Stock Market: Weak Bounce Leaves Bears Dancing

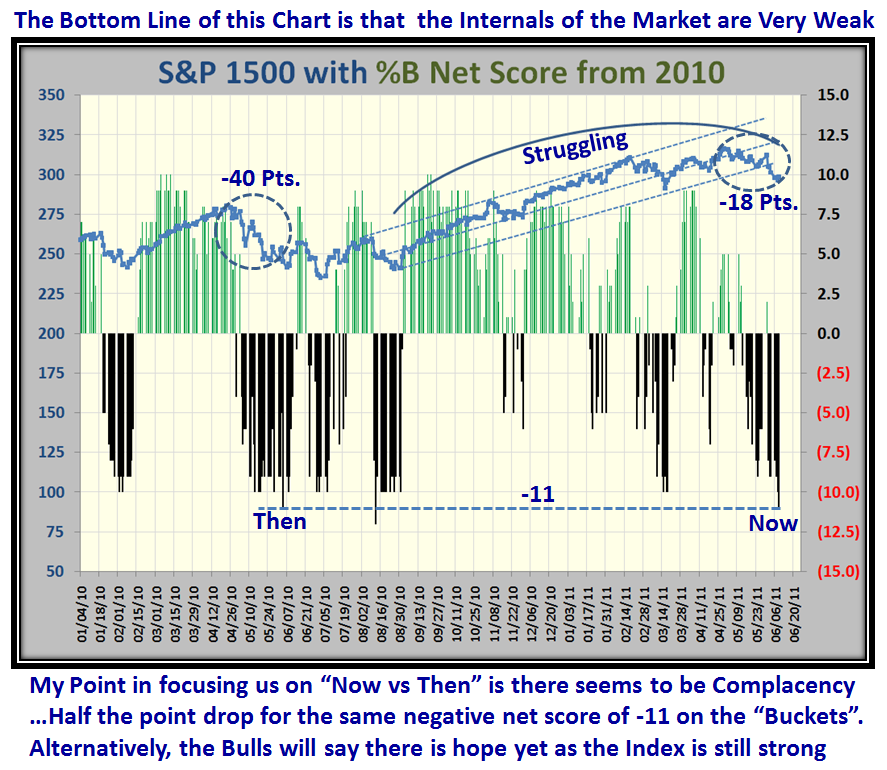

I dug up an old favorite picture I use at times like this where the market is very “iffy”as to whether it can recoup:

…And then to give you perspective as to why, I have thrown in another theme for you to reflect on as to whether a long Pause to Refresh is due:

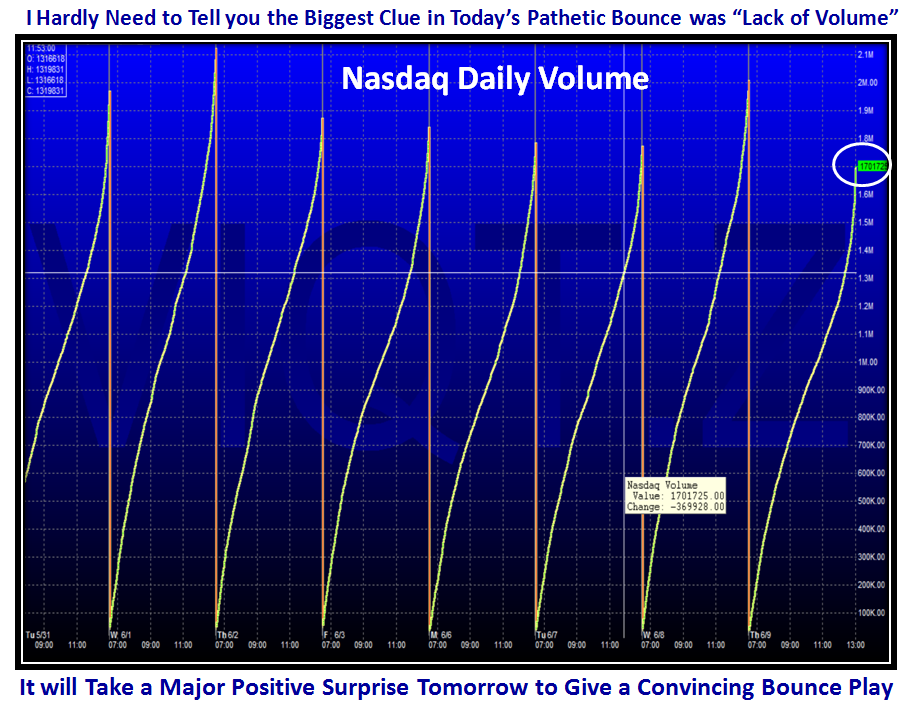

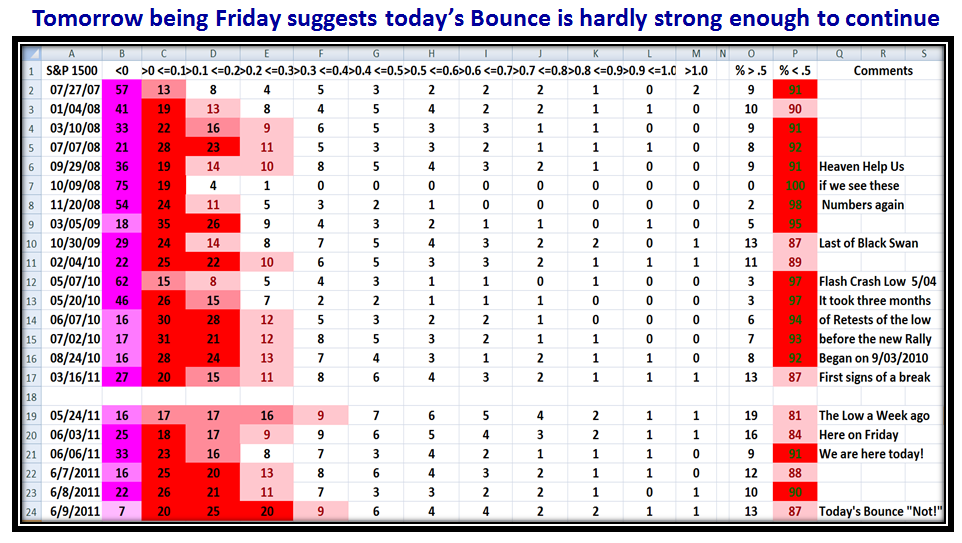

Here is the reason for my dismay in today’s feeble attempt at a Bounce Play. It was due after six down days, but it tailed off in the last hour or so with rather pathetic volume overall despite that it finished up about 0.4% on the Nasdaq:

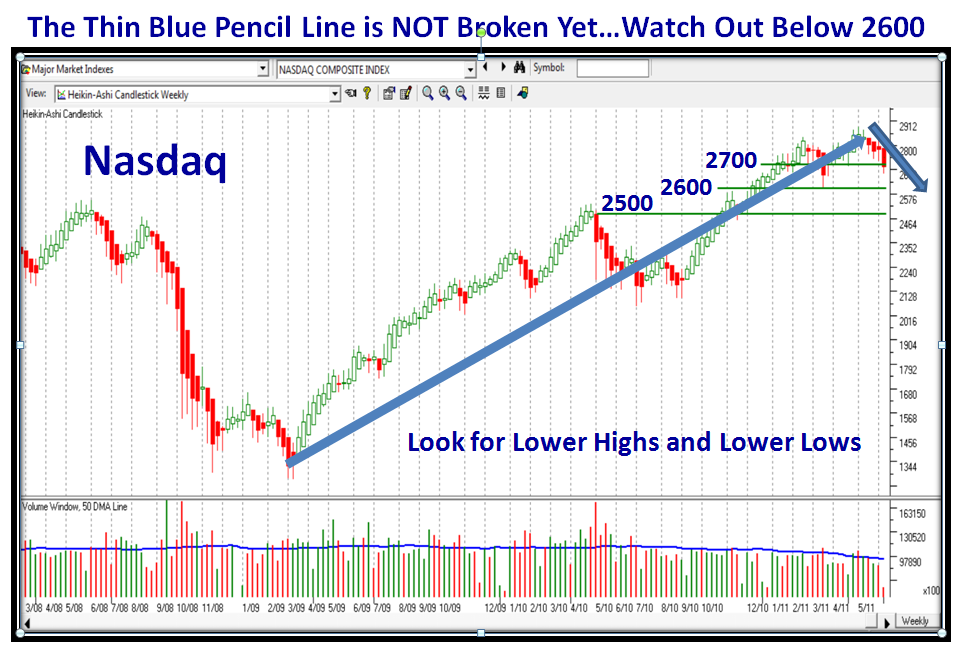

So, it is time to think about the Thin Blue Pencil Line to be aware of Lower Highs and Lower Lows:

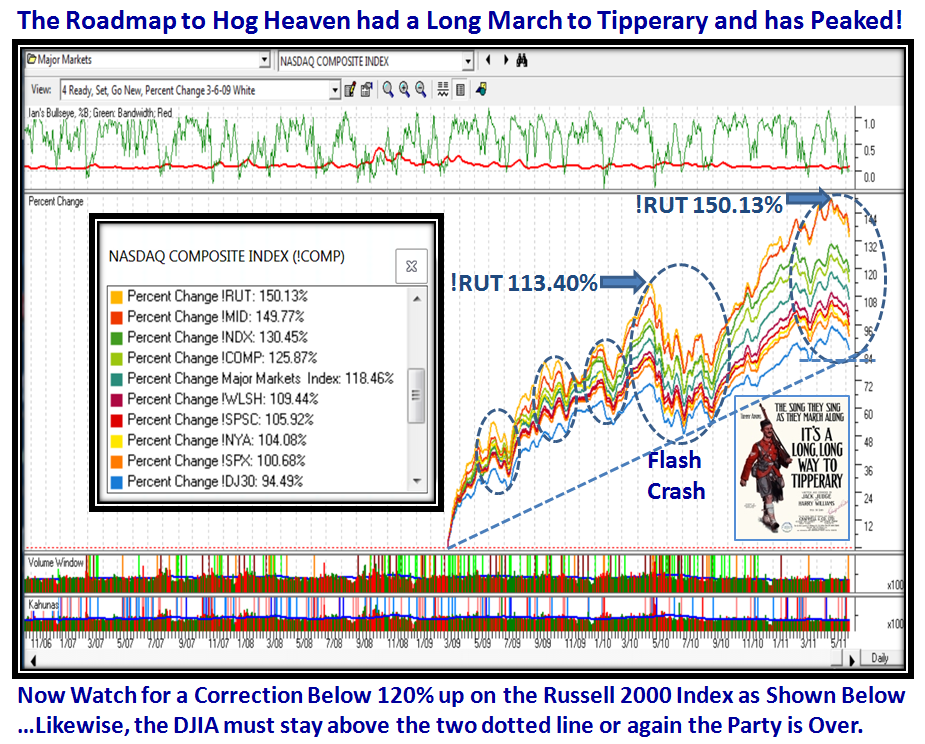

I have dusted off the Road Map to Hog Heaven Chart which was so helpful in 2009/2010 and it shows the Rally has come a long way on its March to Tipperary:

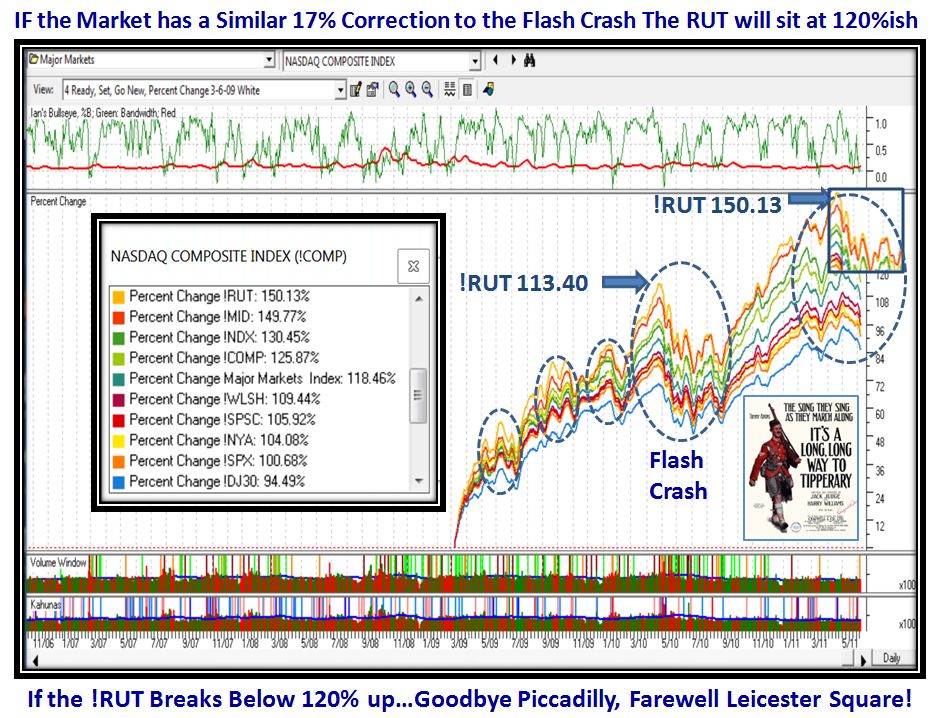

In the next chart I pull my usual trick of doing a “What If”, by looking back to the most recent big correction and pasting the chart pattern at the end of the chart as shown. It won’t happen exactly like that if the market is to fall further, but you get the concept:

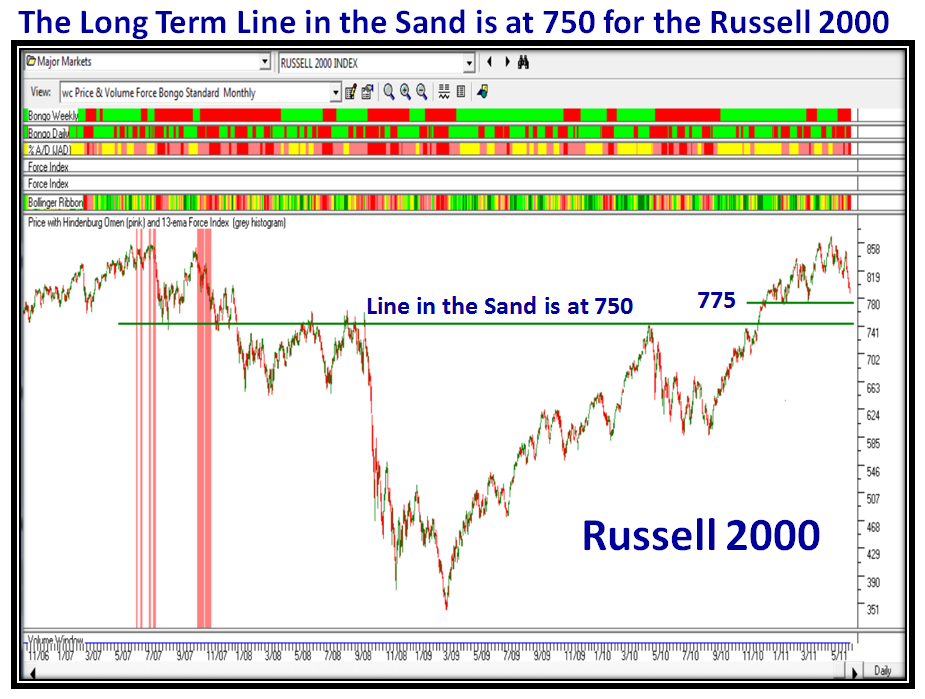

Any further than this to the downside can do much damage to your 401K, so you know the drill by now. The Russell 2000 is a good chart to keep a beady eye on as if it gets below 750 we might look forward to serious damage:

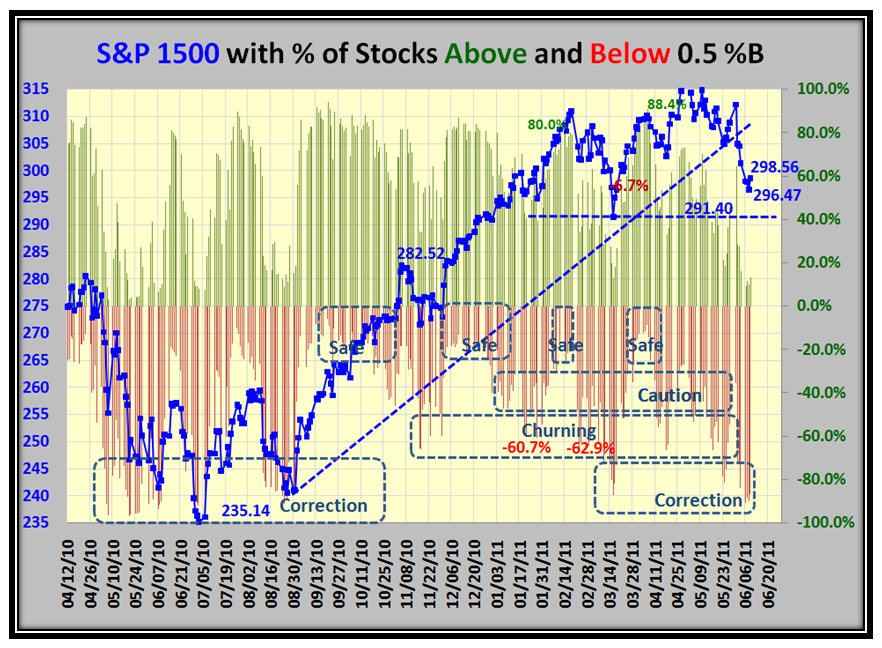

Understand there is more to this “Good Stuff” than Bucketology, but now for a dose of that to show the two go hand-in-glove. We see we are now in “Correction” territory, and dangerously close to the Line in the Sand of 291.40 despite the bounce to 298.56:

Now here we have a conundrum and if you have any other bright ideas besides the scenarios I have postulated, let me know:

My concern is that with the anaemic bounce by the end of day which started off with a good deal of promise will not last long:

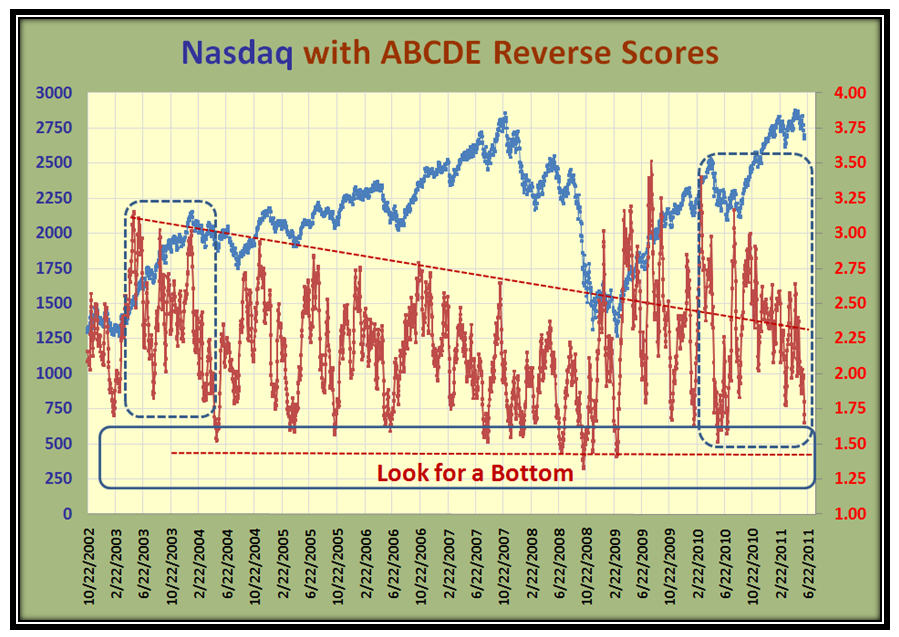

…And finally one chart on Learning your ABCDE’s that I have dusted off. I learned this trick from a good “friend” I know as Billy whom I have never met but has taught me how to apply bias to the Industry Group count of Acc/Dist. I tip my hat to his work:

You can see that the Industry Groups are getting weaker but have not reached bottom as yet. Beware of Fakey’s when it comes to bounce plays. Even past solid bounces that take %B up into the safe zone of 0.7 and above have been known to fail. It is obvious that the general mood in the market has changed, and it will take a miracle to lift things up out of the mire from all the factors that are in play right now. But, then again the market climbs a wall of fear so keep an eye on the few remaining stars like NFLX that now becomes the Canary in the Coal-Mine.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog