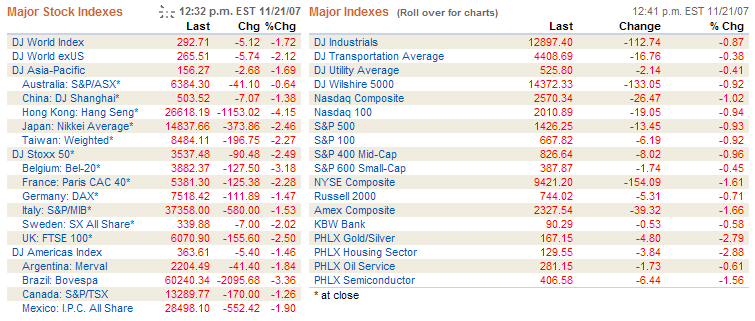

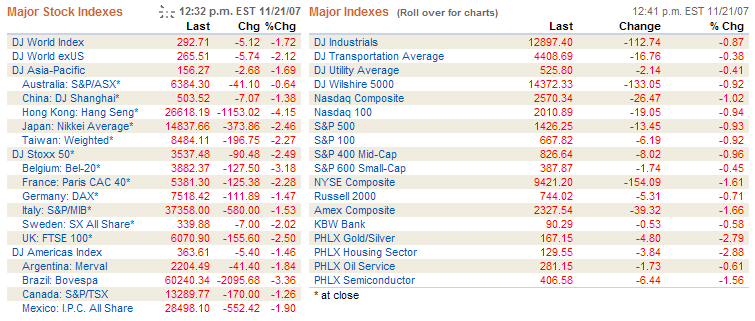

The Market Correction underway is Global by the looks of things. As David Schoon reminds me “with China down >1%, Tokyo down >2%, Taiwan down >2%, Korea down >3% and India down >4%, we’ll find out today how much pep the bulls Stateside have before eating their turkeys!” Here’s a snapshot just before I go out to do a “honey do” to get the Turkey! We can see that the Indexes are all blood red as I write this at 10.00 am PCT:

There is little more for me to say but to wish you all a Very Happy Thanksgiving and I thank you for all your support, encouragement, feedback and friendship. Best Regards, Ian.

This entry was posted

on Wednesday, November 21st, 2007 at 2:01 pm and is filed under Market Analysis.

You can follow any responses to this entry through the RSS 2.0 feed.

Both comments and pings are currently closed.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog