Wall Street Reacts to a Day in the Life of Congress!

Today’s discussion by the Three Musketeers, Secy. Paulson, Fed Chairman Bernanke and SEC Secy. Cox at Capitol Hill was a battle between Wall Street vs Main Street. It goes without saying that the senators questioning and of course posturing was to make sure that the Tax-Payers’ concerns were being heard, since we will ultimately be footing the bill. However it was abundantly clear to me that what was originally expected to be a quick passage of the $700 Billion Bill was not likely and as you will see so did Wall Street by the end of the day. The DOW and Nasdaq closed down another whopping 162 and 26 points, respectively, and so we drift along teetering on the brink of disaster. Net-net, while Rome burns, Congressmen Fiddle!

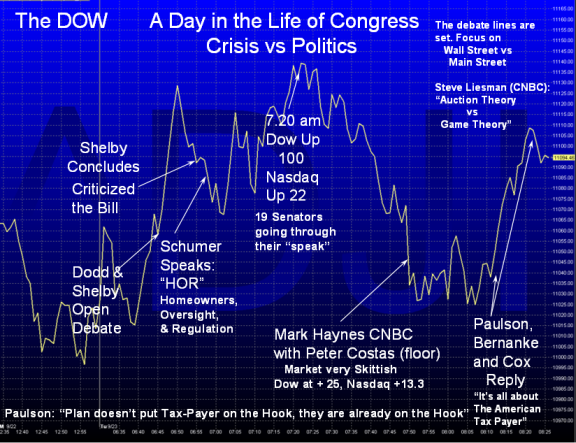

I captured the highlights of the action on a timeline relating to the ebb and flow of the DOW during the course of the hearings, and here are the various snippets from the Administration, Congress and the CNBC commentators in the first two hours in the morning:

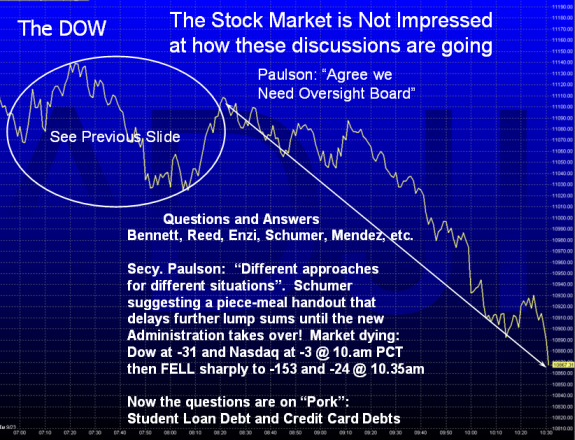

…And here are the next 2&1/2 hours:

Here is a picture of the internals of the market which showed how these indicators reacted during the five hours I kept an eye on this.

The only saving grace is that volume was low which signaled a wait and see attitude by Wall Street.

I submit that another day or two of this pussy-footing will see us on the road to the floodgates all opening to the downside as I forecasted yesterday. Hang on to your hats for a bumpy ride.

Best Regards, Ian.

Editor’s Note! Please read important discussion in the Comments section of this note to understand the context in which it was written.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog