HGS Investing Principles #3 – Review of the Game Plan Index

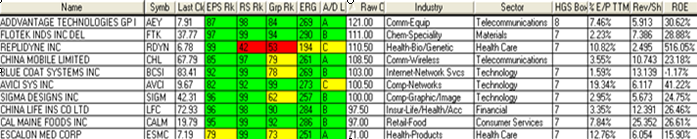

Monday, September 3rd, 2007Most of you are familiar with the concept of the Iandex, which then became the RonIandex, where towards the end of a strong bull market rally, we select a minimum of 15 stocks in at least 12 Industry Groups, with no more than two stocks from the same Group. We watch the Index behavior to give us a feel for what the Market is doing.

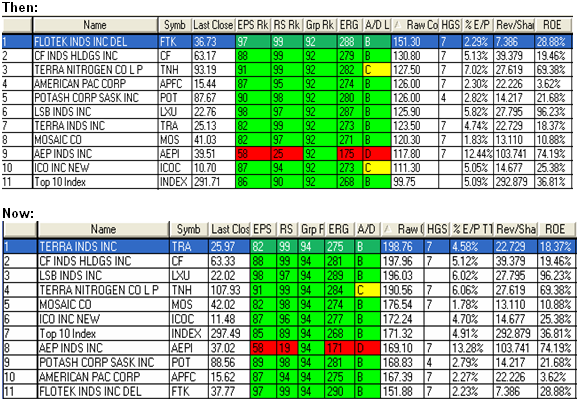

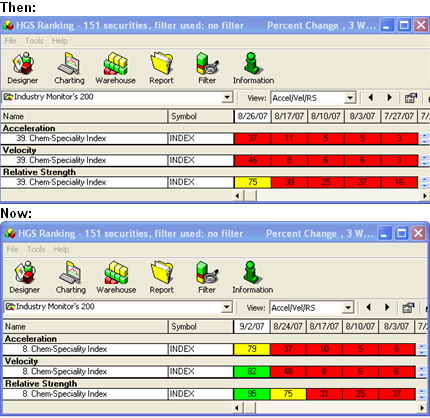

We can take that concept a bit further and take a similar set of stocks after the market has corrected say 8% or so. They are Leaders with solid Fundamentals, have just delivered an excellent EPS report and are essentially bucking the Market trend though have naturally given up some profit, but are not broken stocks.

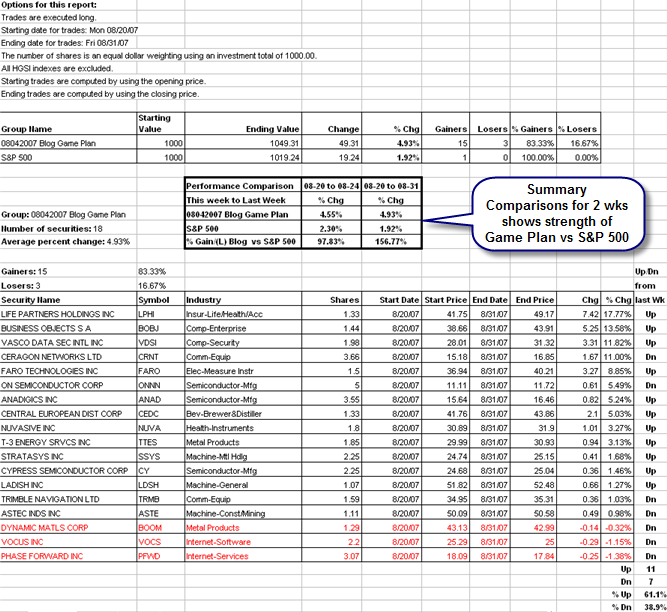

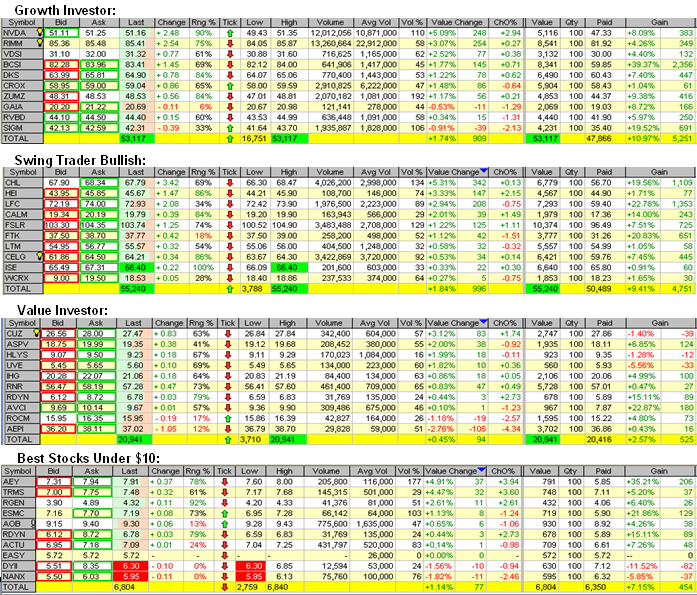

That is what I did with the Game Plan Blog Index of 18 stocks just one month ago on August 4th. In that note I gave you the criteria, so I won’t repeat it here, and I suggested that if these leaders died the market was in for a lot more turmoil. Here then is the performance for the last two weeks compared to the S&P 500:

I also suggested that from a Charting perspective, you should watch three important facts:

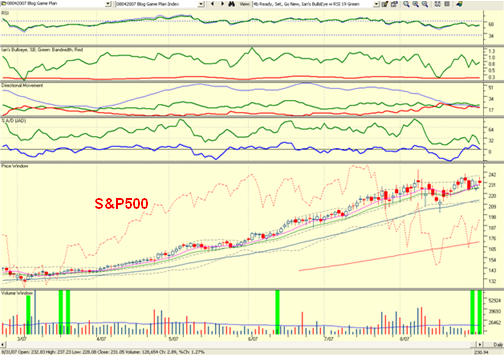

- All great leaders rise above the 9-dma, and as long as the Index stayed above that Moving Average the Index was very healthy.

- A healthy Index will stay above the 17-dma, but will often correct to it and then bounce. Since the Index should stay above the Middle Bollinger Band, i.e., %B >0.5 (50%), there should be few Kahunas either up or down. Ideally one would like the Index to have %B >0.7% to give us a cushion against a sudden drop in the market as a warning sign to liquidate ones positions.

- If the 17-dma is broken and then heads for the 50-dma and/or breaks it, watch out below. The Chart of the Index still looks healthy though it certainly dipped down to test the 50-dma at the same time that the Market Indexes were floundering, but then quickly recovered on the bounce.

Summary Results:

- The Index is up 98% and 157% on the S&P 500 after one and two weeks, respectively

- The Index is above the 9-dma, and all great leaders rise above it

- 15 of the 18 stocks are still positive, i.e., 83%, and 61% are up from last week

- Although Acc/Dist is drooping, all signals are go on the Ready, Set, Go

- The two Eurekas for the NYSE though suspect with low volume, signifies a bonus plus

- A C&H formation and the %B at 0.8, which gives room to act if the market goes down

- A gain of 2.78% per week for 18 stocks shows overall strength

The Message is the Market is still healthy, but this coming week should be the real test. In my next Blog I will summarize what these three HGS Principles mean as mini-stakes in the ground and then reflect on the Macro picture for what will be the two most important weeks to come.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog