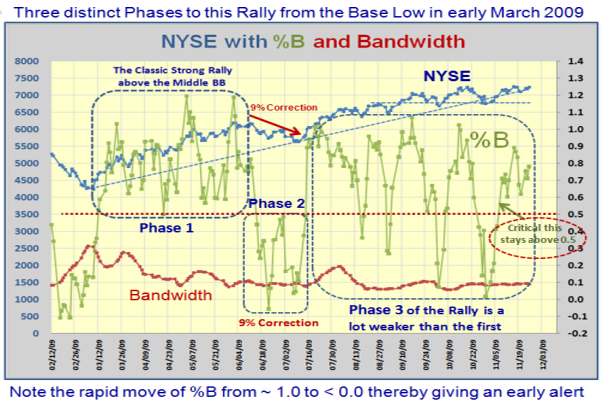

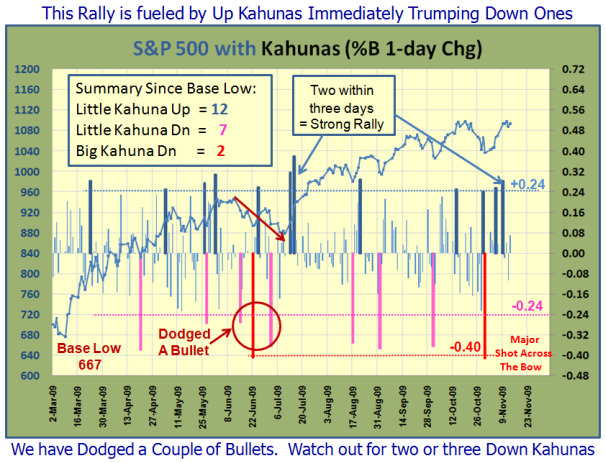

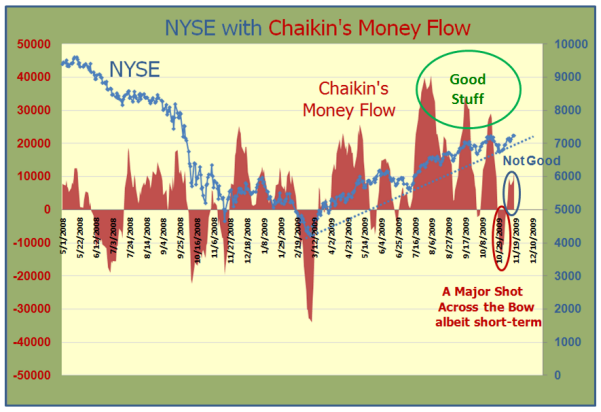

Wednesday, December 9th, 2009We have had a few ho-hum days after the shot across the bow with the Dubai Caper a week ago, and as I pointed out in my last blog note, the market has hit its head against an Immovable Object of 1111 on the S&P 500. Net-net, we are back to playing Snakes and Ladders and even the most seasoned of Day Traders are cautiously looking for any clue as to whether they should go short or stay long. Given the dismal volume it seems that many have even decided to move to the sidelines to wait for a definitive signal of which way the wind is blowing. Yesterday we had a second shot across the bow with Phoenix yet again after the Dubai one, so caution is the word of the day.

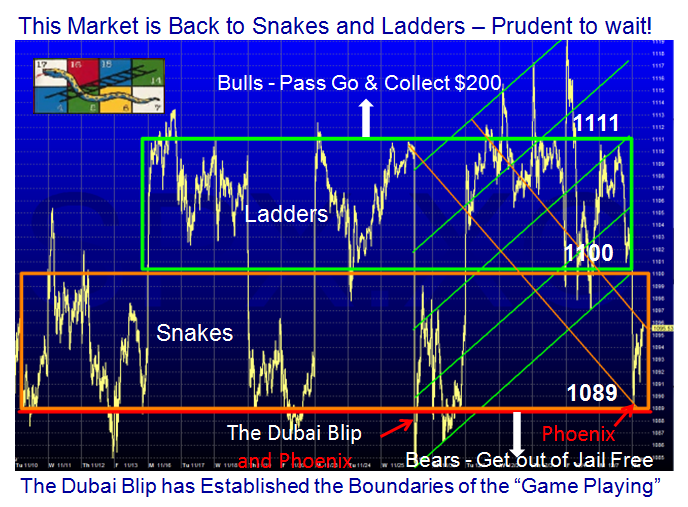

The Dubai Blip set the parameters of the current playing field and as you can see from the chart below of the S&P 500, it is stuck in a tight Darvas Box from 1089 to 1111, with 1100 conveniently being the half-way Line in the Sand. Until there is a breakout to one or the other side of these two numbers, the Market will continue to yo-yo every two to three days in a trading range. Only very short term players need apply, and Type 3 and 4 Players can snooze.

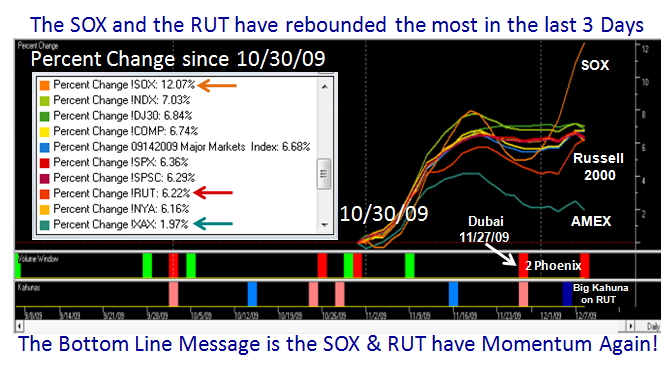

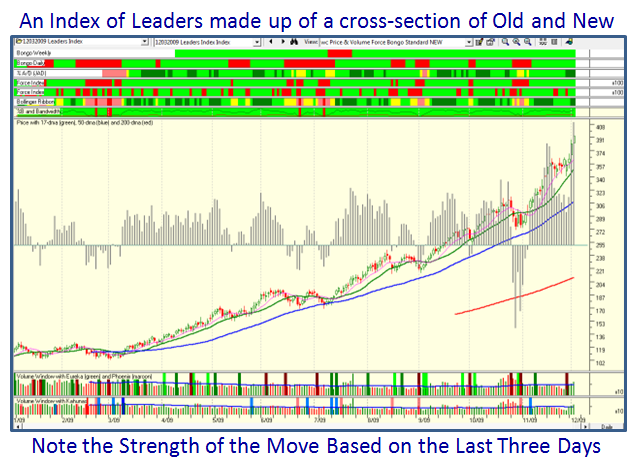

The Leaders in this market since the Base Low of 667 in early March of 2009 have been the Russell 2000 and the SOX, so the Small Caps have been the primary action these past nine months. It was only natural that these same two Indexes gave up the most ground during their recent correction which bottomed on 10/30/2009. Since then the SOX has been on a tare, and at long last in the past couple of days the Russell 2000 has woken up again and produced a Big Kahuna on 12/4 to show it again is gaining momentum. Whether it can catch up to regain the lead from the SOX remains to be seen:

The Bear Camp:

1. Market is in an Ascending Wedge which usually resolves itself to the downside

2. Psychological Indicators show the Bull: Bear ratio at a five year low, hence bearish

3. NR7 tight signal suggested initial breakdown, but watch out for a fakey

4. The market is slowly producing a rounded top…Tops take a long time to establish

5. At 64% up from the Base Low, the S&P 500 is now at initial Viagra Rally levels.

6. Bears are cautiously optimistic, but caught once too soon so are not pounding yet

7. A second Phoenix in seven days shows Bears strengthening

8. Market Internals are starting to slump and show signs of weakness

The Bull Camp

1. Traditional Seasonal Rally still looks good…”let’s keep it up till fat bonuses at hand”

2. Bernanke soothing the markets with no tightening yet and focus on two criteria:

a. There are no deflationary cycles

b. The financial system is stable

3. Although both the SOX and Russell 2000 were hit hard, they are recouping fastest

4. Technology and Transports strong with a preponderance of leading stocks

5. QID/QLD total dollar ratios are at lowest levels; will take a while to emerge

The Bottom Line is the Bulls win if we move up with momentum above 1111, and the Bears will at long last Get Out of Jail Free if it goes below 1089. The second Phoenix yesterday says the Bears have control so watch out until we see an Eureka…The RoadMap to Hog Heaven is still working!

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog