Stock Market: The Party’s Over for Now

This is my St. Patrick’s Day Gift to you and my Wife! Two weeks ago we felt that the crisis in the Middle East, especially in Libya, and the resulting blip in oil would be the test for QE-2 to keep this stock market buoyant. Now we have the terrible disaster of an Earthquake, a Tsunami and the Nuclear Explosions in Japan to test it further. Of course, our hearts go out to the Nation and our friends at Fuji-Xerox. At least for today and the next few days the Party is Over, but who knows what next week brings:

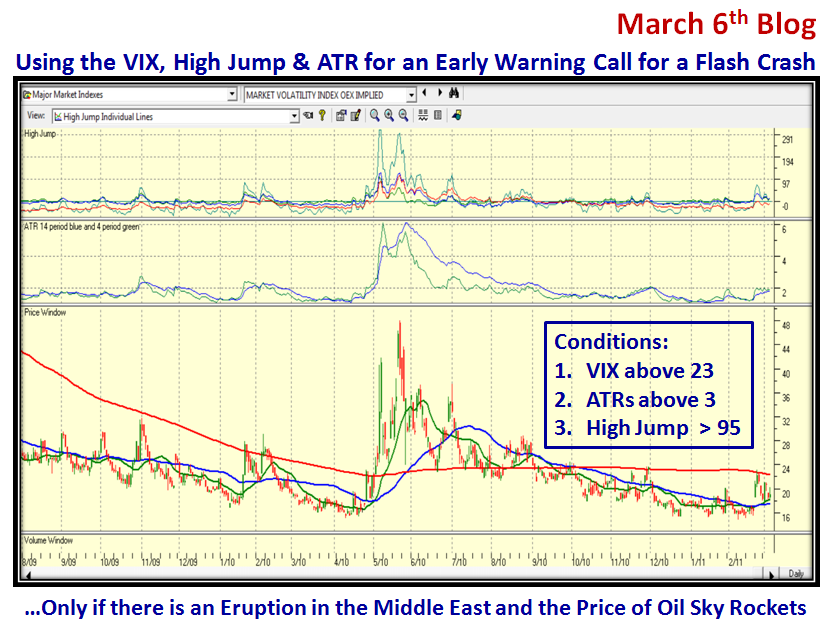

It is now ten days since my last Blog when I gave you the Game Plan using the High Jump with ATR and the VIX, so forewarned is forearmed. The line in the sand on the VIX was very CONVENIENT, as both the 200-dma which was flat, and the fact that the VIX at 23 was turned back several times in the past, gave the right conditions for Custer’s Last Stand between the Bulls and Bears. It was the ideal place for the VIX to be turned back if QE-2 was to dominate over such disasters to cause only temporary blips on the market’s road upwards. However this was based on what I showed you in the picture below using the Flash Crash as a pseudo example for a knee jerk if the Bears were to prevail…hence the Game Plan I gave you:

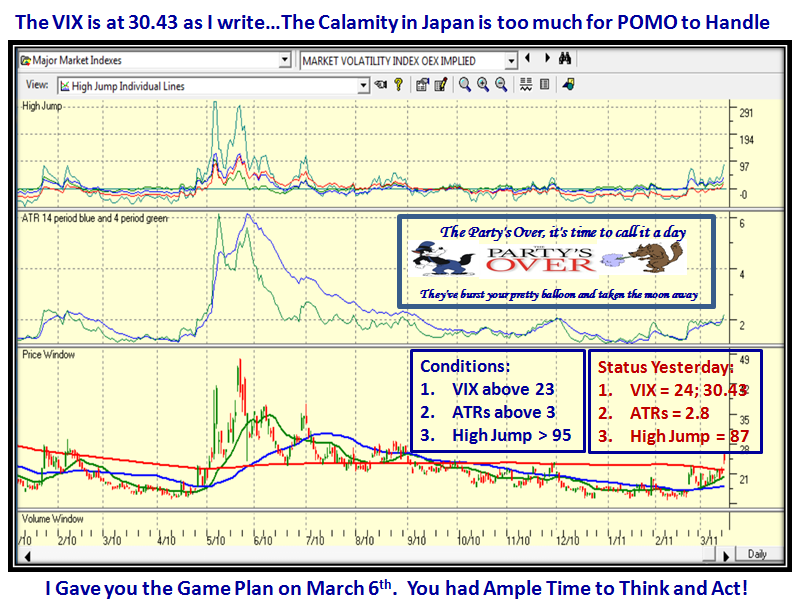

I am writing this while the market still has an hour and a half to go and the picture looks bleak with the VIX into new high territory at a whopping 30.43, so the floodgates have opened. Last night when I looked at the results, it was fairly obvious to me that we were already in trouble with the High Jump at 87, getting mighty close to the target of 95, and the VIX had already broken through to 24, close enough for government work. It is now down to 28ish as I post this blog note with 20 minutes to go in the market:

You have only to look this up at the end of the day to see if the Game Plan came true, in which case chalk one up for this combination the next time we have a Major knee jerk in the offing and set your targets accordingly. I have found a valuable NEW use for the High Jump, which has never let me down in the twenty years I have used it. We will teach you all of this at the seminar in ten days time.

Thanks to Robert Minkowsky who first kept a real beady eye on the behavior of the Leaders through watching ERG 270 and ERG 255, and to my other good friend Stephen Cole for keeping this up to date, here is another Lead Bullet to stiffen your backbones. The beauty of this is to not be too cocksure that one indicator will do the trick and here we find that things are iffy until we see the results tonight. With all the discussion on the bb’s of Pocket Pivots and set ups of leaders still holding the fort, it pays to watch this one as well in the HGSI software tonight to see if these numbers have held up or really given way. Jerry Samet has shown that there is a marked deterioration in his leaders group which he has faithfully produced for months, and Ron Brown shows us the deterioration on %Gain on a daily basis in his One Notes which are gems. Net-net, it takes Teamwork to filter through the Noise and give you time-tested pictures of which way the wind is blowing. Remember you have to be your own Guru, since no two stomach’s are the same and it is your money not the guru’s. But at least you have had ample warning:

Please note the last sentence under this chart…if this is the worst that happens AFTER the Japanese Calamity is behind us, then in all likelihood the market will rebound from a vastly oversold situation. The quality of that Bounce Play will tell us whether once again the QE-2 is propping this market up or that despite the Fed’s Reports and actions, reality of the future is beginning to set in when all of this pumping stops. After all there is money to be made by buying a market of stocks even if the Stock Market is deteriorating, and one can become adept at playing both sides. Good Day Traders love volatility, but eventually those who are trying to preserve a Nest Egg in their 401-K’s do not want to see it dwindle to a 401-Keg. For those who do not know that inside joke, try 401-Keg in the Search Window of this blog and you will see that I enjoyed over 5350 hits in one day when I first published that blog with tongue in cheek on October 8, 2008.

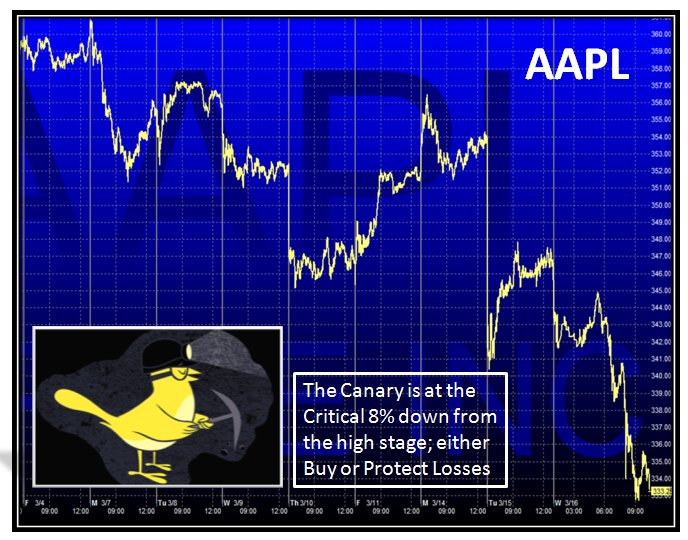

Last, but not least, it always pays to watch the Canary in the Coal Mine, and here is the picture of Apple’s performance these last several days, and especially today:

So I leave you with a picture which sums up the situation and we shall see what unfolds between now and the seminar in ten days time. I have taken time out of my busy schedule to share this with you so that you have a good understanding of the pulse of the market before we see you:

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog