Stock Market: Major Shot Across the Bow

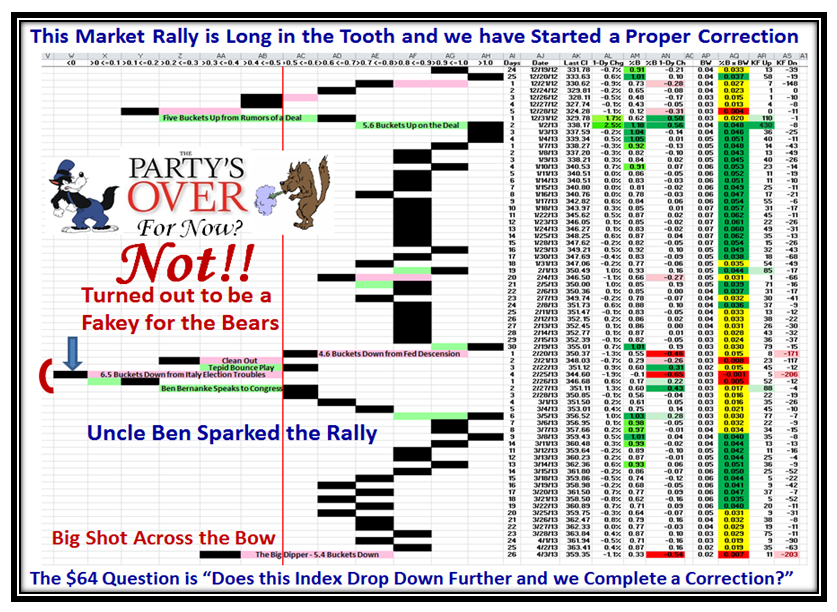

Yes, this was a Major Shot Across the Bow as the Market Indexes dropped down for most of the day. Net-net the Bears had control today, and we shall see if they can continue to take the Market down:

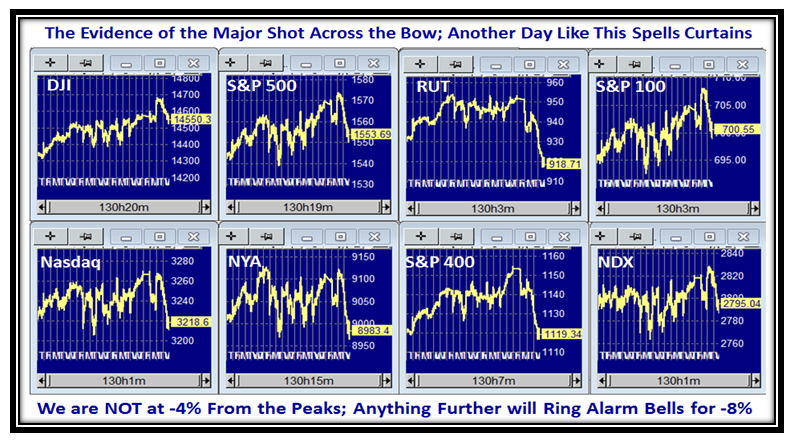

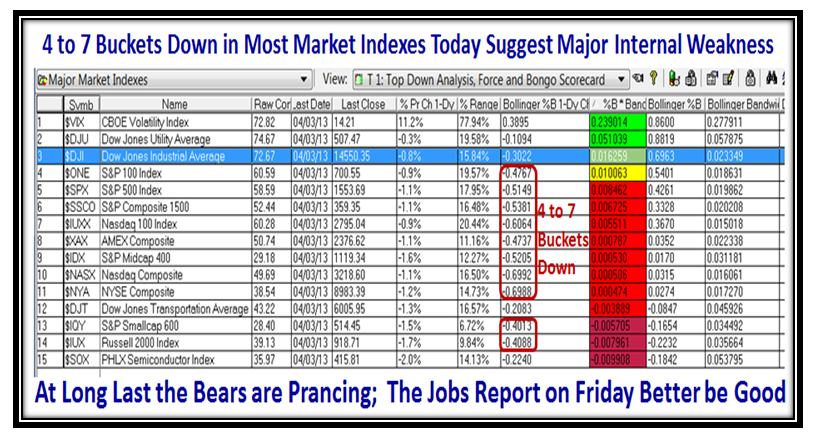

This next Chart shows the damage done today in the Major Market Indexes:

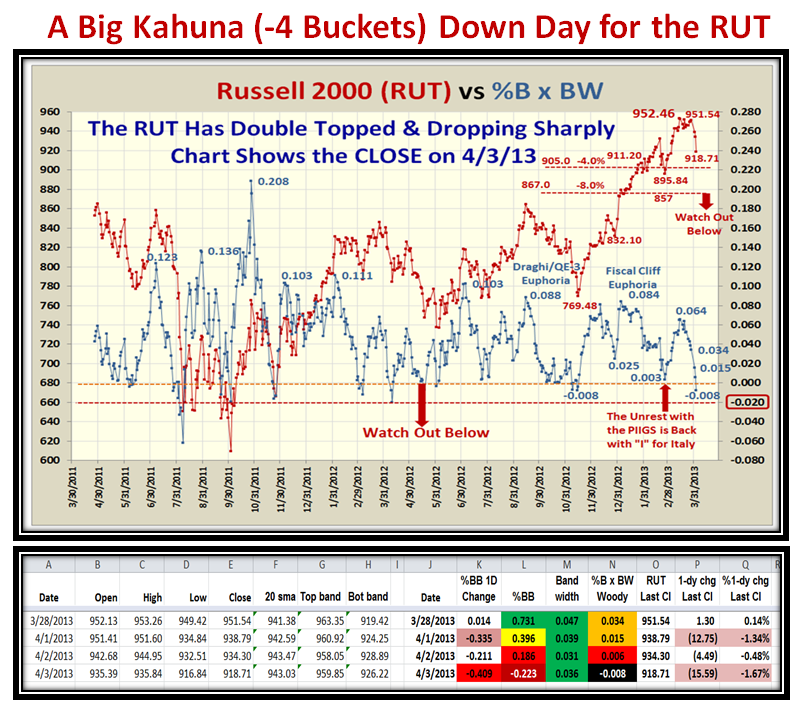

Most of the Indexes suffered greater than 4 Buckets to the Downside, and the RUT was one of them:

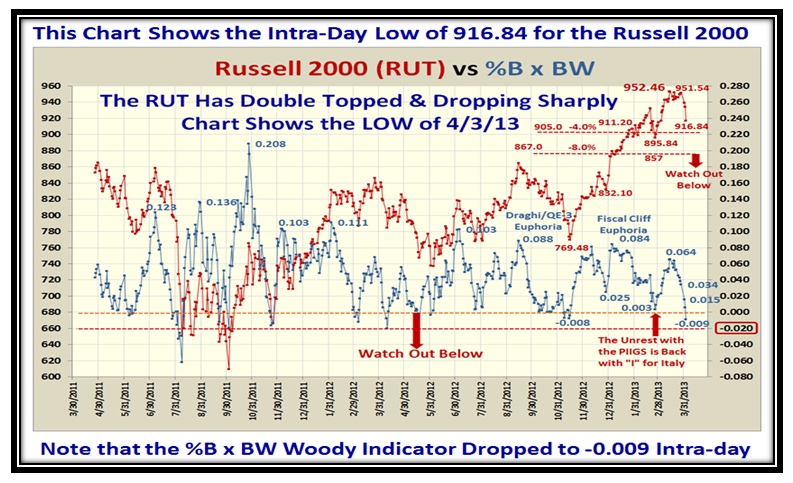

…and here is the picture for the LOW of the day with the RUT. Richard B. from Thailand taught me back in November to keep a beady eye for the %B x BW to fall below “Zero”, so both these charts are a tip of my hat to him, as they don’t get below this level more than twice in any one year.

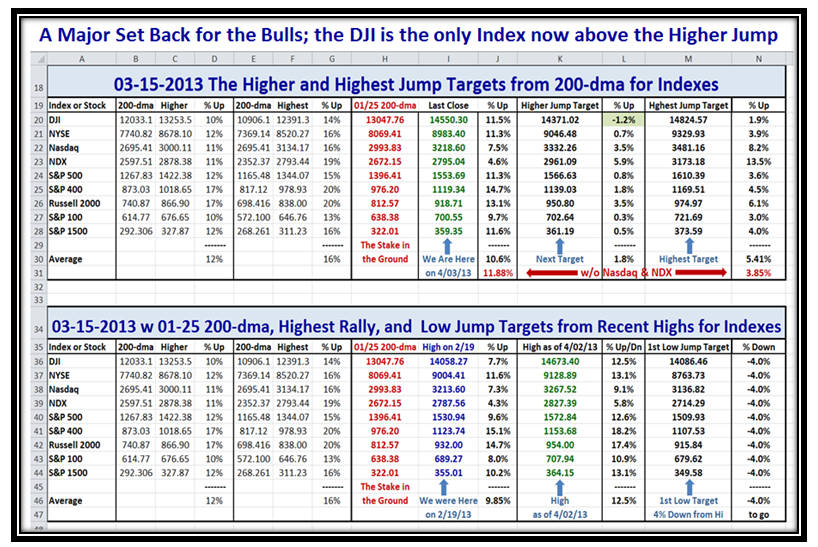

It’s now time to pay attention to the downside targets from the Highs. I’m sure you know by now the natural targets are -4% and then -8%, so here are the Measuring Rods using the Nasdaq:

Here is the picture in a nutshell of the damage done today as portrayed by the HGSI Software:

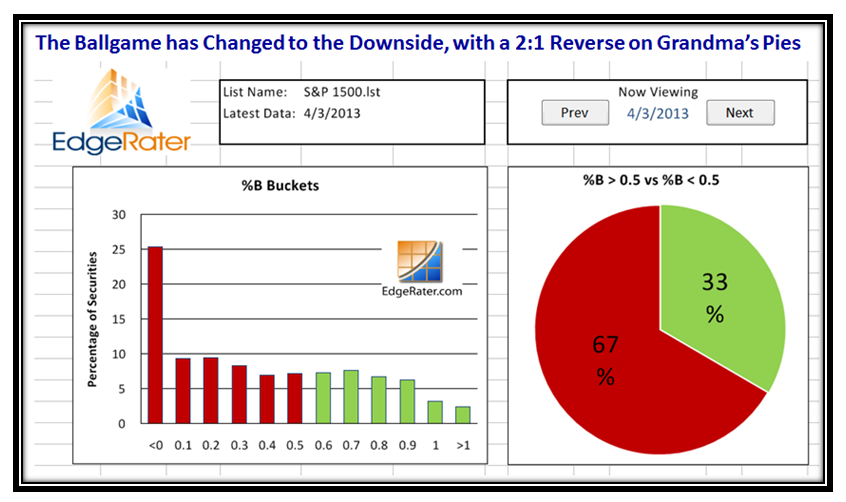

This picture of Grandma’s Pies clinches the story for you with a 2:1 ratio to the downside:

That 5.4 Buckets down on the S&P 1500 says it all, and now we have to wait and see if the Bears can really take control and take this Market into a full correction, or whether this was only a flea bite:

It goes without saying that the road to the Highest Jump Targets were hit hard today and as a result we have only the DJIA Above the Higher Jump Target, whereas there were seven just a couple of days ago:

Please remember that the Jobs Report comes out on Friday and we shall see where this Market goes.

Best Regards,

Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog