Stock Market: Wonders Never Cease!

Last night I wound up the blog note with “The Bottom line is that either there is a Major upward surprise thrust or we continue to drible on down to the next level of support which is certainly “Custer’s Last Stand” at 2900 for the Nasdaq.”

Well, Wonders Never Cease and we got that surge today!

So we have a reprieve from what seemed the inevitable drip-drip process when markets are reaching a peak. As I am sure you have realized the approach I use is to establish Benchmarks through past History to bound the “What If” scenarios. The Stakes in the Ground and Measuring Rods come from significant points in time when the Market indicates unusual 1- Day Changes defining action at Overbought and Oversold points in time depicting Fear and Greed. Days like today come and go and fade into the distance, but by capturing these unusual Impulses as they occur we have a roadmap of the tug-o-war between Bulls and Bears.

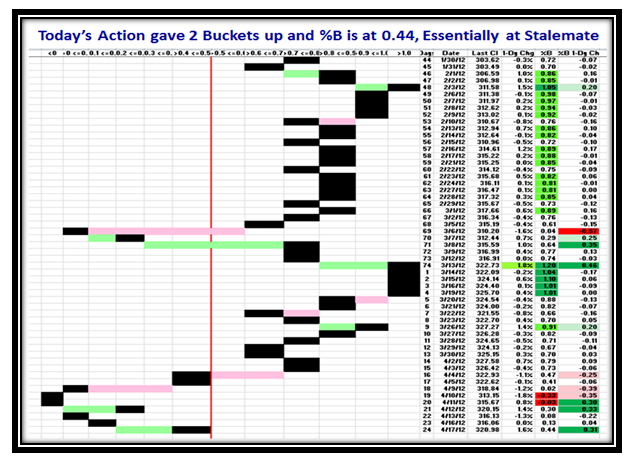

These Impulse Indicators capture the INTENSITY of the move so that we can make judgments as to the possible direction of the Market. The likes of Eureka, Phoenix and Up and Down Kahunas have become staple diets in dicephering the probable direction especially when the preponderence of the move remains unchallenged instead of a see-saw tug-o-war which define uncertainty. Yesterday the Bias was down, today we have a two bucket skip up and we are back in the area of Stalemate!

Any daily change of 2% or greater up or down is invariably a sign of a shot across the bow, so that I felt you would like to understand the “Sweet and Sour Spots” of the past for the last 12 Years on the Nasdaq:

The bottom line message and Rule of Thumb of the above chart is that the occasions to sit up and take notice of potential changes in market direction occur about 10% of the time based on the twelve years worth of history on the Nasdaq. Within a week you and I will have forgotten that we had a 1.82% up day today, but the beauty of using Impulse Indicators such as the Eureka, Phoenix and Kahuna is they will invariably be triggered to give us the framework of the Market action.

When Bulls and Bears are at Tug-o-War, one immediately understands the instabilty and therefore the caution one should apply to your Investments. Clear sailing is when the Positive or Negative set of Impulses go unchallenged which then sets the new direction or a confirmation of the old:

Where this Market goes tomorrow is in the lap of the gods and no one is clairvoyant, but what we do know is that all good leaders rise above the 17-dma which is the green line in the above chart. So the market has work to do to recover from the small correction of about 5% it has had to date. That line provides the immediate resistance, so we should watch that like a hawk. Any further new impulses shortly to the upside will provide added fuel to the move, or anything to the downside negates the bias…it is as simple as that. We are at Stalemate:

The Large Cap Leaders of AAPL, PCLN and ISRG all had strong up days today as did the entire NDX! Good luck.

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog