Early Warning Signs for a Correction

Michael Kahn of Barrons asks:

If I am not mistaken, there was a pheonix last week followed by a eureka. Since we are 25% to 30% into a rally, a eureka is supposed to be exhaustive even w/o the phoenix.

sell?

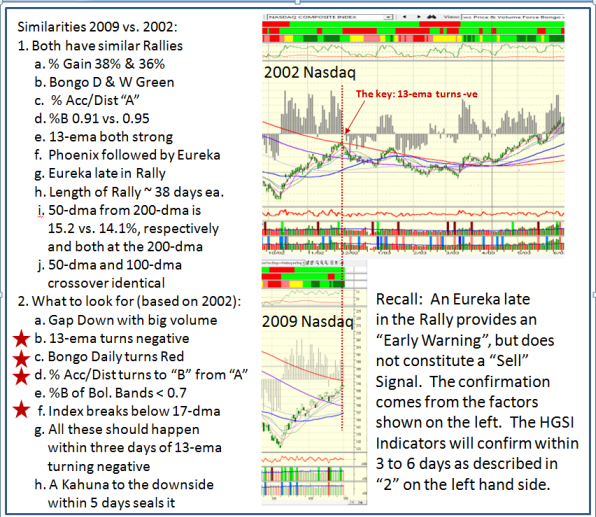

Michael: I wish it were that easy, but you have it “half-right”. An Eureka Signal will indicate the Bulls have irrational exuberance. Where it happens is the clue.

1. Several Eurekas in a row after a Base Low is a strong signal that a new Bear or Bull Rally is starting.

2. However, a Eureka late in the Rally also signals an Early Warning Sign that the Rally is probably over for now and a correction is due. However, that alone does NOT constitute a SELL signal. I have attached a PowerPoint slide below as to the entire rationale. You heard it here first!

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog