Trust the Grand Old Duke of York to leave us a Treat and a Trick!

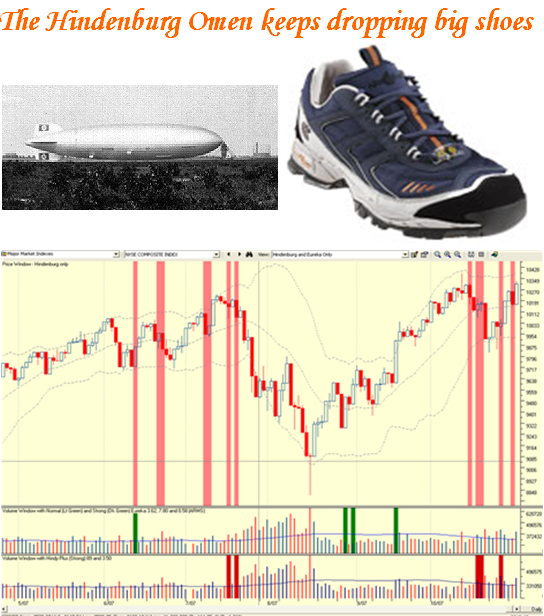

Thursday, November 1st, 2007Having given us a treat yesterday of the expected ¼ point cut in both rates which the markets enjoyed for all of one day, the FOMC injected some $41 Billion into the system today that sent all markets reeling on its heels, especially with the downgrading of Citigroup today. It’s tough to win in this yo-yo market, and it goes without saying that the Chemicals Specialty and Transportation Shipping got whacked again today for -4.94% and -2.33%, respectively. This was on top of yesterday’s -9.00% and -2.14%, respectively, as I reported in my “RoughSeas” Blog. The Nina, Pinta and the Santa Maria are in very rough seas right now, as DRYS, NM and EXM took another hit today. Down nearly 14% and 4.5% for those two Wolf Packs says they are licking their wounds and maybe the signs of topping for them. We are inclined to forget that the leaders in them which I gave you delivered about 50% each as selected Wolf Packs and only focus on the downside when they break. That’s par for the course.

My question yesterday was “Profit Taking or First Signs of Rotation?” I think we will have our answer in one more week if not tomorrow! One clue that suggests this may still be major profit taking is that the volume today in the Transportation Group had only four stocks above average daily volume, so you know full well that unless there is a major collapse tomorrow, the “buy on dips” types will be back in full force…i.e., more complacency. But while that formula is still working that is where you make the money PROVIDED you are nimble. The Chemicals Specialty got hit a bit harder…due mainly to FTK taking a shellacking on very heavy volume.

Wolf Pack Hunting…at its best with HGS Investor (HGSI) Software!

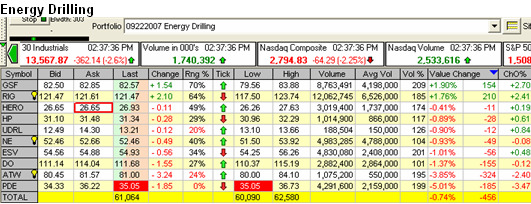

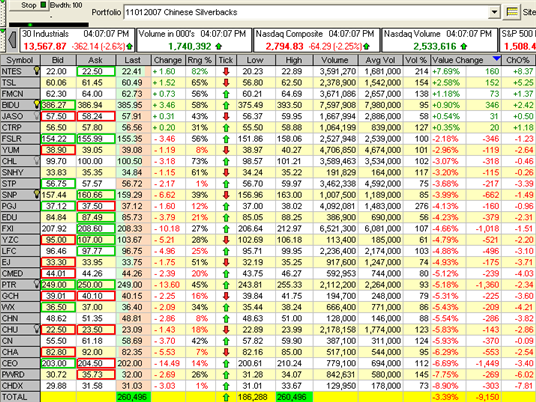

But from the Pain, now comes the Joy. It is the beauty of being able to spot the rotation of emerging or discarded Wolf Packs so easily with the HGSI Software! You will recall that all of five weeks ago I gave you Energy – Drilling, and quickly told you to forget it, as the stocks did not fire up during the following few days as we watched their behavior. That Wolf Pack turned out to be a mighty hungry pack these past five weeks. It may be early yet, but there are the first signs of life due to two things…one is that the likes of RIG and GSF have both delivered stellar earnings, and the other is the news that there is a shortage of supply of crude oil. Pick your spots carefully and keep a beady eye on the market as most boats sink in extremely heavy seas.

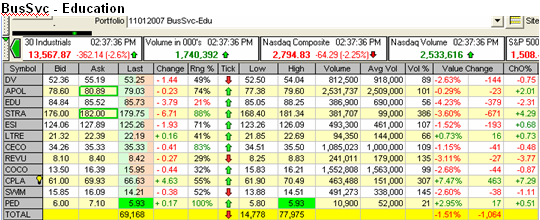

Another Wolf Pack that was making noises of stirring was the BusSvc – Education Group which we spied at the Seminar just finished. Although the leaders got hit today, they are certainly worth watching if this Market is to continue upwards and does NOT give up the ghost. I’m sure you understand by now that these are only pointers for possible fresh opportunities and nine tenths of their success comes from the “Wind being at your Back and not in your Face”. Whatever the immediate results, I ask you where can one find a software product like HGSI which serves these tidbits up on a silver platter?

Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog