Stock Market: Don’t Count Your Chickens Before Hatched

I’ve been fooled before and I’ll be fooled again, but this Market is a wonder to behold. Inching up day-by-day on light volume and all we can point to is Uncle Ben and his wonder elixir called POMO or QE2! That is the beauty of always having three scenarios and letting the market tell you which one it is on. So, one more time the lesson learned is “Never Count Your Chickens Before they are Hatched”:

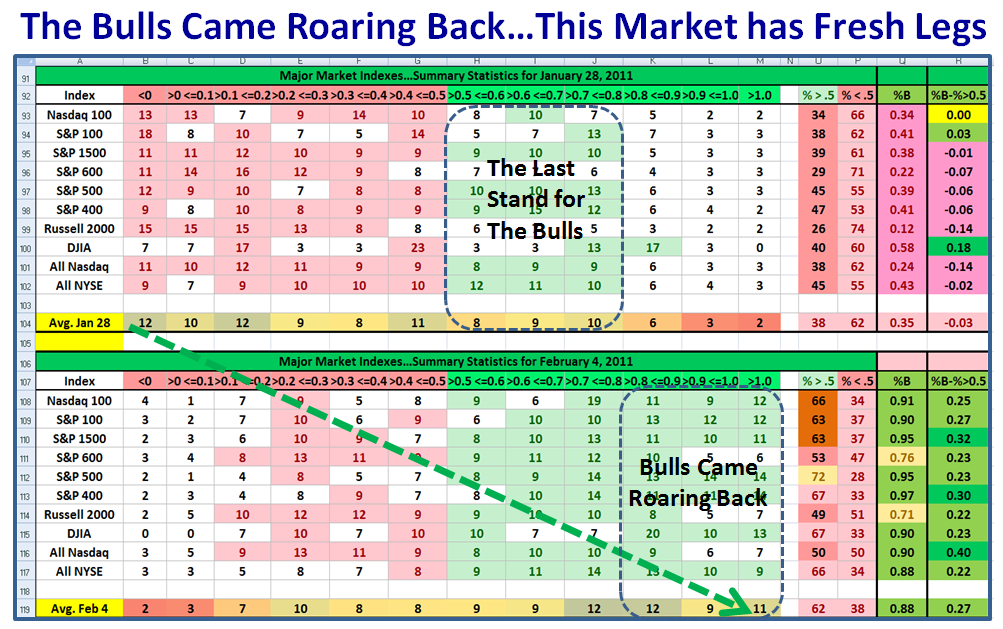

On January 28th, the Market Internals were signaling that we were on the brink of a correction, and here we are barely ten days later and it could hardly look stronger. The Bears were denied and the Bulls came roaring back:

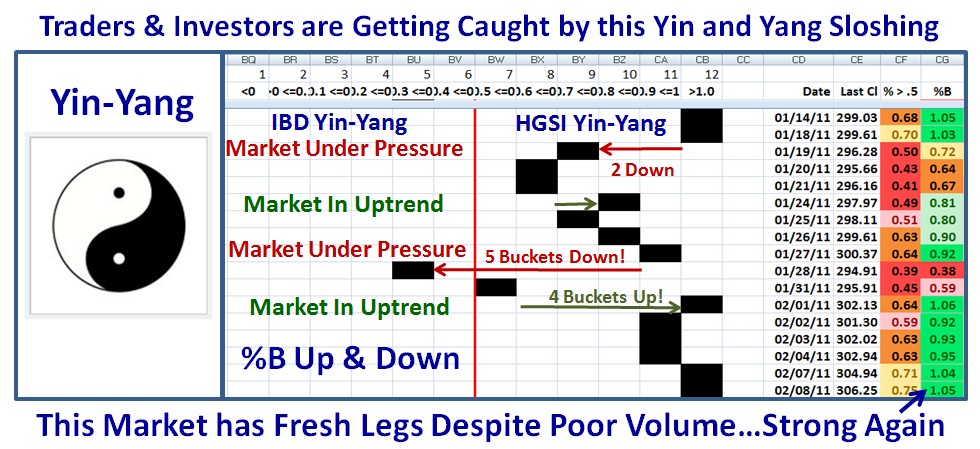

Here is the updated picture of the Yin-Yang with 5 buckets down followed by 4 Buckets up and now an overbought S&P 1500 along with all the other Market Indexes:

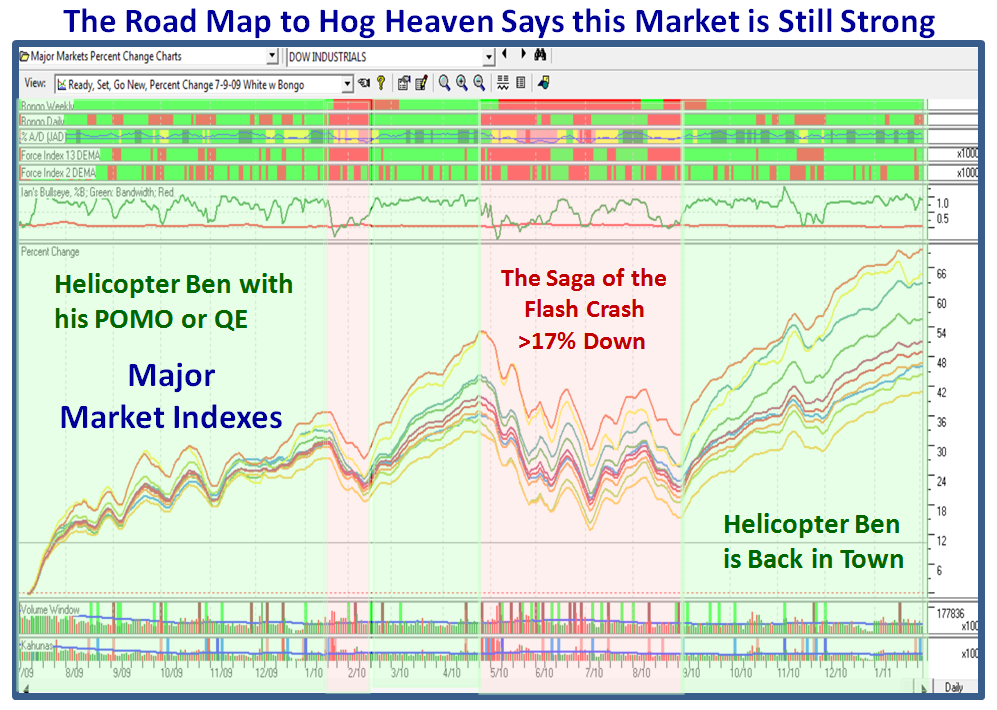

Helicopter Ben is still whirling around town with his QE2 and you may as well enjoy the complacency while it lasts:

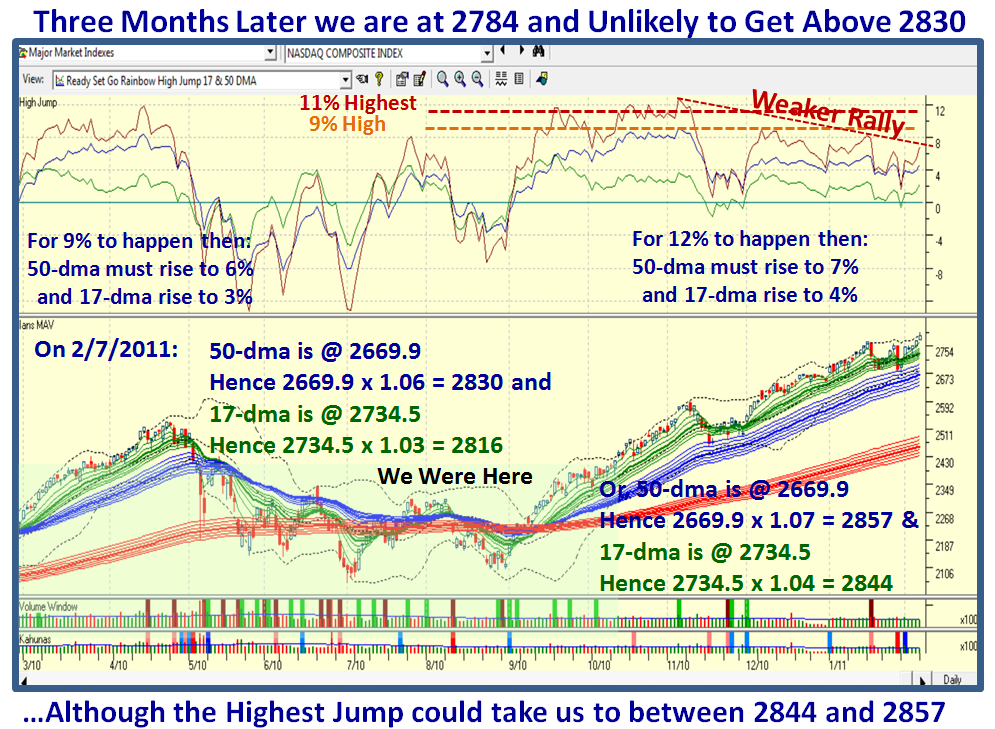

At times like these, curb your euphoria to what are reasonable upside targets. Once achieved, either set higher targets or watch out below. There is seldom any better way of gauging what might be a reasonable target than the High Jump tool. The next chart is a busy one, but if you haven’t learnt it by now, then it is high time you did. When rallies get long in the tooth, they invariably show a tendency to be struggling on making recent previous High Jump targets. In this case I am using only the 50-dma and 17-dma as my guide as we are already a trifle extended from the 200-dma to say the least. Note how much weaker this rally is compared to the burst of enthusiasm from the 9/1/2011 timeframe to that small pause to refresh in November for two weeks just before the Santa Claus Rally. The bottom line is that if this rally continues to show strength then around 40 points higher is as much as one might expect. I show the targets for both the High and Highest Scenarios. Don’t quarrel with me for not showing the Highest at 12% at this stage of events. Let’s get past 11% first:

That should give you plenty to chew on till the next time.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog