Stock Market: Something’s Gotta Give!

At times like these when the market soars like this from the Draghi and QE-3 stimulus, I think back to happy times with Sinatra in his prime, but sooner or later “Something’s Gotta Give!”

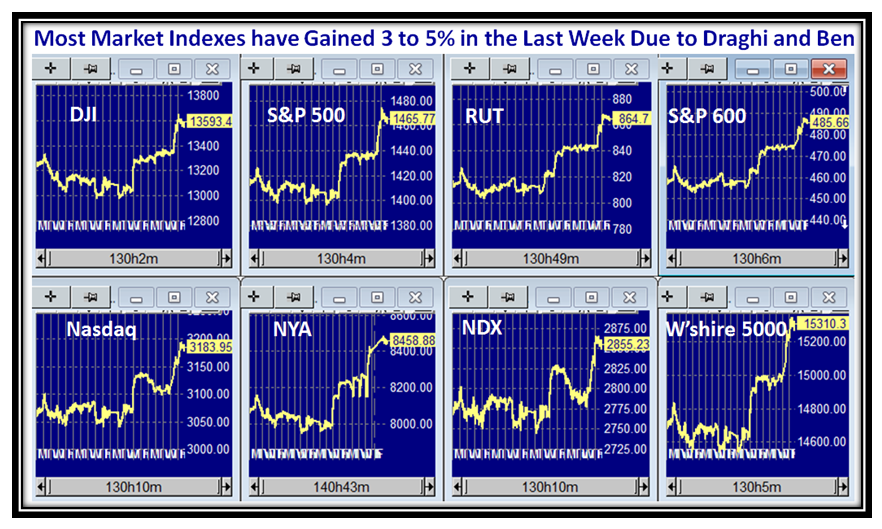

The Market Indexes are flying high and all but one, the NYSE though also strong, has hit New High Territory:

…And here are the Nasdaq High, Middle and Low Road Scenarios…3000 is strong support now, so watch that to the downside:

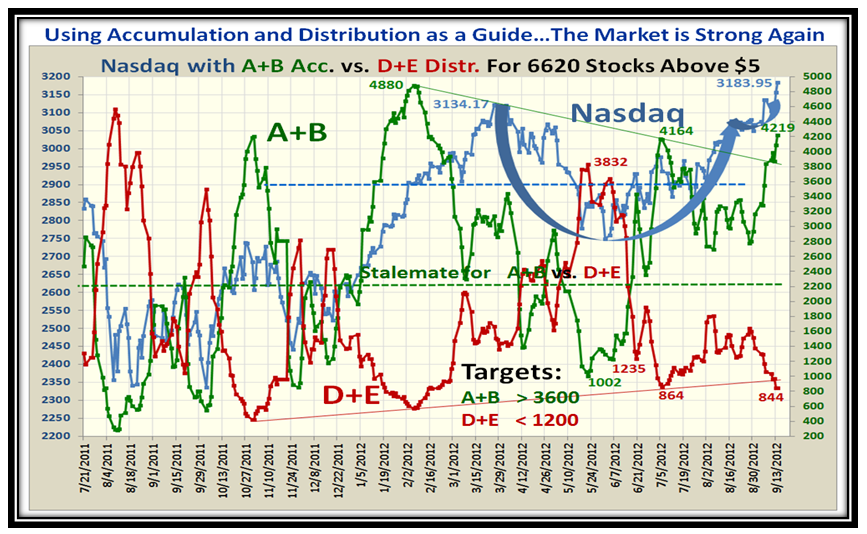

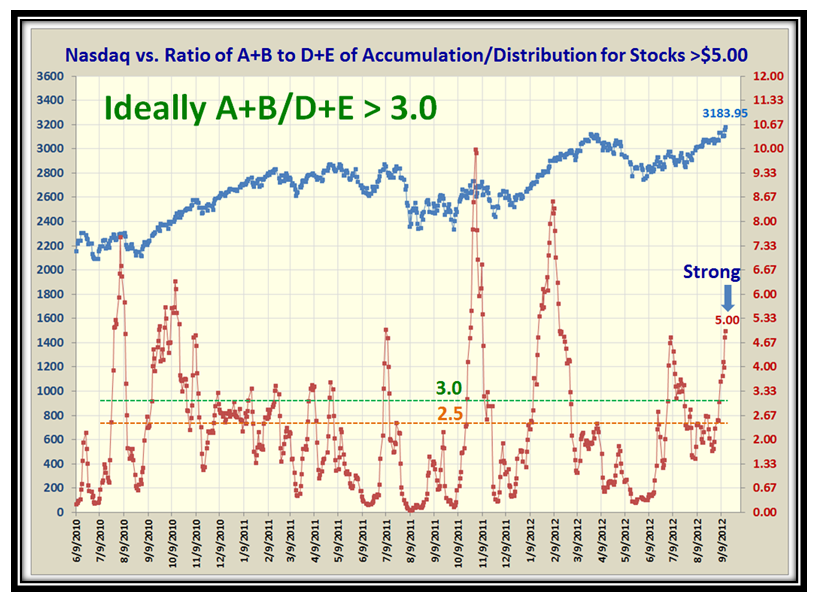

As you would expect Accumulation: Distribution Ratio is strong and is back up to 5:1 as shown in the next two slides:

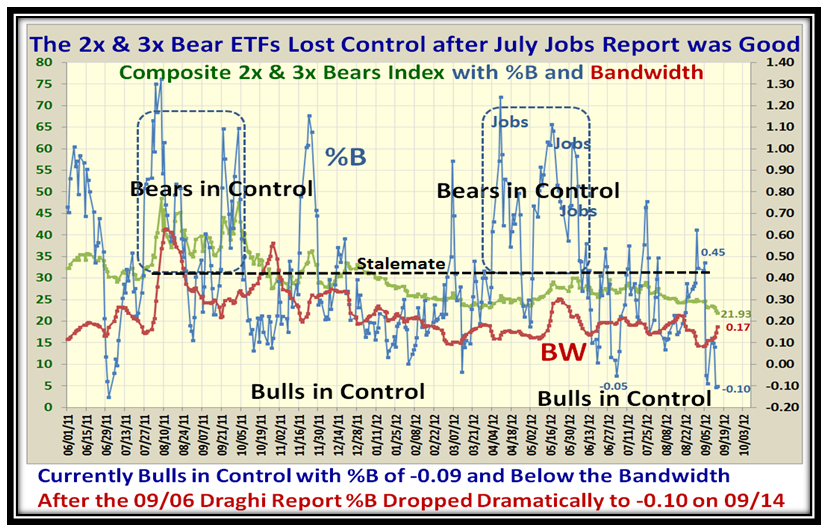

It goes without saying that the Bulls are in Total Control with the Composite 2x & 3x Bears Index the lowest on record:

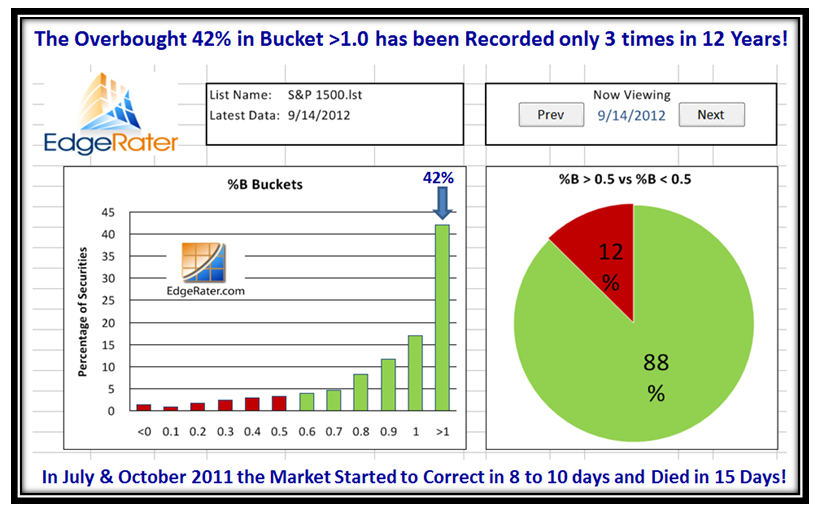

Now’s the time to sit up and listen…we have reached OVERBOUGHT personified with this chart…three times in 12 years!

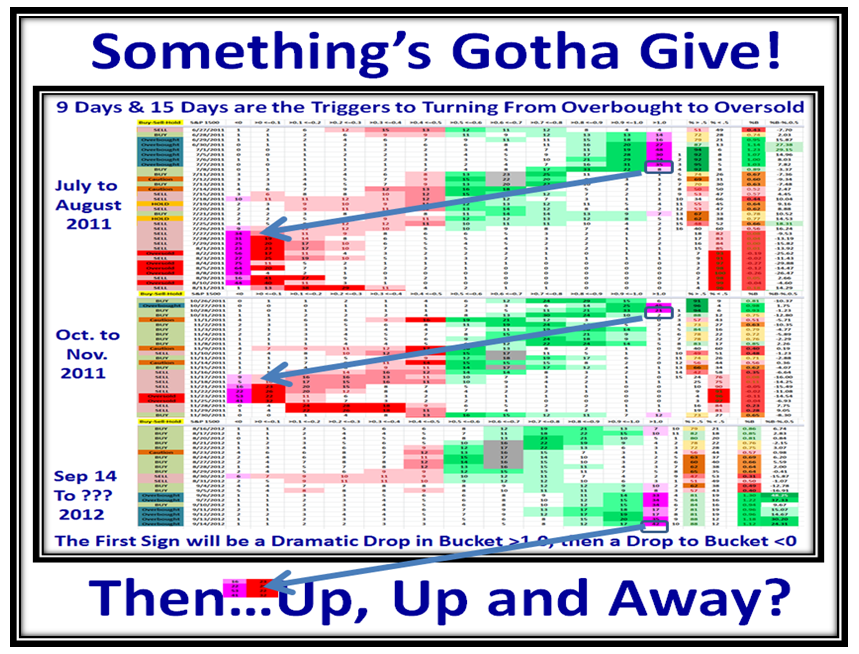

So What say all of you? I am no soothsayer, but at least I can take a stab at what History tells us. I know, I know, history doesn’t always repeat itself but at least it is worth a look. There have been only three times in 12 years of this type of history where the number in Bucket >1.0 has exceeded 40, the other two were in July/August and October/November, 2011. One glance at the chart tells me this one now is similar to that in July/August of 2011 when we had the Euro Jitters and Crisis. Note that the down arrows I show in the next chart are all parallel, so I am suggesting that within 15 days we should be at a hard bottom, and in between that we should see a move towards Bucket <0 within a week…between friends.

Then What? Who knows, but for sure we will all be on the look out for the Jobs Report a week later on October 5. You know this is the 4th year of a Presidential Cycle, and the Market NEVER Tanks before the Election so the odds are as I show on the chart “Up, Up and Away” unless there is some extraordinary upheavel by way of worldwide chaos. At least I have stepped up to the plate as “Fools Rush in where Angels Fear to Tread”…another of my favorite Sinatra songs.

My worldwide audience gets stronger by the week, and we have one coming to the Seminar from London and another trying to arrange his busy schedule from Australia. See you all in five weeks time. Let’s hear from some of you folks or are you just lookie-loos like ships that pass in the night doing whatever they fancy by scraping the latest news from their favorite blogs:

The Best of Luck to all of you in these difficult times.

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog