Mailbag: My friend David Elliott wrote:

Ian: Many moons ago you wrote “Where is the Beef”. As I remember it was a market that climbed higher on low volume, but eventually failed. Is our current market similar?

Hope you have a good day. Why not play golf; the market seems to like it when you do. David

Well David, you have a good memory and your wish is my command as I watch the U.S. Open at Pebble Beach, along with the Soccer and of course the Lakers, yesterday. If the Market can do as well after a hard fought series we should gradually see this Market rise out of the ashes. But you are right…the Volume has been a trifle putrid, but we must have patience as we have only achieved Step 1 of the Recovery.

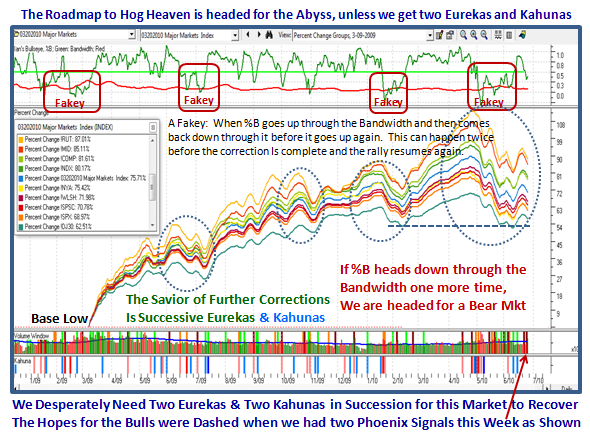

I hear Hsin saying: “All Ian’s bullish signals have been fulfilled, so should we be bullish now?” Short term traders have long since closed out their shorts by and large after that rotten FTD call by our friendly newspaper. We waited patiently for the two Eurekas and simultaneous Kahunas and the Composite %B >0.50, so yes the requirements for a Rally were met. However, that does not guarantee a successful Rally, just a start to getting off the bottom. So Day Traders turned to the long side once they got the second FTD, the earlier the better since the Early Bird catches the worm.

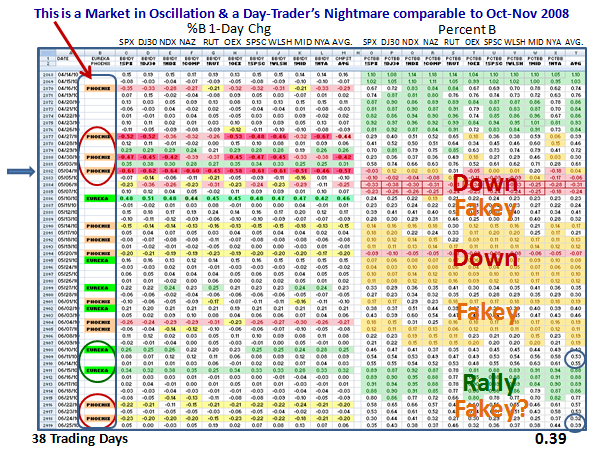

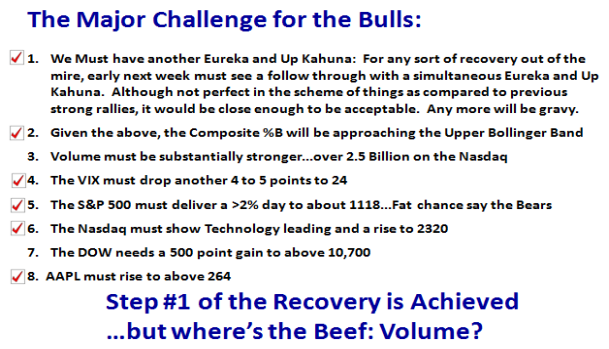

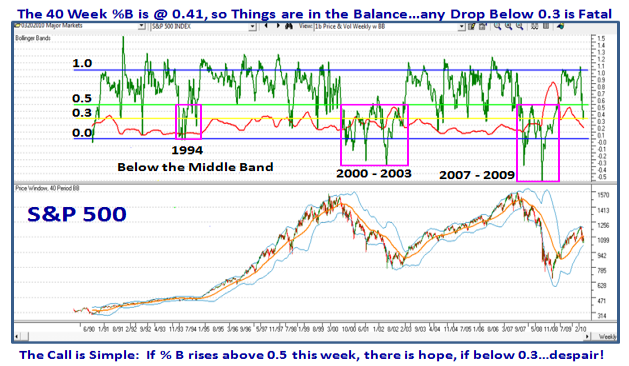

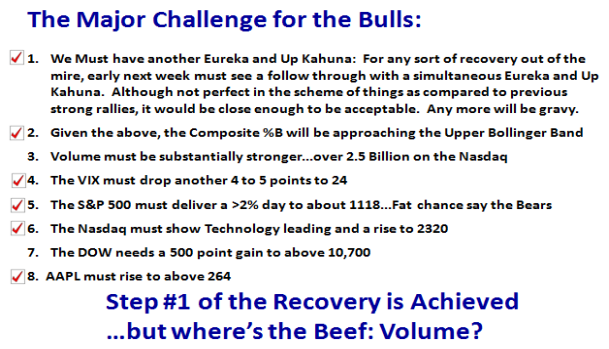

Rome was not built in a Day, and after an Intermediate Correction which has been this deep, i.e., 14.4% from High to Low on the S&P 500, and in this case, we need three steps in all to get out of the woods to a fresh solid rally. Here is the picture of what was achieved this week:

That’s not bad for a week’s work, but now comes the next step which is harder. My good friend Dave Baratto reminded me at the March Seminar…”Ian, with all the new good stuff, we are inclined to forget the golden rules of yester-year you have taught us regarding Classic Recoveries”.

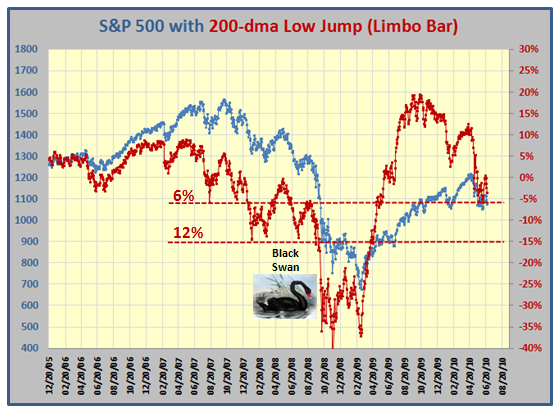

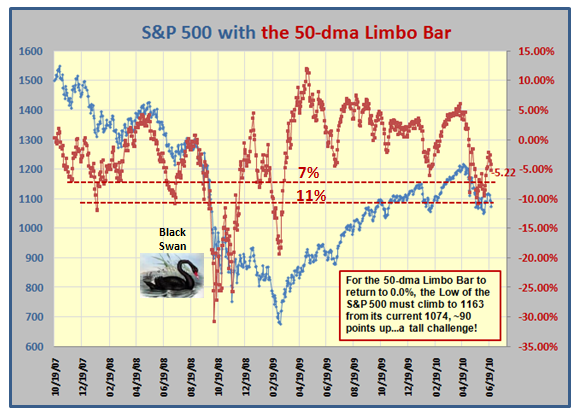

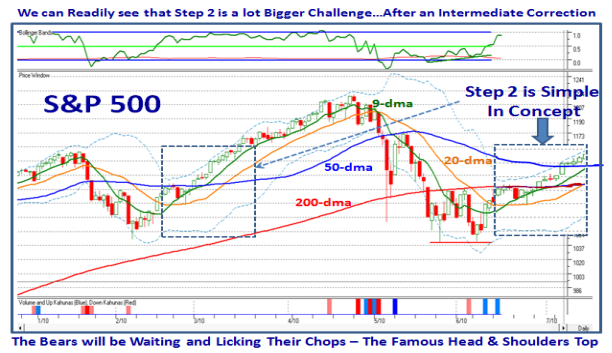

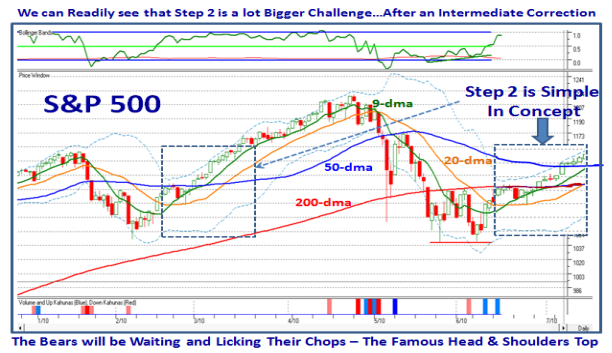

I gave you that Winky-winky in my May 30th Blog, so please go back and see the Chart Pattern. However, here it is for your convenience, and I have stuck the need on the Right Hand Side of the chart, so that the challenge is perfectly clear:

1. We must rise at least half-way up the right side of the cup

2. We must form a handle…Cups without handles will burn you

3. The 50-day Moving Average must be flat to slightly pointing up

4. A breakout above the Declining Tops Line (DTL) from the high to the top of the handle, aka…the 405 Freeway.

5. The 9-dma >17-dma >50-dma with the moving average crossovers

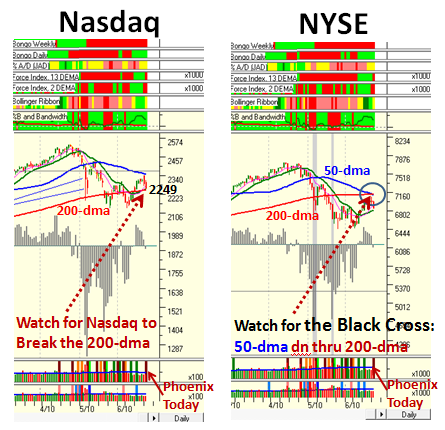

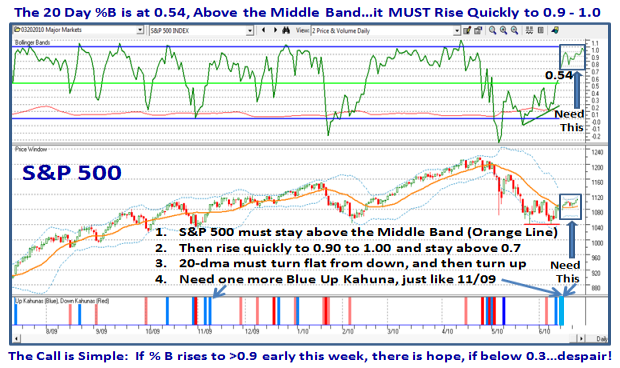

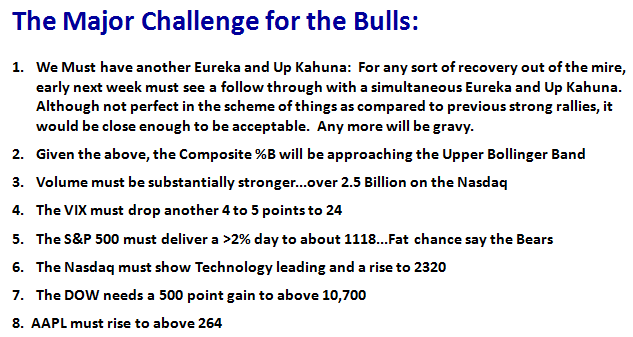

So here is Step #2:

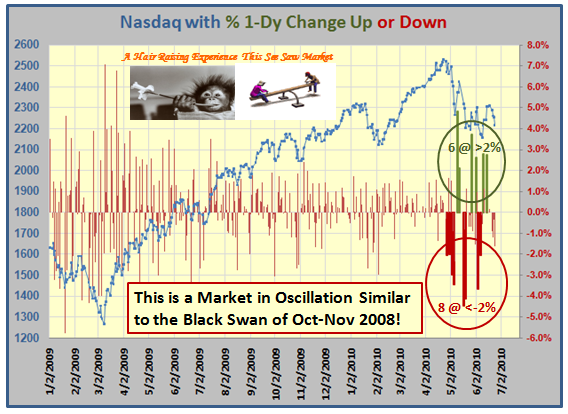

Obviously the longer you wait, the higher the Indexes rise and sooner or later there will be a correction. So far the Bulls have dodged a bullet as the market has risen at least five days in a row. One might have expected a correction today being Options Expiration Day, which is certainly a surprise, though nothing should surprise us these days. The correction can come in two forms, a minor tight move sideways to form the most important requirement in Step #2 which is a “Handle” or the rally fizzles and goes down as a bust. Don’t forget this: Handles must of necessity have light volume as a signal that bulls and bears are in agreement on the value of the Index or stock. Then the breakout must have high volume…mark my words, or it fizzles.

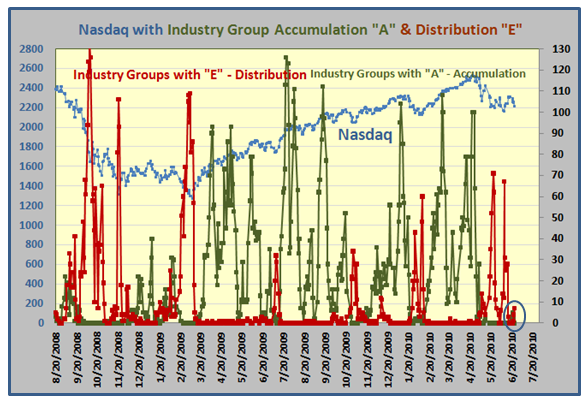

And now we come to Step #3. This comes with always understanding three Scenarios and recognizing what your Competition is thinking and is up to. I did it all my career…”Know thy Competition”. If you are Bullish then at least understand the Bearish Scenario and vice versa. If the Market has just come out of an Intermediate Correction or worse, you must recognize that the Bears are just waiting to trounce the Bulls, especially if they were trapped themselves on the wrong side of the market. It goes without saying, but I will say it, that is how the favorite patterns of Double Tops and Head and Shoulders Tops come about especially when they coincide with the 50-dma in the case of the right shoulder! The higher the Indexes rise towards the 50-dma or 200-dma (whichever applies in this case), the more the skeptics of the move rub their hands, and those who are feint of heart never get in until it is too late. It’s all a case of Approach, Style and Stomach which is different for each one of us…so here is Step #3:

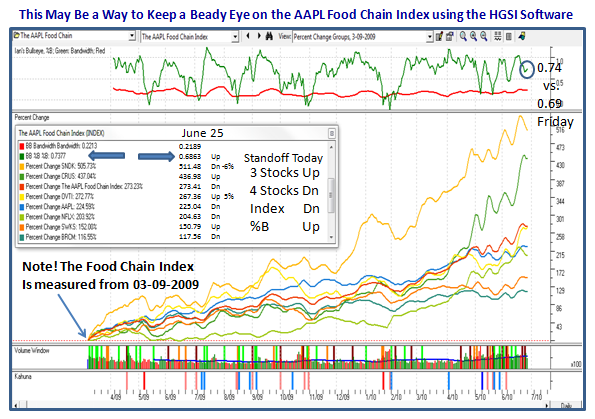

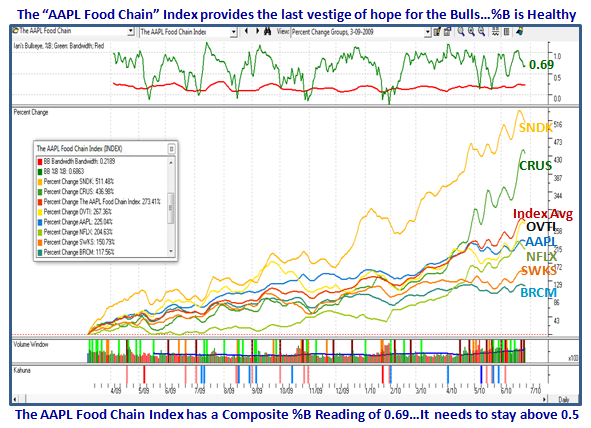

I didn’t say it was easy, but at least you know what to look for. Remember this, there is absolutely no harm in establishing Targets which come from the discipline and experience of Stakes in the Ground, Measuring Rods and Rules of Thumb. That suggests you have done your homework. Never fall in love with a Scenario, but you will immediately recognize which one the Market is telling you it is on. The Major Challenges I set have been met, but then that sets the stage for a worthwhile rally, especially as the canary, aka AAPL has more than a dose of oxygen and looks a trifle “Perky” since it is now at a new all-time high. Don’t stop there…when you see the likes of SNDK and OVTI also trotting off into the sunset, you realize that the food chain is also benefitting.

We started this with “Where’s the Beef?”…and it remains that way as the conundrum for now; the higher the market goes without volume the more vulnerable, but it’s the second mouse that gets the cheese in the trap! Whether that is the Bulls or the Bears remains to be seen. So far, the Bulls are thankful for small mercies, and the early birds are enjoying the worms.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog