HGS Investing Principles – Using Different Investing Styles

About a week ago I chose four different Investing Styles to give me clues for what’s working now. You probably looked at the list and hopefully paused to think about what my message could possibly be, as I am sure you scour the HighGrowthStock.com website all the time. Those who attend our seminars know me better by now, but I wonder if you got where I was taking you with the snapshot I showed you only ten days ago.

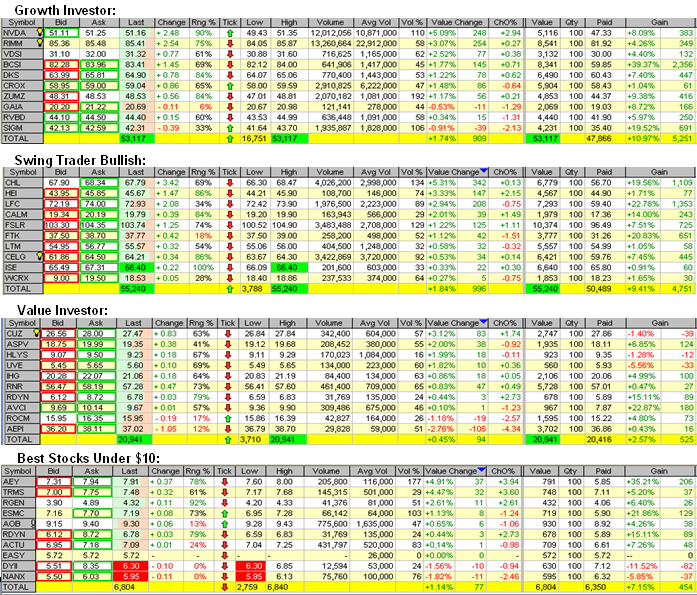

Here is the update to the same four Investing Styles and we can certainly glean quite a few points out of this updated view:

I know your eyes are squinting at this view, but the detail is not important…it is the color green! So what are the Messages:

-

Pick the groups from StockPicker from the DAY BEFORE once you see a strong up day in progress in the market. I originally showed this same set of groups after I saw a strong move upwards on August 22nd in my note “Looking a Gift Horse in the Mouth”.

-

Go back and look at that note. You will see that after one day Growth Investor and Swing Trader both delivered strong performances of 5.5% and 3.0%, with Value Investor and Best Stocks Under $10 behind, but respectable with 2.4% and 1.6%.

-

The exact numbers are not important…what is important is that a basket which delivers 3% in one day is a strong basket, and Growth is better than Value at that time.

-

Now fast forward to yesterdays results…granted on another strong day finishing up the week and eight trading days later. 11% and >9% for the same two groups of Growth and Swing Trader with all ten stocks positive tells me several things:

- Say what you will, this market is healthier than we think and there is money to be made

- Growth Stocks that are Leaders is the place to be

- Doesn’t that sound familiar after watching Ron Brown’s Movie today

- There are five big winners in these two groups with 20% gains or better

- It speaks well that STOCKPICKER groups give you a good starting point to ferret�

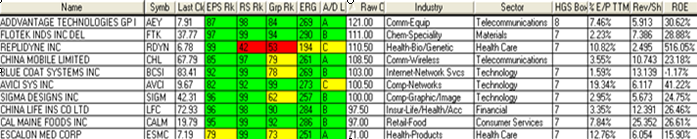

Now dig further to get to the nuggets…take a look at the top 10 stocks from the four groups or whatever other menu you like. Here is what you get:

It is exactly what you would expect…Technology, Telecom and Health Care is where its at. Look at the # of Box 7 stocks and look at the Fundamentals in the last three columns.

At this point, I’m sure you are saying “But I don’t have time”. Of course not. Ron and my job is to teach you how to fish, your job is to catch the fish. More importantly, doesn’t that stiffen your backbone that there are opportunities to be found and that the HGSI software brings the cream of the crop to the top with its StockPicker Groups. What you should get out of this note is to know the What, the Why, the When, the How, and the So What of ferreting for HGS Stocks. Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog