Buying North of the 405 Freeway with Wolf-Packs!

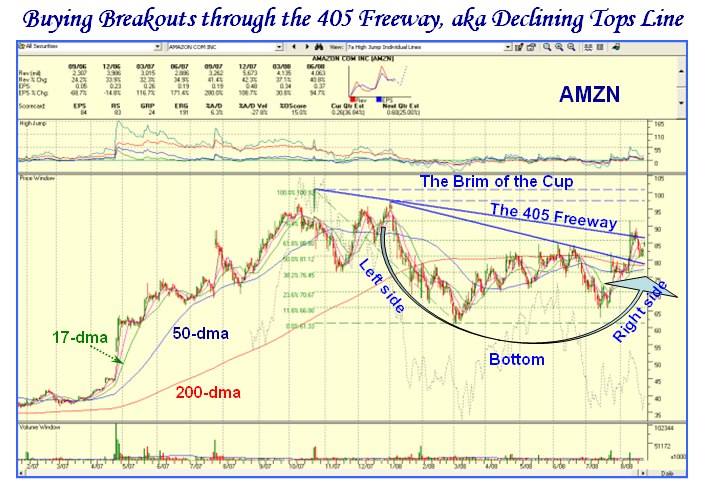

High Growth Stock Investors have long since learned the secret of “Buying North of the 405 Freeway”, aka buying breakouts through the declining tops line, rather than at the brim of the cup. This is especially true when the stock market has been trashed where most potentially new or old warriors have bent out of shape Chart Patterns that hardly resemble the ideal shapes one looks for such as Cups and Handles and Flat Bases. In a see-saw or yo-yo market, the way to play is to Strike While the Iron is Hot and take short term profits.

In recent weeks we have seen several stocks with good fundamentals fail at or soon after breakout such as AMED, EZPW, MPWR, and VISN compared to those that have given some explosive moves such as CNQR, ILMN, NUVA, PMTC, VAR and WGOV to name a few. Had the recent rally attempt not fizzled, some of these stocks from both lists could have been true leaders. Now they wait for fresh winds at their backs.

1. Many of these stocks show a similar characteristic of a Breakaway Gap; this usually occurs at the 405 Freeway. It implies a positive earnings surprise.

2. Those that are successful show the gap has NOT been closed, and are hovering to gain a second wind to move higher, again confirming “Wall Street halo”.

3. Only one, ILMN, has a Lower Left to Upper Right (LLUR) chart pattern and is an undisputed BIG Stock for this phase of the Market if it can hold at $87.

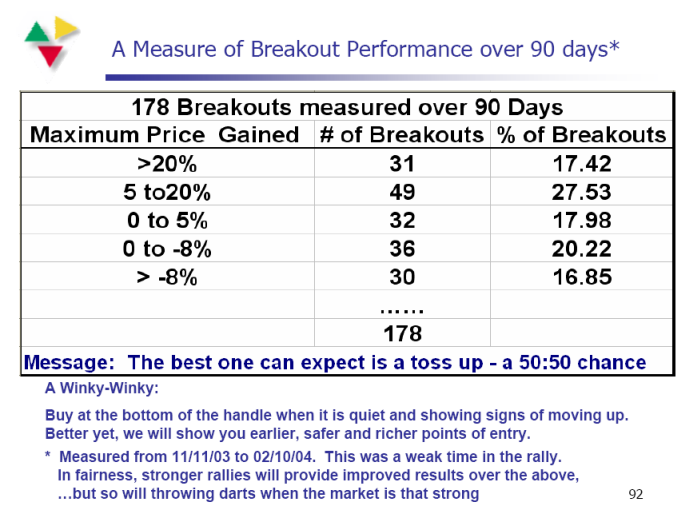

At times like these where we have seen some decent Earnings Reports and the market is trying to find a bottom, there are some old warriors and new candidates that are delivering false breakouts. This is much to the consternation of those dyed-in-the-wool investors who haven’t stopped to think that the so-called “standard approach to buying breakouts at the brim of the cup” is a toss of the coin and in Bear Market rallies the odds are even worse. Here are some statistics from the past that will make my point:

I grant you that this in an excerpt derived back in the 2003-04 timeframe, but if anything, the results would be expected to be worse now given a vastly oversold market. Short of bottom fishing or dredging which has a better pay off these days for “Value” stocks, it seems to me that commonsense suggests that given there is new news both in terms of a good Earnings Report as well as some new product or service, it pays to look for such opportunities after they have shown they have turned the corner by displaying a double bottom and have started to head up the right hand side of the “cup”. Amazon, (AMZN) is an old warrior that is turning the corner, and is a great example to buy at the 405 Freeway than waiting for the brim of the cup. The 405 Freeway in

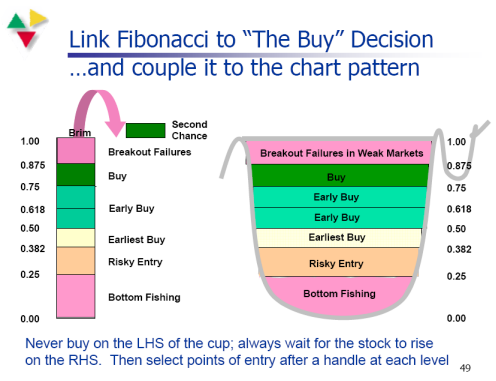

In the above chart, I have shown the overlay of the Fibonacci Lines and as you can see AMZN is between the 50% and 61.8% retracement level. Stocks that are below the old high are vulnerable to providing a Head and Shoulders pattern for shorting should the Market not follow through and the initial breakout fizzles. However, the counter to that is the reception by the Street to the recent positive Earnings Report as well as the current hype on their new product relating to “Kindle” new models of its e-book reader. In the chart below, I give you my opinion on where to enter after the stock has risen off the bottom to be at least the 38.2% level as an early buy, AFTER the stock has made a handle. Strike while the iron is hot off breakouts above the 50% mark is safest, and use Fibonacci to help in the buy decision:

The bottom line message is that one sure way to know if a Market is repairing is to watch the number of breakouts and the number that succeed relative to those that fail. At the moment this is a shaky market on that score. I showed you another way in my previous blog note which looks at the Industry Group momentum or lack there-of. One such group which is hot at the moment is the old Solar Wolf-Pack with six stocks delivering from 23 to 62% gains in ten days! They are SOLF, STP, LDK, SOL, SPWR, and CSIQ. Here is another in Enrg-O&G Explor&Prod with a range of 18 to 47% with stocks like PDO, MXC, PETD, ARD and GEOI.

In tricky markets like this, you need the assurance of safety in numbers, i.e., Wolf-Packs. Remember that this is the summer season where volume is naturally down due to graduations, weddings, and vacations in the Hamptons, to say nothing of the Olympics these past two weeks. The way to compensate for the lack of volume is to know which Wolf-Packs are getting the attention. Use Wolf-Packs to find where the action is, select the stock(s) from the Wolf-Pack, and then Strike While the Iron is Hot for that day or as long as the Wolf-Pack stays hot! Otherwise stay in your foxhole. If 1257 on the S&P500 is broken, watch out below.

Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog