Highland Fling or Snakes & Ladders Market?

As I write this on Thursday Morning, the Rally suggests we are into a Highland Fling for now! We had a great Seminar which offered these two alternatives:

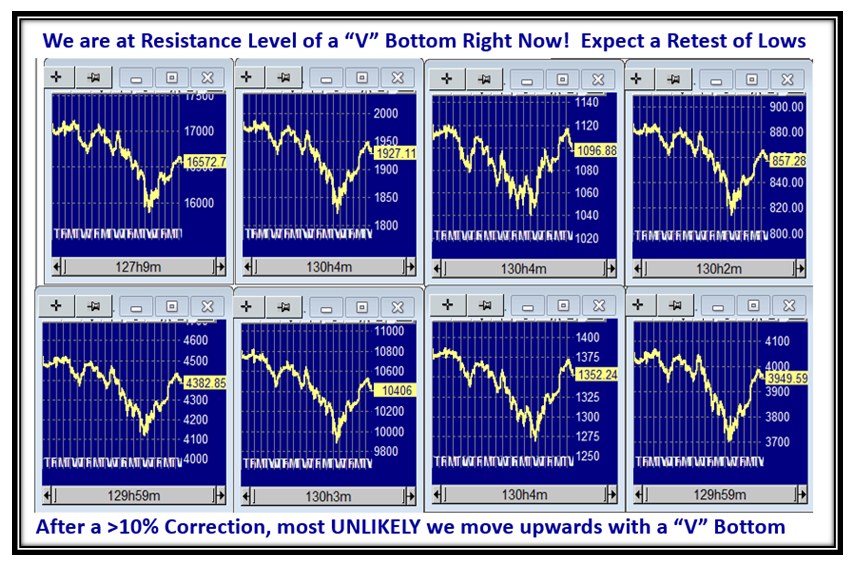

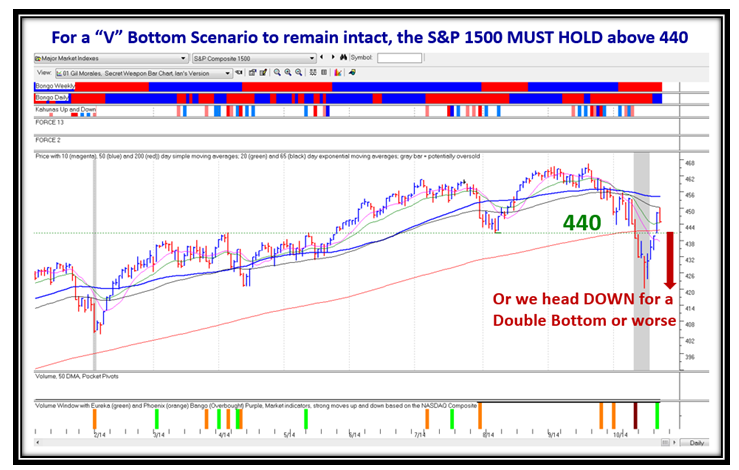

The Market Indexes had all produced a “V” Bottom and were either headed down for a retest of the lows or continue up. This morning’s strong Rally suggests we go higher before we pause to refresh:

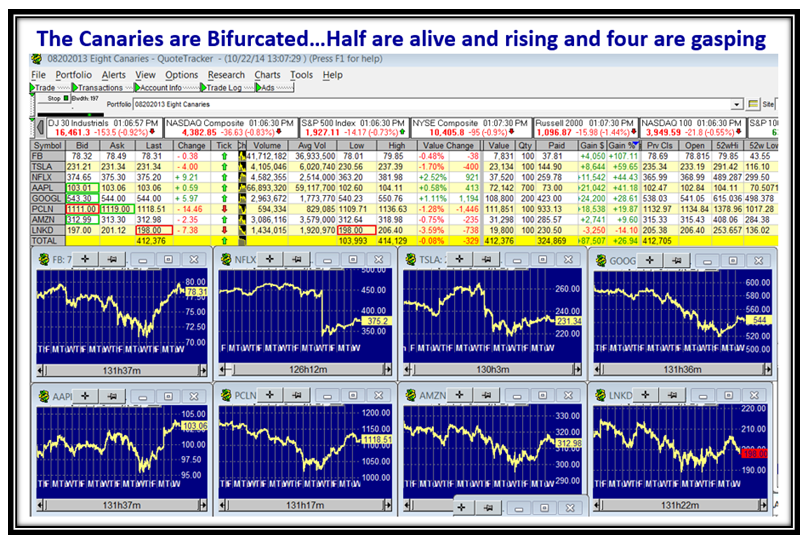

The Canaries are half strong and half sluggish, but holding at their support levels and higher:

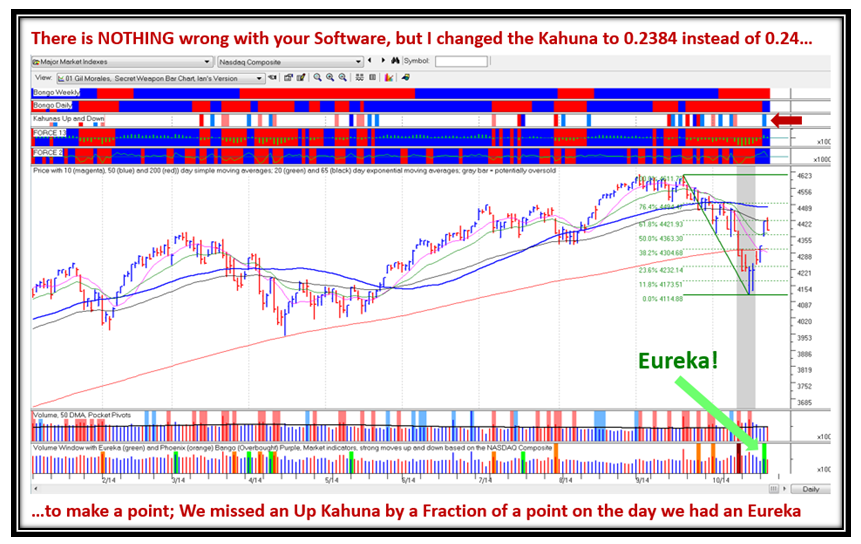

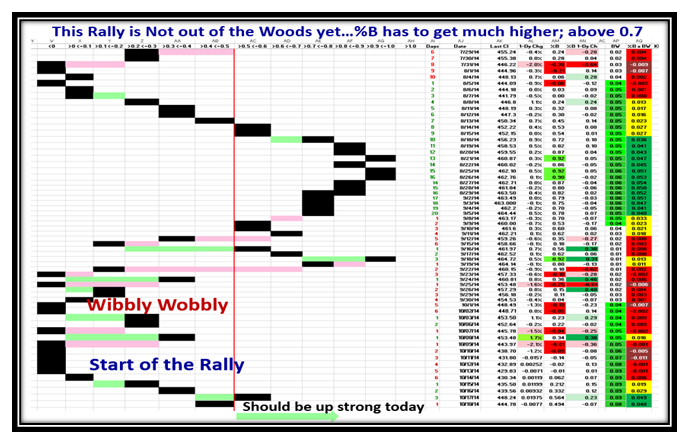

The BRIGHT spark in all of this to and fro is that we had an Eureka on Tuesday and as you can see from the chart below we also had an ~Kahuna, with it only being off by 0.016 of a point…Close Enough for Government Work! At the seminar I hammered on the need for an Eureka and two Kahunas within a week, and it seems as if our wish is coming true for a Rally to take off:

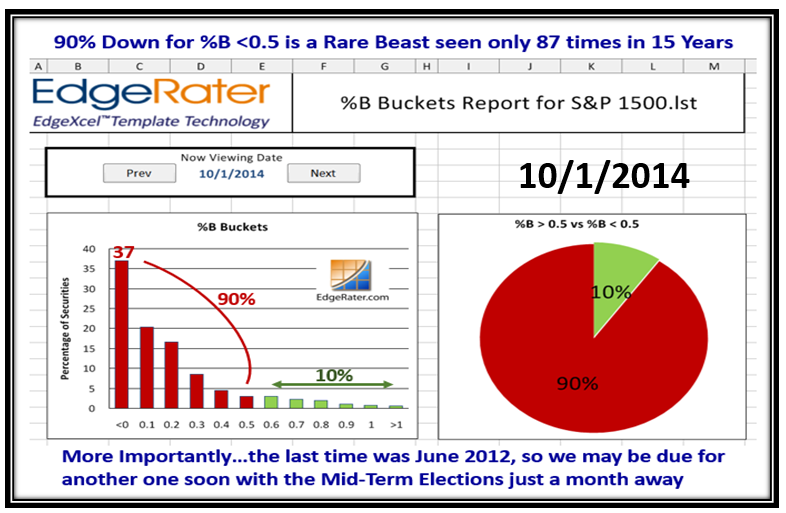

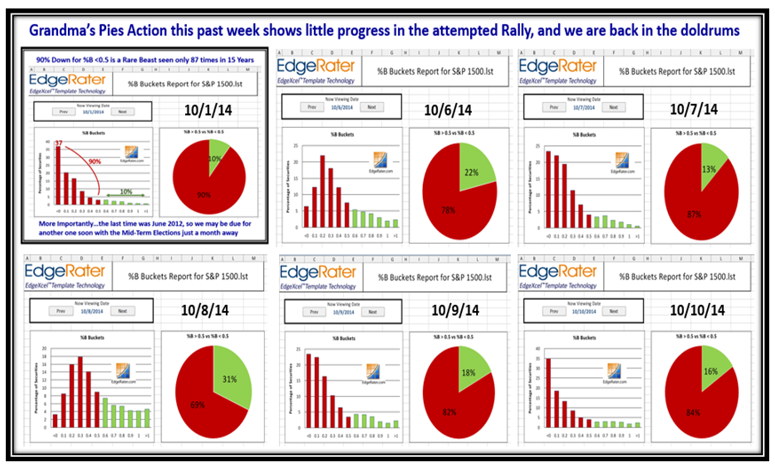

This next chart shows the tremendous sell off we had on 10/1/2014, and the following charts show the slow recovery until yesterday:

Here is the struggle to recover the following nine days:

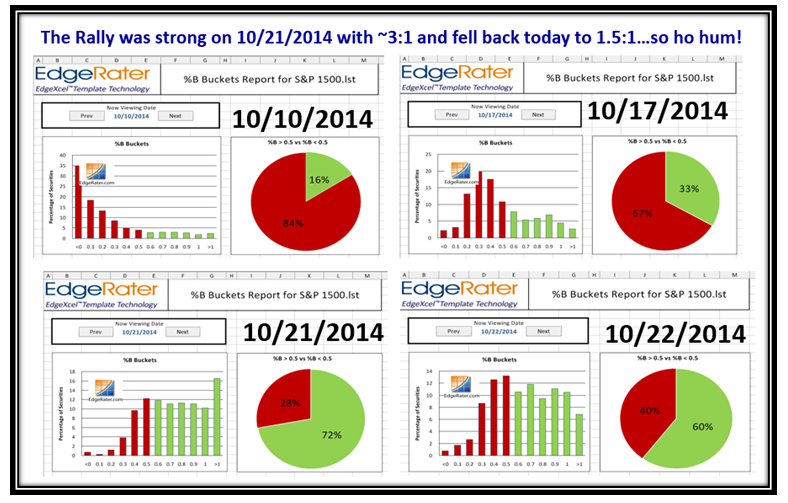

…And here is the Rally attempt two days ago after more struggle:

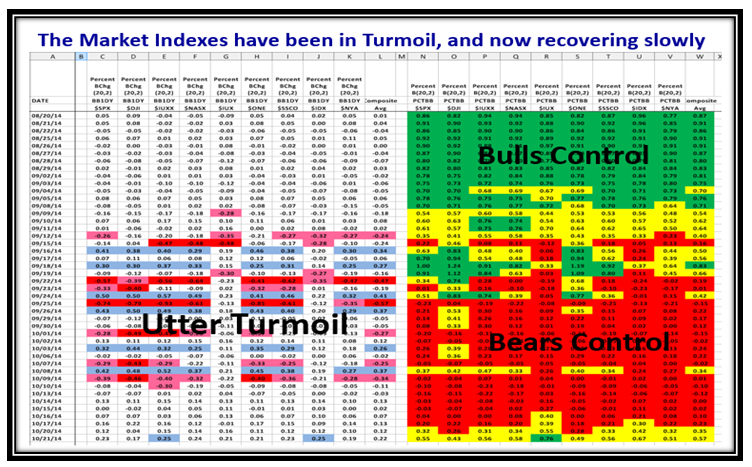

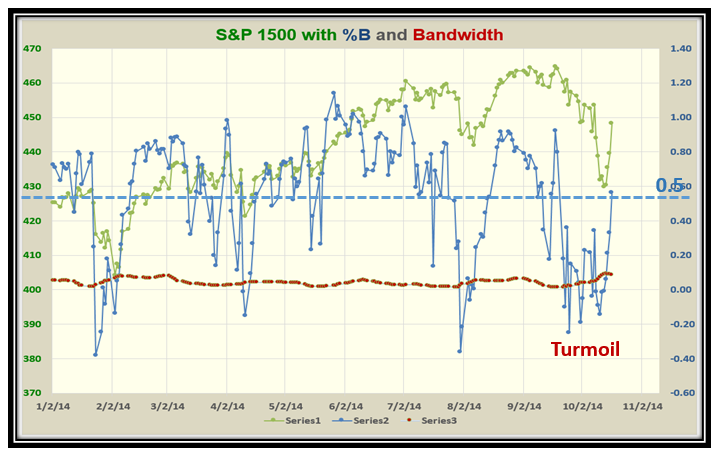

This next chart shows the Utter Turmoil the Market Indexes have been through with the Bears in Control until today:

This chart shows we should be into “Safe Territory” with %B by tonight:

Here is a chart of the S&P 1500 showing more turmoil in %B below the Bandwidth:

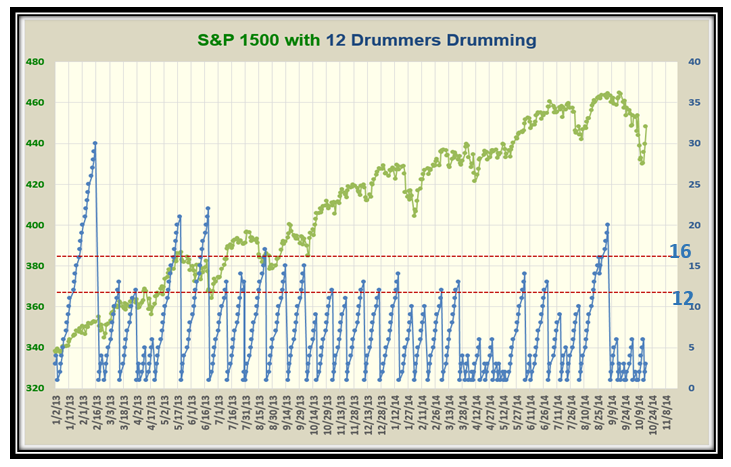

Twelve Drummers Drumming continues to show it is a good short term measure of Rallies and Fades, and also Turmoil:

Finally, the S&P 1500 must hold at 440 and above or we head down again:

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog