Stock Market Gunfight @ the OK Corral #4

I’m back in the saddle after an exhilarating three day Seminar where the participants had a fun time even though the general Stock Market outlook was gloom and doom especially when it tried desperately to break the previous lows on all Market Indexes yesterday. Hence we come to the Desperate and Decisive Gun Fight at the OK Corral #4, since if it goes any lower we are due for records to be broken to the downside on all fronts:

As the saying goes, “To move the market, one must surprise the Market”, and it seems that Helicopter Ben’s winky-winky of last week may have done the trick by suggesting that the Fed was not averse to cutting rates yet again.

The Bears were at it again first thing this morning as Maynard’s Warriors from San Antonio, Texas who attended the Seminar will attest, but fortunately on two scores the Bears fumbled the ball at the goal line and the Bulls threw a “Hail Mary” Pass to get us breathing again at least with about a 10% cushion from the Base Low:

1. Rumor has it that there will be further cuts in Interest Rates on a Global front with the Bank of Japan leading the way by leaning towards cutting its benchmark interest rate by 0.25% and so the Dollar rose against the yen, and

2. The Fed’s interest-rate setting committee begins deliberations Tuesday afternoon at the start of its two-day meeting, with expectations for a half-point cut to bring the federal funds rate to 1% — which would be its lowest level since June 2004.

So it seems the tradition which my good friend Manu reminds me at the HGSI Seminars is that the Market always goes up after we hold one, and although it looked miserable yesterday maybe we will keep the tradition alive.

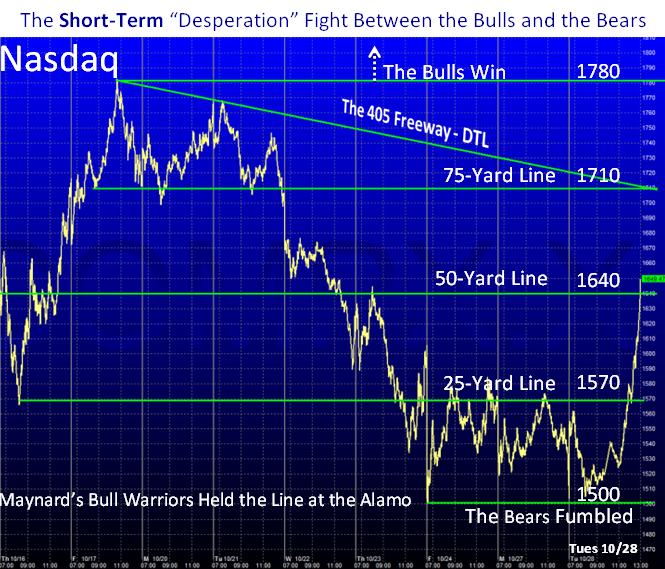

All of this gives the Bulls a couple of days to catch their breath and hope the promising Bounce Play today can continue. Naturally, with a 10.88% move of 889.35 in the DOW which is the 2nd best point move ever, there is hope that the rally will push past the strong line in the sand at 9250 where the Bulls failed to break through on three occasions the previous couple of weeks since the watershed decline on 10/10/2008. Below is the picture of the Stakes in the Ground, the lines in the sand and the measuring rods where the short-term game is being played between the Bulls and the Bears. I call it a Desperation fight as any lower and this market will be in deep yogurt.

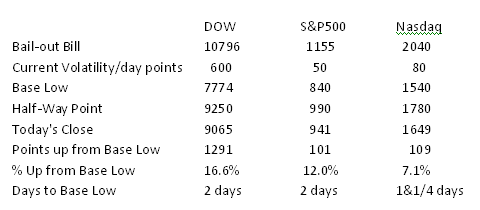

Please don’t be misled by the arrow pointing up at 1780 and the remark that says “The Bulls Win”. As attendees to the seminar will attest, this trick of mine of using this picture has great value for a very short-term feel for where the ball game is being played right now. Clearly we have a lot further to go to get up far enough to even consider this as a Bear Market Rally. My advice is to always make a note of where the Market stood when an important event occurred, and that to our way of thinking is when the Market swooned AFTER the Bail Out Bill was passed. Please make a note of these Lines in the Sand for that occasion and what has transpired since:

From the above table we can see that the best snap-back today from the Base Low is the DOW, followed by the S&P500 and then the Nasdaq. We can also see that, given the current volatility, we are only a couple of days worth of snap back from the Base Low. The best we can call today’s action is an Excellent Reversal Day with a reasonable snap back. We must now wait for a Follow through Day (FTD) with some signs of Eureka’s firing up before we can get excited that we are in a decent Bear Market Rally.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog