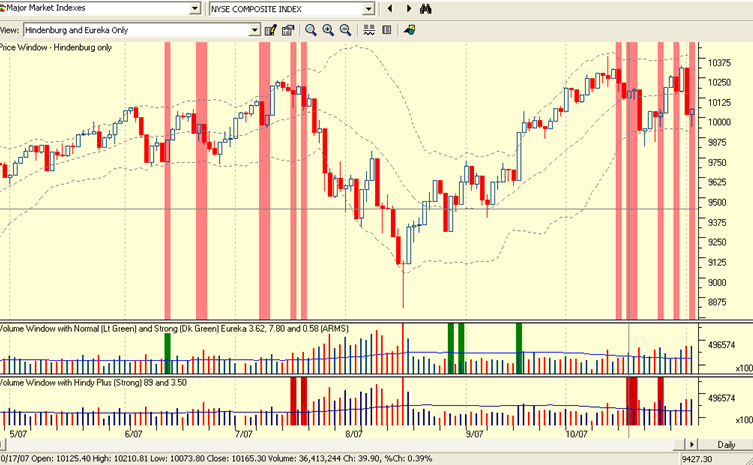

The Hindenburg Omen Signals between 2005 and 2007

Tuesday, November 6th, 2007Kevin and his wife Diane are new readers of my blog and ask to be brought up to date on the Hindenburg Omen track record since 2005. Here is his question: “I’ve been reading your blog with great interest ever since I heard about the Hindenburg Omen signal elsewhere (on ADVFN). I see on the Wikipedia site there is a link to an article giving the historical performance of this signal from 1985 to 2005, but I was wondering what signals there have been since 2005 and what happened thereafter.

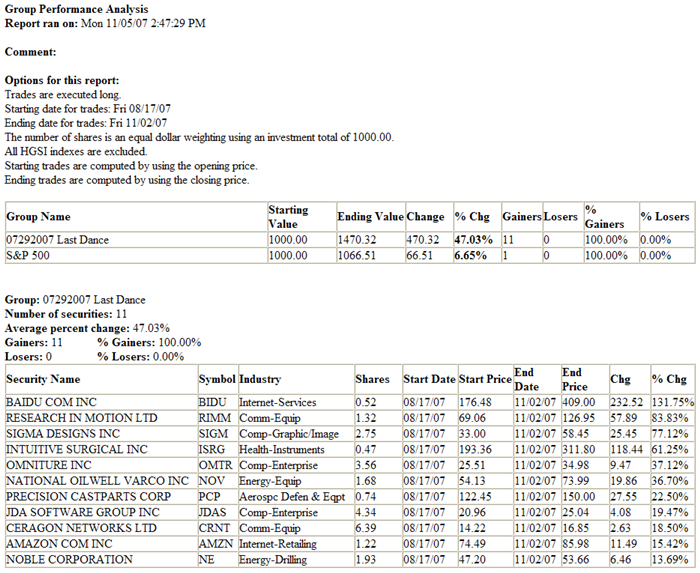

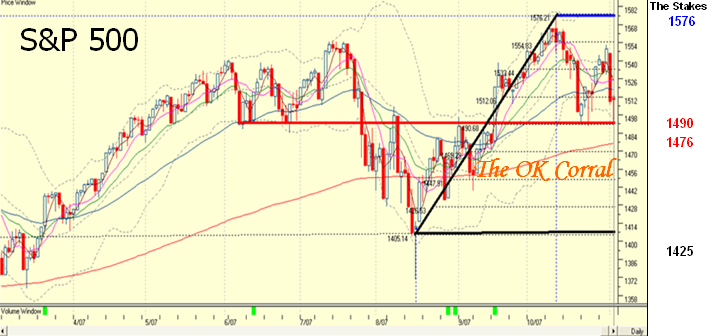

Obviously there were valid signals in July-August this year too, but do you know if there were any signals between 2005 and 2007 and were they false or true? If you know of any website or article that has an up-to-date performance record of the Hindenburg Omen would you mention it on your blog please? Thanks – and thanks also for all the other interesting market commentaries you provide in your daily blog.” The short answer is three Valid Signals, One False Signal and One waiting in the wings right now between 2005 and 2007! I also show three spurious signals which are single events and DO NOT count as the requirement is at least for two “True” hits to occur for a valid signal. The picture below will bring you up to date:

I don’t know of any article that has an up-to-date account other than the one you are reading on this blog and web-site, thanks to the excellent work of the HGSI Software Team, which I am sure all of us appreciate. In the hustle and bustle of life, if my viewers of this blog like this expression of their good work which I share freely with you, drop them a line of appreciation. The e-mail address is support@highgrowthstock.com. Thank you for your positive feedback on my work and the interest in my efforts to give my supporters the pulse of the market and other Principles of HGS Investing. Stay a while and you might pick up a few ideas that may help you in this tricky volatile Market.

Late Breaking News! After posting this blog, I find there is a further signal triggered after today’s download, so as the market goes higher, the Hindenburg Omen continues to signal irrational exuberance. As I said in an earlier Blog, 41 days from the confirmed second signal on October 17 puts us at November 27 before these signals are deemed invalid…according to the historians.

Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog