Group Inclusion Function in HGSI

I am often asked “But Ian, how can I find potential candidates in a down market that still may be providing gains on the long side, rather than sitting in my foxhole?” Of course those who just can’t tolerate withdrawal symptoms want to look for the reward and are prepared to take the risk…i.e., roll the dice in the face of a hurricane. Well, for those who are not feint of heart, here are 15 stocks that have shown the highest count across several HGSI Proprietary Groups.

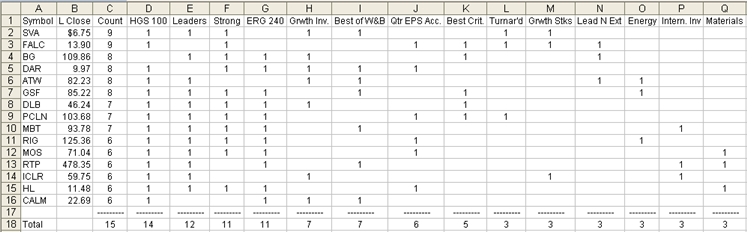

Taking a feather out of my associate and good friend Ron Brown’s cap, I felt I might show you the results of the top 15 stocks for the newly developed function in the HGSI Software, called Group Inclusion. As he showed you in his video today, this new feature shows the stocks with the most hits in selected StockPicker and SmartGroups. Shown below are the 15 stocks with scores of 6 to 9, and the groups that had 3 or more “hits” for these stocks. Note…Column C, labeled Count, is the number of groups that had the stock listed, but the total score shown may not equal that shown on any one row, since I had to cut the view off so that it would at least be readable. For example, SVA is shown with a count of ‘9”, but only 7 are shown on the list; the other two were in the Health Care Sector and Best Stocks under $10.

I have absolutely no idea if there will be opportunities in this Group of stocks, but it gives us a basis to do paper studies at the onset of a bad down-turn to see if there is anything we can glean out of this lot. I suggest you put these in QuoteTracker or whatever other Real-time on-line software you use and watch how they do tomorrow and through the week.

One thing which I find gratifying is that those who have been using their favorite Groups to hunt for stocks will find to their relief and satisfaction they are all prominently shown in columns “D” through “I”. Naturally the HGS 100 should clock up the most hits, but ignoring that one, your best hunting ground for ferreting would appear to be in the favorite groups you already use as shown.

As far as I am concerned this is a paper study to see if HGSI can find the proper fish swimming upstream against the tide…It is always “Your Call”. Ron and I will focus on this feature on our newsletter due this week, and maybe we will shed more light on its performance and uses then.

Please let me know if this blog is of value to you as it took a fair amount of research to make the simple chart above handed to you on a platter. Or, are you sitting in your foxhole twiddling your thumbs for better times? Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog