Fishing for High Growth in Your Portfolio

I have done this Stock Market Blog for nearly five years and hope that those who fish in my pond have felt that over the years I have kept you on the right side of the market, helped you GROW your Portfolio and 401K with my ideas, and have given you the key warning signs to protect your Nest Egg in understanding Fear and Greed. In essence Ron and I cover High Growth Strategies be they for Growth, Value, and Dividend Investors, with a prime emphasis on which way the wind is blowing in the Market Indexes.

With that preamble in mind, I have also shown you the value of using two Software Products which I use and have recommended by example after example in these blog notes. This Blog Note shows you that we are again at a critical juncture in the Market, and how to use the tools to your best advantage right now, especially when the examples in recent blog notes are fresh in your minds:

Talking about “Fishing” I have shown you a tool to fish for up and coming “New America” companies that become the lifeblood for continuing the growth of this country, which have a balance between strong Fundamentals and yet are in the early stages of their growth. Those who use the HGS Investor software know it well as the Nine Box Matrix, and particularly those that meet the requirements for Strong Earnings Growth and Revenue of over 100% in the last two quarterly reports, known as Box 7 Stocks. Better yet, these are the very stocks that invariably will enrich your Portfolio.

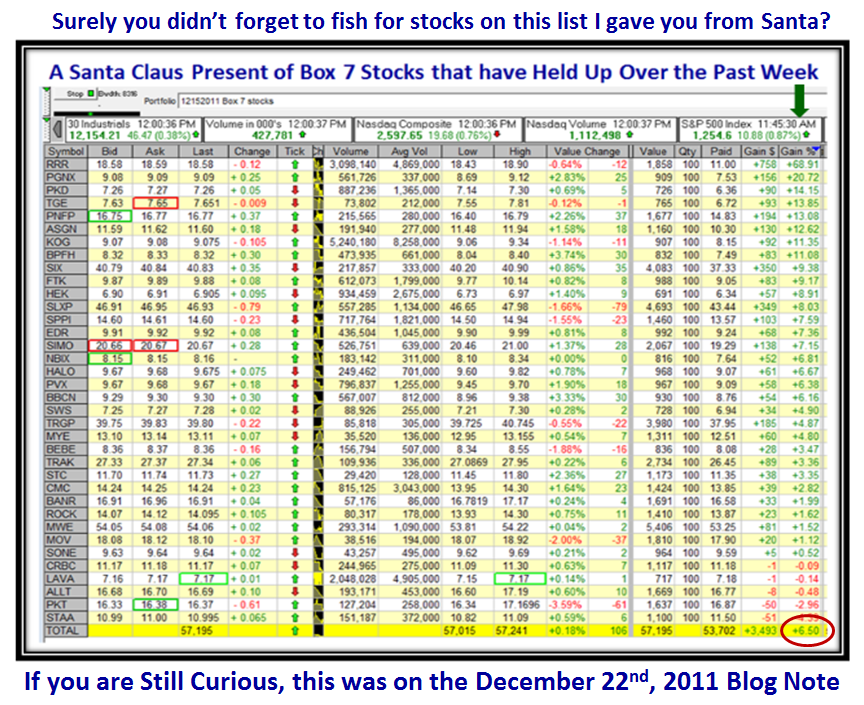

You will recall that the week before Christmas I gave you a long list of Box 7 stocks to keep a Beady Eye on which might help to make your Portfolio Grow and here it is posted from the Dec. 22nd, 2011 Blog note.

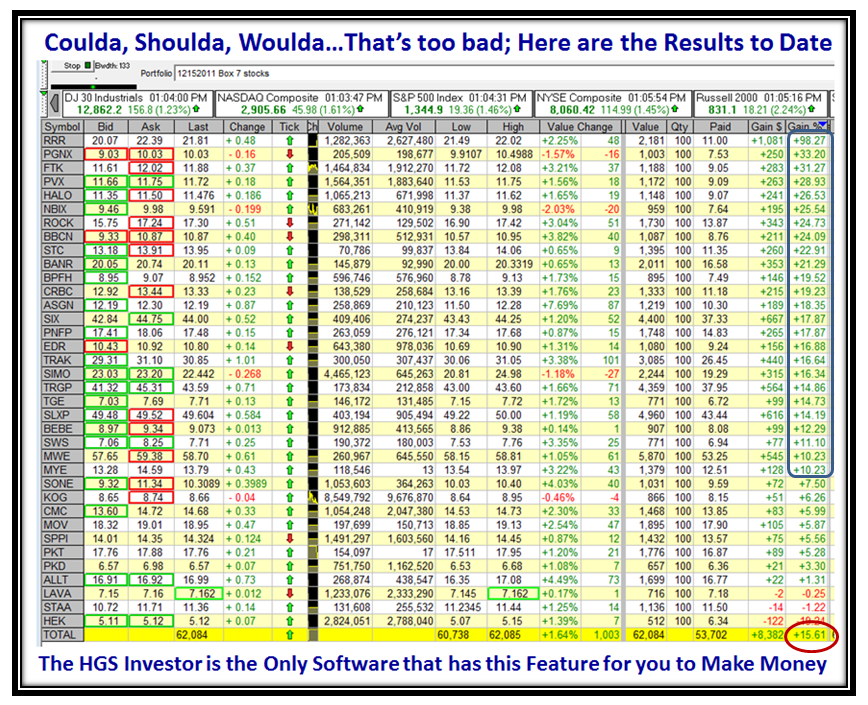

You will note that the list used equal lots of 100 shares each for me to keep it simple. It would be different for Equal Dollar Weighted. So let’s see how this bunch has performed since then, recognizing of course that the Market has been kind to us during this period, but none-the-less delivering a respectable 15.61% in a matter of 7 weeks, and up 9+% since I posted the note…if you had the temerity to take them all! That’s more than many make in a year in their Portfolios. Now if you were good at Technical Analysis which I assume you are and know when to buy and sell, just look at the 25 stocks that made over 10% to 98%, you might well feel this process has VALUE as a Strategy in providing High Growth to your Portfolio.

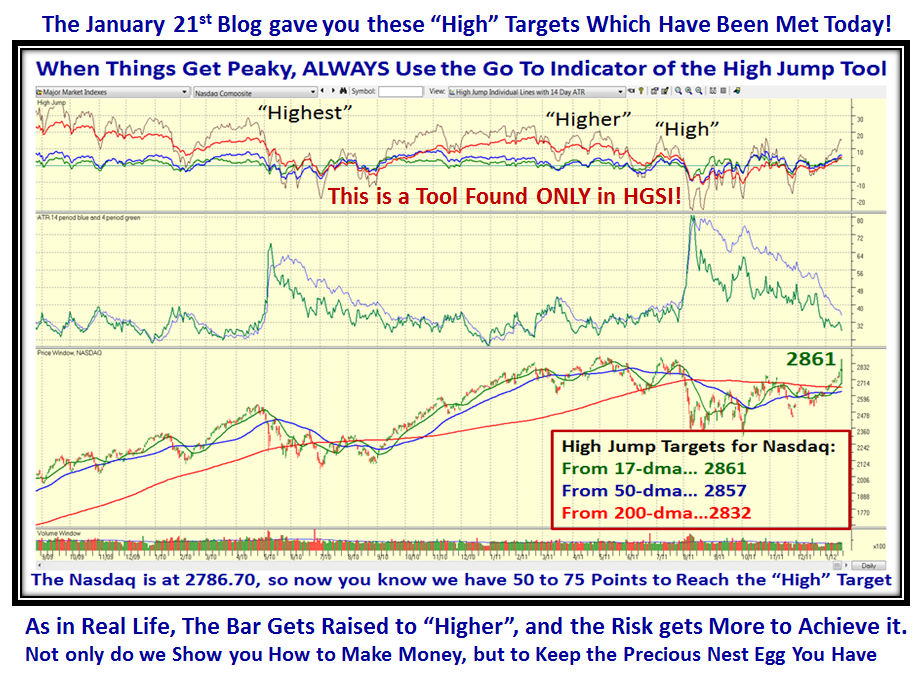

Don’t forget to either click on the chart or change the % of the view at the bottom of your Internet Explorer to get a bigger picture. Now those who have seen me time and again use the High Jump Tool to assess “Greed and Meltups” when the market is getting “Peaky” will recall that just a week ago I gave you the “High” Targets, again a tool found only in HGSI:

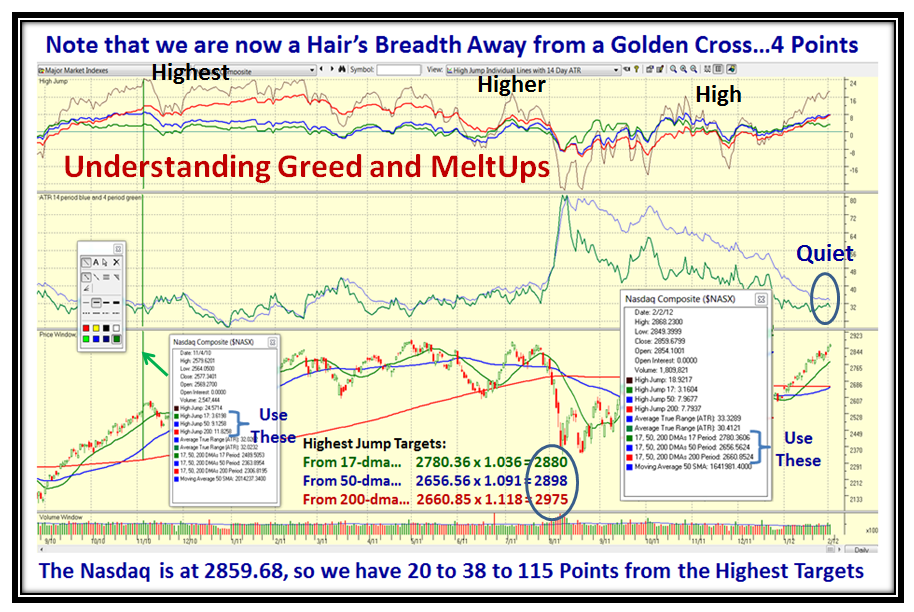

This time I show you how to raise the bar as the Market rises, the Greed turns to Irrational Exuberance, and to assess the next level of Higher and/or Highest based on past expectations. This work of mine helps you to understand “Greed and MeltUps”:

This chart was done yesterday and with today’s explosive move we have not only had the Golden Cross I predicted as the High Road Scenario, but have already surpassed the targets for the first two conditions shown above for the “Highest” Targets from recent history over the past year or so. Not only do I give you the “How To” do it, but also provide the expected results on a silver platter.

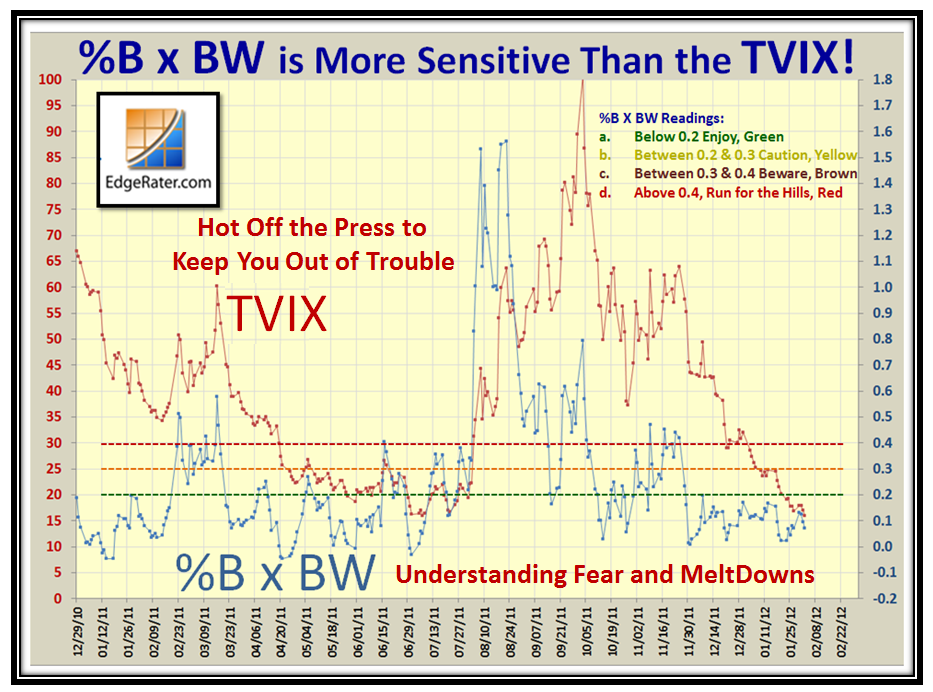

Having shown you only a smidgeon of the Value of using HGS Investor as your Analysis Tool, now let’s turn our attention to the other one I use, EdgeRater, which as you well know works hand-in-glove with HGSI and has provided me with the breakthroughs I feel I have made in using John Bollinger’s Indicators of %B and Bandwidth with a Woodward Twist!

Those who take Ron and my Monthly Newsletter were privileged to see my latest work of blending %B x BW into what my associates have dubbed the “Woody” Indicator and those who have both products are already reaping the benefits that is immediately visible. Yes, I know that those who are good at “scraping” gems like this will immediately do so into their favorite programs, but over these past twenty years I have given generously of my research to help others help themselves. Of course Ron and I expect some return for all the work we do by attending our Seminars and buying our Newsletter and many of you have supported us faithfully over the years for which we thank you. However, in this day and age it is a fact of life that scraping is here to stay without nary even a Thank You!

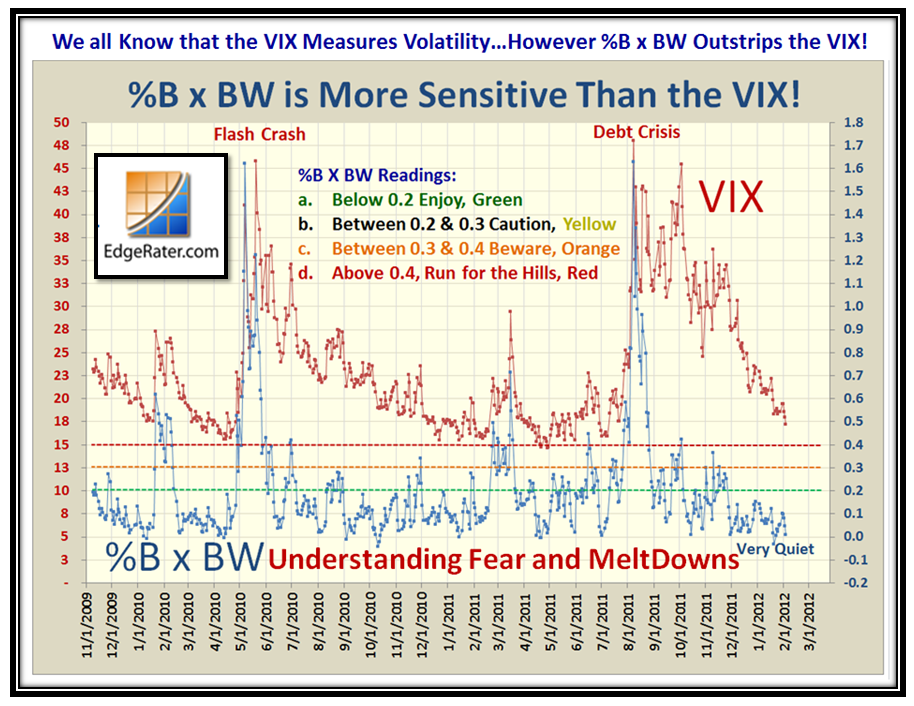

So now by any stretch of imagination the Market is Overbought and the key at this stage is to understand Fear and MeltDowns which is easy to figure out with what you see on this next slide, where I have given you the whole nine yards:

I see a lot of jabber on the HGSI Yahoo bb today about the TVIX and its value in hedging one’s Portfolio at times like these and I hope that those who are into this high risk good stuff will sit up and take note of how and when to get the best of both worlds BEFORE the TVIX takes off into the sunset:

If the cap fits, I will remind those who had promised me their third million that I am still waiting and maybe this goodie might tip the scales!

Now then…here’s a new teaser for you to ponder over when a market like this can take off into the sunset ala March 2003 and 2009, so don’t be asleep at the switch…more fun to come:

As I mentioned in my last Blog, we are holding a series of “Drip Fed” Videos that you can view at your leisure and we thank you for your enthusiastic response to our advertisement to help you help yourself. I’m sure you enjoyed the one that Ron did a few days ago and also the introduction by Chris White to what I will do next Tuesday, so look out for that, or if you haven’t, you can still Register:

Please take a moment to register for the EdgeRater / HGSI mini-course below:

Register for the course

…And last but not least, if you like all you see, why not sign up for the Seminar on March 24 to 26 where you will get the whole nine yards:

Register for the seminar:

Register for the seminar

Best Regards, Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog