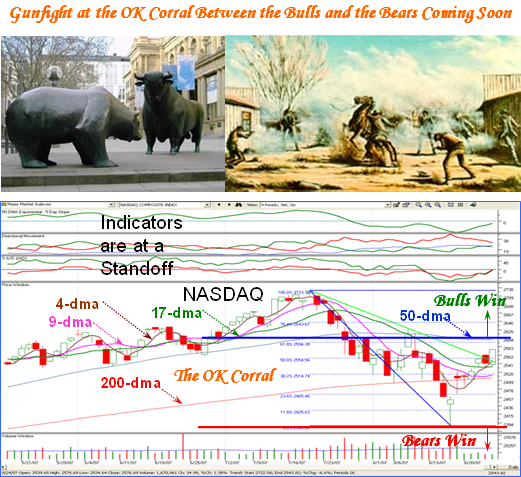

Gunfight at the OK Corral Coming Soon

The Stage is set for the Gunfight at the OK Corral

The Combatants: Bulls and Bears:

The Site: The Nasdaq with lines drawn at 2572 for the Bulls and 2387 for the Bears

Early Signs of Who’s Winning:

The Bulls:

- 4-dma, 9-dma come up through the 17-dma; later 17-dma up through the 50-dma

- A Eureka Signal with a Follow through Day of 35 points up and 2 Billion Shares

- Directional Movement: Di+ above Di-

- The Nasdaq Index gets above the 50-dma at 2572 and then above 2616…the Upper BB

The Bears:

- The Nasdaq breaks down through the 200-dma at ~2500

- The Nasdaq goes down below the Lower BB, i.e., 2460, and %B goes Negative

- The Nasdaq breaks the previous low at 2387

- The Nasdaq drops over 16% from the High…down to 2290

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog