The Bears are Ready to Dance

Make no mistake about it, the Bears are sharpening their lists and are ready to dance. Type 3 Swing Traders are confused and naturally when things get to a crossroads, they finish up caught on the wrong side of the Market.

As my Kiwi friend Keith from New Zealand says in part “…the market volatility is making us all day traders…all I have time for and due to my location, is weekly position taking so am looking for a way I can do this (in futures and options as well as stocks) without getting my ass spanked…any thoughts?”

My response: “Keith, my Kiwi friend: I am afraid to say with Weekly Positions “You are in the Fertilizer”. This market RIGHT NOW is only for Type 1 and at worst Type 2 Moment and Day Traders, respectively. Type 3’s such as you who are swing traders are getting their butt kicked, unless they have very tight stops and have seen the light…they either turn to being Type 1’s or stay out until the dust settles. Ron and I and the rest of the gang from the seminar are all in accord, the only place to be right now is in the Camp of “Light Feet”. I seldom make suggestions, but the wisest thing for you to do is to save your precious earnings and stay out…given your circumstances and since you asked for my thoughts.

Yes, of course, Type 3’s are kicking themselves, because they are a day late and a dollar short, but with the Phoenix as you rightly say triggering three days ago, the Bears have control until further notice (I showed this in the Chart I posted last night in my latest Blog).

Now I know you are eyeing the ARMS (or TRIN as they now call it) and hoping for an Eureka today…if it happens all well and good, but at this stage of the game the BEARS are getting their SHORT CANDIDATES List ready for when they can thump the likes of the Type 3’s and 4’s again. They are already watching the VOLUME intently for today, and if it is anything but strong, you know the consensus from the “Guru’s” will be that this is a reactionary bounce in an oversold market.

So what do the Bulls need to thump the Bears? You got one answer today with the Eureka which is the Bounce Reaction to an oversold market. The volume could have been stronger for the bounce to show the Bulls had conviction, but it certainly was not putrid. Two Eurekas in quick succession with strong volume will suggest the Bulls have stiffened up their backbones and are back in control at least for now. You know the Gann, Elliott Wave, Fibonacci, and any other Measuring Rod Types including myself (but as you know, I keep it simple) will be eyeing support and resistance levels to their heart’s content.”

After the 13% move up on the VIX the previous day, the fear was in the market, but the market was badly oversold and the sharp bears were looking for a bounce play today as shown below, with the VIX retracing from its big move:

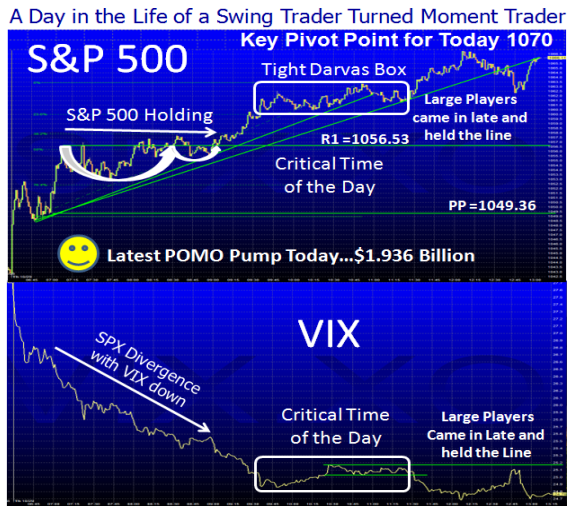

Today’s action on the S&P 500 and VIX suggests the “Large Players” came in late in the day to hold the fort when the Market didn’t crumble around the vulnerable midday period. The Seminar attendees knew that this Thursday there would be a new POMO (Permanent Open Market Operations) pump by the Fed, and true enough it was $1.936B.

The message is to “Know thy Competition” and then decide to either fight them or join them. I therefore used Type 3 simple indicators to know where they stand while tying the day’s action to the S&P 500 and the VIX. There are four points on the chart:

1. The move up in the S&P 500 coupled with the VIX going down first thing confirmed that the Bounce Play was in full swing for the first part of the day. Note how it met resistance at the R1 level at 1056.53 in the Elliott Wave good stuff which we showed you where to go at the seminar. Note the cup and handle formation right at that level, before it pushed up again.

2. The critical “after lunch” time period suggested that the bulls were wary and the tight Darvas Box on both the S&P 500 and VIX confirmed this as Large Players were probably expecting a drop to confirm that the Bounce was over and stayed out to confirm which way the wind was blowing before they committed to this strong move up by all the Indexes.

3. When the Big Guys decided to move in after the market didn’t stall, the S&P 500 finished up close to its Pivot Point at 1070.

4. As I mentioned above today was POMO Thursday and that probably helped the strong turn around today. I taught you all that mumbo jumbo at the seminar.

I know it is a trifle frustrating, but keep your powder dry until the Bulls are in control again are my best thoughts right now. “When will that occur” you ask? When that score of -6 turns to +3 or better…the road back to Hog Heaven Chart I showed in the previous blog note and in the October Newsletter. Today’s action took the score back up from -6 to +2 on the NYSE and +1 on the Nasdaq. Since the Nasdaq has been hardest hit of late, I would suggest you watch it carefully. But first things first, you need a couple of Eurekas, otherwise get your short list ready and go with Camp Gloom and Doom, as that score will stay negative until there is a new rally.

I’ll leave it there for today as there is a lot to digest and we shall see if there is a follow through on Friday or soon thereafter, or whether we will just have a bounce followed by a continuation of the correction. A healthy bounce will follow through above 1070 and head back to the old high. The Jury is out for now. Stay nimble.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog