Stock Market: Floodgates Open or Bounce Back? Part 2

So it seems you like this stuff from the feedback I am getting. Here are a couple of quick snapshots which will give you the “What If” should the Markets tank next week. I have used the Russell 2000 (RUT) as the guinea pig so see if this will help you. I am NOT discounting a Bounce Play from this Oversold condition…but the object of this lesson is to see if the pointers I give you work SHOULD the Market go down. Then at least we will FAITH for the next time if not this time!

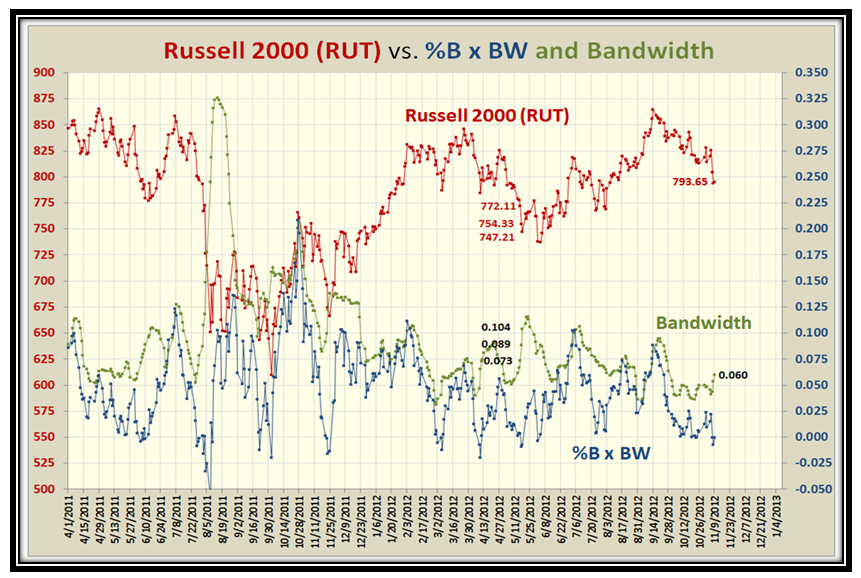

Many moons ago I taught you that when the Market Drops rapidly, the floodgates open on the BANDWIDTH which rapidly gets wider, so that’s the thing to watch. Here are the three steps it took when it was at a similar (not identical) point in time in mid-May 2012, when it rapidly moved up to 0.073, 0.089 and 0.104 in three days, while the RUT lost 25 points in three days as shown:

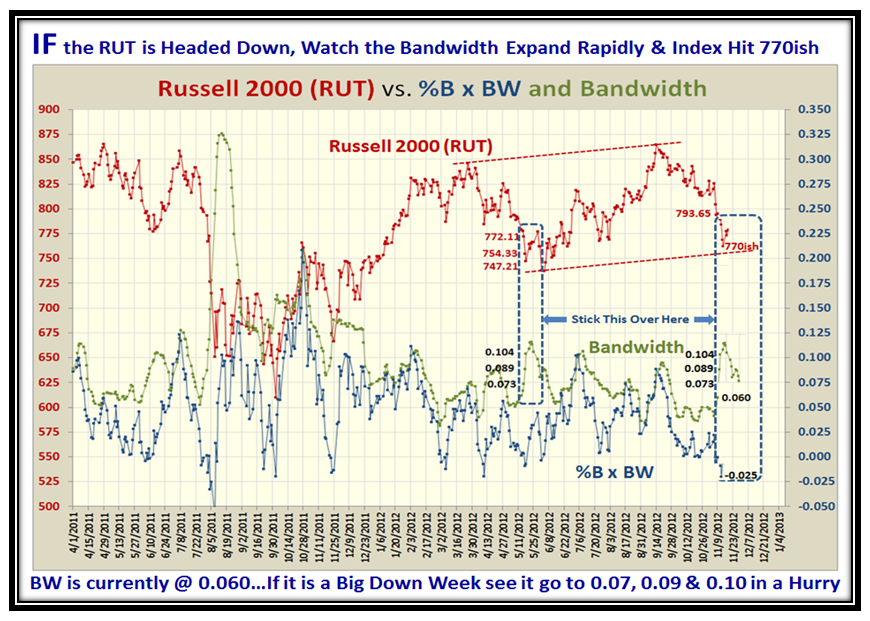

You know by now that the trick is to lay that same picture on “now” to see what to expect at this stage given the same move when playing “What If” games:

The net-net result is to expect 770ish if it is a big down week. Now, I am no soothsayer, but you get the message. The all important point is that in times like these when things are on a cliff edge, it is the change in Bandwidth that gives you the big clue day to day. Of course they will try to hold the Market here, but if the floodgates start to open these last two Blog Notes should be your guide! Watch the Bandwidth 1 Day Change, and the %BxBW as I showed you in the last Blog Note.

All the best,

Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog