Stock Market: Hanging on by a Thread

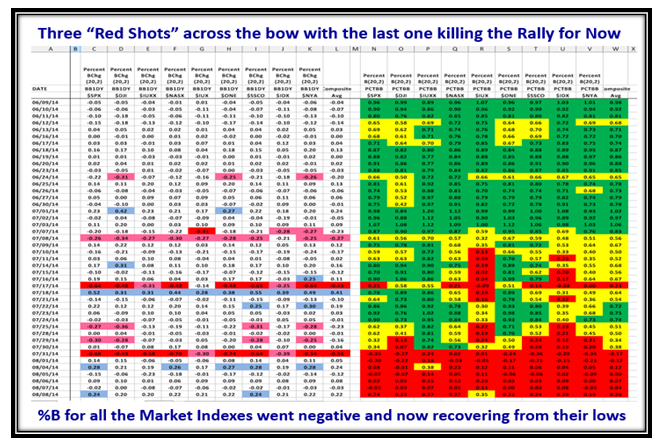

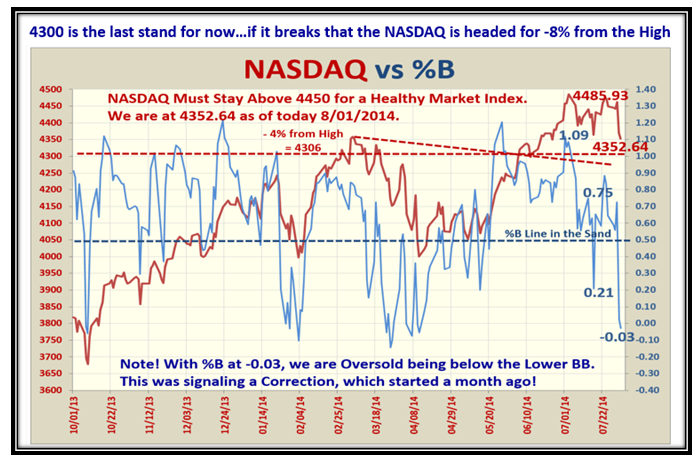

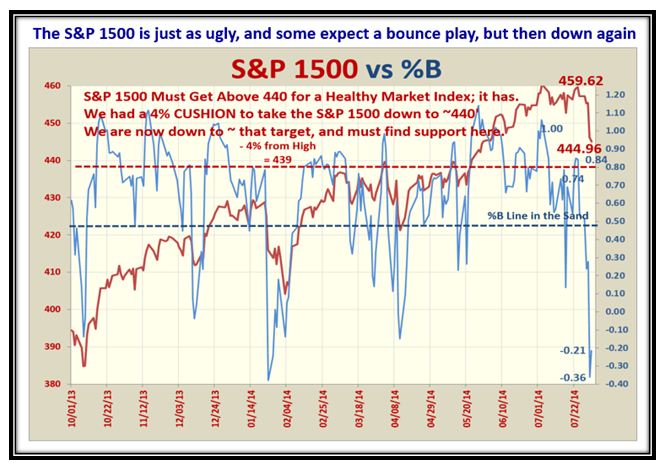

Sunday, August 10th, 2014Friday’s Bounce Back saved the Market from heading down further while the Market Indexes are hanging on by a thread at the crossroads. The Market Indexes are trying to hold here at Support, but as those who have followed my blog notes for years will immediately recognize that with %B at the ~ 0.2-0.3 area we are hoping for a further move up, and yet can trundle down very quickly:

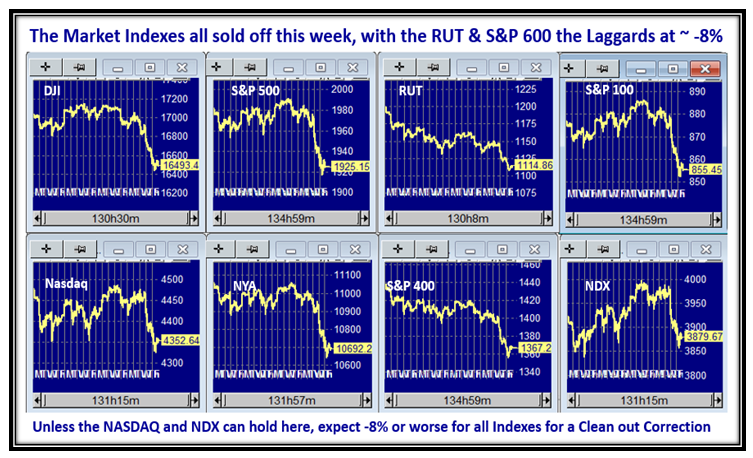

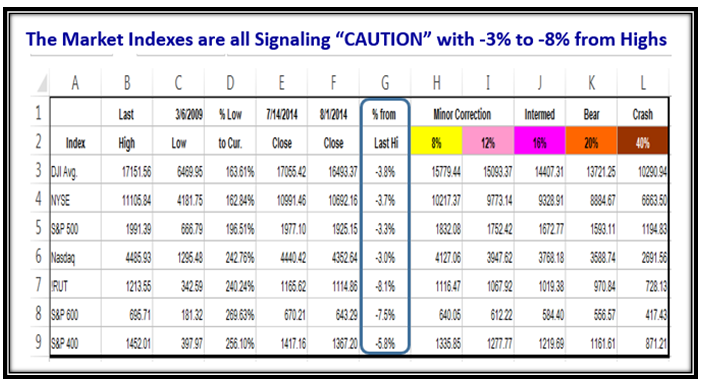

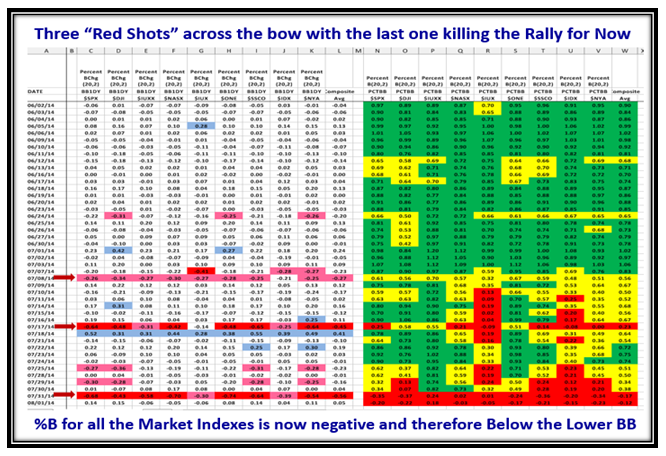

It is touch and go, but as we see all the Market Indexes are trying to find support this past week:

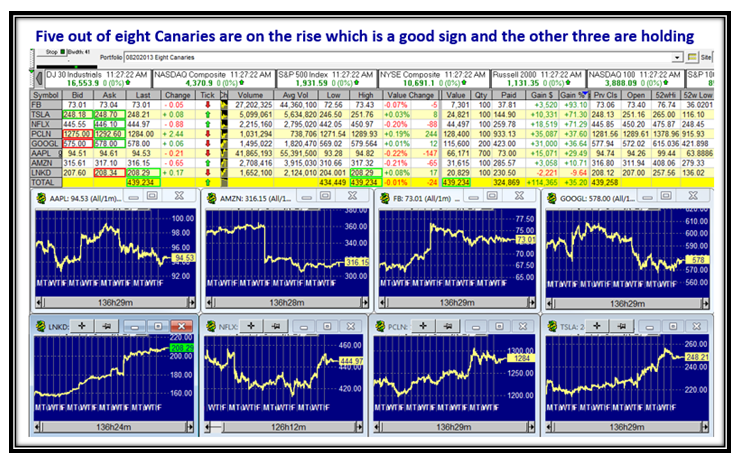

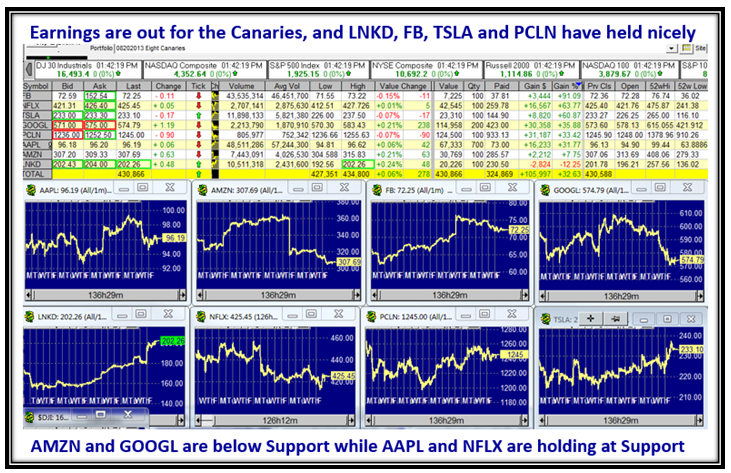

Likewise, the Canaries are showing some renewed strength, and is a good sign to counter some of the gloom:

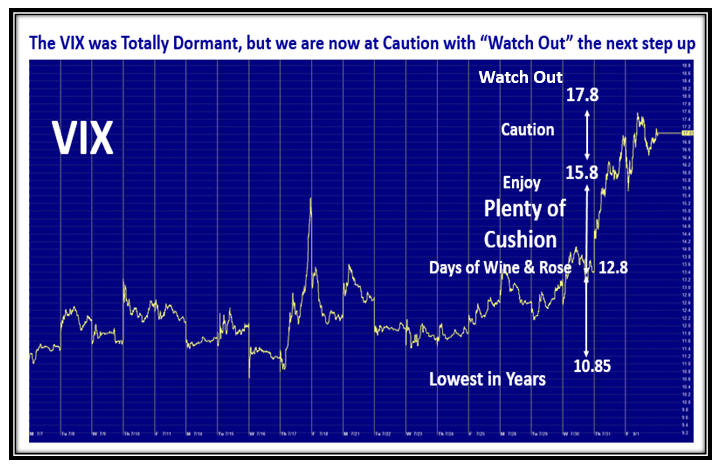

The VIX has been bouncing around just below going into oscillation. Watch carefully for moves above 18:

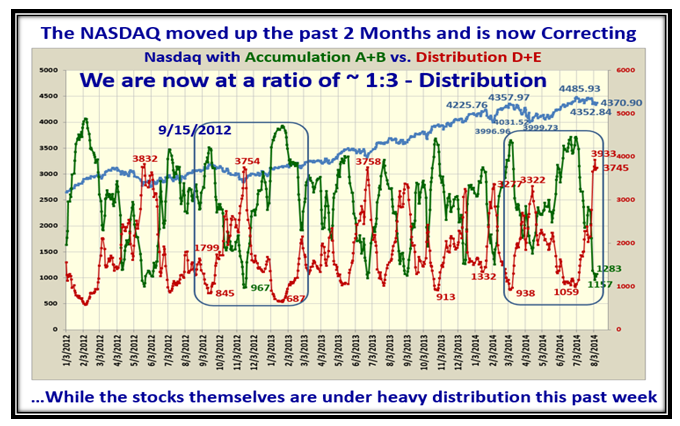

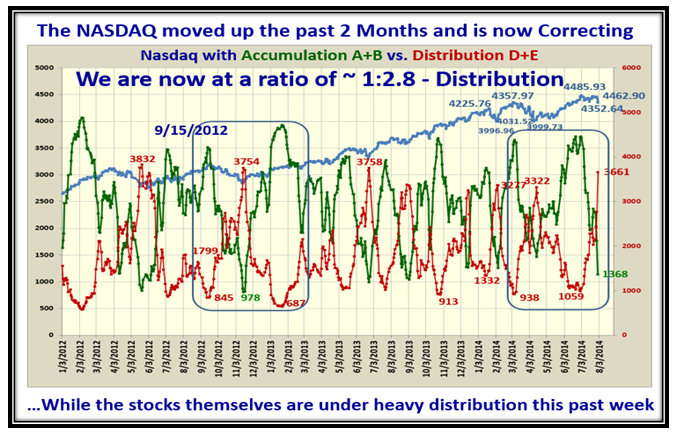

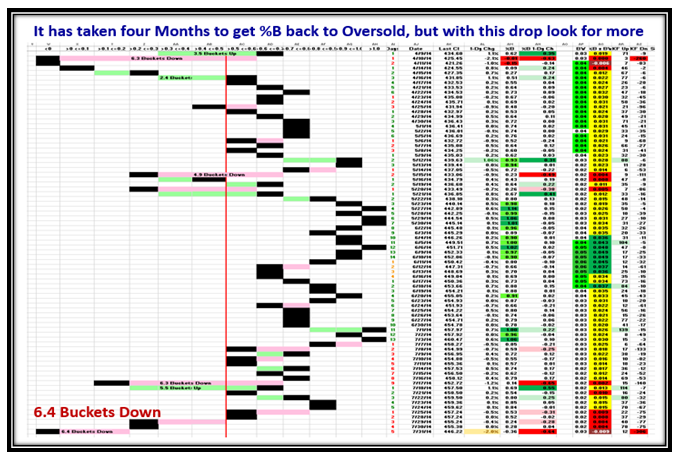

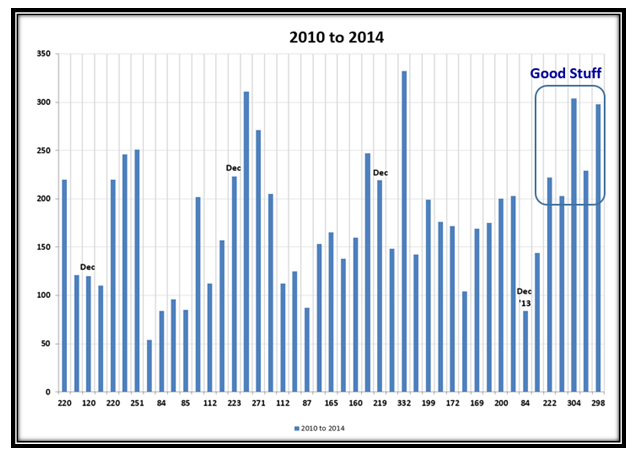

Past History shows we have reached the Depths of Distribution, and we need a quick reversal to the upside:

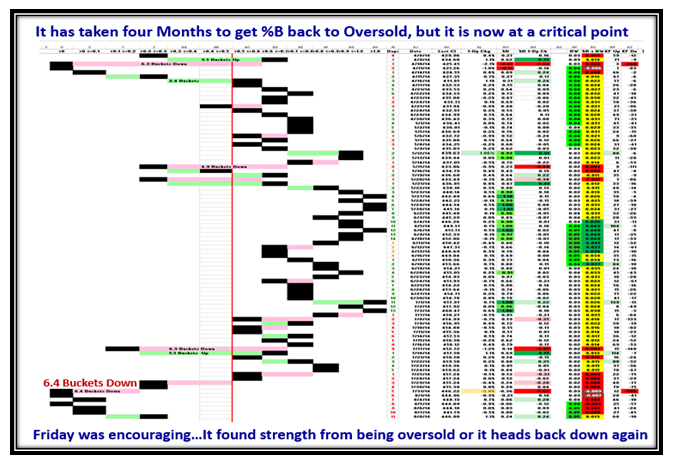

The 6.4 Buckets down killed the momentum of the Rally, and we are now 11 days down, so should see a reversal soon, which may have already started with this past Friday’s decent move up:

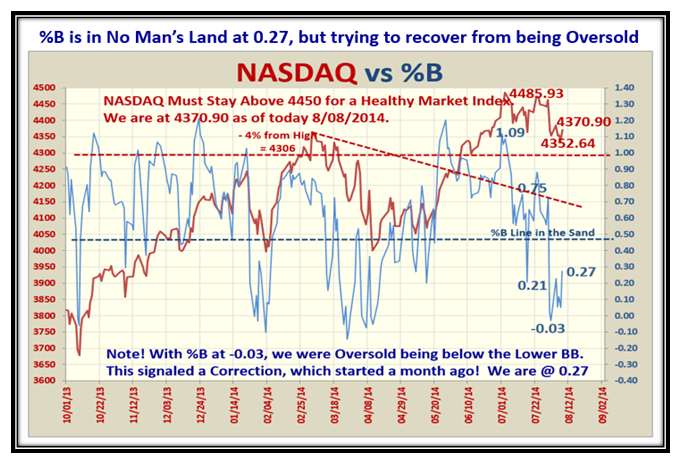

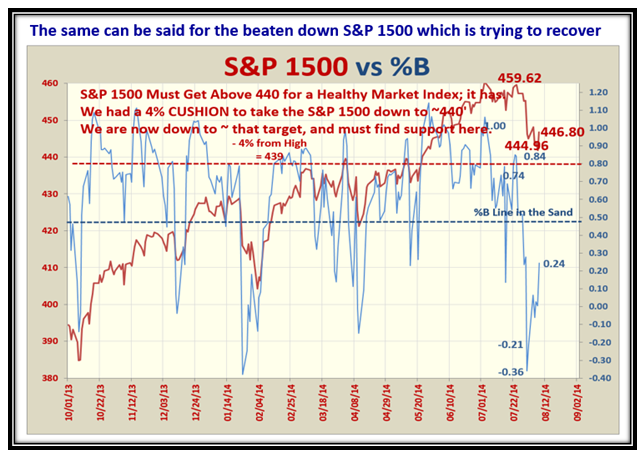

As we will see %B for the Major Market Indexes is between 0.2 to 0.3, and this is no man’s land where either the recovery continues to force %B above 0.5, the mid point, or we fall back again and the Market moves down:

The next two charts show the cliff edge that %B is on and confirms that Type 3 & 4 Investors need to be patient:

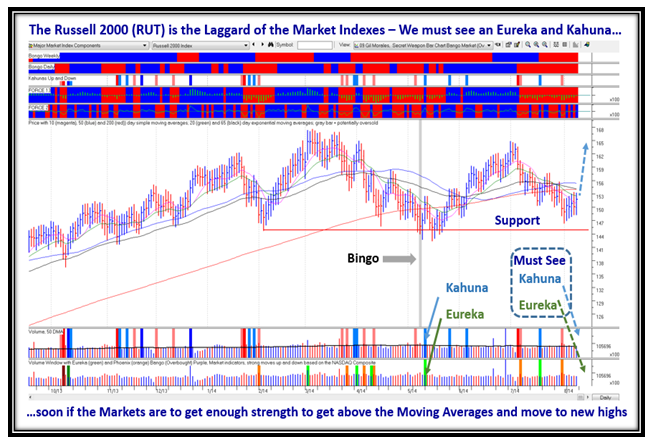

We all know that the Small Cap stocks have fared the worst of late, so I have used the Russell 2000 (RUT) as the Guinea Pig for showing what to look for before longer term Type 3 & 4 Investors should engage in this market. The Index must get above the resistance of the moving averages before there is any hope that there is a longer term move up…we need an Eureka & Kahuna to appear as shown:

Well folks, there you have it. I couldn’t take my eyes off the TV watching Golf today, but I am sure you will still enjoy this.

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog