Is This the Year Without a Santa Claus?

Now we are cooking as I really appreciate inputs from my friends and supporters. One good friend who lives in Dallas reminds me that these two characters sum up the Market really well right now…hot and cold! Almost everyone who was a child in the US during the early-70s seems to remember that Christmas special on TV with Heat Miser and Snow Miser. Here’s a snapshot I showed you yesterday of three pictures I watch during the day among others, and it tells a sorry tale of a probable dead cat bounce. With the CPI due tomorrow and Options Expiration on Friday who knows where we will end up for the week, but for sure they were rushing for the exits in the last half-hour and all the decent gains of the day turned to mush.

The Nasdaq swooned for a loss of 1.1%, the volume was lower again today, and the FXP which is the Ultra Shorts on the Chinese stocks began to perk up towards the end of day, after starting with the bulls rubbing their hands at the open based on a strong Hang Seng performance last night. The tasty morsels were where the action has been in the Silverback Gorillas, the Chinese Gorillas and the five horsemen we watch in AAPL, GOOG, GRMN, RIMM and BIDU. However, by the end of the day, the first four were negative and only BIDU was up a paltry 0.75%.

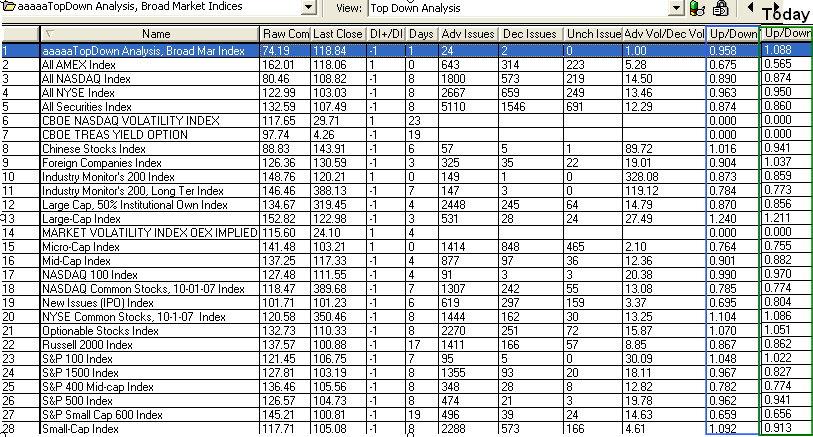

Another supporter which goes back quite a few years alerted me to get my beady eyes on the Up/Down Volume Ratio for the market indexes yesterday, which while decent, were not exactly convincing, and he is right. But more importantly, he went on to say “We’ll have to monitor this along with price if the follow-thru day appears.” If it is to happen then if and when we have that follow through day, remember to bring up the picture below and see if the Up/Down Volume is substantially better. Although there is no question that the Adv Issues to Dec Issues were strong along with the accompanying volume, it helps to have many of you keeping watch on what might be significant clues and I appreciate the feedback. Let’s take a look at that picture:

I made a snapshot of today’s Up/Down Volume and tacked it onto yesterday’s table at the end. Today is lower than yesterday as we would expect from the volume picture above and the Large Cap Index is over 1.2 on both days…again confirming that the Gorillas is where the action is. What would we do without the slicing and dicing we can do with the HGSI Software? Thanks for the feedback David and keep up the good work. Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog