Stock Market: Bears are Dancing Again

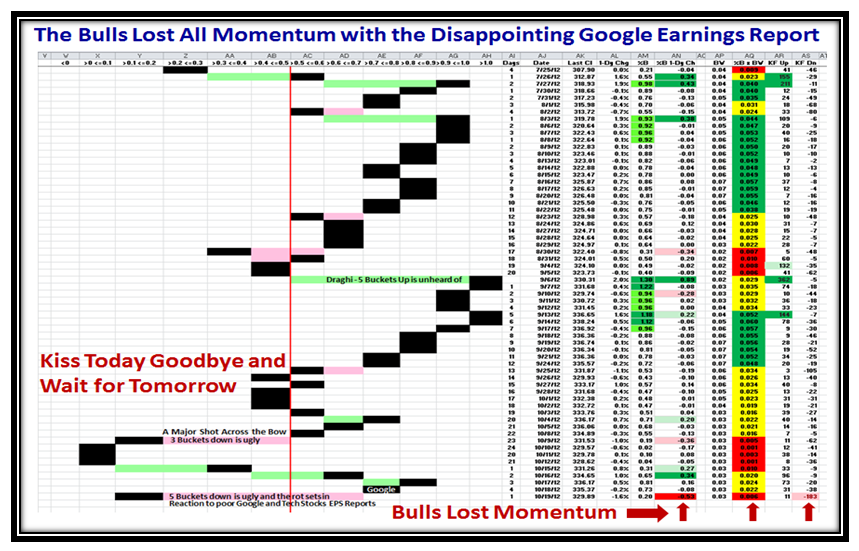

I see the Tom-Toms are beating loudest again in Thailand and my good friends in Qatar looking for more information after the Major Five Bucket Down Day we had on Friday which took a Bite out of GOOG for a disappointing Earnings Report among others such as IBM and McDonalds. Net-net we are back in the doldrums and the Bears are in Control for the moment. Next week is critical to see whether we have a Bounce Play or trot on down further to test the mighty important line in the sand of the -8% Mark on all Indexes from their recent Highs.

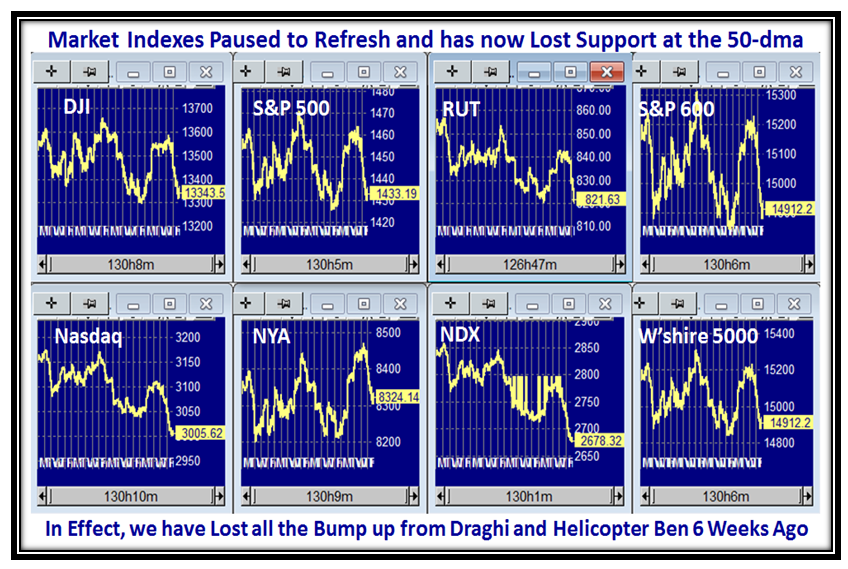

Here is the usual picture I give you of the Market Indexes which are all droopy:

…And here is the Roadmap for the High, Middle and Low Road Scenarios while doing a Highland Fling for my good friend Mike MacDonald:

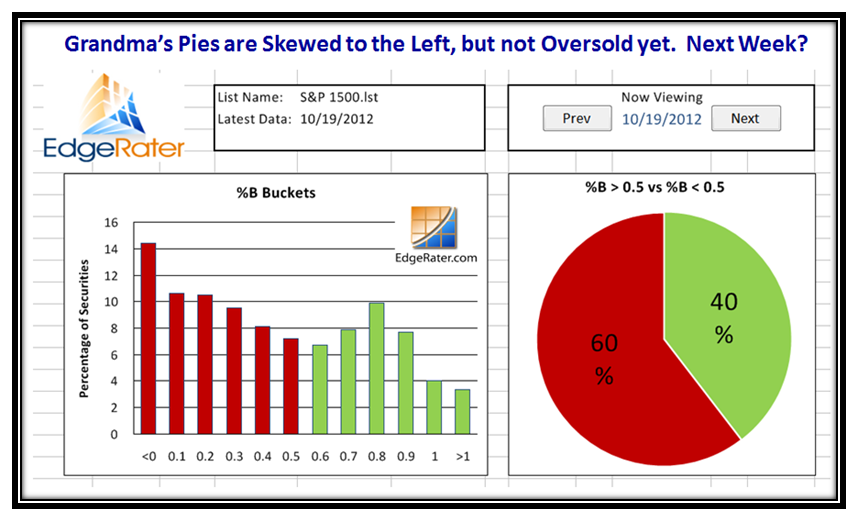

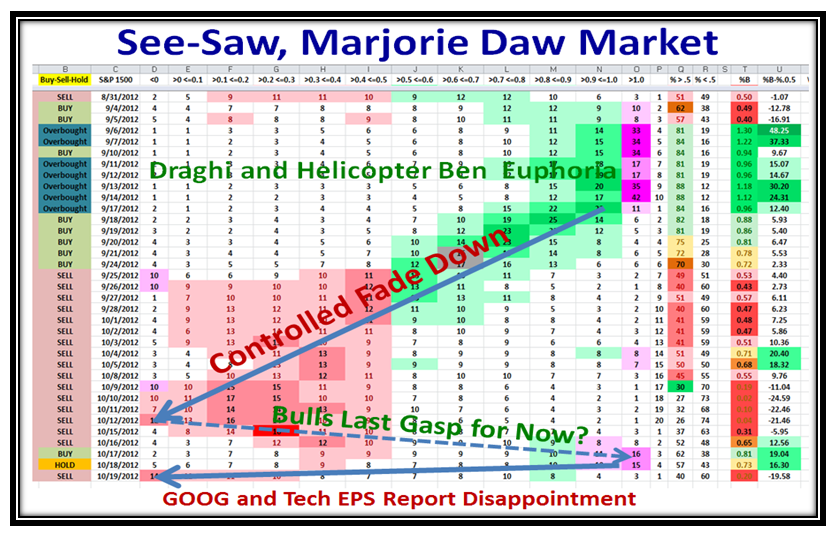

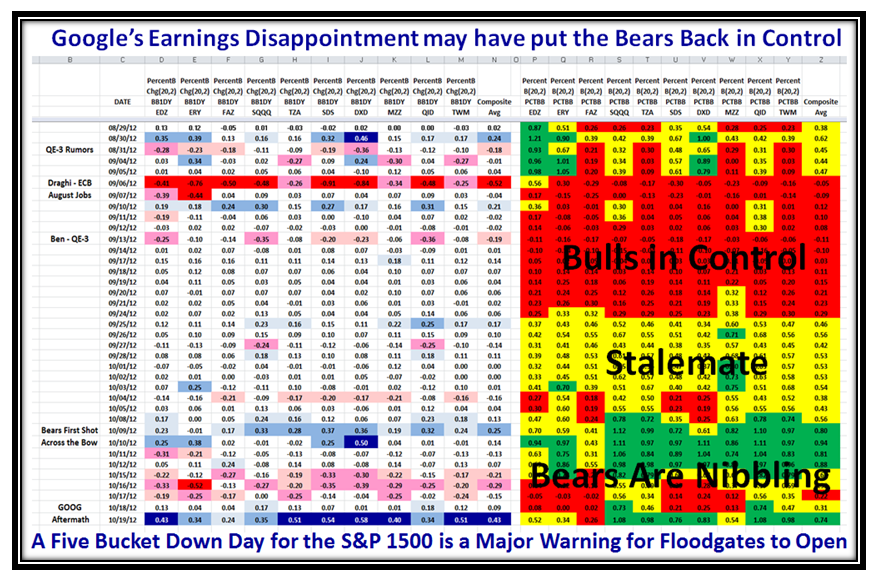

In a matter of one month, we have moved from Irrational Exuberance being overbought from the euphoria of Draghi and Q-E 3 to being down in the dumps through the phase of Stalemate as you will see from these various charts:

…And here’s the See-Saw, Marjorie Daw Picture:

Here is that Five Bucket Down Warning I gave you. It may snap back or it can drag you down next week:

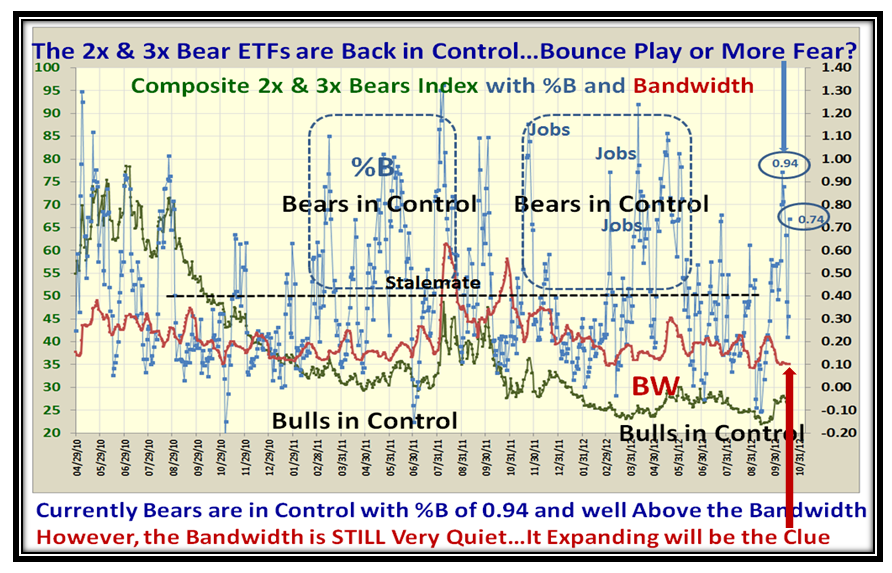

You folks who are into this stuff with a vengeance are already on top of the 2x & 3x Bears Picture which looks ominous:

…And here is the twin picture. There is some hope for the Bulls as the BANDWIDTH is still quiet, and if things break to the downside, this will be the first clue as it will jump up fast.

Well, we are down to the last week before the Seminar and we will be well into it this time a week from now. As a sneak preview for the people who will be attending Bob Meagher helped me develop this next slide which we will cover at the seminar. It shows the history of 3, 4, and 5 Bucket skips either up or down and gives ample warning of Fear, Hope and Greed. The bottom line is that next week is nail biting time and it may turn out to be a fizzle, and then again your job is to preserve your nest egg…which is what I have taught you for these past twenty years!

Best Regards and thanks for all your support,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog