Stock Market: It’s the Real Thing!

We had a follow through day to the downside, and the odds favor “The Real Thing” over a “Knee Jerk” as I suggested as the alternatives in last night’s Blog Note. I will treat this as an update to yesterday, so I will show you the charts with very little verbiage:

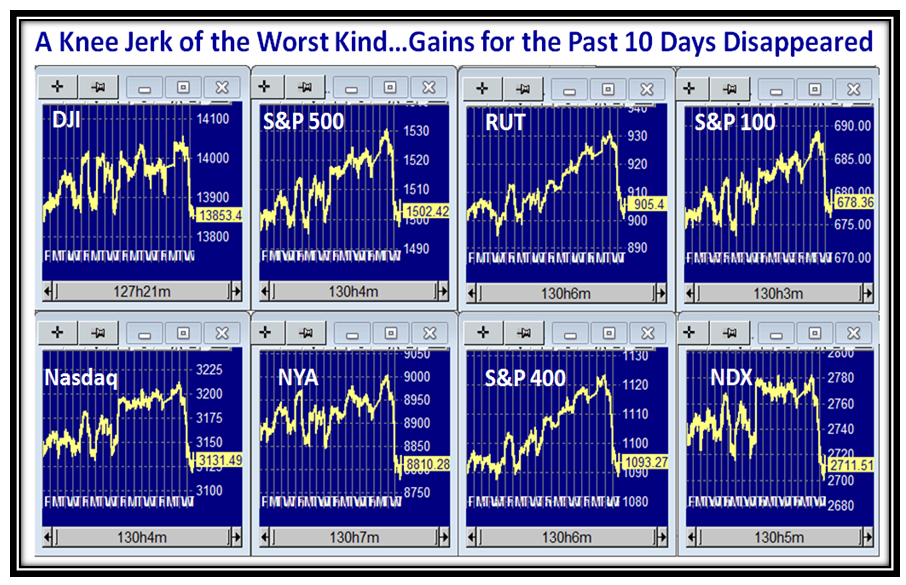

Ten Days Gains were lost in just two days on most Market Indexes:

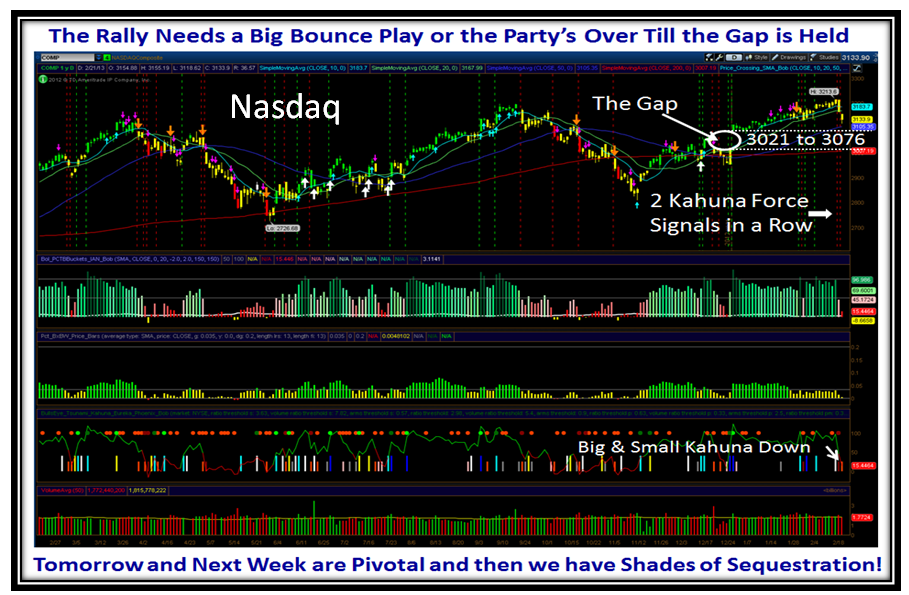

There is an inviting Gap between 3021 and 3076 that is below here and needs to be filled on the Nasdaq:

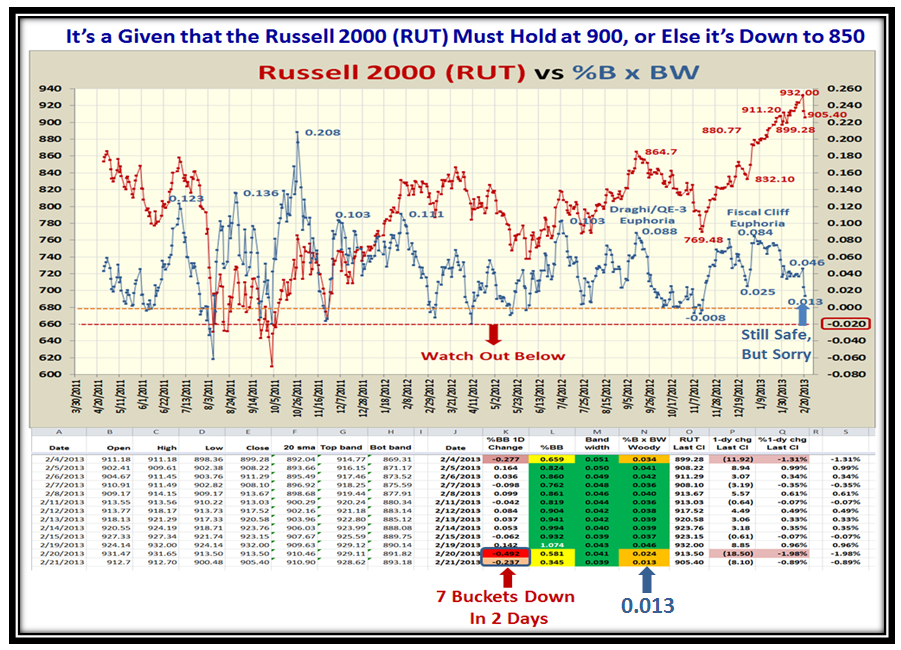

The Russell 2000 (RUT) took a big hit these last two days with 7 Buckets down:

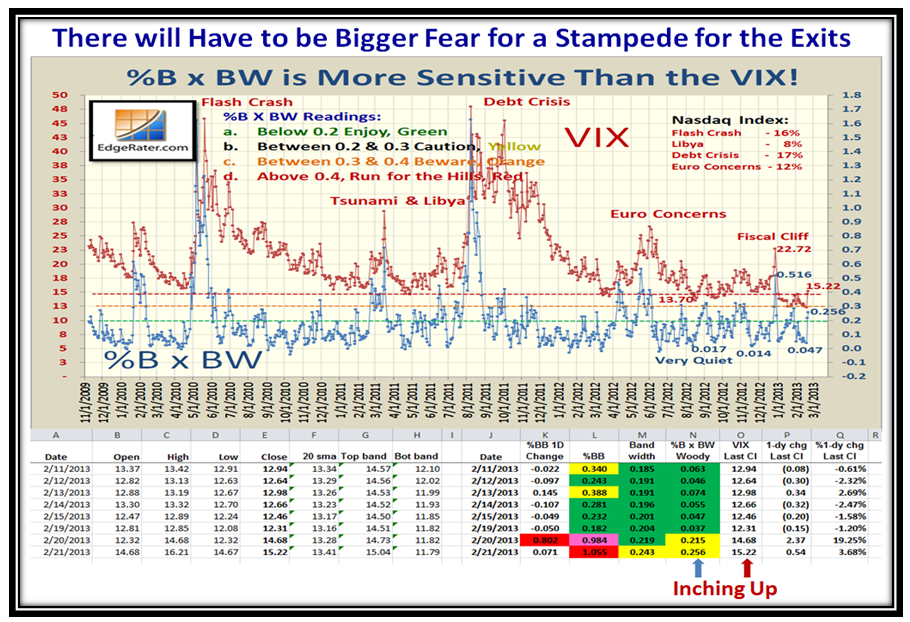

…While the VIX is inching up as you would expect. It needs to get above the 200-dma at 17 to cause fireworks:

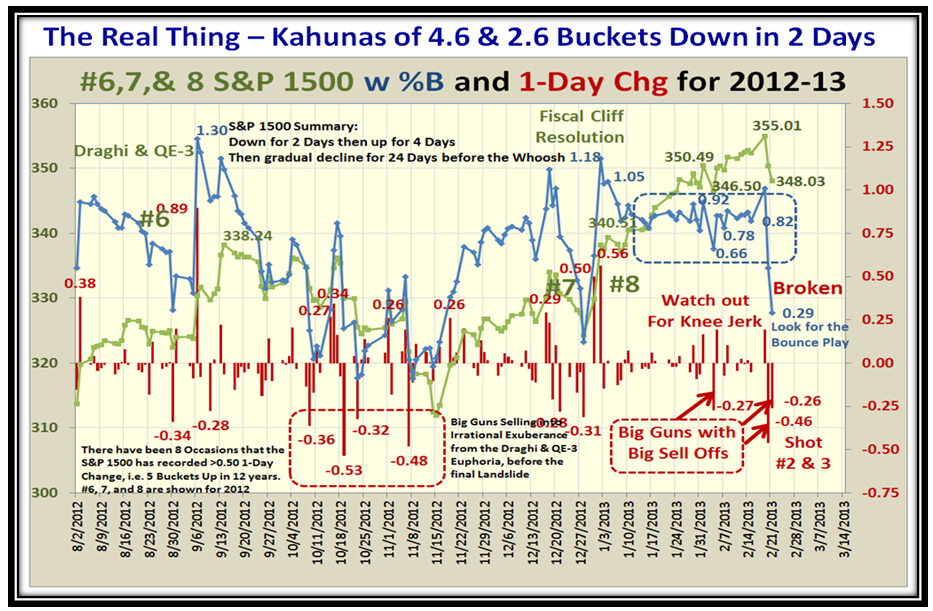

Since the two big days at the turn of the Year we have been waiting for the Big Guns to produce heavy selling and now we see it:

The Leaders are getting Trounced:

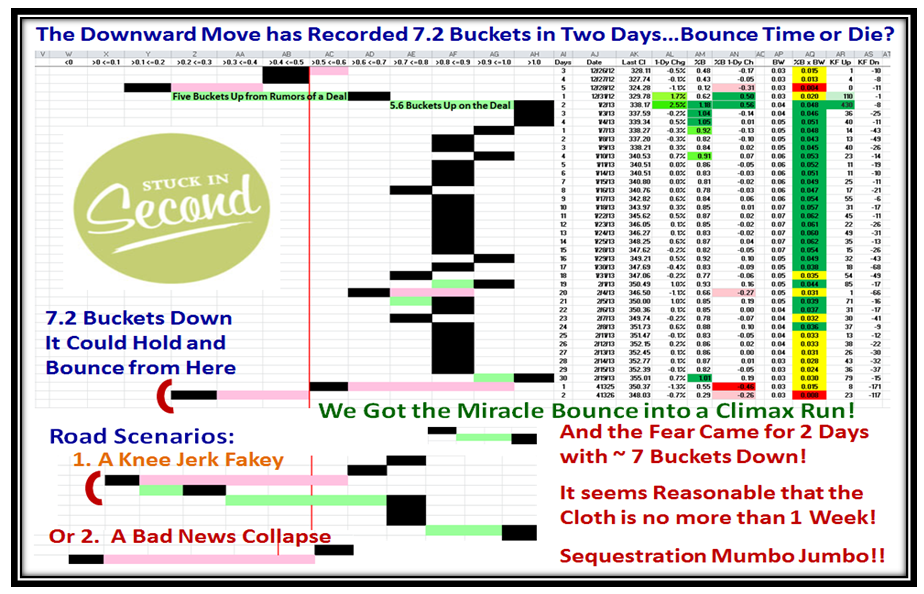

7.2 Buckets in two days is hard to recover from, but don’t count out a Bounce Play. The quality of that Bounce will tell us a lot:

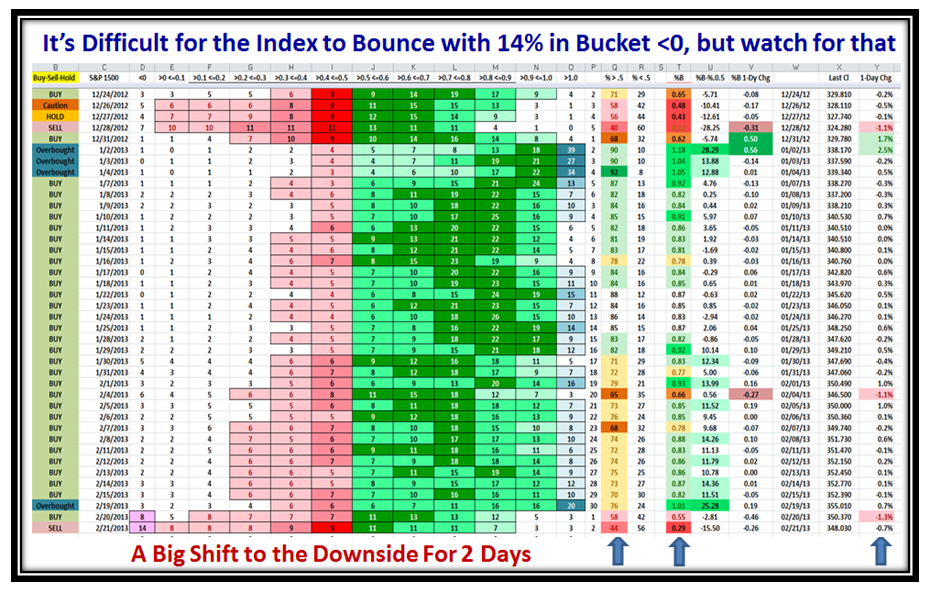

As we would expect, there is a big shift to the downside on the % of Stocks in the Lower Buckets:

The majority of the evidence points to the downside, but sometimes the Market will fool you. Stay alert, and Keep your Powder Dry.

Best regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog