This Stock Market is in Code Red!

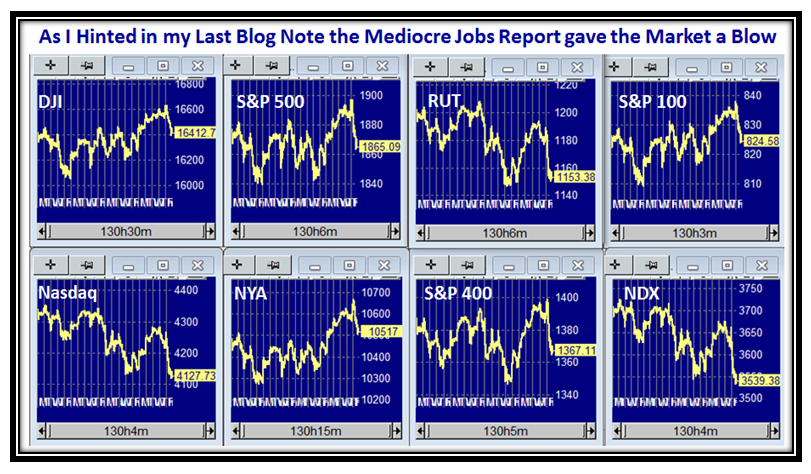

Sunday, April 6th, 2014I suggested in my last Blog Note that a mediocre Jobs Report would send the Stock Market into a tizzy and head down, and that is what happened with most Market Indexes down 4 Buckets. Another day like Friday and the Bears will have full control, and you and I will worry about being trampled at the exits, and saying “Coulda, Shoulda, Woulda!

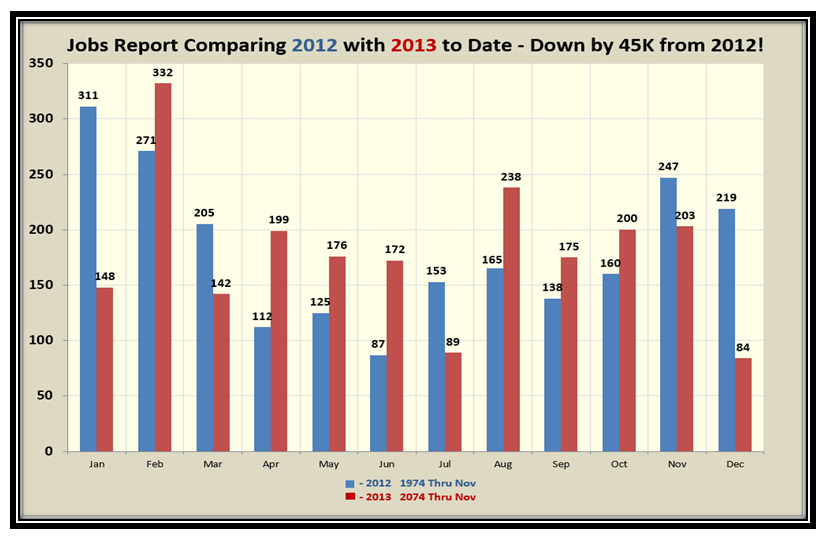

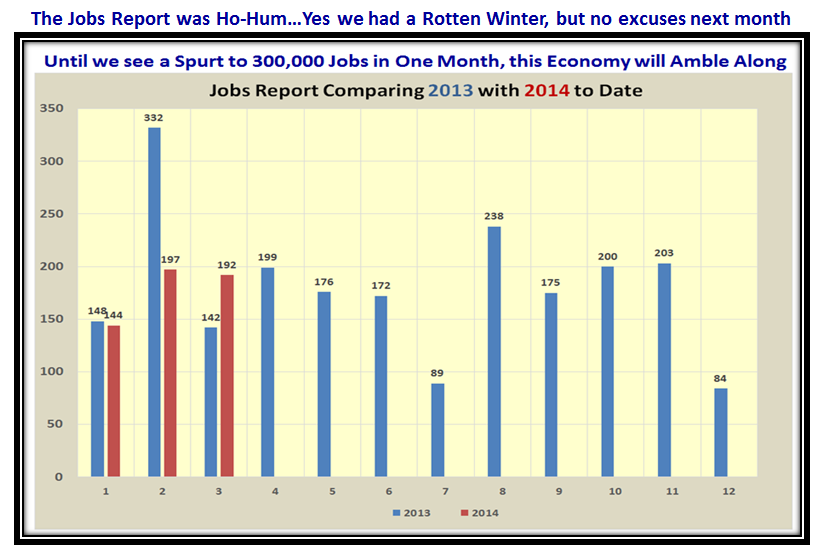

We have had fifteen months of ambling along with the Jobs Report numbers, and unlike last month where the Market felt they were good, we got a trouncing for being essentially at Stalemate. Here are the numbers for 2013 vs. 2012 and then the first three months of this year compared to last year:

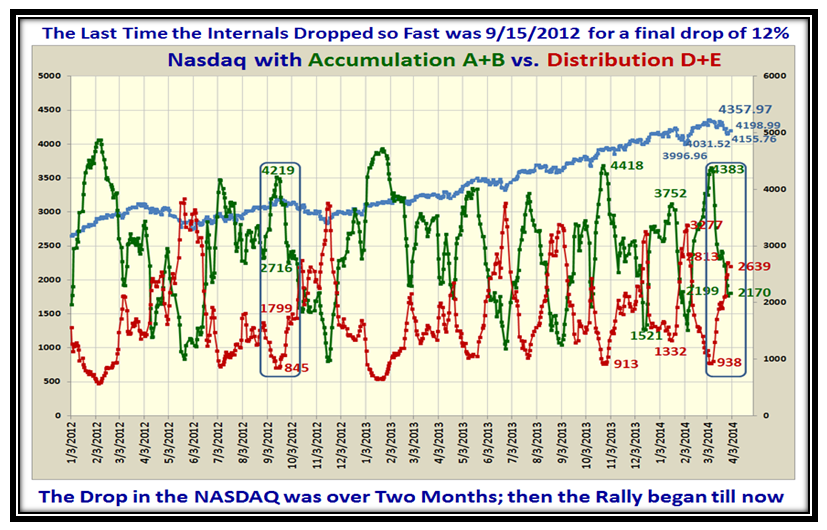

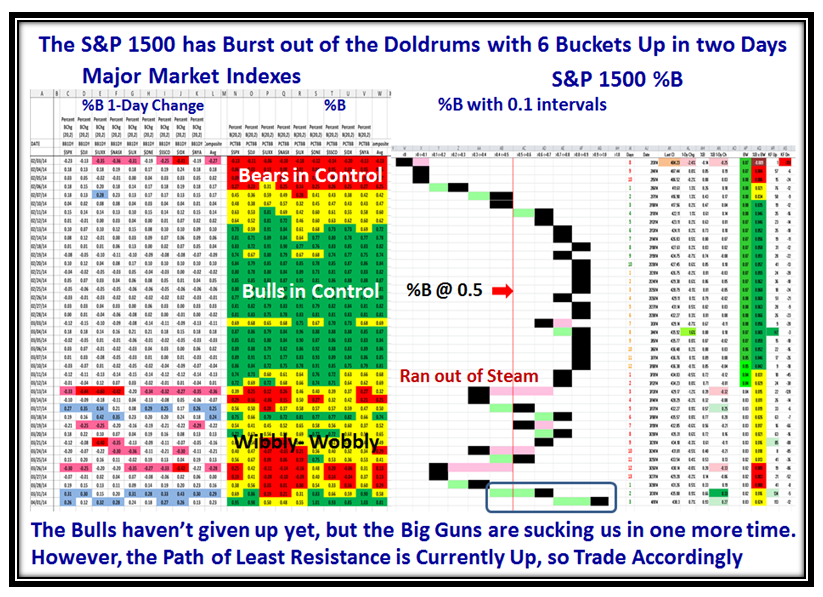

Here is the picture of the Market Indexes over the past month, which shows they have been struggling:

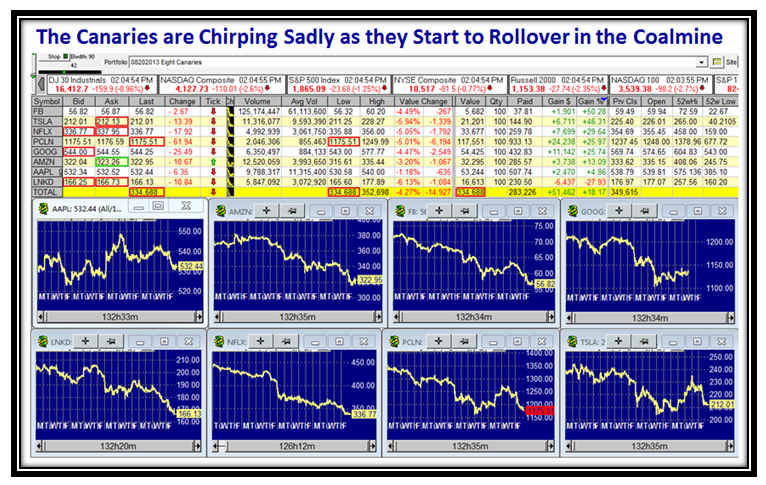

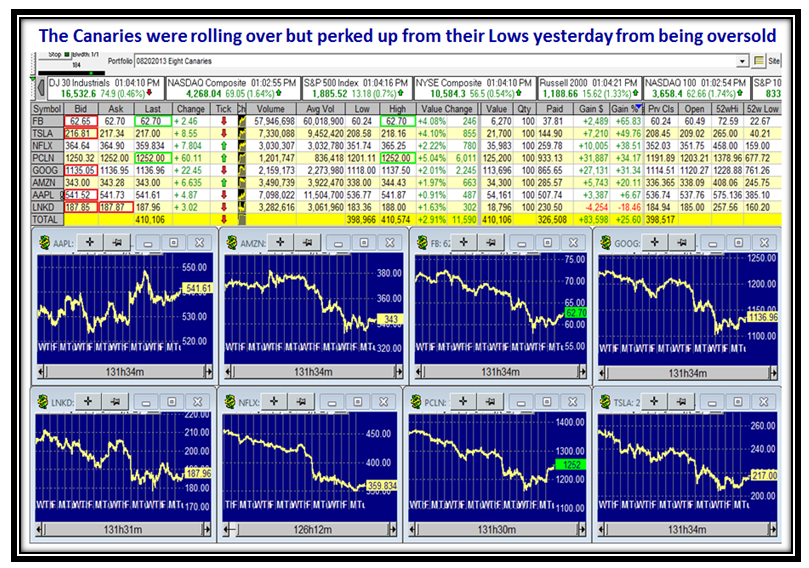

Needless-to-say the Canaries took a beating and are rolling over from their highs of a month ago:

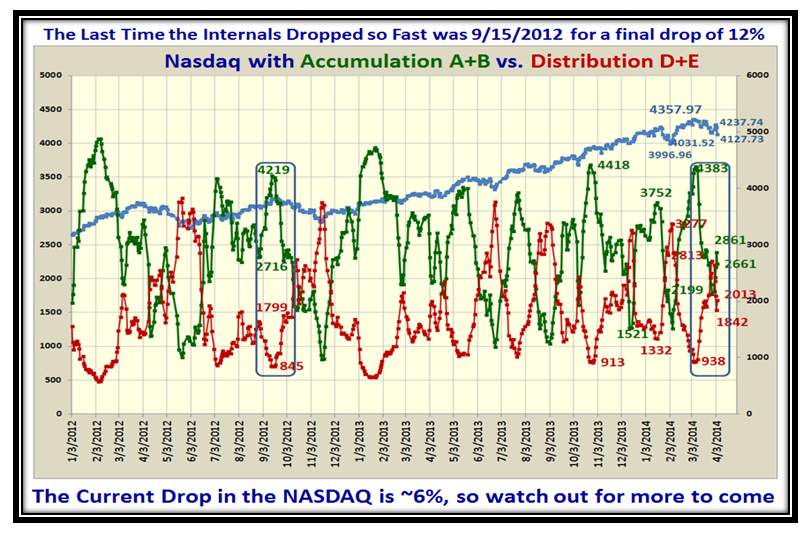

The Accumulation vs. Distribution Ratio bounced up to 2861 vs. 1842 and has slid back to 2661 vs. 2013:

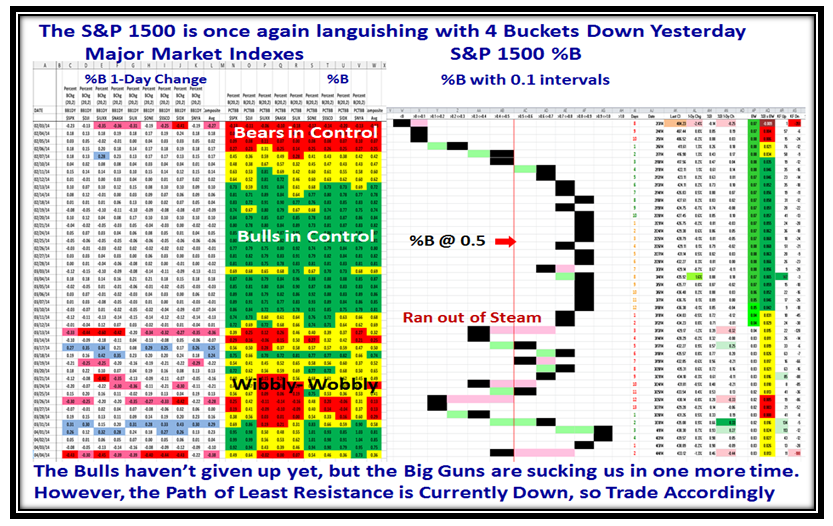

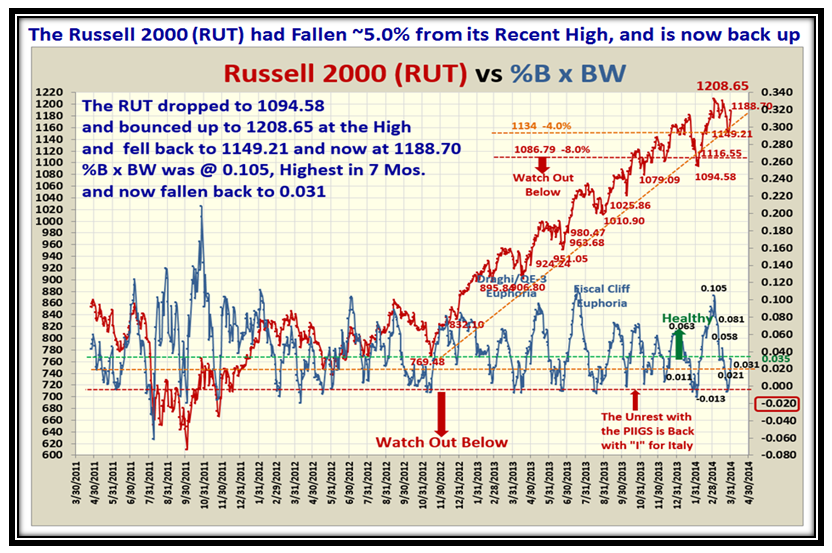

After the 4 Bucket down day on Friday, the path of least resistance is down once again:

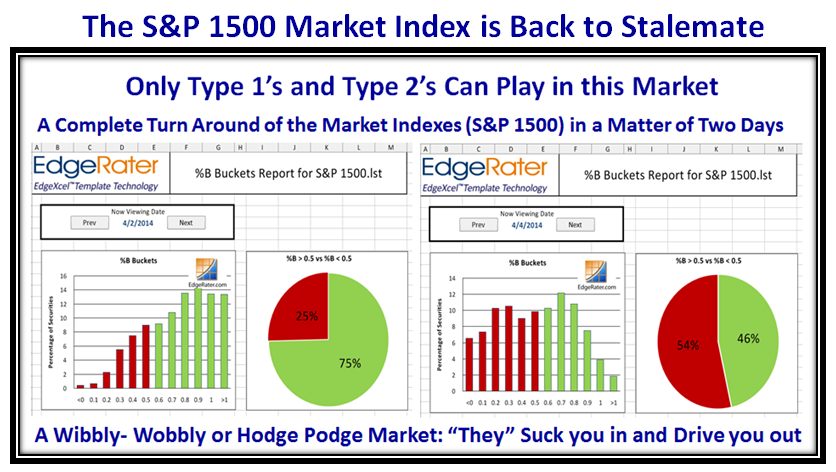

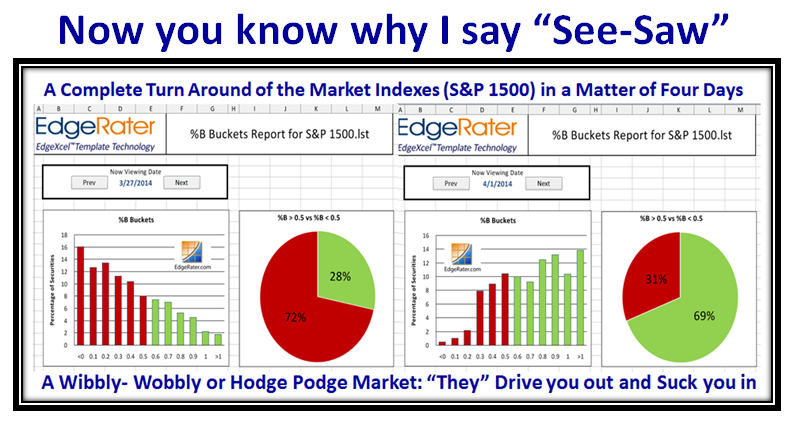

…And Grandma’s Pies show the instability with the S&P 1500 back to Stalemate in 2 days:

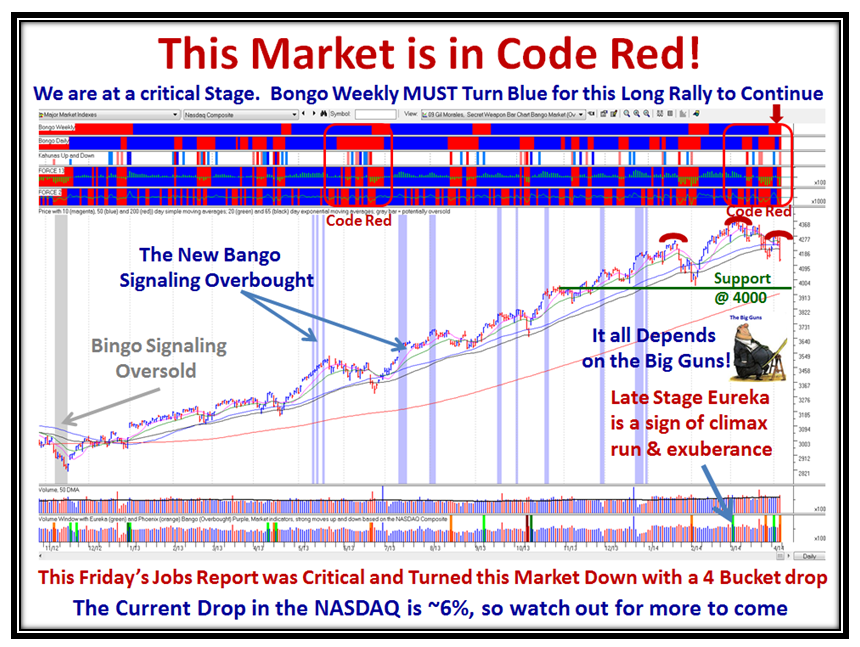

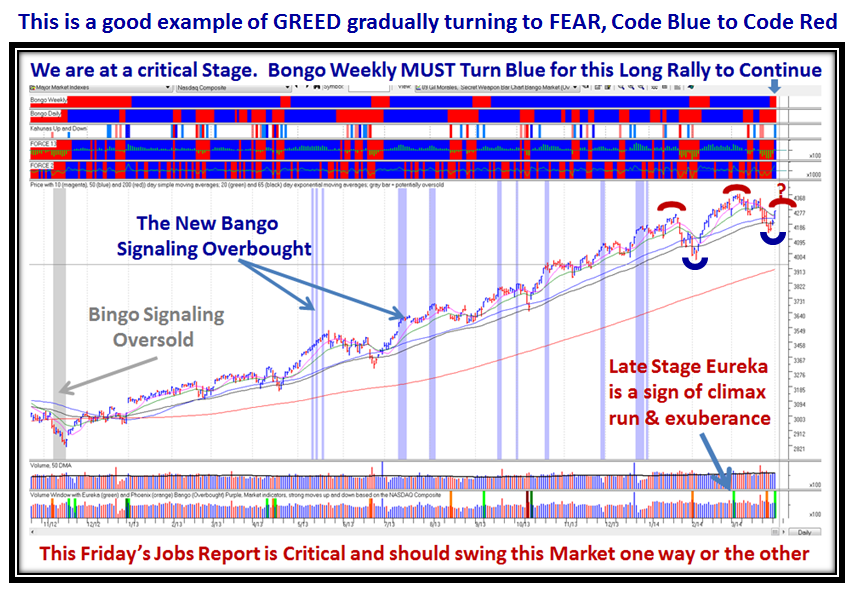

Here is the chart that summarizes it all and shows you why the Market is currently in Code Red!

Have a Happy!

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog