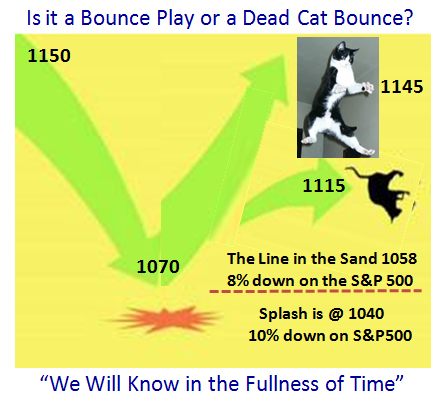

Bounce Play or Dead Cat Bounce?

Here is a sequel to the last blog where I discussed Bounce Plays. The thought struck me that I should show you the relationship of the VIX to the S&P 500 over the last ten days or so. My new good friend Billy from Belgium planted the idea in my mind with his recent work, and I felt I might build on that to harness the near term parameters for defining a Dead Cat Bounce vs. a fully fledged Bounce Play. As my other good friend Dave Steckler said “we will know in the fullness of time”, but I hope you will enjoy this short note, with no offense intended for Cat Lovers:

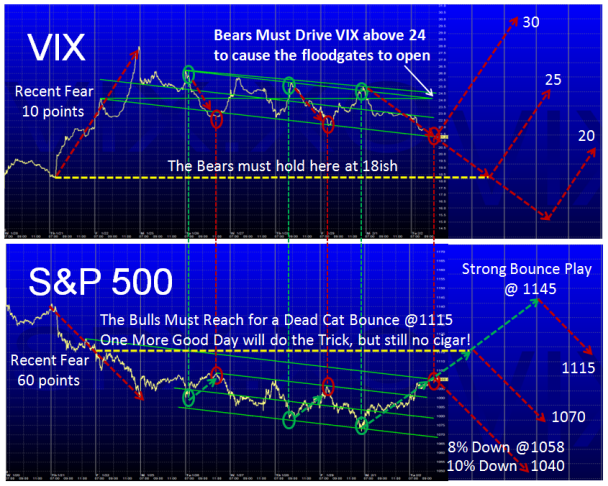

The next chart needs no explanation, but as you can see there is tremendous symmetry in the relationship between the VIX and the S&P 500, so it seems to me that it is an easy call to make on the demarcation of where the Bulls and Bears are winning the tug-o-war. We are sitting at around 1103 at the moment and with any luck another 12 points are on the cards to get to that stubborn line @1115.

I suspect that given the general mood and bias to the downside that a Dead-Cat Bounce will peter out at 1115 and produces no Cigar! The Bears are itching to short, but waiting patiently for the first sign of weakness after this two day rally.

The Bull’s Challenge:

1. Drive the short-term rally as far as they can towards 1145, and anything short of close to that will be the signal for the Bears to have at it.

2. On the downside they must hold 1070…the recent low, or we will see the famous 8% down where 77% of all S&P 500 corrections turn back, or we head on down to 1040 which is 10% down. After that it is anyone’s guess.

The Bear’s Challenge:

1. Hold the fort at above 18 on the VIX and I would be surprised if it will get much below 20 even with a move to S&P 500 of 1115.

2. Drive with “Bear fear” of 5 or more points per day on the VIX and break above 24ish for the real floodgates to open. That could take the VIX to 30 which is where most recent moves are turned back unless the floodgates turn into a deluge.

So now you have the simple game plan for the foreseeable future. The March Seminar is now less than eight weeks away and it is time you signed up to get a seat. We will be back at the Library, so as usual we can take 55 people with first come first served.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog