HGS Investing Principles #2 – Wolf Packs

In the August 26th Blog I showed you how to ferret for Wolf Packs. The particular one I showed you was the Chemical – Specialty Industry Group which caught my eye since there were 10 such stocks in the top 20 when I applied the 0a Key to All Securities, and sorted on the Combo Rank column. No matter what list I look at, I always look for Wolf Packs as they often give clues as to “What’s Working Now”.

Wolf Packs come in at least three different forms:

- Industry Groups that have been trashed and show signs of life usually for a day or two and is invariably news driven. An excellent example was a spurt of life the other day based on a rumor that Warren Buffet was buying the beaten down Housing Stocks. Stay away from such wolf packs unless you are prepared to sit with dead money for a long time.

- Industry Groups that are hot due to a theme or story in the market, such as the Energy Alternatives recently during the past several months. These are excellent Wolf Packs provided you catch them early enough. FSLR, TSL, JOS come to mind in this group.

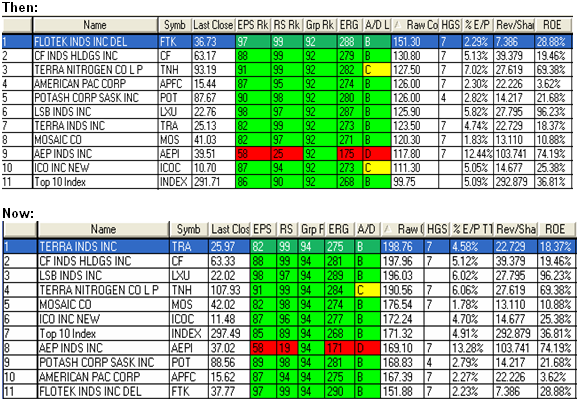

- Industry Groups that have had a long run, have a very high long term Ian Slow Group Rank, but have recently been trashed and are showing signs of a re-birth. This is the example I chose when I showed you the Chemical Specialty Group. Here were the stocks I showed a week ago:

The key point to observe is that the GROUP RANK for Ian Slow has gone up from 92 to 94 and this is a significant step showing continued long term strength. I’m sorry I couldn’t maintain the same order, but take my word for it eight of the ten are up, albeit some only slightly.

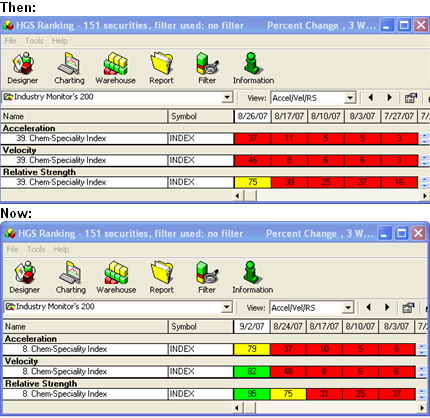

The more important picture is the comparison for the short term Group Rank which has jumped appreciably since a week ago. However, the real message is to watch the wolf pack and wait for a down day and then on the next move up take the pick of the bunch. They were FTK and ICOC at the time and I took the latter (as it was breaking out) for a 10% ride so far in less than a week.

Finally, the chart says it all…the Wolf Pack is alive and kicking, again showing that the Market itself is healthier than the flat performance of last week shows in the Indexes.

Best regards, Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog