Stock Market – There Goes the Neighborhood!

Monday, September 15th, 2008I had a nasty feeling when I wrote my last blog of making a silk purse out of a sow’s ear that we were headed for more gloom and doom, and it hardly took a week before it happened.

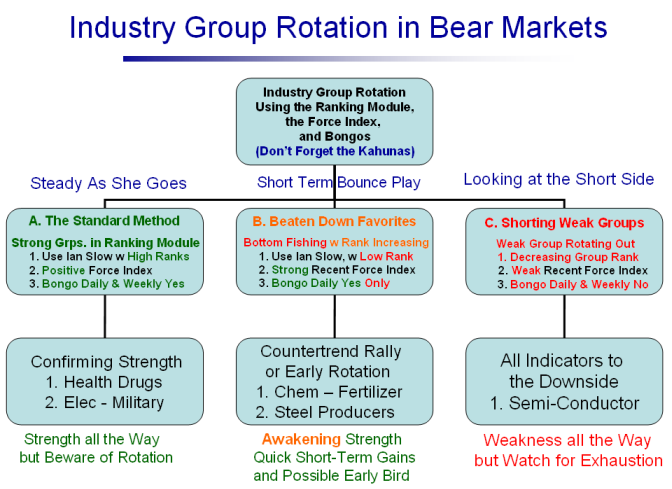

- I am sure that after the hubbub has subsided with today’s downdraft on the stock market, there will be ample opportunity for Dredging, Bottom Fishing and Bounce Plays galore for those who haven’t thrown in the towel and given up in utter disgust at the undercurrents that pull one under.

- This on top of the dreadful damage that Hurricane IKE has caused in the gulf leaves most of the country with a sense of forlorn that will take some time to weather, but then out of misery and disaster comes hope.

- Sad to say it starts with hope and then turns to greed and ultimately to fear and we have come full circle.

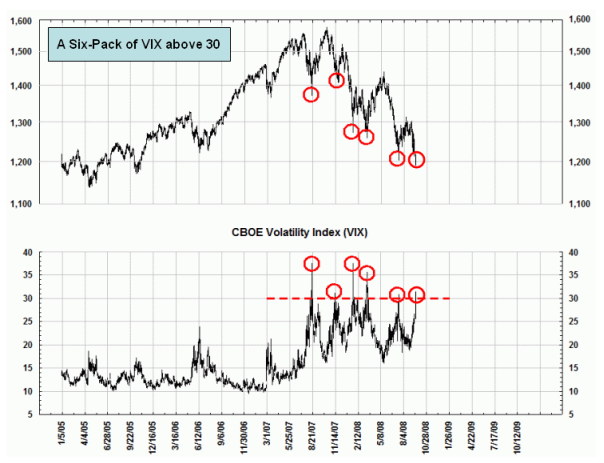

- The gurus of VIX are dancing since they would not be satisfied until the VIX hit above 30 to make it a six-pack of super-fear, and they got their wish today with a spike to 31 and a pullback to 28.32 as I write this blog.

You will pardon me for allowing my personal feelings to creep into this sad state of affairs with regard to the utter debacle that has unfolded and the serious consequences to decent folks who make an honest living and try to leave their children on a higher rung than they and their ancestors left them in turn. There is a saying used in England to describe the mentality of those who could care less about anyone but themselves. That feeling seems to have permeated throughout the world, where decency and honesty have given way to selfishness and greed with “Blow you Jack, I’m all right!”

Now the vultures will make hay and ultimately this too will pass but not before the turmoil around the world finds most of it suffering from a deep recession and many in sheer misery.

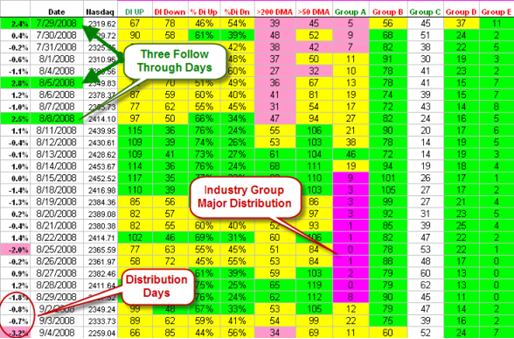

For those who still wish to dabble in this market, I feel that Ron and I have given you all the tools both in this month’s High Growth Stock Newsletter which was out yesterday and in the Seminar to come. Here is a way of how to find the opportunities both on the long and short side using a Decision Tree:

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog