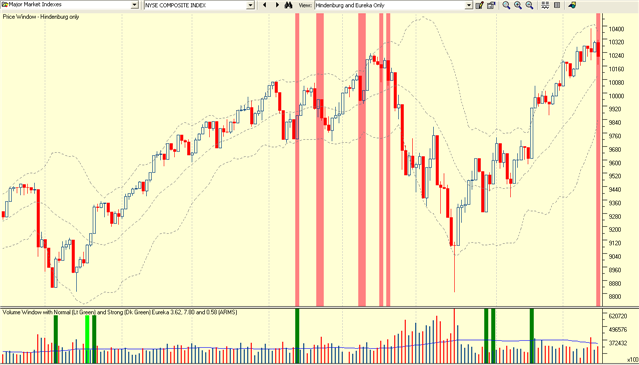

The Hindenburg Omen Triggered Tonight

I have Late Breaking News tonight…The Hindenburg Omen triggered today. Those of you who are new to this signal should read an earlier Blog of mine written on September 30th, 2007, describing its potency. So to be fore-warned is to be fore-armed. Please understand that a SINGLE signal does not constitute gloom and doom to come; there must be a minimum of two and preferably more before one should take full heed. In other words, this is a YELLOW Alert and not a Red Alert. We need to watch carefully from here but there are a few observations we can make:

-

We have risen sharply on all Indexes in the last eight weeks with many Indexes into new highs.

-

We had our first shot across the bow when they knee jerked the Market with the BIDU downgrade last Thursday.

-

The Market had another sell off today based on the Citigroup EPS Report, and although this was expected to be disappointing, they took the market down anyway.

-

Since the McClellan Oscillator was positive up to now, this was the perfect set up to trigger the Hindenburg Omen as it turned negative today…being one of the required conditions that rarely occur in concert with the other requirements.

The Hindenburg worked true to form as shown by the chart predicting a correction accurately. Since this is new to us all during this 2007 period, this signal today may be a one day wonder in which case it will be shrugged off as a spurious signal. We must wait to see if we get another one shortly and what further factors come into play in the future. In addition, although the Gorilla RonIandex we gave you in today’s Newsletter was negative today relative to the S&P 500, it is far too early to declare that we have anything but a one day knee jerk. Please read the points I made in the Newsletter on the Calendar of Events leading up to the FOMC meeting on October 31st. Two key earnings reports are due from GOOG on October 18 and AAPL on Oct. 22. How the market reacts then will be a serious clue of what might be in store for the future. So I am not for one minute suggesting anything but caution at this stage.

The bottom line is that this is a Heads-Up Message. Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog