Whither Goes the Volatility Index – VIX?

- I am grateful to my Finnish friends from kestustela.kauppalehti that have pounced on an earlier blog of my musings on the “Long Road Back for the S&P500 written on March 23rd under Happy Easter Wishes. Unfortunately there is no English translation on their site, so I am not sure what excited them to take a peak at my blog, but many thanks to all of them.

- Here is a mailbag question from one of our Newbies at the March High Growth Stock Seminar, “It appears that the VIX has rebounded and not broken down thru the resistance. What do you think that means for market direction? Has it rebounded enough to continue the decline? the Newbie-Pete

- Well done, you are learning fast and have now cast off your “Newbie” handle and fresh from the March Seminar, I dub thee “Oldie Pistol Pete”…you are one sharp dude, as my sons would say!

- Everyone on this earth should be asking the same question, but you have come to the right place to find the answer. Friday was a major set back for the Bulls, but the game is not over for them yet. The GE earnings disappointment really took its toll, and any more of that scenario this week will certainly cause the rally to fizzle when it was looking so promising.

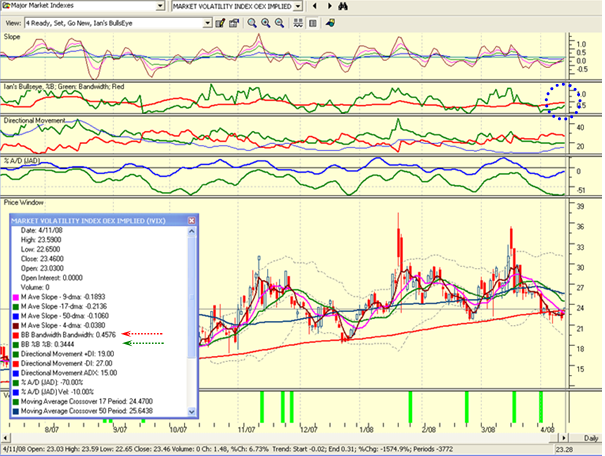

- Now then, to answer you directly, it is close to rebounding enough to continue the market decline, but it is too close to call. The VIX is currently still below the Bandwidth and it needs to break above. Where do you find that you will surely ask? It is all in the High Growth Stock Investor Software as the only place to find the answer, and we have made it easy for you if only you can remember to go to the right place. Go to my trusty Chart View which is the standard I always use along with 9/10th of the people out there and that is the “4 Ready, Set, Go New, Ian’s BullsEye” Chart. It used to be the 4b chart, but is now the first one in the series of 4 charts. You will need to bring up “Major Market Indexes” in the Chart View along with selecting the Market Volatility Index and there before your beady eyes you will see that in the Ian’s Bullseye Window the second one down, the green line is BELOW the Red. If you bring up your Data Window you will see that BB %B is 0.3444 and BB Bandwidth is 0.4576, so still below, as shown in the chart below:

- And now the $64 question is “Ian, I want to be ready to go short or go long on Monday morning and I am in the process of getting my candidate list together right now…can you Help me?

- I won’t let you down but nobody knows for sure. However, I will give you the conditions for the VIX for tomorrow and the week ahead that will guide you as to whether the direction is sideways, up or down and then all you have to do is sit back and enjoy!

Conditions for the VIX for tomorrow and this week:

- The minimum requirement for the VIX is a reading of 24.10 from its current reading of 23.46 for the %B to just be equal to the Bandwidth, i.e., green line touching the red line. That will spell hope for the Bears and further concern for the Bulls.

- The ideal requirement for the VIX from the Bears standpoint is a “Little Kahuna” of +0.25 up on the %B which would require the VIX to jump to 25.95, which would be tantamount to a major down market tomorrow and would be pretty obvious.

- The ideal requirement for the VIX from the Bulls standpoint would be a “Little Kahuna” of -0.25 down on %B which would require the VIX to fall to less than 20.20, or essentially very close to the lower Bollinger Band to continue to give major hope for the rally to continue.

- So the answer is that anything up big between 23.46 and 25.95 for the VIX, the Bears win. On the other hand, if the VIX goes down big between 23.46 and 20.20, the Bulls smile with the bull rally continuing. Anything minor in between, we go sideways.

Stay tuned Pete, as I must now feverishly turn my attention to the newsletter where I will focus on the value of the Kahuna in these difficult times. But the most important priority for this afternoon is the Masters Golf Tournament at Augusta 🙂 Best regards, Ian

Late Breaking News! I have had a few comments from viewers and I refer you to the response I made to Dave in the Comments Section below to see my latest thoughts since posting this blog. Net-net, the VIX %B has not even broken through the Bandwidth which was the first target I set, so we sit and wait! Meanwhile enjoy the Hot Wolf Packs. Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog