Beware of the Market Gloom in September!

It’s funny how History repeats itself; we all know that historically September is the worst month for the stock market and here we are only three trading days into September and all have been down and certainly distribution days.

The Bounce Play since mid-July is curtains for now, and once again we might soon be staring at the lows of this Bear Market, with the distinct possibility if the lows are broken the market trots on down to the next level of 1150 on the S&P 500.

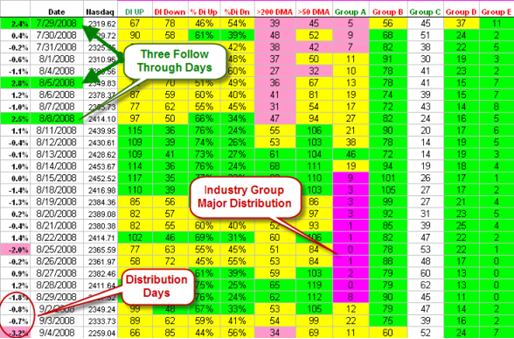

For the record, it is a sinister sign that we had no Eureka signal, despite the Follow Through Days (FTD) we experienced on July 29, Aug 5 and Aug 8 were healthy moves of 2.4%, 2.8% and 2.5% in quick succession, we soon fell back into the doldrums. At the time I discussed at length that we could excuse the lack of Eureka signals which to those who know show some signs of irrational exuberance by the Bulls. The reasoning was that the market was so heavily oversold that it was unlikely at that time. However, that was a month ago, and it was easy to see that the entire rally had stalled and at best was going sideways and at worst setting up for a fall. The evidence is in the chart below:

I showed you a similar picture just eight trading days ago, two blog notes earlier, so I hope that if you did nothing else you kept an eye on the # of stock market Industry Groups that had “A” Accumulation. It takes less than one minute on High Growth Stock Investor: Select IM Industry Groups in the Warehouse and then select the Filter Named Accumulation “A”. Read the # of Groups in the Warehouse. You’re done.

After a -3.2% distribution day today on top of the three previous days totting up to a further -3.3%, the Bears are dancing and we cannot make a silk purse out of a Sow’s ear. Now one waits for fresh signs of the “same mumbo jumbo” (good stuff) for a rally. Qid’s win over Qld’s at the moment in the ETF department, so short till the picture reverses.

In my opinion, it confirms that the FTD concept alone is lacking and not to be trusted without additional evidence that a fresh rally is underway. Meanwhile the mountain of fresh new lows is starting to increase as we have 160 today. Also the number of Declines to Advances on the NYSE was over 5:1 and so were the Dec to Adv Volume, so it was a terrible day all around. All Major Market Indexes are on a Daily Bongo No and all but two are also on Weekly Bongo No, so the Bears have the bit between their teeth.

The lesson learned is to wait for the Irrational Exuberance exemplified by a Eureka signal as this time there is no excuse for the bulls not to step up to the plate in that the market is not as oversold as before and we have the evidence to prove it since at this stage there are no Bingo signals. I hope you see how the logic and the stock market tools we have given you are working hand-in-glove and keeping you on the right side of the market. Should it break down below the current recent lows, then that is a different matter and we will need to review the bidding at that time.

Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog