Stock Market: Doom and Gloom or Plain Sailing?

There is always a Market of Stocks, and although we have had a major blow to the budding Bounce Play with the two days massacre of the Stock Market last week, there are always opportunities in the short term when the Market is oversold. However, Types 1&2 near term traders can have fun, but Types 3&4 must wait one more time to opt in. This Blog Note shows the current status and then portrays the alternatives for how to ferret for opportunities while getting early clues of which way the wind is blowing:

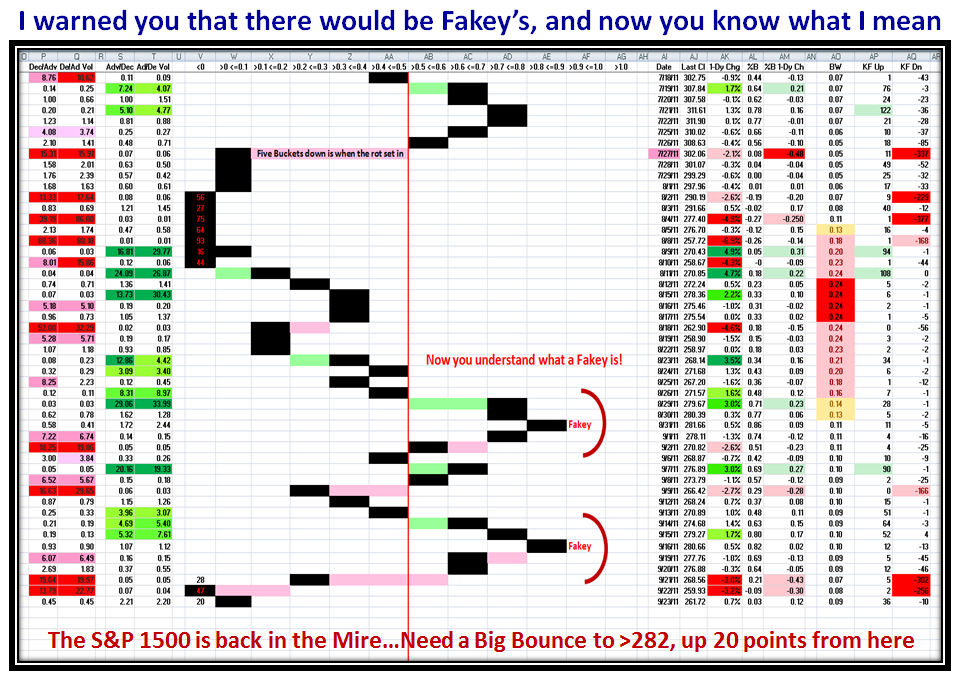

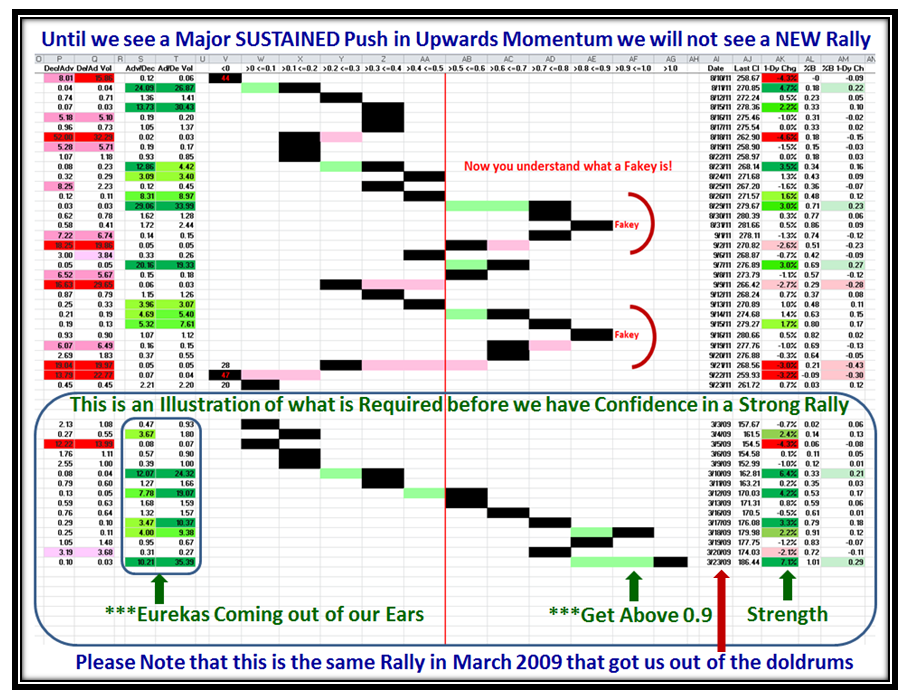

So let’s start with the bad news and show you that we have now suffered from two Fakey’s while ending down in the dumps of despair once again. Those two heavy down days on Wednesday and Thursday just took the wind out of the sails of the Bounce Play. Some Technical Analysts would suggest that we have now experienced a Double Bottom and that the Market is Oversold, so the near term opportunity is to the upside. Others would argue that we haven’t seen the worst yet, particularly with little consolation from Helicopter Ben which started the rot down, and the uncertainty in Europe with the knife edge for the Greek Economy and Debt Crisis:

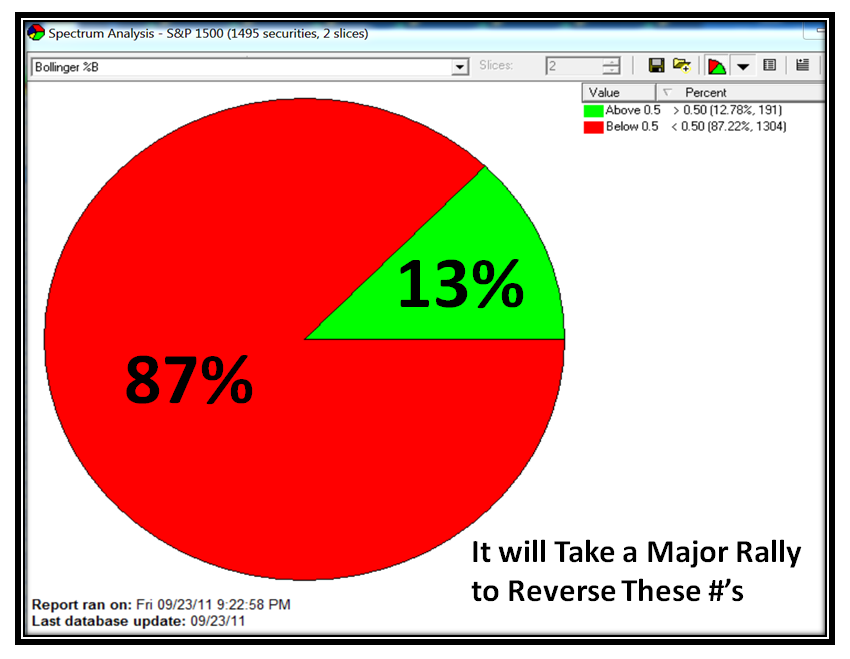

…And just to show you the damage in terms of the % of Stocks in the S&P 1500 that are above and below %B of 0.5, i.e. the Middle Bollinger Band, here is that picture, which will take a Major Rally to reverse:

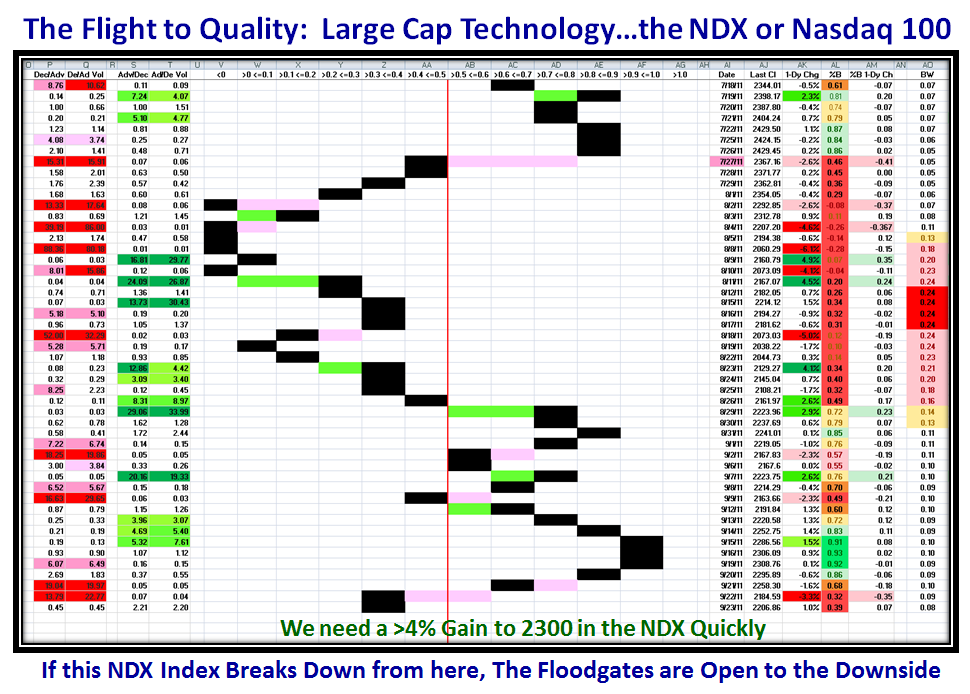

At times like these, it is important to understand the Flight to Quality, and naturally we would expect to see that in either the OEX or the NDX. This time it is Technology that is holding up the fort from a Market Index point of view and here is the NDX:

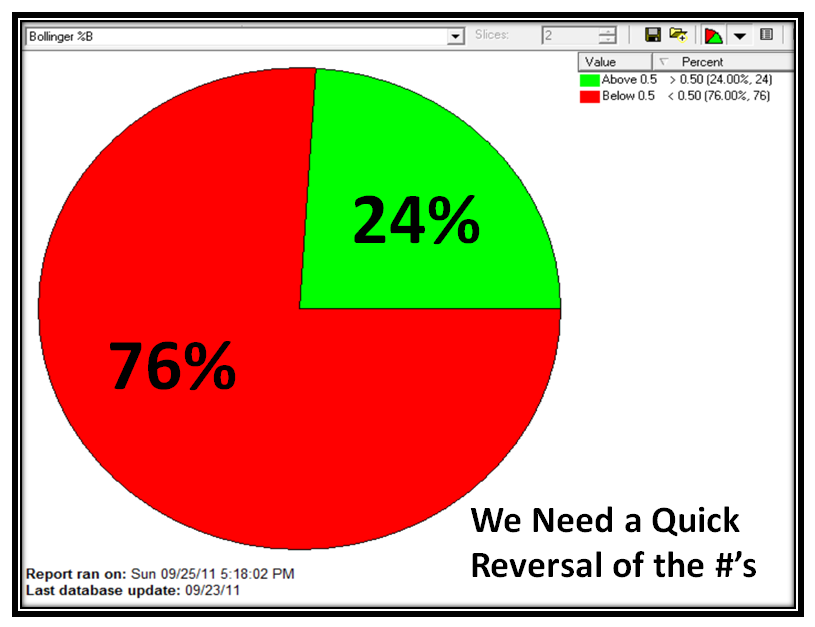

This shows a slightly brighter picture, but we still need a quick bounce play to get us back to respectability of %B above 0.7:

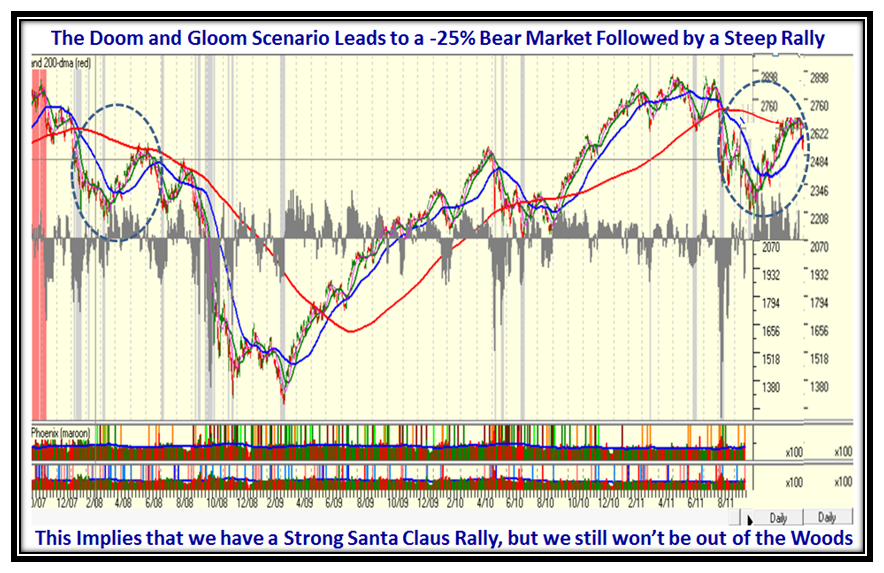

It’s not quite as sick as the S&P 1500, but that is what we should expect. So now that we have a feel for the status, the next job at hand is to look at the Alternative Scenarios as I have taught you. I warned you that the Death Cross was looking ominous and with that drop last week it has widened the gap between the 50-dma and 200-dma to the downside. So now we know the extent of the challenge we face in getting back to a Golden Cross where the 50-dma comes back up through the 200-dma. If we zoom out to a long term chart, it doesn’t take two minutes to see that we are way past the dynamics of the Flash Crash Scenario and that the challenge looks more like the early stages of Black Swan as I show below. I have superimposed the left hand side dotted circle on the right hand side, and it suggests two points, unless we have a miraculous recovery from these depths…which I will show you what that will take later:

1. The expectation with this scenario is a further drop into Bear Market territory of around 25% (say), before we perk up for a Santa Claus Rally.

2. It will take a strong Santa Claus Rally in his Red Car with no Grinch or Moose Droppings along the way!

This is the Low Road, Doom and Gloom Scenario:

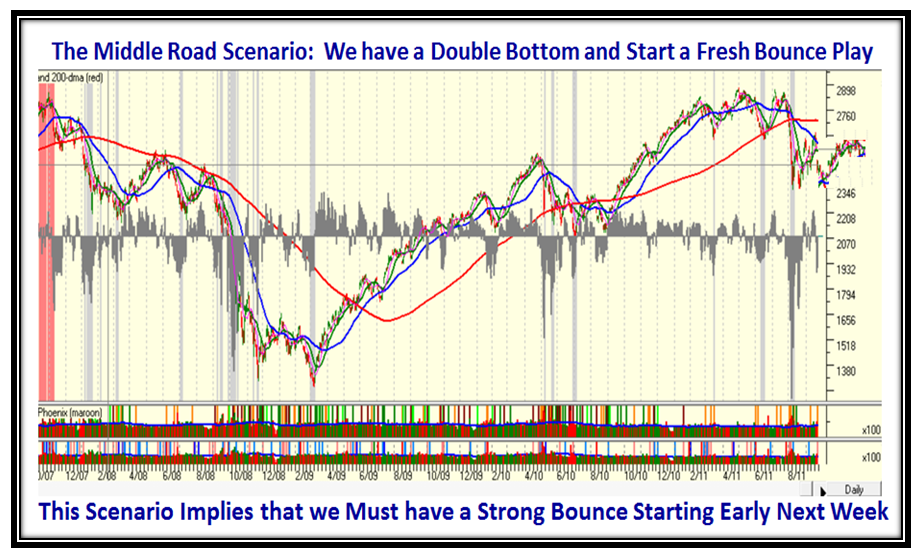

So let’s now take a look at the Middle Road Scenario, which dictates that the Double Bottom HOLDS and we bounce back with vigor this coming week to at least reach the highs we hit before the disaster of last week:

Earlier, I promised you what the High Road Scenario looks like. If you are so optimistic as to believe that this double bottom is the clue for you to dive in with both feet, be my guest. However, it is not difficult to identify the challenge that must be met and there is no better way to show that than to go back to the start of the Rally back in March 2009. I have superimposed what that should look like on the S&P 1500 chart I showed you earlier and the bottom half of the chart below shows exactly what I am talking about. As I say, “We need Eurekas and Kahunas coming out of our Ears.” Unless we see this kind of performance don’t get fooled into dipping your toe in the water:

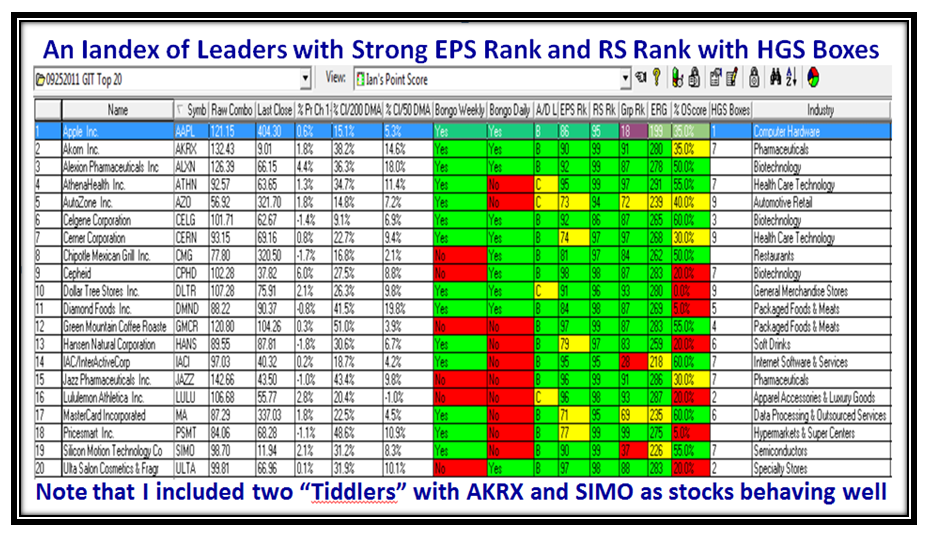

I’m sure at this stage many of you are saying “That’s all very well, Ian, but how can I keep an eye on Leading Stocks in Wolf Pack Industry Groups that will give us a clue of whether this market will start to blossom or will continue to crater.” It’s been a while since I have done the “Iandex” Index for you which selects current Leaders in various Industry Groups that are currently above their 50-dma and 200-dma and can potentially lead us out of the mire or fall back to earth and die with the rest which are already underwater.

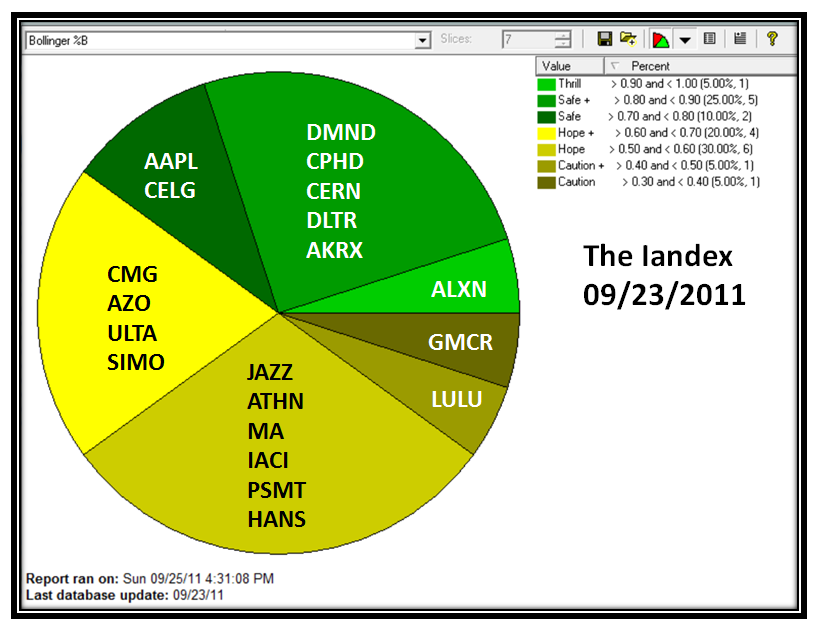

We are exactly one month from the HGS Seminar on October 22 to 24, so the performance in the next month of this Iandex will give us a good yardstick of where we stand by then. Put these stocks into your HGS Investor Software and you can follow along and judge for yourself. Remember that its main purpose is to see if the Market Craters, but if these Stocks hold up then the other purpose is to zero in on the Wolf Packs. The first Chart shows the familiar Pie Chart as to where the Stocks in the Index sit now:

The chart below is the Index of these twenty stocks and one can see that as a group it shows current strength:

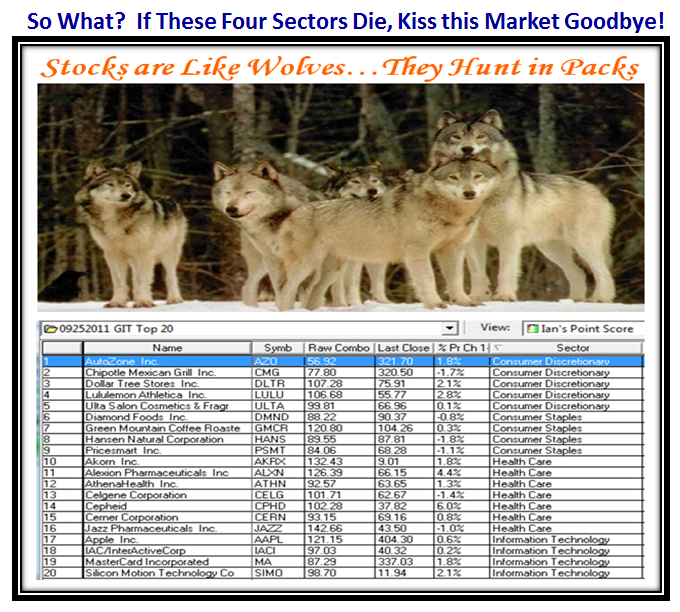

This Blog Note would not be complete without getting to the answer of the “So What?” Always remember that Stocks are like Wolves…they Hunt in Packs! There are currently Four Wolf Packs as shown below. That should please some of my regular viewers who use this slogan to look me up! Enjoy:

If these Wolfpacks survive, we have hope for a new rally; if they die, the party will be over for now. Ron and I look forward to seeing all of you in just four weeks…hurry, hurry, hurry there is plenty to learn and master to keep your Nest Egg safe and growing.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog