Late Breaking News! There will be a New Release of the HGSI Software this evening at around 6.00pm Pacific Time and George Roberts will be sending out a notice to that effect. He says “Keep in mind that anyone running Vista will get an error message from our installer when they do the download instructing them to go to the website and do a manual download. We have Vista improvements in this release but the first time out I have no choice for existing Vista users. There will be plenty of warnings about this.” Please read the instructions carefully.

So let’s come down to earth as to what are the two items front and center in the tug-of-war between the Bulls and the Bears. The two most important items on the platter are the EPS Reports and the FOMC Meeting to come on October 31. The former has been mixed with the Caterpillar Report throwing a pall on the market as of Friday, despite the upbeat reports from GOOG, YHOO, AAPL etc. As Art Cashin put it, we might be importing inflation with the two edged sword of a low and still decreasing dollar value while the Multinational Companies benefits of seeing their overseas profits go straight to their bottom line. However, it doesn’t seem to have done much for Caterpillar. It seems the potential impact of EPS reports to come is blunted now and the key event is on Halloween with the FOMC meeting. Whether the Market Bulls can stave off another drop before then remains to be seen but that seems to be the only hope. Let’s review the Fear and Hope items: The Fear factors outweigh the Hope items at this stage of events:

- The Financial Loans woes haven’t gone away and not likely to anytime soon

- The dollar continues to slip with concerns of a “run” on the weak dollar

- The Price of Oil continues to climb to that imaginary goal of $100

- The Beige Book Report showed that the US Economy has slowed

- Housing continued to take its toll and is expected to remain subdued

- The Hang Seng market continues to rock and roll into bubble territory

- The internals of “A” accumulation stocks is less than Distribution “E” stocks

- Taking that point further, there has been a dramatic drop in the leaders, i.e., “A+B accumulation stocks in the past week or so

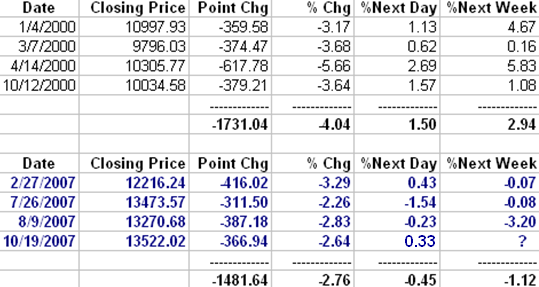

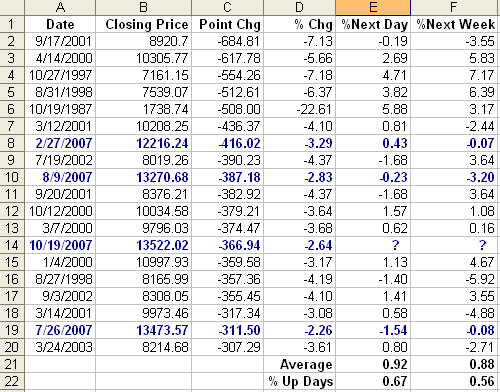

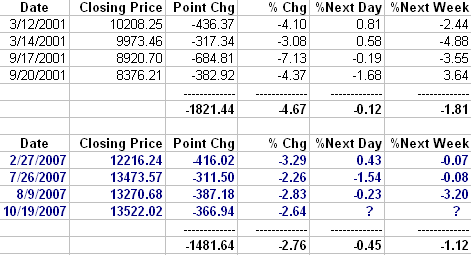

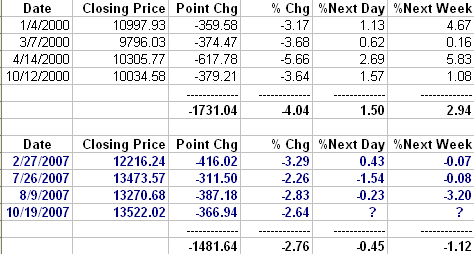

- For the Folklore types, years ending in “7” have been disastrous for the month of October in 110 years. Only one of the 11 instances going back to 1897 was positive for the DOW. The average return has been -8.5%.

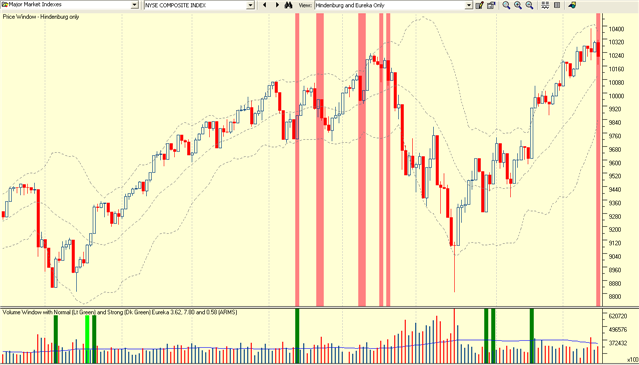

- For those watching the RSI on the NYSE, any reading below 40 spells more trouble to the downside. It is currently at 44 so any down day will kill it. Since the NDX (Nasdaq 100) is the strongest Index, watch the Gorilla Index.

- One month and one day after the Fed cut the Fed Funds and Discount Rate by 50 bps, both the S&P 500 and the Dow are now below the levels they were trading at prior to the Fed’s September announcement, but the Nasdaq and NDX are still above. The S&P 500 and DOW have both “broken” their 50-dma. We have a split market based on the above. Technology leads.

- …and the litany of woes go on

The Case for the Bulls is primarily one of hope:

- There is a 70% chance the Fed will be forced to reduce rates again on Oct 31

- We have just had a decent correction and the new rally is only 8 weeks old

- That correction has wiped away the folklore cloud of no 10% correction in over four years for the S&P 500.

- We have had an explosive rally wiping out all the losses of the correction

- We had a false breakout but this dip is small in the long term perspective

- The S&P 500 P-E is still at very reasonable levels of around 18

- 4th Qtr earnings are expected to be strong, therefore justifying a higher S&P Price with most Forecasters indicating it to reach 1600 by year end

- If we get past Halloween and the FOMC has a treat for us instead of a trick, the Santa Claus rally will take us into new highs and any major correction will have to wait until early January

All of that is nice to know, but the proof of the pudding will be in the eating on Monday…then your stomach and your Portfolio will tell you what to do. So let’s look at the steps in the process between now and then:

- Tonight before trotting off to bed look at the “World Markets”. Their reaction to the

US markets will be very apparent and you will know whether we are in for another stormy day.

- First thing when the market opens, the likelihood is it will open down since all Market Indexes finished at or near their lows.

- If your Portfolio is blood red, you may be tempted to lighten up early.

- My suggestion before you do so is to see how the Gorilla Index is behaving

- If they are giving up the ghost, the party is over for now. If not we have a chance of a bounce day. I didn’t say bounce play, I said bounce day.�

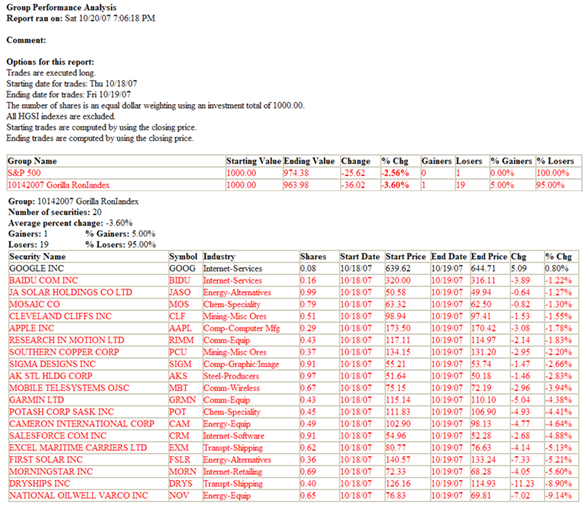

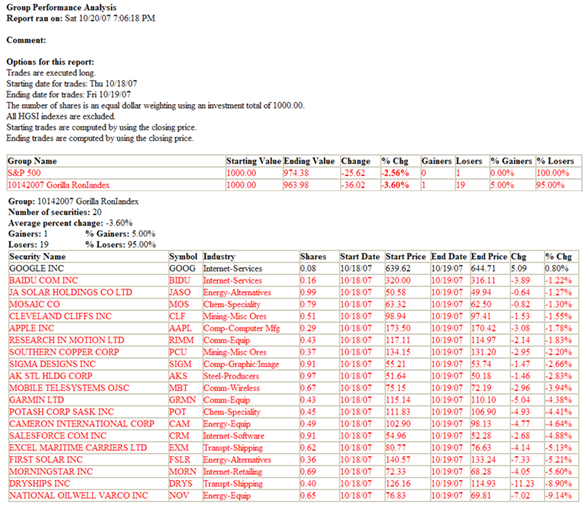

Here is the Gorilla RonIandex performance on Friday, with the Index losing 1% more than the S&P 500. It was ugly with only GOOG up, and even it was down for the day as it gapped up at the open and those that chased it lost money. It may be your lifeline on what to do regarding your own portfolio on Monday. If it is either lower than the S&P 500 or down again by 3% on Monday, it is most likely that we will finish down, and that we are headed for another big correction. It is unlikely the FOMC will act before October 31st, so only a really oversold bounce play may be the only thing that will hold it together until then. I repeat, don’t guess what you think the market will do, let it tell you what to do, but you must be nimble and that is the only trump card you have, but play it correctly both ways.

As I go to press, I am reminded by my good friend Manu that the action is still in the Chinese stocks, but it seems that my blog on the Chinese Dragon didn’t get much of a peep out of you folks, so you missed a winky winky. I don’t blame you as it is a two edged sword. However, you play at your own peril; it’s always “Your Call”. Good Luck and Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog