The Greek Gods are Smiling on the Bulls!

Just when the Bears had the Bulls on the ropes, up pop the Greek Gods to smile down on the Bulls and stop the rot that could have set in. That does not mean that the danger of a further drop has evaporated, but until the problems with the various Eureopean Economies are settled including Portugal, Italy, Ireland, Greece and Spain there will be unsettled markets across the globe.

The Bull and Bear fight for turf can be summarized as follows:

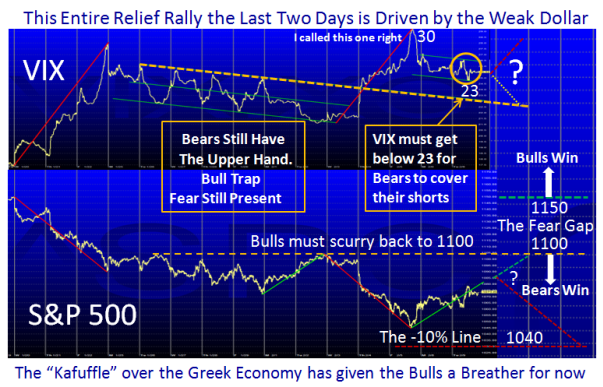

1. After a downturn from the high of close to 8%, the Market bounced for two days with a very tepid dead-cat bounce as I described in my last blog.

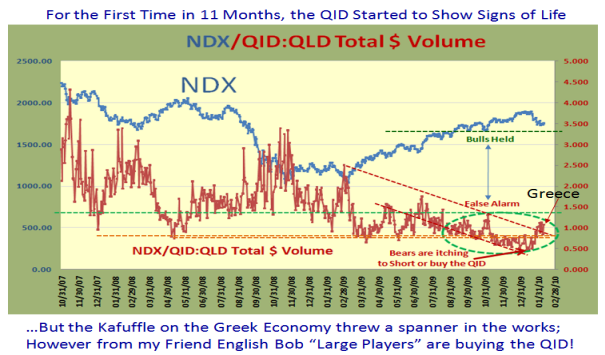

2. This gave the Bears confidence that the 11 month rally had stalled and it was time to look to the short side and nibble at the QID, SDS, and other similar ETF’s.

3. Having shot the VIX upto the famous 30 mark where we reached recent crossroads, low and behold the Euro/Dollar situation turned around with rumors that the Germans would bailout or at any rate assist the Greek Government with its Economic woes.

4. This led to a strong bounce today at the onset, with a precipitous drop in the dollar and resulted in a new relief rally for the Bulls who were literally on the ropes.

5. As I show in the attached chart, the Bears still have the upper hand and we must wait to see what transpires these next three days with the long weekend ahead of us.

6. Despite the decent rebound today, the Bulls must show courage to drive the S&P 500 Index to at least the 1100 mark, and that is only the beginning in trying to recover the internals of the Market which are now badly oversold on most fronts.

7. The gauge of the Fear Factor would seem to be that the VIX must subside to below 23 before there would be short covering by the Bears, who have the ball at present.

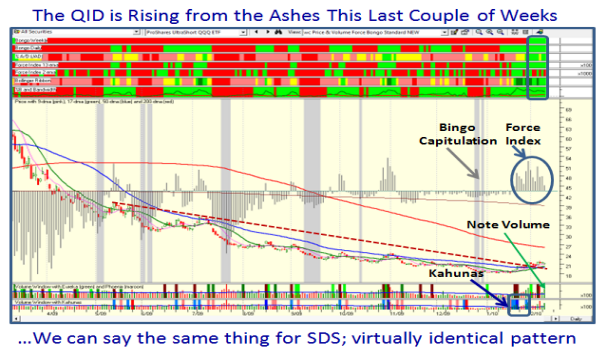

8. The QID has risen from the ashes and is stirring slowly; it had a set back today:

I trust you are all using the wc chart to spy the rotation that is taking place and what better way to see it than to look at the QID (and SDS, which have identical patterns):

If the market continues to go down, the winky winky is not to forget to watch out for a Bingo to see some form of Capitulation. In a Market Rally with a Minor Correction you will watch for a single Bingo followed very quickly by an Eureka (or the more the merrier) for a renewal of the rally. However, in an Intermediate or Major Correction, expect several Bingos and Phoenix before there is exhaustion to the downside. We came within a hair’s breadth of a Bingo yesterday on the NYSE, until the RSI 19 was driven back to over 40.5 today…so no cigar.

Remember that the -8% mark is at 1058 & -10% is at 1040 for the S&P 500.

Now you all know what to look for until I write the Newsletter this weekend!

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog