Staying Abreast of the Stock Market’s Moods

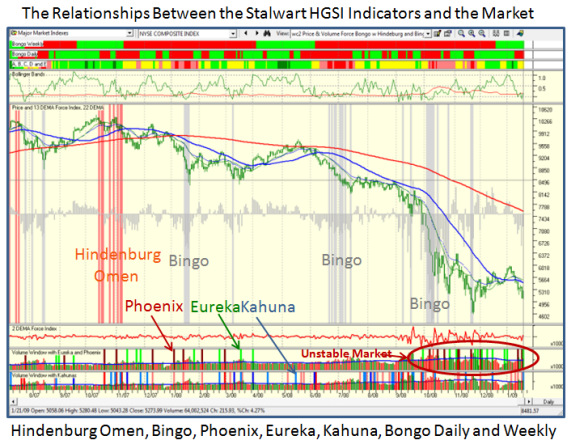

As my regular viewers have come to recognize, I place a very strong emphasis on what the White House, the Fed and the Congress do at critical points in time. The direction the Stock Market takes at such times have helped me understand its Moods of Fear, Hope and Greed. As such, the HGSI Team has developed a series of Stalwart Indicators that have kept our clientele on the right side of the Market.

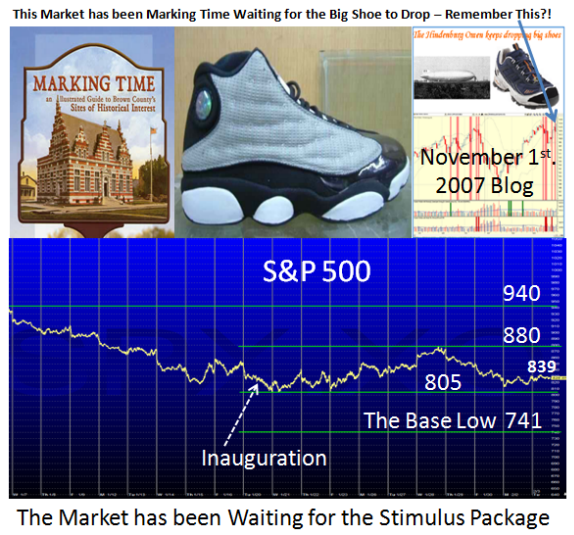

It is now over 15 months ago I flexed our muscles and gave you the importance of the Hindenburg Omen to warn you that the Big Shoe was about to drop, and drop it did. Incidentally, that particular Blog proved to be a long term winner as not only did it get a substantial amount of “hits”, it continues to do since it is referenced in Wikepedia and also shows up on Google Images for “The Big Shoe”! A little bit of trivia never hurts along the way. We got you out at the right time, and we hope we can get you back in again when the coast is clear.

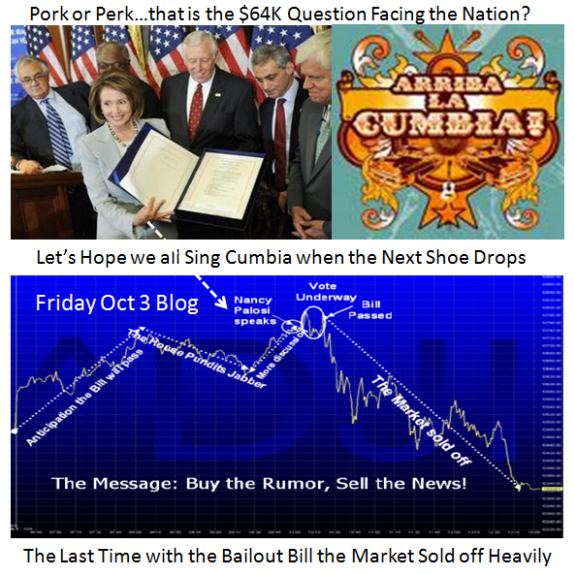

So here it is again resurrected as a Caption to remind us that a momentus decision is about to be made and let’s hope for all our sakes that we will be singing Cumbia this time or else we are surely headed for a Depression in the weeks and months to come.

Lest we forget the last time that I defined a momentus decision was upon us was with the first stimulus package known as the Bailout Bill which flopped before the ink had dried. I recorded that event in the October 3 Blog, since when the Market and the 401-K’s have suffered serious damage. That was TARP I. It seems the House has done it again where the Nation now waits with baited breath to see if the Senate will right the ship with a meaningful and sensible package. Time will tell if TARP II is any better.

It goes without saying that the Market is at a Critical Juncture once again. The Santa Claus Rally fizzled out along with the January Effect to end up with the worst drop in history for the month of January with a -8.57% decline. I have shown you the instability and oscillation of the market as Bulls and Bears fight to gain the upper hand. Once again the HGSI Proprietary set of Indicators have shown us clearly the warning signs of this Unstable Market, and a picture is worth a thousand words so here you go with the latest Indicator the Phoenix prominently showing the fight between it and Eureka. Please understand that despite all the fru-frau, the last indicator standing is an Eureka signal posted on January 21, 2009. It goes without saying that it is tenuous at best, but Markets will always surprise you when you least expect it and we will just have to wait and see if the Psycholgical Mood turns from Fear to Hope to Greed!

I have shown you both the short and intermediate term criteria for a Bear Market rally, so keep your powder dry and use this Game Plan to decide whether Type 3 and 4 investors should participate at this juncture. Type 1 and 2 short term traders know what to do and they enjoy this volatility. Don’t forget that the Employment Report is due this Friday and one can assume there will be bad news on that score based on the several recent layoffs announced. The only good news is that many think this is already baked in!

Last but not least, there are three schools of thought regarding the bias of the market direction:

The Pessimist: We are in a confirmed 17 year Consolidation Phase and are only about half way there. In any event, the As Reported P-E for the S&P 500 will need to be less than 10 before we can be assured of a New Bull Rally in their view, based on past history. We are currently around 15!

The Optimist: We have seen the bottom, and we are due for a new strong rally similar to what transpired 100 years ago in 1907!

The Middle of the Road…Realist: We are currently in a Trading Range, the bias is obviously down, and unless we see a marked improvement in the Economy and particularly the Housing Credit Crunch, we will probably retest the recent low of 741 on the S&P 500. We could break it to the downside before we can find a true bottom and clear out the rest of the Fear.

I leave you to decide which Road you think we are on.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog