Stock Market: See-Saw and a Climax Run Market

I am back from an exhilarating and exhausting three day seminar at Sunny Palos Verdes, and Ron and I thank all of you our supporters for a rollicking good time. The Newbies now know how to read my blog and the winky-winkies I give from time to time. The first Picture chart usually spills the beans of what I think:

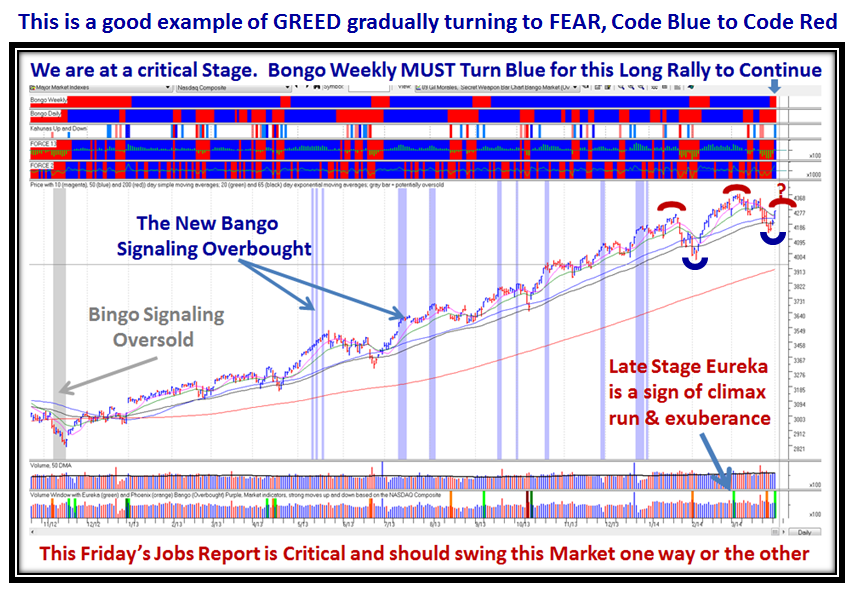

Unlike last Month where the Stock Market reaction to the mediocre Jobs Report was surprisingly good, this month’s report due on Friday should give us a better indication of the health of the economy here in the USA.

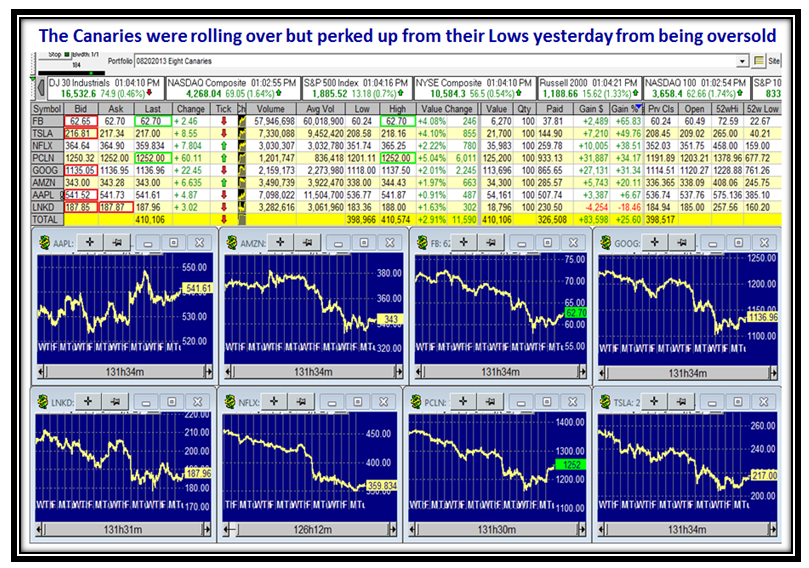

Here is the performance of the Canaries which have essentially rolled over from their highs, but are still hanging in there:

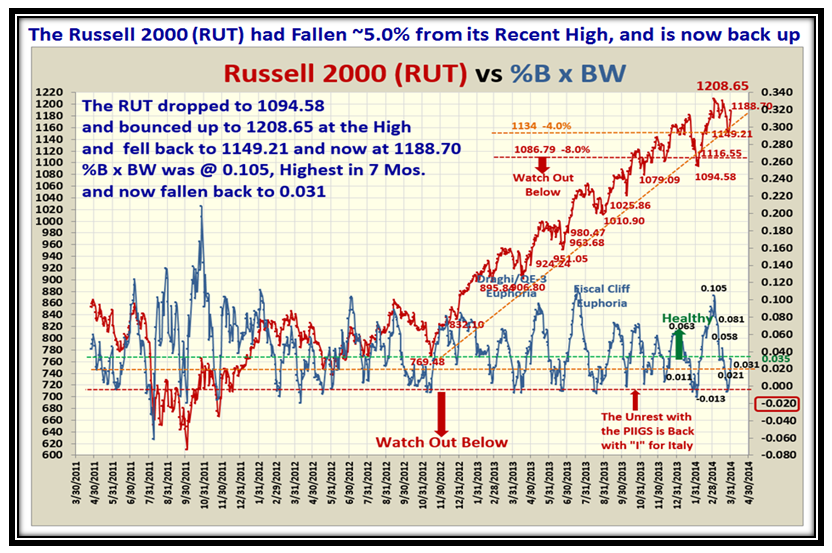

The Russell 2000 (RUT) suffered about a 5% loss from its high, but true to form turned up once again. Before it breaks that trend-line hard is when we should all run for the hills and that should be when 1000 is broken to the downside:

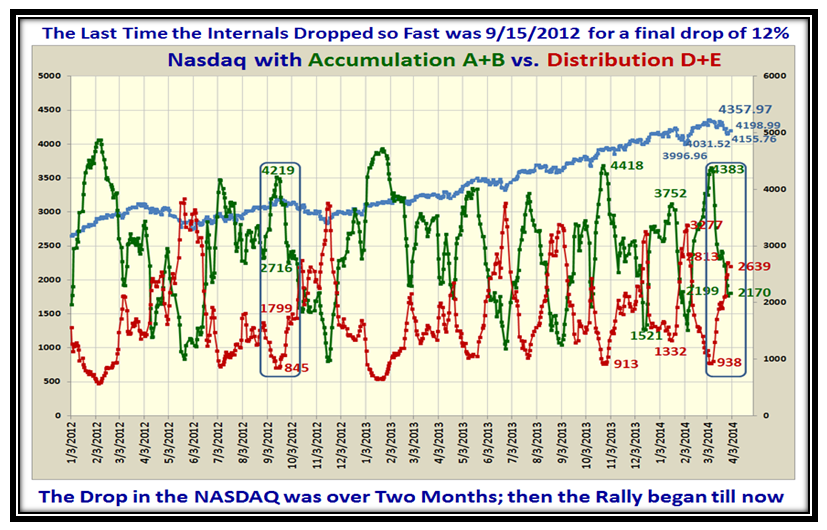

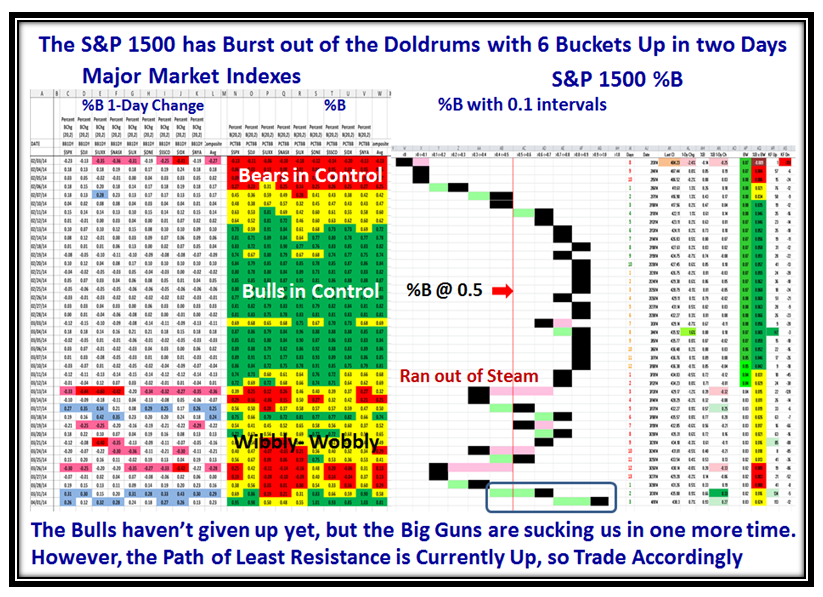

We are now at that Critical Juncture I warned about of at least a 12% Correction since the Acc:Dist ratio is below 1.0 (Stalemate) and now we wait to see if there is a gigantic recovery in the Internals of the Market or it gently fades away:

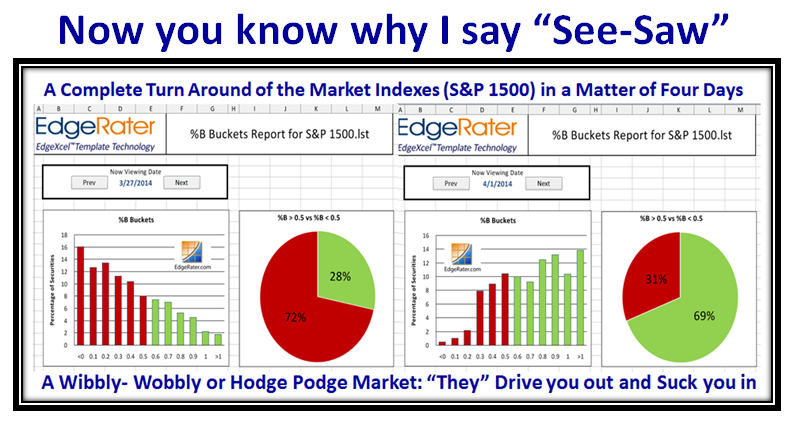

Grandma’s Pies says it all…a complete turn around of 6 Buckets up in a matter of four days. Now What?

The Path of Least Resistance is up, so play it that way until you get another Knee-jerk down. Counting today, we are now into Day 4 of Twelve Drummers Drumming, so keep a beady eye on that count:

Here is nice new chart to digest, which shows the critical signals we have had in the past few weeks that tells the story:

Well, that’s it for today. Keep your powder dry and your nest egg whole is job 1! Write a comment to give me feedback.

Best Regards,

Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog