Get the “Edge” with %B x Bandwidth!

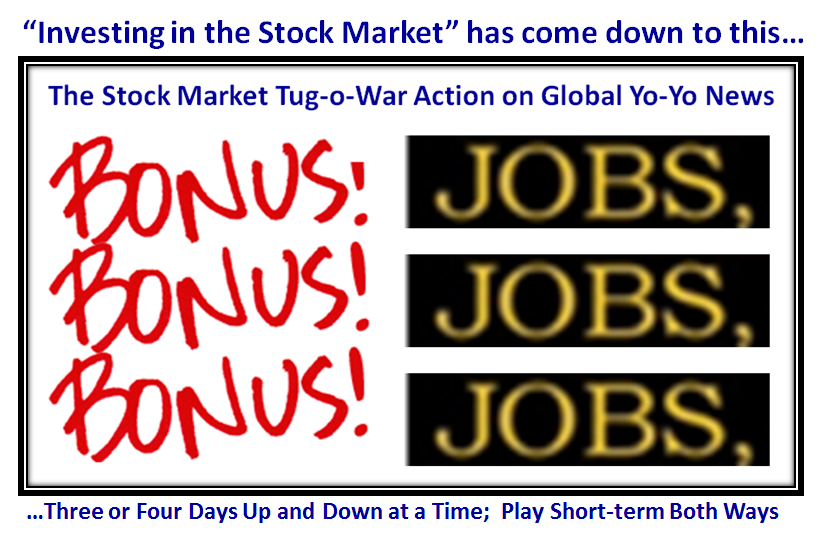

Wednesday, November 9th, 2011With the Yo-Yo Market we have tolerated these last several months, I feel that No Longer do we need the Blind leading the Blind for Short & Long Term Market Direction.

With the Help of Chris White, the CEO of EdgeRater, we now have a Template that will make life a lot easier with the introduction of a new gem which I have conjured up to find an “Edge” with %B x Bandwidth. We will need to watch this phenomenon to be absolutely certain, but on a Day like today, there is no better time than now to introduce this new concept. I will save that gem till the last chart in this note, but thank Chris for this improvement in the EdgeRater Template for Major Market Indexes, which makes life easy for EdgeRater and HGSI Software Users:

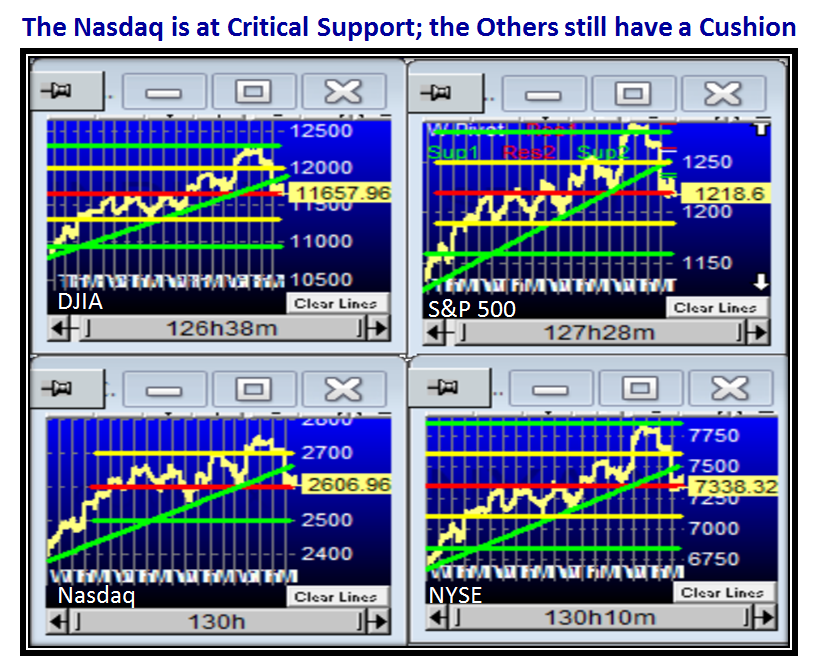

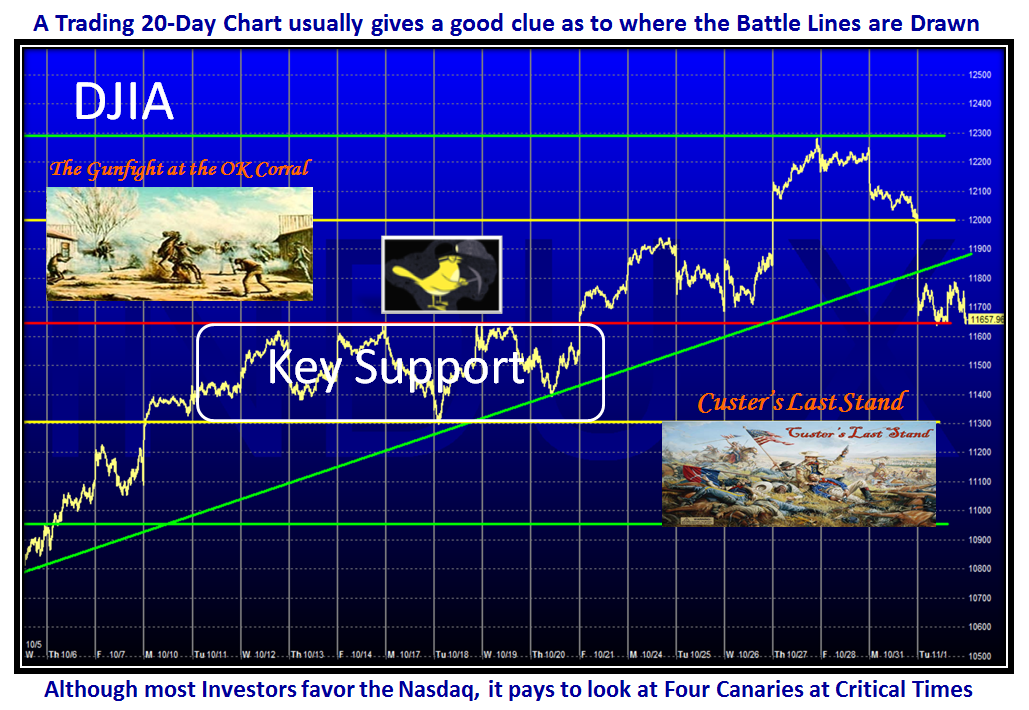

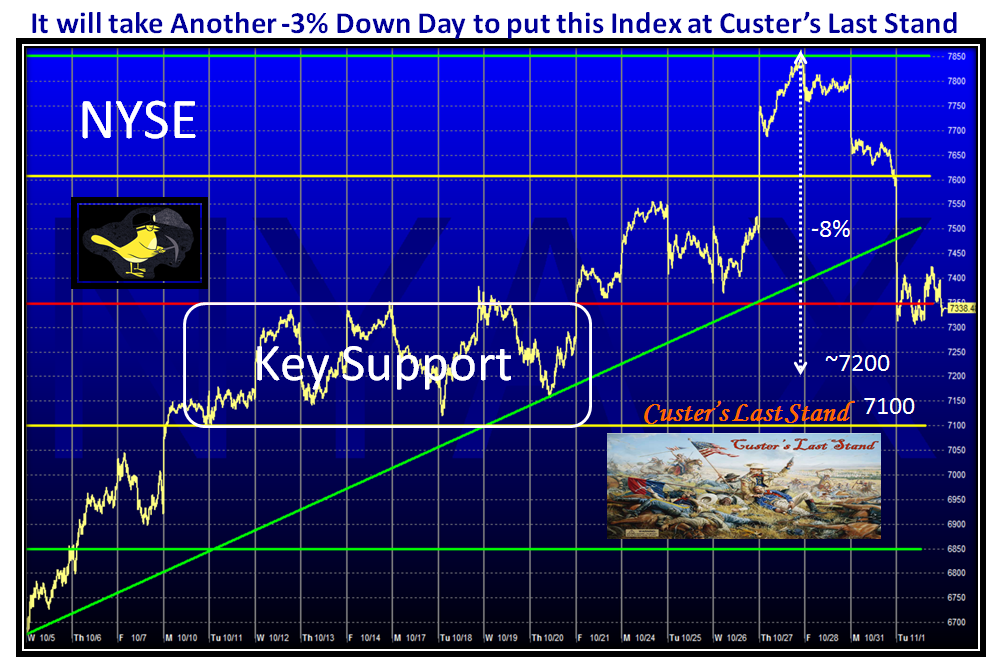

But, let’s first take a look at the hairy edge the Market Indexes are at given a huge down day from the Italy debacle. They are all within a hairs breadth of breaking the Major Support level I described in an earlier Blog Note.

If we zero in on the Nasdaq, we see that the previous five days gains were all wiped out by today’s major drop:

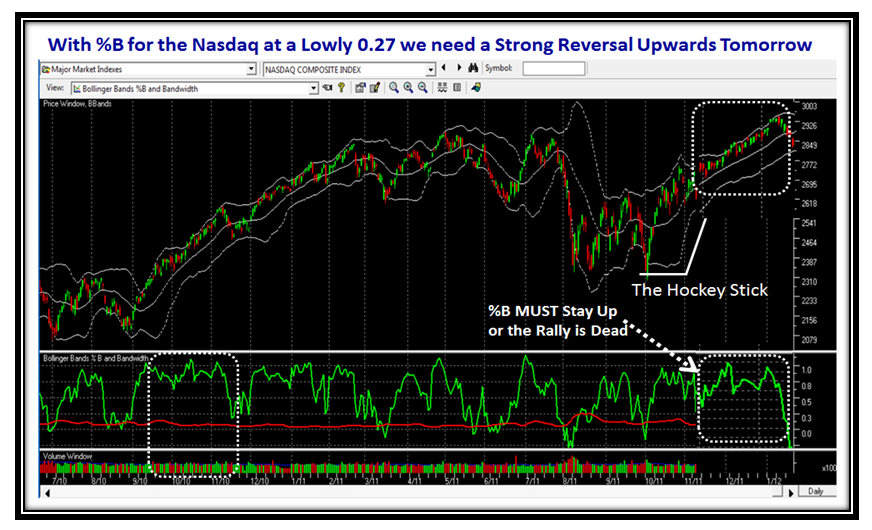

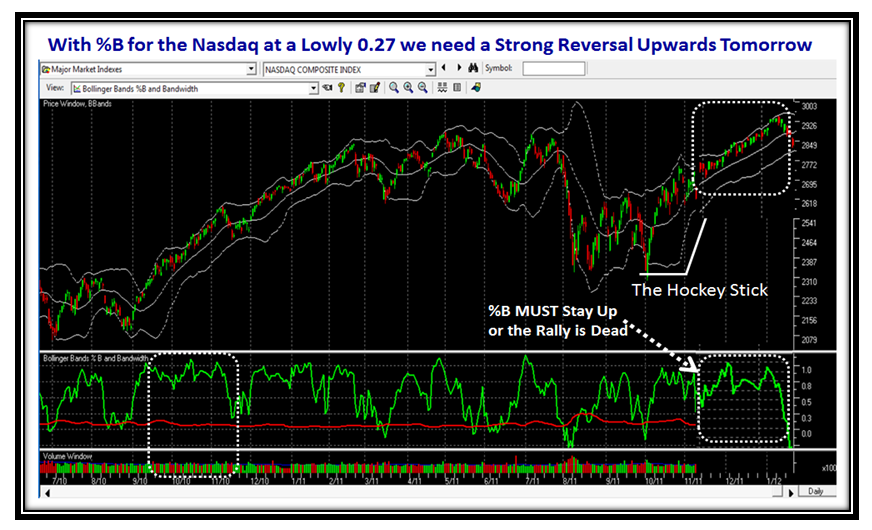

The Nasdaq along with the other Indexes took a major dumming today, ending up with a %B of 0.27…precariously low:

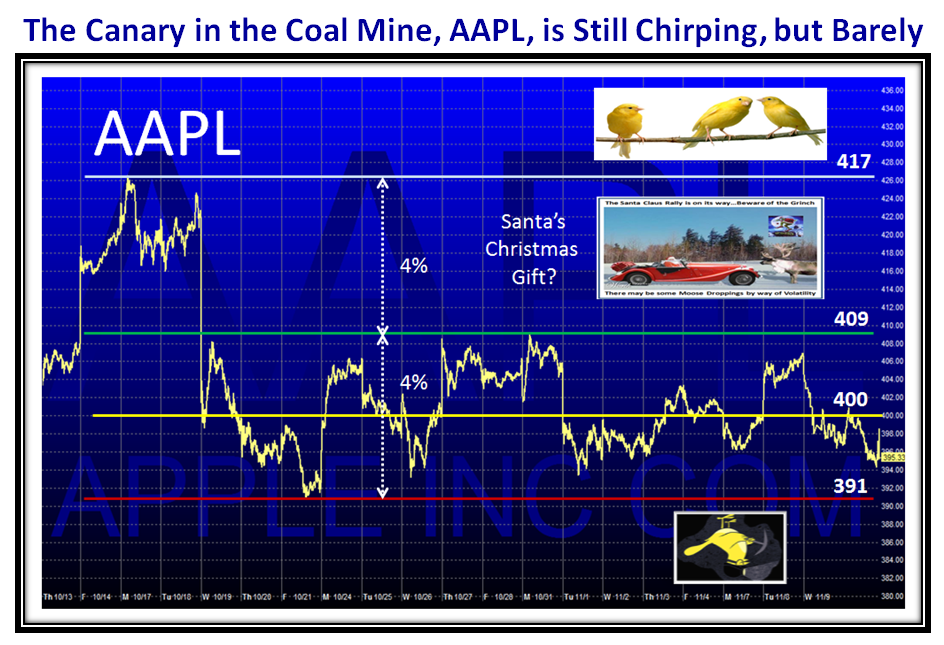

When things get really rough, always turn to the “Go To Canary” in the Coal Mine…AAPL:

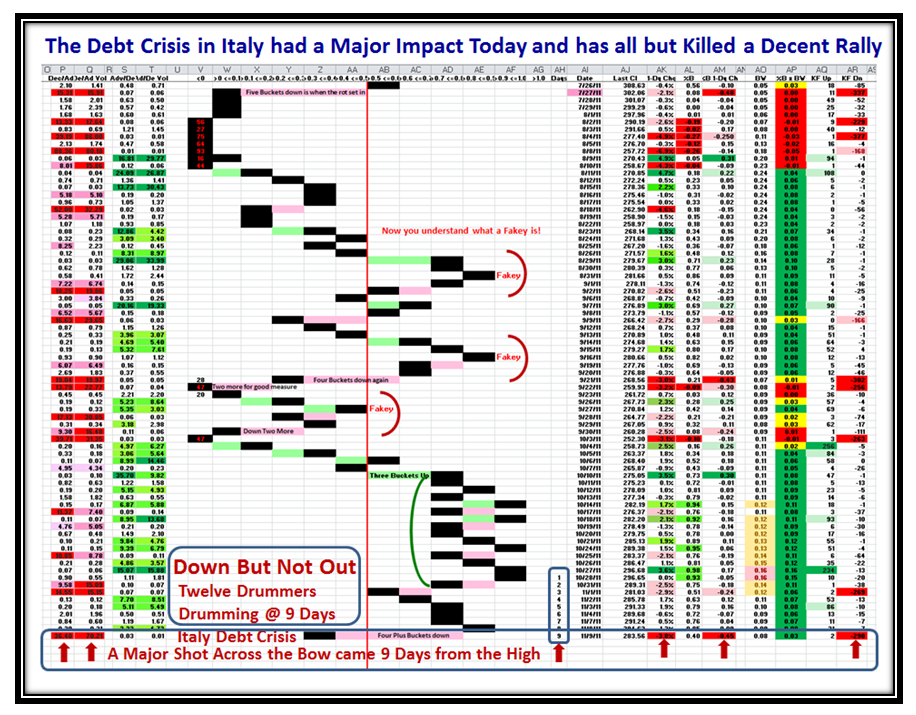

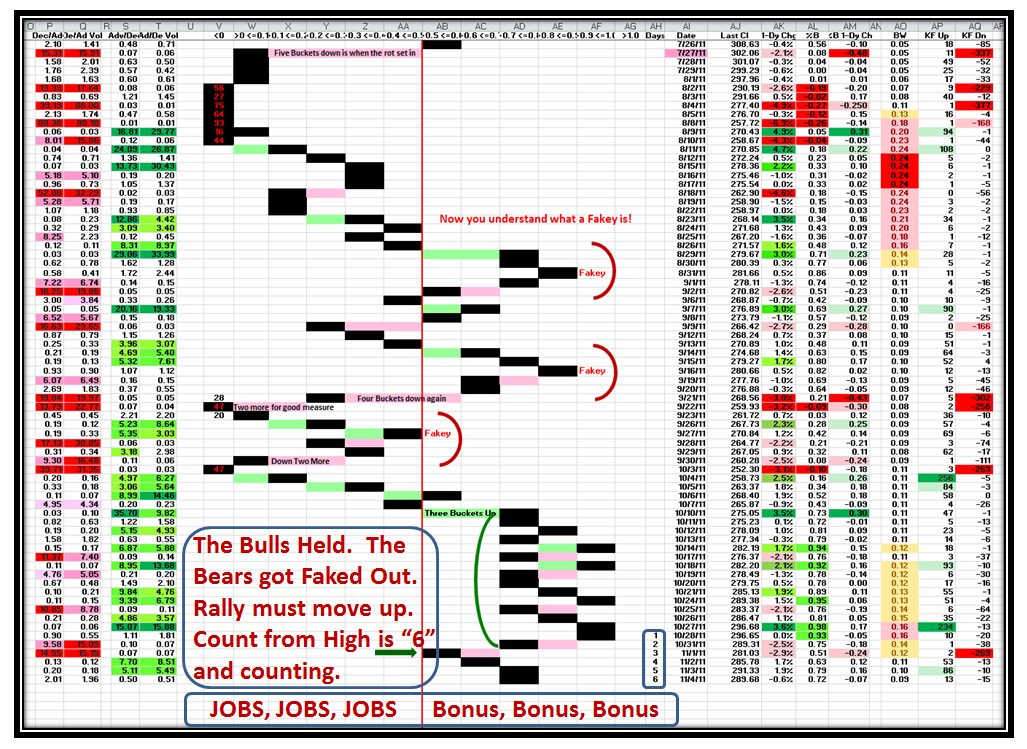

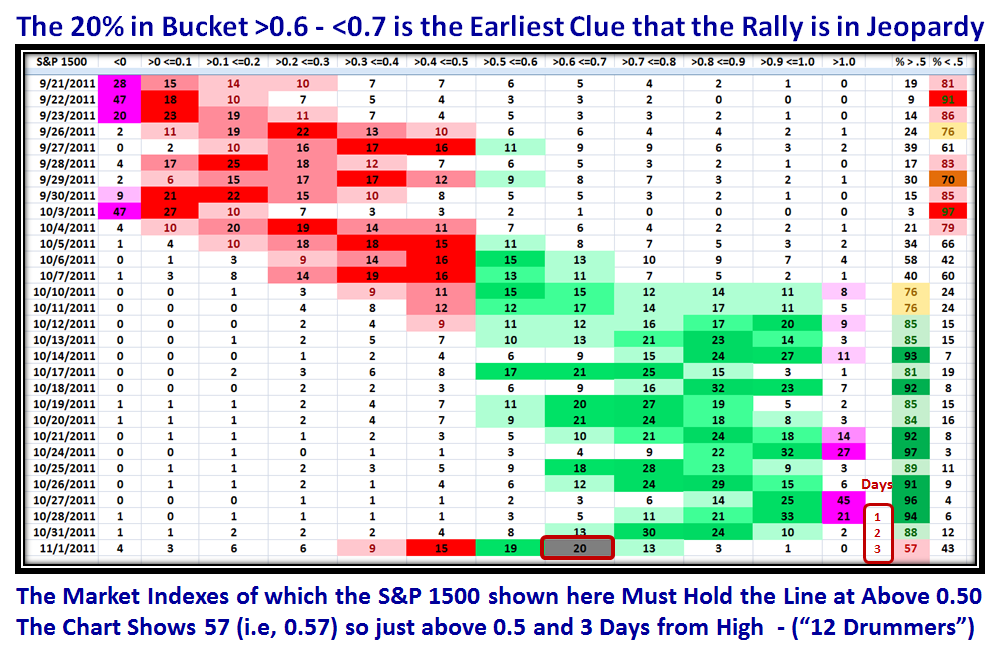

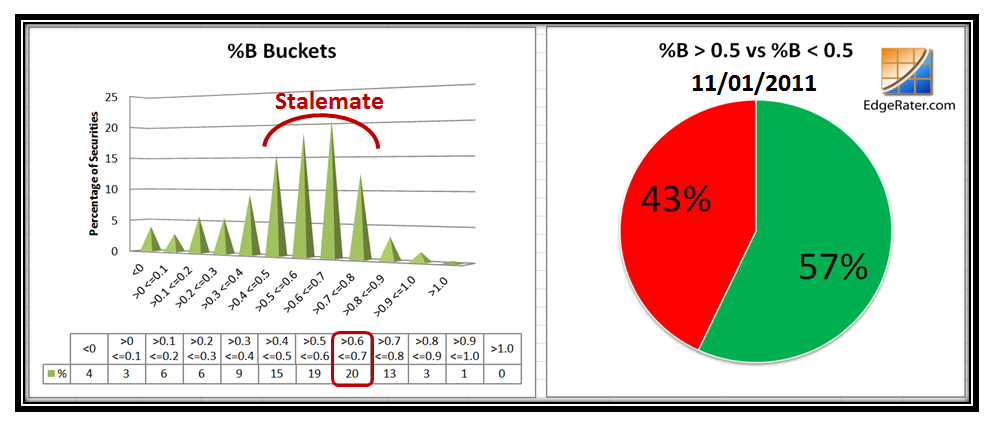

This next chart shows the Four Plus Buckets down we suffered today. Please Note all the Red Arrows at the Bottom of the Chart. So far we have had nine days from the high, so the Signal of “within 12 days that the Drummers are drumming” for an expected correction seems to have come through once again.

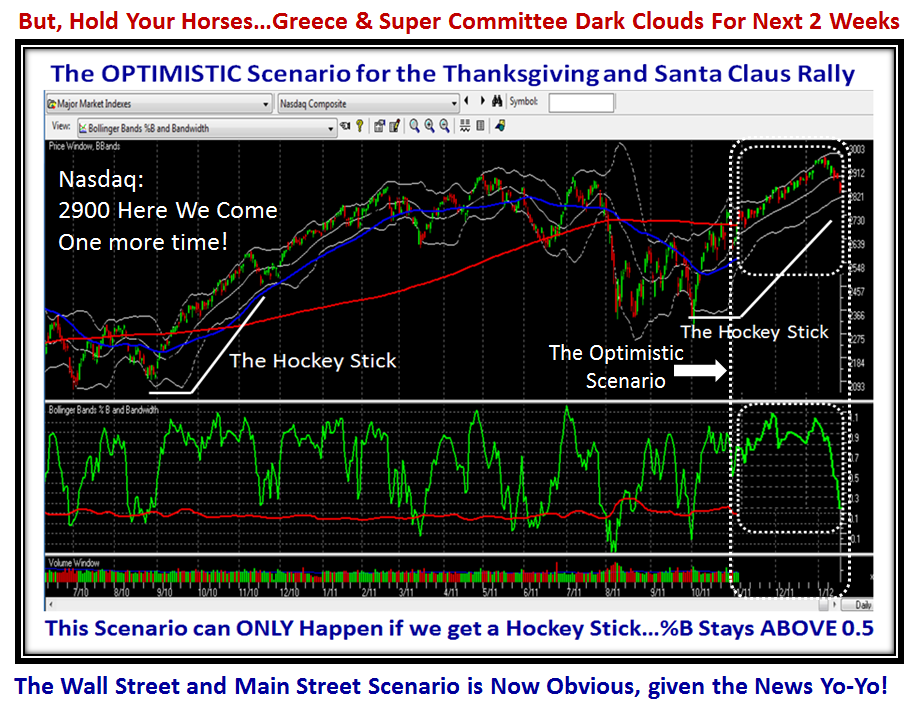

The Hockey Stick formation has formed so far, but it is obvious it is in jeapordy and tomorrow will determine whether %B breaks down through the bandwidth or can hold and return to its original glory of staying above the Middle Bollinger Band, with %B >0.5:

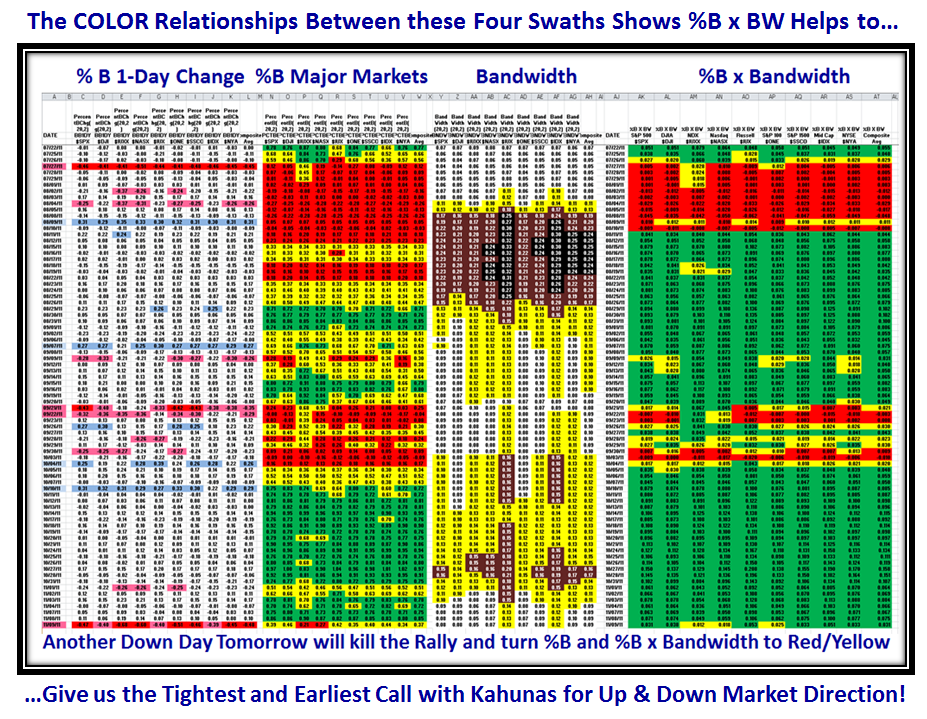

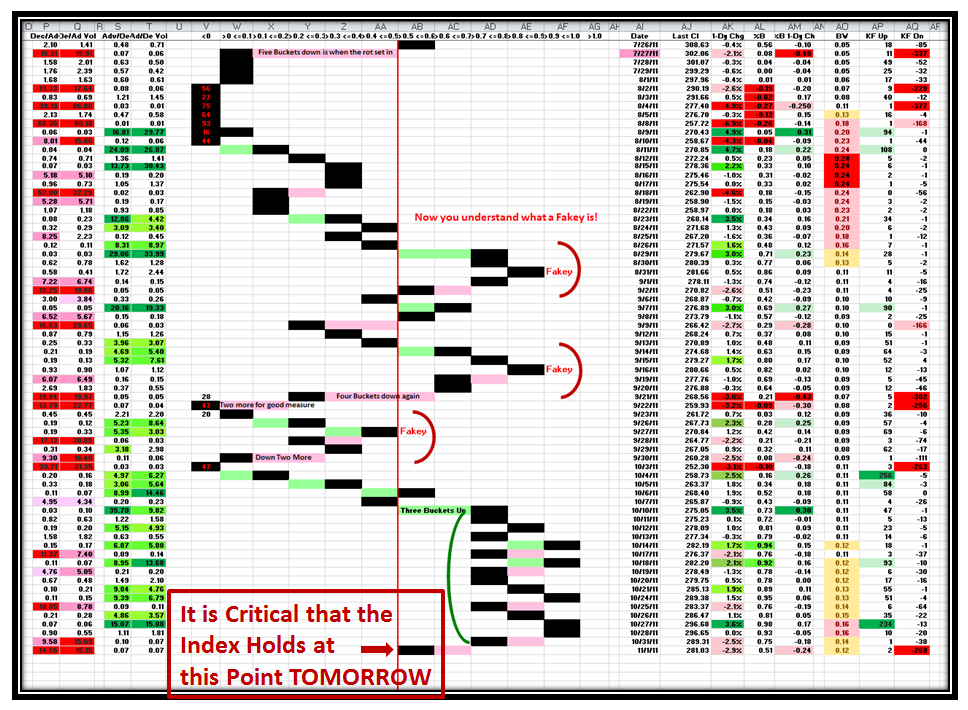

…And last but not least, here is the chart I promised you at the beginning. Study it well and let’s follow what transpires:

Many thanks to Chris White for this Template which makes life easy to follow with regard to Market Direction with hopefully the earliest calls both up and down. Note the Kahunas on the Left in Red and Blue coupled with the change in color with %B x Bandwidth on the right hand swath for the earliest calls.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog